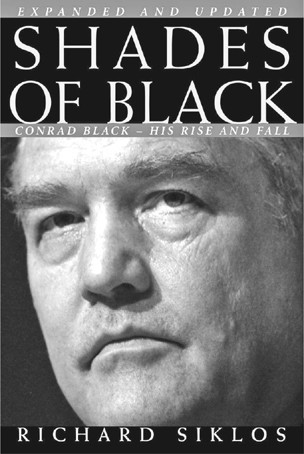

ADVANCE PRAISE

“When a great writer is falsely imprisoned for a crime he didn’t commit and decides to write a tell all non defensive account, the result is likely to be riveting. Conrad Black’s memoir does not disappoint. With his characteristic verve, turns of phrase and brilliant insights, Black puts his persecutors on trial. I am confident he will win the verdict of history.”

ALAN M. DERSHOWITZ

“Conrad Black’s A Matter of Principle is a fascinating, erudite, and defiant prison memoir – must-read for lawyers, politicos, and gossips alike!”

MARGARET ATWOOD, on Twitter

“Conrad Black is back – and it’s payback time, Jack!”

TOM WOLFE

“Compellingly readable, A Matter of Principle is partly a witty high-society memoir, partly a business book, partly a searingly-argued case for Black’s defence, partly a moving love-story, and partly a polemic explaining the death of his once profound admiration for the USA. What it is emphatically not is an apologia, but instead more a case for the prosecution of what he calls America’s ‘prosecutocracy.’”

ANDREW ROBERTS

“Written with high indignation but without so much as a drop of self-pity, and tempered by his characteristic panache, eloquence, and wit, A Matter of Principle is Conrad Black’s account of how and why he was toppled from his position as one of the great newspaper publishers of the day and then sent to prison on charges of which he was innocent. It is a fascinating, illuminating, and in some ways a horrifying story that should and hopefully will repair the damage that has so unjustly been done to his reputation.”

NORMAN PODHORETZ

“Conrad Black, who writes vigorous, muscular prose, relishes the fact that writing can be a way of fighting. In his spirited memoir, this pugnacious man of many accomplishments tells a fascinating story of, among other things, the prosecution of him that got the disapproving attention of the U.S. Supreme Court.”

GEORGE F. WILL

“You hold in your hands a vivid account of what has become a crucial threat to the American way of life: Class warriors of the Left enlisting all-powerful prosecutors to demonize and destroy successful entrepreneurs and executives. The injustices reach well beyond the targeted executives and result in widespread collateral financial damage to likewise innocent investors and shareholders, who also pay a steep price. This is an important, captivating account, lived and recounted by one of the sharpest minds of our time: Conrad Black.”

RUSH LIMBAUGH

ALSO BY CONRAD BLACK

Render Unto Caesar: The Life and Legacy of Maurice Duplessis

A Life in Progress

Franklin Delano Roosevelt: Champion of Freedom

The Invincible Quest: The Life of Richard Milhous Nixon

Copyright © 2011 by Conrad Black Capital Corporation

All rights reserved. The use of any part of this publication reproduced, transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, or stored in a retrieval system, without the prior written consent of the publisher – or, in case of photocopying or other reprographic copying, a licence from the Canadian Copyright Licensing Agency – is an infringement of the copyright law.

Library and Archives Canada Cataloguing in Publication

Black, Conrad

A matter of principle / Conrad Black.

eISBN: 978-1-55199-316-4

1. Black, Conrad. 2. Newspaper publishing – Canada – Biography.

3. Capitalists and financiers – Canada – Biography. 4. Businessmen –

Canada – Biography. I. Title.

PN4913.B56.A3 2010 070.5092 C2008-901956-3

We acknowledge the financial support of the Government of Canada through the Book Publishing Industry Development Program and that of the Government of Ontario through the Ontario Media Development Corporation’s Ontario Book Initiative.

We further acknowledge the support of the Canada Council for the Arts and the Ontario Arts Council for our publishing program.

Library of Congress Control Number: 2011935307

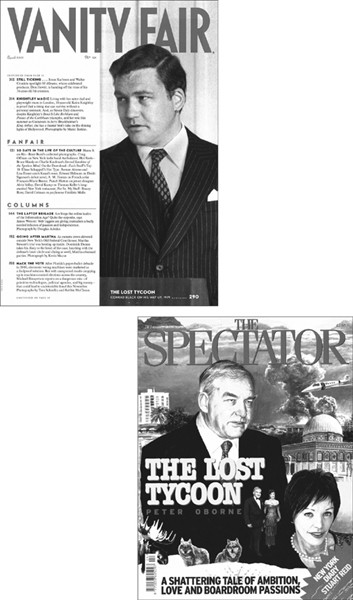

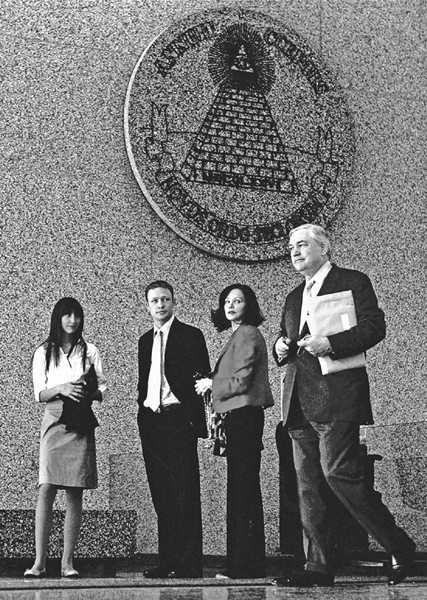

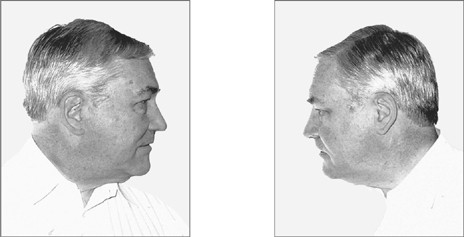

Cover photograph: Peter Bregg

McClelland & Stewart Ltd.

75 Sherbourne Street

Toronto, Ontario

M5A 2P9

www.mcclelland.com

v3.1

To Barbara, my indomitable, unofficial co-defendant, and my daughter Alana and sons Jonathan and James; to my dear friends June Black, Dan Colson, Midge Decter, David and Murray Frum and Nancy Lockhart, Roger and Susan Hertog, Laura Ingraham, George Jonas, Roger Kimball, Seth Lipsky, Joanna MacDonald, Joan Maida, Brian Mulroney, Norman Podhoretz, Andrew Roberts, William Shawcross, Brian Stewart, Bob Tyrrell, and Ken Whyte; and to Rob Jennings, and other friends in the prison to which I and many of them were unjustly sent; and to all others who have sustained and encouraged me in this difficult time, including thousands of strangers in many lands. All in their different ways have been magnificent. I will never forget their encouragement and will try to repay, or at least justify, their kindness.

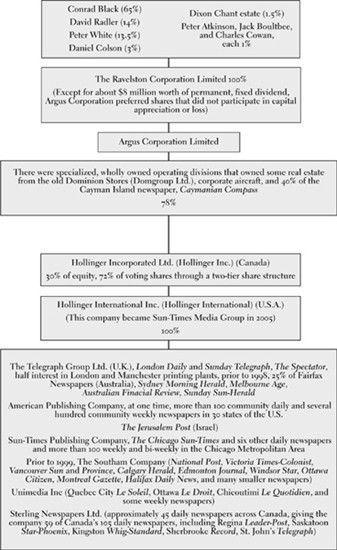

RAVELSTON, ARGUS, AND HOLLINGER

[CONTENTS]

Ravelston, Argus, and Hollinger

Postlude: Reflections on the American Justice System

[CHAPTER ONE]

MARCH 2010: COLEMAN FEDERAL CORRECTIONAL COMPLEX, FLORIDA

I sleep in a cubicle that shares a ceiling with sixty other identical spaces, rather like partitions in an office, except that these are painted cinder block and there are no potted plants. At 10:30 p.m., the ceiling lights placed every twenty feet or so go out. The residents turn out their cubicle lights, leaving only an overhead row of red, dimly lit panels, pierced here and there by the beam of portable reading lamps, which enable the readers among us to escape into books, letters, newspapers, snapshots, and tokens and reminders of the world beyond the gates. In the morning, daylight creeps past the condensation generated by the confrontation between the Florida heat and the fierce air conditioning of the Federal Bureau of Prisons into the outside cubicles through narrow rectangular windows grudgingly set in the concrete walls.

Here, we concern ourselves with how many postage stamps (the local currency) are needed to buy an extra notepad. We see and hear the talking heads on tele vision in the activities room or, in my case, read in the newspapers of the steady failures or crises of great institutions: AIG, General Motors, Citigroup, the State of California, the New York Times, the Harvard University Endowment. How could this country have become so incompetent, so stupid, and why was this debacle so unforeseen? The pundits have the usual uninformed answers, not greatly more well thought out, and less entertaining, than those of some of my fellow residents. Lying in my bunk after the lights have gone out, I reflect on the ludicrous demise of my great love affair with America.

Bemused by the economic and political shambles, created largely by people I have known, I fight on from this absurdly shrunken perimeter for recovery of my liberty, reputation, and fortune. I still expect to win.

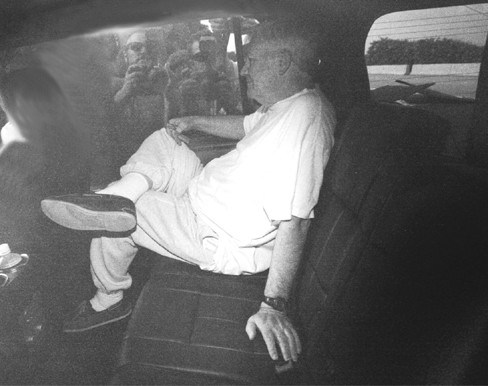

My prison number, 18330-424, is stamped on my clothes and mandatory on all correspondence. I am sixty-five years old. I entered these walls a baron of the United Kingdom, Knight of the Holy See, Privy Councillor, and Officer of the Order of Canada, former publisher of some of the world’s greatest newspapers, and author of some well-received non-fiction books. In December 2007, a courteous federal district judge in Chicago sentenced me to seventy-eight months in a federal prison and imposed a financial penalty of $6.2 million. This is all winding its way through final appeals and is completely unjust, but so are many things. I was convicted of three counts of fraud and one of obstruction of justice, of all of which I am innocent. Three charges were dropped and nine led to acquittals. I have gone through but survived straitened financial circumstances, have sold two of my homes, and am responding to and initiating endless civil litigation. For the last six and a half years I have been fighting for my financial life, physical freedom, and what remains of my reputation against the most powerful organization in the world, the U.S. government.

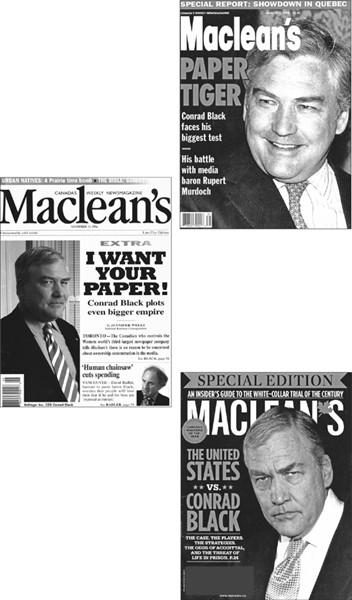

My shrunken newspaper company, once owner of distinguished titles in Britain, Canada, Australia, and America, as well as the Jerusalem Post, was now bankrupt under the dead weight of the incompetence and corruption of my enemies, who have hugely enriched themselves under the patronage of American and Canadian courts of law and equity. I am estranged from some of my formerly professed friends, including a number of famous people, though in greater solidarity than ever with some others. Much of the press of the Western world was long agog with jubilant stories about the collapse of my standing and influence. For years I was widely reviled, defamed, and routinely referred to as “disgraced” or “shamed” and “convicted fraudster.” (This was the preferred formulation of the London Daily Telegraph, of which I was chairman for fifteen years.) In light of my lately improving fortunes most of my less rabid critics are now hedging their bets. Whatever happens, this will not be the end of my modest story. But it seems an appropriate moment to update it.

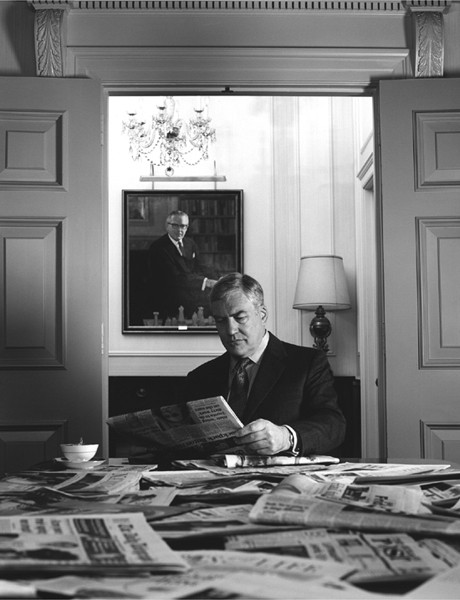

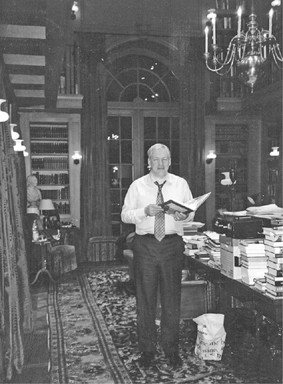

OCTOBER 2003: MY HOME, KENSINGTON, WEST LONDON

London’s yellow afternoon light filtered in from windows overlooking gardens on three sides of my room. All about me was the reassuring evidence of an active career and an eclectic range of interests. Shelves of leather-bound first editions giving every side of the French Revolution and Napoleonic Wars. Depictions of the great English cardinals Henry Manning and John Henry Newman. Jules Mazarin and the esteemed diplomat Ercole Cardinal Consalvi, strikingly rendered, looked down impassively upon, among other things, a small bust of Palmerston, a fine crystal model of the Titanic given to me by my tragically deceased driver, Tommy Buckley, and an iron copy of the death mask and hands of Stalin that I had bought from the estate of the great British maverick politician Enoch Powell. Gifts: a shield from Chief Buthelezi of the Zulus, a naval painting from our directors in Australia, the extravagantly inscribed latest memoirs of Henry Kissinger and Margaret Thatcher, each evoking interesting times and powerful friends, historic figures who had helped me and whom I had helped.

My lengthy biography of Franklin D. Roosevelt lay in galleys on my desk. This was a room that had weathered all efforts of interior decorators and remained comfortable and practical for my work. Good chairs and reading lamps, a large and deep sofa on which I sometimes napped, its antique decorative pillows turned backward to hide the scorching received when one of my younger son’s friends fell asleep on it and knocked over a lamp. Though large, the room exuded a sense of safety, a barricade at the far end of the house away from prying eyes and noise. All the same, increasingly I felt an indefinable foreboding. Mazarin, the protegé and successor of Cardinal Richelieu, could have warned me. He knew the signs of insurrection well. All was silent; I was uneasy, but my vision was impaired.

I knew well enough where the trouble lay. Some of our large institutional shareholders were attempting to break up the newspaper company I had created, Hollinger International, in order to sell it off for a good short-term price while newspaper stocks were sluggish but newspaper enterprise values – the sale of newspapers as going concerns – were still buoyant. Now, firmly riding the hobby horse of shareholder activism, a backdoor attempt to overthrow me and achieve the sale was in progress – though I didn’t entirely grasp it at the time. All I knew was that allegations of overly generous payments to myself and other executives were keeping business writers, especially those of competing newspapers, phoning around for colourful anecdotes to illustrate our supposed extravagance with company funds. In response, I had agreed to establish a special committee to examine these matters, confident of our complete vindication. Now these committee members were beavering noisily away, with the concentration and attitudes of antagonists. I did not know then how easily a special committee could decapitate even a controlling shareholder. But I knew enough to be uneasy. If I could be rattled severely enough, the company could be sold and all the shareholders instantly gratified. I thought more could be achieved by gradualism, selling assets when they were ripe, and separately to targeted buyers, as few companies would be attracted at top prices to such geographically disparate newspaper properties. I also considered, and the directors and shareholders professed agreement, that these were decisions for the managing and controlling shareholders who had built the business. This was the core of what became a huge controversy.

FROM MY EARLY YEARS, I thought that publishing large and high-quality newspapers was the most desirable occupation of all: this was a business that could offer commercial success, political influence, cultural and literary potential, and access to everything and everyone newsworthy in every field. As a young person I read about famous newspaper owners such as W.R. Hearst, Lord Beaverbrook, Lord Northcliffe, Lord Rothermere, Colonel Robert McCormick, and Canadians that my father knew: J.W. McConnell, Joseph Atkinson, George McCullough, John Bassett, the Siftons.

During a break in my university years, I took over an uneconomic weekly newspaper in Knowlton, Quebec, about fifty miles east of Montreal, from my friend Peter White, who had become a special assistant to the premier of Quebec, Daniel Johnson. I paid Peter $500 for half of the Eastern Townships Advertiser, approximately $499 more than it was worth. I wrote, edited, and laid out the eight-page half-tabloid and sold whatever advertising could be had in the elderly English-language minority of that area, who lived chiefly from the avails of maintaining and milking the country houses of wealthy Montrealers. I even dealt with some of the circulation distribution. In winter, the wind whistled across frozen Brome Lake, and I often needed snowshoes to get to and from my car. I read a great deal and found the life of a coureur de bois exhilarating, especially when the first signs of spring began to appear.

When I was in my third year at the Laval University law school, Peter White and I, together with David Radler, a new acquaintance Peter introduced me to, bought the insolvent Sherbrooke Daily Record, another twenty miles east of Knowlton. This newspaper had a circulation of seven thousand. Its press had been repossessed by the manufacturer and it was in dire straits. We paid only Can$18,000 for it. I became the first university student, at least in Canadian history, to be a publisher of a general-interest daily newspaper. David Radler, who was almost a caricature of a penny-pinching businessman, focused entirely on costs and revenues. He was alert, suspicious, and often entertaining.

I had moved from Toronto to Quebec in 1966, suffused with enthusiasm for Canada as a country that had the advantage of having the two greatest cultures of the West within itself. I became fluent in French, studied the civil law, and wrote a book about Quebec’s longest serving and most controversial premier, Maurice L. Duplessis, which has stood as a serious work on the subject.

I moved back to Toronto in 1974, just before my thirtieth birthday, exasperated with Quebec’s endless threats to secede from Canada – while retaining all the economic benefits of Confederation, including huge transfers of money from English Canada in institutionalized annual Danegeld. I became a fairly vocal and widely publicized advocate of a strong line against Quebec separatists, suspecting, correctly, that they could never get near half the votes without an umbilical association with Canada that in effect combined official independence in the world with continued provincial dependence, both eating and retaining the cake. The whole concept was a fraud. I was also an advocate of transforming Canada into a greater enterprise state than the United States, one that could, by its low crime rate and tax reductions, attract industry and people that would otherwise go to the United States or had already moved there. My views were widely mistaken as annexationist – that is, advocating federal union with the United States. I made the point that Canada would be better off making a deal with the U.S., including instant parity for our 65-cent dollar, than continuing endless fruitless tractations with Quebec separatists who wanted concessions but would never make a durable agreement.

However I was seen, I couldn’t regard myself as a pillar of the Canadian establishment, which at that time, it seemed to me, operated a back-scratching, log-rolling operation that took care of its own but underperformed the vast potential for the country. As much as I was out of favour with the comfortable Canadian centre-right, I could never make common cause with the Canadian left because of their anti-Americanism and their addiction to high taxes and excessive unionization and wealth redistribution and their imitative mediocrity. They received almost no international attention. I often felt like a party of one.

MY ENTRY INTO THE CORPORATE WORLD was a splash. In 1978, following the death of its incumbent chairman,* one of Canada’s famous holding companies, Argus Corporation, of which my father had been a sizable shareholder, became the subject of a sharp takeover struggle. My parents had died only ten days apart in June 1976, and my brother and I now had our father’s 20 per cent of the shares of the company, the Ravelston Corporation, that owned 60 per cent of the voting shares of Argus Corporation. Factional disagreements ensued. My brother and I were one of the factions, and we were successful. What we took over in Argus was a mixed bag of assets in an obsolete structure.† There were influential but not really controlling shareholdings in Massey Ferguson (tractors and farm equipment), Dominion Stores (supermarkets), Domtar (forest products), Hollinger (through a subsidiary, iron ore royalties), and a genuine controlling interest in a radio station and television company. The reputation of the founders had made Argus Corporation famous, but the reality was a moth-eaten hodgepodge of positions of questionable value.

Through the Byzantine financial structure the former owners had created, Argus itself owned 14 per cent to 24 per cent of the first four of these companies. Four-fifths of Argus’s shares did not vote. My brother and I now had 57 per cent of a company that had 51 per cent of the company that owned 60 per cent of the shares that voted (i.e., we had 12 per cent of the Argus voting shares and 8.4 per cent of its total equity, as we owned some of the non-voting shares separately). And beneath that were the 14 per cent shareholdings, apart from the radio and television business. Our interest had an apparent economic value of about Can$18 million, and there were significant loans against that. This was my baptism in close-quarters financial manoeuvrings, and I saw both their possibilities and their hazards.

I set about trying to refashion the company toward something the owners would really own and would have some aptitude to manage. In my 1992 book detailing some of the complicated manoeuvres, I cited Napoleon’s dictum that “mass times speed equals force.” In those early business years, I had had little mass but great speed. My corporate performance was far from Napoleonic, but I got on. Deals now occurred with such profusion and rapidity that the Toronto Star referred to me as “Canada’s answer to [the American television program] Let’s Make a Deal.” I gave the Massey Ferguson shares away to the company pension plans to assist in a refinancing, which did then occur and helped to save the company. Over several years, the Domtar shares were sold, the supermarket and radio and television assets were sold, and energy assets were bought and sold. The group was consolidated, with something close to a real owner, and refocused in the newspaper business. All this activity, which was more financial engineering than operational progress, attracted the interest of regulators, who actually rewrote the Canadian “complex transaction” rules in my honour. The convoluted progress through these various businesses stirred up some controversy in Canada at times, but all was resolved without much difficulty.

I was a financier, and a fairly agile one, but still only an industrialist in the newspaper business. I did not seek out controversy, but as someone who expressed controversial views trenchantly and hovered about several different vocations, I was bound to attract a fair bit of comment, especially in such an understated country as Canada. I enjoyed debate and political argument but had an imperfect sense of public relations and never saw the need to concern myself with it. As a result, I became a catchment for many traits and opinions I did not hold, dwarfed by a caricature public image that has lurched about like a clumsy monster for decades. Though wounded at times by this portrayal, I never grasped the real danger in it and simply made a virtue of necessity: I boxed on, still am.

The transition to being truly involved in the newspaper business again came when, on behalf of our company, I acquired control of the Daily Telegraph in London for Can$30 million in 1986. From this, all else follows. The newspaper was suffering from an aging readership, antiquated equipment, all the usual British labour problems, and elderly but conscientious management. We installed an almost entirely new management team and ethos and expanded the Daily Telegraph to be a full-service newspaper. Two-thirds of the aged employees were negotiated into voluntary retirement, which they sought but had been unable to consider under the company’s frugal pension scheme, and the Telegraph titles recovered admirably. Robert Maxwell, the egregious proprietor of the Daily Mirror, whom I did not yet know, said, “Mr. Black has landed Britain’s biggest fish with history’s smallest hook.”

AT A MEETING OF THE DIRECTORS of The Telegraph plc in December 1986, the owner, Lord Hartwell, fainted. His loss of consciousness was prompted by the realization he had lost control of the newspaper that his family, the Berrys, had acquired in late-Victorian times. The boardroom sounded to me like something out of a Mitford novel. “Daddy, Daddy,” called his son Adrian from one end of the boardroom table. His other son, Nicholas, was hissing at his father for what he thought was a rotten deal and at the Canadian “predators” for taking up the deal. Rank and decorum were firmly maintained throughout by Hartwell’s admirable secretary, who stood over him as the paramedics arrived, pronouncing, “I will not allow just anyone to lay hands on Lord Hartwell.”*

Hartwell had done his best to maintain the editorial excellence of The Telegraph plc but had dragged it almost to bankruptcy largely through an ambitious attempt to install modern presses in two vast plants in Manchester and London. But he had made no effort to arrange demanning from the unionized workforces, nor to arrange long-term financing with banks, and just kept writing large and extraordinary construction payments against a current account.

Hartwell, who fortunately suffered nothing more than a fainting spell, remained chairman for another two years as we sorted things out. I would not consider treating him abruptly. The fissiparous Nicholas Berry vowed eternal vengeance and did everything in his power to poison the waters with concocted stories about my associates and me. Adrian Berry, an exceedingly amiable British eccentric liked by all, with esoteric scientific interests that entirely possessed him, remained at the Telegraph as its science writer and a director. Mercifully, the pestilential Nicholas peevishly resigned.

Gaining control of The Telegraph plc in the U.K. changed my life. As its proprietor, I finally had a meaningful political voice (which I did not at that point have in Canada) and access to echelons of international decision-making I had not previously enjoyed, because of the influence of one newspaper and the British custom of deference to national newspaper owners.

For seventeen years the fortunes of the Telegraph and its staff were pre-eminent in my thoughts. Running a leading British quality newspaper requires some agility. The waters are shark-infested, with seventeen national newspapers, including the Sundays, which are considered separate and often have different titles, competing in London.

The Telegraph plc had been a way of life for more than a century. A writer might mention the Telegraph in a novel or essay, as George Orwell did in The Lion and the Unicorn, and that reference would be shorthand for an entire set of values, idiosyncracies, and even colour of shoes. The Daily Telegraph was generally thought to be the greatest bastion of the British Conservative Party. The men who built it up, Lord Burnham and Lord Camrose, were influential Conservative peers. The Daily Telegraph had engaged Winston Churchill at various times in his career, including after the Munich Agreement (which the Telegraph commendably opposed). The editor at the time our company invested in it was Bill Deedes, a former minister of the Harold Macmillan Conservative government and said to be the model for Auberon Waugh’s accidental hero in his famous newspaper novel, Scoop. It was the pre-eminent newspaper of middle England, the gin-and-tonic, cricket-watching backbone of the nation. To be proprietor of the Telegraph was instantly to enter to the core of Britain, with all the benefits that implies. Once installed in Britain, I got a free pass on the many tests of accent, lineage, school, and other yardsticks by which the British subtly calibrate one another. I was Canadian, apparently literate, but it was assumed, in the unerringly apt words of my magnificent and distinguished friend Lord Carrington, that “he doesn’t quite get it.” Which I sometimes did not.

The British had long been accustomed, since their days of empire, to assimilating foreigners into prominent places in their society, especially from their former empire. This was an adjustment to geopolitical realities, not a relaxation of English xenophobia.

They are contemptuous of those who are abrasively foreign and of those who seem ingratiatingly imitative. It is a subtle and invidious game, and the British are difficult to please. I understood that the natives found me somewhat irrepressible and overbearing, in the manner that fits their caricature of North Americans, though. I was generally credited with literacy and a fair knowledge of British history.

–

IN 1986, THE BRITISH SOUL was still absorbing Thatcherism. Margaret Thatcher’s long-standing chief adviser, Charles Powell, said that her first meeting with me was “love at first sight, politically speaking.”

Outwardly, the Conservative Party was united behind Thatcher. But from fairly early on in my time in the United Kingdom, I was impressed at the size of the pockets of resentment in her own ranks. She was too pro-American. She was too “uncaring,” had pulled the rug out from under former prime minister and Conservative Party leader Edward Heath when she defeated him for the leadership in 1975. (Except for Stanley Baldwin and Sir Alec-Douglas Home, all British Conservative leaders since Bonar Law in 1923 have been undercut by their own ostensible supporters, even the octogenarian Churchill in 1955.) But most of all, in stylistic terms, she was the champion of “bourgeois triumphalism” (a slightly sniffy phrase coined by our Sunday editor, Peregrine Worsthorne), and she was “that woman” and thought to be a bossy woman (not entirely without reason). My position kept me in touch with all the Conservative factions, although my personal loyalty to Thatcher was well known. It must be said that she was rather insouciant; she could have warded off the problems that came down after the damning resignation speech of her deputy prime minister, Geoffrey Howe, in 1990 and would almost certainly have been re-elected in 1992. But her many victories had dulled her sense of self-preservation. I warned her and her chief loyalists several times of the conspiratorial fermentation among the MPs, obviously without naming anyone, but was treated as a well-meaning alarmist. I had been around politics, albeit in less storied places and with less distinguished leaders, a long time, and I knew unsafe levels of restiveness when I found them. Her enemies were not her peers, her successors were relatively undistinguished, yet “great (Thatcher) fell.”

Three candidates for the succession emerged from the scrum, and the usual editorial infighting began as to whom the Telegraph would support. Michael Heseltine was a tall, handsome man with thick, wavy blond hair and superbly cut Savile Row suits, an accomplished businessman and former defence minister, and a formidable public speaker. He was the closest in policy terms to Thatcher, with the important exception of the issue that still burns in the United Kingdom while barely being noticed in North America – namely, the degree to which Britain should be assimilated into a unified Europe. Heseltine was an ardent Euro-joiner.

Douglas Hurd was to the left of the party, a Tory “wet.” His shock of spiralling white hair and his efforts to play down his Eton and Oxford background by wearing buttoned cardigans while talking about his work as a “tenant” farmer (on his family’s land) made him a natural target for such diabolical mimics as Britain’s Rory Bremner, who would play Hurd in a red cardigan sitting surrounded by little children serenading him with a song: “Douglas, you’re useless and so is all that you do. Douglas, you’re clueless and that’s what we think of you.” (The tune was from a popular British sitcom.)

The Sunday Telegraph endorsed John Major, the son of a trapeze artist from Pittsburgh. He had no university education, let alone an Oxbridge background, and his contribution to the campaign was to talk about Britain’s new “classless society” in flat, unadorned prose that some saw as altogether too representative of his vision.

I erred on the side of liberality and left the editors to make their own choices. Douglas Hurd exercised an intellectual domination over Max Hastings, the otherwise formidable editor of the Daily Telegraph, as thorough as that which Douglas would soon assert over John Major. We should have gone for Heseltine as the strongest leader, or Major as Thatcher’s choice, but as Worsthorne on the Sunday was supporting Major, and I was happy to have a foot in two camps, and Heseltine was Thatcher’s nemesis, and I felt that I owed it to her inspired leadership that I was in Britain at all, I didn’t overrule Max. I liked all three candidates personally.

One of our leading editorial commentators, Sarah Hogg, wife, daughter, and daughter-in-law of Conservative cabinet ministers, was a Euro-joiner and urged upon me, at Max Hastings’s prompting, the view that John Major was not intellectually qualified to be prime minister. I was slightly surprised when she called me a few days after Major’s victory to ask that I say nothing of her opinion of the new leader, as she was about to become head of his Downing Street policy unit. Her appreciation of him rose.

The Daily Telegraph did its best, along with most of the major national newspapers, to help Major win the general election of 1992. This was the first time a British party had won four full-term consecutive elections since the First Reform Act had expanded the electorate beyond a small and comparatively wealthy group in 1832. But it was not long before we began to have some reservations. An amiable man and a talented former whip, Major was better at organizing and conciliating than he was at leading in a way that rallied the fractious elements of the Conservative Party. Max Hastings parted company with Major more on the basis of this evaluation of his leadership abilities than of his policies. Hastings started the rumour that John Major tucked his shirt inside his underpants, a uniquely British, snobbish (and outrageous) reflection. Major weakly told me that at least where he had gone to school, he did not have to fear for his safety when he picked the soap off the floor of the shower stall, referring to alleged homosexuality in Britain’s famous private-sector schools. There was an unseemly disregard for the prime minister and a pattern of unconfident responses from him.

The deputy editor of the Daily Telegraph was Charles Moore, former editor of the Spectator. Moore was a particular type of Englishman: reserved, well mannered, difficult to read, a man who had been accepted to Eton and Cambridge because of his considerable intellectual prowess rather than family connections. He and Hastings had a very abrasive relationship. Where Hastings was a closet Euro-joiner and more or less a Red Tory in all matters except taxes and unions, Moore was a Euro-skeptic and High Tory of Edwardian leanings. For Moore, the defining moment in the evolution of his opinions and in his career development was when Hong Kong under British rule (until the 1997 handover to the Chinese) admitted and then forcibly expelled the Vietnamese boat people.

Moore, who before this had had the standard High Tory doubts about the basic reliability, civility, and good taste of America, suddenly decided that the United States was the only country that had the integrity, courage, and bearing of a great power. Max jubilantly told me that Charles had put in for the position of Washington correspondent.

I determined that if Moore had come to this realization, it was time for him to move up and not down, and appointed him editor of the Sunday Telegraph. Under Charles Moore, the Major government got a very rough ride, which brought out the proprietary instincts of the Conservative Party. They believed they had the right to the unwavering adherence of what was often called the Torygraph and that anything less than that was a betrayal. To the credit of the editors and the political desk, even Neil Kinnock, the leader of the Labour Party in the 1987 and 1992 elections, told me that though he did not agree with the Telegraph’s editorial positions, he regarded it as a newspaper of scrupulously fair reporting.

The wheels started to come off the Major government. Chancellor Norman Lamont was dumped in 1992 after the Exchange Rates Mechanism fiasco (fixing the pound opposite European currencies in a narrow band that the pound fell out of), though he had been one of Major’s leading backers for the party leadership. He then became an intractable opponent of the prime minister, accusing him of being “in office but not in power.” At the Bilderberg meeting in Bürgenstock, Switzerland, in 1995, I probed this subject with him over some local wine. He exclaimed, “I am prepared to discuss treason, but not while drinking this ghastly Swiss weasel-piss.” We moved to a more potable French wine.

John Major decided to clear the air by resigning as party leader and calling an instant vote of his caucus in a new leadership election, where he would stand to replace himself. I learned this while I was a guest of Lord Woodrow Wyatt at the horse races at Ascot. Cellphones were not yet popular in Britain, so I went out to my car, which was equipped with a phone, and called Rupert Murdoch to ask whether he would join in a solid front for Michael Portillo, a possible candidate for the leadership – a rather exotic and unlikely member of the Tory caucus due to his Spanish ancestry and interest in opera. He said he would, so I called Portillo, who said he had just announced he would not run but explained he had rented space and ordered the installation of a large number of telephones because he thought someone else would stand and force Major out, and he could take advantage without the opprobrium. Trying to be a loyalist while really being an opportunist is risky. Portillo’s balancing act undid him, and his promising career as a politician went into decline. Major easily retained the leadership.

A number of rather odd initiatives were launched to rally the Telegraph to the Tory government’s aid. At one point John Major intervened with the Canadian High Commissioner, Fred Eaton, to ask me to impose moderation on the paper’s reflections on the government. Lord Wyatt, a bibulous, gossip-addicted, and almost incomprehensible salonnier who had lived for years off the Thatcher government’s patronage as head of the horse race betting authority, hatched a scheme to offer me a peerage in exchange for extinguishing the criticism of the Major government in the Daily Telegraph. Wyatt was by now so ineffectual that he never made this plan clear to me, though I would have paid no attention if he had. I discovered the scheme only when reading John Major’s memoirs and Wyatt’s incoherently acidulous, posthumously published diaries. Major demanded to know of Wyatt why I wasn’t responding. Did I not have control of the Daily Telegraph?

Technically, of course I did have control of the newspaper, but I was always wary, there as in the National Post and elsewhere, of imposing my will too strongly on valued editors, other than for the most overwhelmingly important issues. I asserted my views forcefully but have met the full range of editorial resistance tactics. Raising children is a good formation for dealing with editors and journalists. They are all fiendishly clever at promising compliance with the wishes of the owner, appearing to give superficial adherence while in fact continuing in their exceptionable practices. A cat-and-mouse game ensues, in which my refusal to be made a mockery of struggles for mastery with my desire not to have to micro-nanny every detail of the production of the newspaper and my concern not to be ground down by arguing endlessly with the editor and his entourage.

In Moore’s case, the entourage was what is known as the leader conference, the editorial page writers. They were a medieval collection of learned eccentrics. Where Max Hastings had been impatient with comment and published banal editorials, except for those on military matters, Moore was preoccupied with comment. Both Max and Charles are elegant writers: Max a vigorous journalist and Charles a fine commentator. But where Max was impatient, Charles tended to adopt, or at least propose, positions that were, to say the least, impractical, which aggravated our problems of seeming to be an esoteric, or even reactionary, newspaper. I found myself fighting hard to prevent the newspaper from dedicating a section to the five hundredth anniversary of Archbishop Cranmer’s death at the stake.

The lot of the proprietor, especially if he has an international business to run, is not easy if he aspires to uphold a line against the guerrilla activities of his editors. There may be more instances of proprietorial abuse than of irresponsible editorial positions, but finding the right balance depends on the relationship between the publisher and the editor.

–

WE GREW QUICKLY INTO A far-flung newspaper company. We rolled in the newspapers we had bought between 1969 and 1974 (Prince Rupert, B.C., Daily News; Summerside, Prince Edward Island, Journal Pioneer; and others) and those that David Radler had added since. We had a group of French-Canadian newspapers, including the slightly historic Le Soleil of Quebec City and Le Droit of Ottawa, and began acquiring small American community newspapers, ultimately owning such newspapers in thirty-one states. The Telegraph flourished, and we were able, in 1991, to borrow against its earnings to buy the largest stake in the leading Australian newspaper company, Fairfax, which had gone into receivership when a leveraged buyout put twice as much debt on the company as it could afford to carry.

The Sydney Morning Herald, Melbourne Age, and Australian Financial Review were fine titles, but the Australians were paranoid about foreigners. Australian prime minister Paul Keating allowed us to raise our percentage of shares in these papers from the initial 15 per cent to 25 per cent but, frustratingly, did not allow us to go further, to 35 per cent as he had indicated a willingness to do. Keating was an extremely entertaining and in some ways brilliant man, a likeable scoundrel – a larrikin, in Australian parlance. But by this time, the legendary Kerry Packer, Australia’s most formidable resident businessman, owner of a television, magazine, and casino company, who had initially organized our bid and then been forced out by a combination of cross-media ownership rules and political pressure, had become resentful of our position. He was also hostile to Keating. Keating claimed that with the physically imposing Packer and me, he was choosing between “a 900-pound gorilla and a fucking Thesaurus.” He was not a solomonic judge. As political and business skirmishing accelerated, my talented friend and associate Dan Colson, with whom I had gone to the law school at Laval, visited the opposition leader and next prime minister, John Howard, arriving concealed – to avoid the press – under a blanket in the back seat of an automobile as it entered the garage of Howard’s office building. Finally, we concluded that owning 25 per cent of Fairfax but having entire responsibility for it was not a long-term strategy we wished to pursue. We sold out at a $300-million tax-favoured gain.

In 1992, we bought a 23 per cent block of shares in Canada’s largest newspaper company, Southam. Torstar (publisher of the Toronto Star) had sold out to us because it had been ring-fenced and confounded by the independent directors and the remnants of Upper Canada’s old families who had controlled the company for most of its history. Southam owned the only, or the leading, newspapers in Montreal (English language), Vancouver, Ottawa, Edmonton, Calgary, Hamilton, Windsor, and several smaller cities. Southam was a serious contributor to the Canadian malaise, as I conceived it. Meekly publishing derivative, dull, and complacent newspapers, and without owning one in Toronto – Canada’s principal city – the country’s national newspaper company deprived itself of any influence. I was confident that Southam could be turned around quickly, in product quality and financial performance.

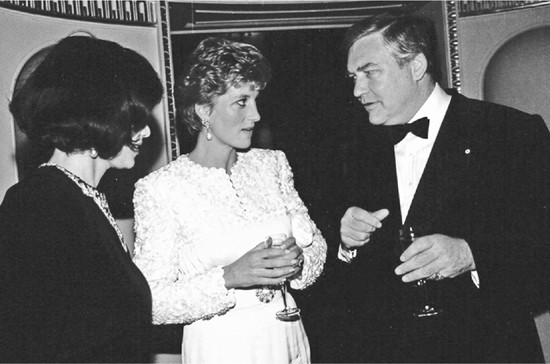

As our newspaper company grew, I attempted to combine aspects of the traditional newspaper owner with contemporary requirements of corporate conduct. I did believe in trying to do things with a little style and to use the access accorded the press to become acquainted with leading figures in different fields while never forgetting the obligations of heading a public company.

When I entered the newspaper business in Quebec in the late 1960s, it was a commercially good business, not particularly labour or capital intensive, generally yielding an operating profit margin of 20 per cent or more; that is, a fifth of its total revenues was profit, before allowing for depreciation and taxes. Managerial talent in the industry was spotty. There were some inspired cost-control managers, of whom the most famous was Roy Thomson.

There were very few newspaper companies that were seriously concerned with both quality and profitability. The Washington Post was one of the few.

In general, the chains deadened newspapers, made them bland, cookiecutter purveyors of wire service copy and uniform soft-left reporting and comment. Few managers had any newspaper editorial experience, and most assumed that if more money were allocated to the editors, this would improve the content of the newspaper in the hands of the reader. More often, it merely compounded the existing shortcomings.

The key is to engage the best personnel, control the numbers of staff, and insist on – and reward – high professional standards. The old Southam was a prime example of the Faustian bargain in which non-interfering owners are praised as ideal as long as they are extravagantly indulgent of the editorial workforce. In the last great boom of the newspaper industry, profits were such that the editorial department could be given a blank cheque for cost and quality – profits would still roll in, enabling management to look good while basking in the praise of the working press. It was a commercially fragile and intellectually corrupt arrangement.

The most important function of the editor or publisher is to assure a just tenor to the newspaper while encouraging lively writing and an imaginative variety of perspectives, and enforcing as strict as possible a separation between reporting and comment. We rarely asked the editors for more than equal time for our views, which were an economically conservative and, in foreign affairs, generally pro-American alliance position. We didn’t try to banish contrary opinion or slant reporting. Our record was not perfect, but it was pretty good.

Gradually, I bought out my brother and the other partners at substantial profit to them. We privatized Argus Corporation, all of these share acquisitions financed by the sales of the old Argus constituent assets. In 1992, Argus Corporation and its affiliates owned about 40 per cent of Hollinger, which owned about 65 per cent of the Telegraph, 23 per cent of Southam, and one hundred of the smaller Canadian and American newspapers. The Telegraph owned 15 (and then 25) per cent of Fairfax (Australia). There was a fair amount of debt, but the group was solid enough, and the promise lay in the possibility of gaining absolute control of Southam and Fairfax.

This was the scene shortly after I married Barbara Amiel in 1992. Hollinger was a good but modest company, with many bits and pieces and quite a lot of debt but possibilities for dramatic growth. The central engine was the income generation of the Telegraph. If that continued and was amplified, if our Australian and Canadian positions could be transformed to ownership of the flows of cash those assets could produce under serious management, and if the newspaper industry did not give way under technological pressures or the deliteration of society, great prospects beckoned.

I ALREADY REGARDED RUPERT MURDOCH as the greatest media proprietor of all time. He had come from a faraway place, had conquered the London tabloid field, buying the derelict Sun from the Mirror and swiftly outpacing the Mirror. He had cracked the Fleet Street unions that had reduced the industry to a financial shambles for decades, and I was the only Fleet Street chairman publicly to acknowledge the debt we owed to Murdoch for this. We all were able to pension off most of our workforces, automate the typesetting and printing processes, and see the whole industry move from the financial margin to solid profitability. Murdoch was a modern pioneer of media integration, buying a film studio and television stations, and he was about to crack the triopoly of television network domination in the United States and break new ground in satellite television.

We had a joint printing venture in Manchester and several other direct arrangements with him. I had always found his word to be fairly reliable, and he was a straightforward negotiator. He developed astonishing enthusiasms at times. Once, he telephoned to urge me to buy the satellite transmission air space allocated to Canada by treaty with the United States in order to fill it with his American-directed signals. I replied that there would be an international dispute over which country would have the honour of prosecuting us: the Canadians for piracy or the Americans for trespass.

Personally, Murdoch is an enigma. My best guess is that culturally he is an Archie Bunker who enjoys locker room scatalogical humour and detests effete liberalism. I have long thought that his hugely successful animated cartoon television program, The Simpsons, is the expression of his societal views: the people are idiots and their leaders are crooks.

His airtight ruthlessness does have amusing intermissions. From time to time, he conducts a campaign to humanize himself in the media of others: appearing recumbent on a bed in one of the glossies; dressed in black, with dyed orange hair, pushing a baby carriage in Greenwich Village; explaining to the Financial Times that he was on guard against errors and arrogant misjudgment in his company; claiming to be a churchgoer and mentioning his possible conversion to Catholicism.

Murdoch has no friendships, only interests; no nationality emotionally – the company he has built is his nation. Except Ronald Reagan, and perhaps Tony Blair, he has deserted almost every politician he ever supported, including Paul Keating, Margaret Thatcher, John Major, Jimmy Carter, and Hillary Clinton, to several of whom he owed much.

In the summer of 1993, my wife Barbara and I chartered a boat with some friends in the Aegean. While loitering around the Greek islands, I read of Murdoch’s plan to restore The Times’s strategic position by lowering its cover price. He would start with a regional discount only. But, knowing Rupert as I did, knowing his compulsive belligerence as a competitor – and his daring – I was sure that if there was any encouragement in the response, he would cut prices very aggressively. Across the gleaming waters of the Aegean, with its splendid yachts and frolicking porpoises, I saw a disquieting vision of the economics of the British national newspaper industry being torn apart by my formidable competitor.

It was not an idle concern. The preliminary results were encouraging enough, and the Furor Murdochus that I had feared ensued. The Times cut its cover price from fifty pence to thirty pence. The Telegraph was at forty-eight pence. We remained there for six months, gamely doing our best with contests, promotions, discount coupons, and so forth, and generally held the Daily Telegraph’s circulation at just above a million, almost as great as the combination of its three broadsheet rivals: The Times, Guardian, and Independent.

The tabloid market was largely dominated by Robert Maxwell’s Mirror and Rupert Murdoch’s Sun and News of the World. Maxwell was a notorious figure, obscure, immense (more than three hundred pounds), bombastic, a vintage charlatan. A British government inquiry declared him unfit to be a director of a public company. His dealings with Iron Curtain dictatorships were particularly contemptible. “Tell me, President Ceaušescu, why do your people love you so?” he asked the Romanian president a few weeks before Ceaušescu was overthrown and executed amid popular rejoicing. Following Maxwell’s death in 1991 and the collapse of his company into receivership, Murdoch had cut the cover price of his own tabloid Sun, which had been running about even in circulation with Maxwell’s Mirror. The court-appointed administrators could not respond to Murdoch’s price cuts, and the largely working-class readership of the Mirror was very price-sensitive. The Sun opened up a circulation lead of almost six hundred thousand over the Mirror; Murdoch clearly thought he was on to something. He accompanied his price reduction at The Times with an intensified effort to clone the Telegraph, including our daily separate sports section and to hire our personnel (at which he was not very successful), and conducted a massive promotional blitz.

A couple of years before, when Murdoch faced a dangerous financial crisis, I had given an address at the Media Society at the Café Royal, convened by Charles Wintour (former editor of the Evening Standard and father of Vogue editor Anna Wintour), and expressed confidence that Murdoch would come through his problems and that most of his critics were motivated by spite and envy. Murdoch wrote to thank me for my support. (He swiftly recovered from his financial crisis, as I had predicted.) I sought and expected no competitive quarter, but did not foresee the frenzied and relentless abuse I received from his organization when I passed through the valley of humiliation.

As the price war developed, the Independent in particular squealed in pain and with the Guardian and others made several pilgrimages to the Office of Fair Trading, to complain about predatory pricing, which is defined in the U.K. as selling at below the cost of production and distribution. Of course Murdoch was doing just that, but so were many other people in various industries. I refused to join these protests and publicly stated that as a capitalist myself, I believed in a man’s right to lower his prices if he wished to. My supportive noises were reciprocated but led to no early de-escalation of the price war. Murdoch made it clear, including to a couple of our Sunday Telegraph reporters, that in a few years there would be only three newspapers in London: The Times, the Sun (both owned by his company), and the Mail. The Financial Times and the Guardian, he generously allowed, might survive as niche products for the financial community and the academic and clerical left, respectively.

In London and Australia, Murdoch’s newspapers routinely referred to News Corporation’s ability to control Hollinger International’s profit by tuning the London broadsheet price war up and down. There was, unfortunately, some truth to this. Hollinger’s only revenue was dividends from the Telegraph only because the ineptitude of the Southam management had forced the cancellation of their dividend. Hollinger was short of cash and still had some debt to service. All this was known to Murdoch, and he put on all the pressure he could. In the early spring of 1994, we sold some Telegraph shares because of Hollinger’s cash needs.

IN SUCH A SITUATION there was no alternative but to play it aggressively, as Murdoch himself would. Barbara and I returned to London from New York on June 9, 1994, and I was greeted the next day by a phalanx of determined editors and senior executives advising that we cut the cover price immediately or lose our position as market leader. The only dissenters were a couple of men approaching retirement who were very concerned with the options given them to reinforce the comradely esprit of the company and spread the profit around. I wanted all the employees to think of themselves also as owners. But it didn’t happen. As we were not a listed stock, every day the company secretary would calculate a reference price from the price/earnings ratios of listed U.K. newspaper companies, and descend to the lobby of our building to post the price prominently before everyone entering. The company would buy the options at this price, once they had vested, though I hoped the employees would continue on as shareholders. With almost no exceptions, the employees sold as the rights vested.

To Murdoch’s considerable astonishment, as was severally reported to me, we abruptly cut our cover price from forty-eight to thirty pence. He had assumed that I would react like other publishers he had fought: husband the profit, economize, protect short-term gain even at the expense of the franchise, and hope for a merciful relaxation of the competitive pressure. I knew better than to anticipate any mercy from Murdoch. He at once implemented a further cut, to twenty pence. The balance between circulation and advertising revenue in the United States and Canada is about one to four, but in Britain it is between one to two and one to one. Cutting our cover price from forty-eight pence to thirty pence could cost the Telegraph more than $50 million annually. Only a controlling shareholder, prepared to eat such a heavy loss and face the abuse of the minority shareholders, could afford to take such a step and jeopardize short-term profits so seriously. But nothing less was necessary if we were to preserve the leading position of the Telegraph.

After our cover-price reduction, I tasted the temper of the city of London. Financial analysts stirred up the media with allegations that our sale of the block of Telegraph shares was fortuitously just ahead of our cover-price reduction. Cazenoves, who had been our broker for the sale and assured us that they would do nothing precipitate, abruptly resigned their association with us, telling the Financial Times that this was an unprecedented step for them. We had loyally stayed with the firm when one of their senior executives, David Mayhew, was facing criminal charges (of which he was acquitted). The London Stock Exchange investigated the sale and quickly discovered that there was no thought of cutting the price at the time the block of shares was sold and that this decision was made only after I returned from overseas to face an almost unanimous recommendation from the executive team, led by the editor. Two years later, we privatized the Telegraph at approximately the share price it had enjoyed before the cover-price cut, and all the shareholders departed happily. But the performance of Cazenoves was scandalous, a harbinger of some of what was to come when a much greater crisis developed nearly ten years later.

I received twice-daily bulletins on circulation and followed our sales in every corner of the United Kingdom. We imported circulation-building techniques we had developed in Australia, of the sale of discounted, prepaid subscriptions. By the end of 1994, it was fairly clear that we were holding our own in the battle to retain our status as market leader. Our research also revealed that Rupert Murdoch, in his fierce quest for our circulation, had followed his natural instincts and brought The Times editorially down market, which again tended to make it a second read for the mid-market tabloid readers. It gave us the opportunity, which we took, to invest in product and take over much of the traditionally Times-reading top income and top education-level readers. The old Colonel Blimp Telegraph would emerge from its ordeal almost the newspaper of record of the British establishment and national institutions, and the greatest and most respected daily newspaper in Europe.

The pressure of the price war was relentless. Murdoch was wooing our staff with salaries we couldn’t possibly meet, but we lost few people as the Telegraph was a relatively happy ship, without News Corp.’s constant Australian back-biting and chippiness, which Murdoch likes and promotes. Barbara’s job at Murdoch’s Sunday Times gave her independence from charges of spousal favouritism but at the cost of justifying moves to Murdoch by our own editorial people. I had to tell Barbara she could not continue working for Murdoch. She left, but not happily.* Most of our management cracked under the pressure. The managing director, Joe Cooke, had a minor stroke and retired. The finance director, promotions director, and several other senior people retired or otherwise departed. Dan Colson, my old friend from the Laval University law school and the very capable vice chairman of the Telegraph, became the co-chief executive, and he and I took direct control of the management. Our editor, the redoubtable Max Hastings – dashing and irrepressible but with a short concentration span and even shorter temper, at times an almost Monty Python–like awkwardness, and a hodgepodge of dissonant, half-formed opinions – also left abruptly.

He developed an elaborate catalogue of concerns including dislike of the Docklands as a place of work and concern about money being invested in our Sunday newspaper. All the same, Max told me that with a stylized option and bonus package, he would stay. I worked like a beaver for three days and prepared a plan for him, designing around his current divorce proceedings, in consultation with tax and benefit specialists, and assuring him a tax-designer sourced income of over $400,000, but when Max arrived for our meeting, he said, “I’m leaving. I’ve signed with the Evening Standard.” He subsequently wrote a memoir of his time at the Telegraph that was perfectly amiable but represented me as an overbearing proprietor. There was little truth to this, and it is the usual beetle-browed self-dramatization of the frazzled editor, which journalists always absorb with gape-mouthed credulity. I intervened forcefully once, to reverse his original opposition to the American air raid on Libya in 1986. I defended him from all comers, from the widow of one of his former schoolmasters, offended by Max’s vituperative obituary, to Lauren Bacall, who claimed to have been misquoted, to Margaret Thatcher, over her daughter Carol’s disembarkation from the Daily Telegraph. And although our working hours were quite different, I telephoned him after midnight only once, when I read in our principal op-ed piece that the best cure for clinical depression was a cup of tea. His stubbornness and the philistinism of some of his opinions were exasperating. But he was a great newspaperman and a strong leader. Furthermore, I liked him. At the least, he was non-stop entertainment.

Dan Colson and I had a stab at hiring Paul Dacre, editor of the Daily Mail, as Max’s replacement. In a cloak-and-dagger meeting one evening, Dacre came to our house in Chester Square and enthusiastically accepted in principle, saying that it had always been his dream to be the “editor of the U.K.’s leading broadsheet newspaper.” A few details remained. The next day, Dacre ensured that our conversation was leaked, and the group’s editor-in-chief, David English, offered Dacre a large raise and his own position, with English himself moving up to chairman of the Daily Mail. Dan and I did not especially mind Dacre using us to better his own lot. But we found his self-righteous public claims that he had dismissed our overture – and asked English for an increase in the editorial departmental budget only after English inexplicably got wind of our discussions – tiresome. Dacre and I had a rather acerbic exchange in the Guardian, of all places. I have not seen him again.

A couple of nights later, I had dinner with Vere, Lord Rothermere, chairman and principal shareholder of Associated Newspapers, which owned the Mail and Evening Standard, where Max Hastings was now going, and told him I did not highly appreciate his poaching our editor. (It was only after his raid that we approached Dacre.) Vere admonished me with all the authority of the head of the Harmsworths and the heir to Northcliffe, saying that we are just theatre owners and that the journalists and editors are actors. They play in our theatres but have no interest in or loyalty to us. It was an apt metaphor.

The Sunday editor, Charles Moore, became editor of the Daily Telegraph. Dominic Lawson moved from the clever and stylish 175-year-old Spectator magazine, which Andrew Knight and I had bought in 1988, to the Sunday Telegraph. Both proved to be successful appointments. One of the group’s most brilliant writers, Frank Johnson, became editor of the Spectator. After a few years, Frank reverted to writing and Boris Johnson (no relation) became the Spectator’s editor. Boris, with his shock of unkempt blond hair, Wodehousian pratfalls, and endearing teddy-bear appearance and personality, was already something of a folk figure in Britain. His columns were hilarious, and so was almost any conversation with him. When he was doorstopping in his 1997 parliamentary campaign, a housewife informed him that she was going to vote for him. “But why, madam?” Boris famously replied. We managed to get a solemn promise from him that in exchange for the editorship he would not run for election again. A few weeks later, he threw his hat in the ring in two constituencies and was eventually elected as successor to Michael Heseltine in Henley in 2001. In 2007, he deposed the two-term hard-line Marxist Ken Livingstone, generally known as Red Ken, in the election for mayor of London.

ONE OF THE MANY INITIATIVES we examined was the possibility of buying the competing daily newspaper the Independent. The main shareholders were my left-of-centre friends Carlo Caracciolo (Fiat owner Gianni Agnelli’s brother-in-law and the ultimate limousine liberal) and Juan Luis Cebrián of El Pais in Madrid. In the end, they chose to sell to the Mirror, then headed by Rupert Murdoch’s former editor of the News of the World and Today, David Montgomery. (Murdoch claimed to have fired Montgomery because he “stared at me.” I was incredulous, but Rupert told me to note carefully how he stared the next time I met Montgomery, a serious and intense Ulsterman. I did and found that Rupert had a point.) In January 1995, Barbara and I attended the World Economic Forum at Davos. The days were crisp, with perfectly blue skies and icy, snow-covered pavements. I appeared on a panel in a plenary session with Rupert Murdoch. In the questions we answered jointly after the panel discussion and during the private lunch that followed, with Barbara, Murdoch, and his wife, Anna, Murdoch said he foresaw an early rise in the London newspaper cover prices, to allow for newsprint price increases. Anna, whom I had first encountered when we were receiving communion at the Brompton Oratory, left us early to stop in at church. I thought it inappropriate to accompany her in prayerful thanks at her husband’s signal of de-escalation in the price war, though I felt the urge to set to work on yet another corporate reorganization. The price war continued, but less intensely. The mortal threat dwindled to a serious nuisance.

THROUGHOUT THE PRICE WAR, I had been toughing it out with our Southam investment in Canada. Here, I was struggling with a suffocating group of grey and greedy minds. We were getting nowhere, ring-fenced by the old management teams and directors. I came up with a plan to merge Southam and Hollinger by exchanging our newspaper assets for their shares. That would give us effective control of the company. But the notion of me in charge of Southam was too much for the independent directors, who began feverish attempts to find a counterbalance.

The familiar and formidable figure of Paul Desmarais, chairman of Power Corporation and probably Canada’s most distinguished businessman, loomed. Driving out to the airport in London to fly to Toronto for a Southam directors meeting the next day, I responded to a message from Desmarais, and he told me that, by invitation, he was taking up an equal shareholding to Hollinger’s with shares issued by Southam’s treasury. I knew this “invitation” was going to be a difficult battle.

On the airplane, I considered how to deflect the dangers of this move while Barbara, already fatigued with the price war and having some sense of what lay ahead, toyed with the possibility of ejecting herself from the plane mid-flight. I had great respect for Paul, but this was essentially a project for his son André, an amiable young man. Paul is a multi-billionaire, and neither he nor his son really intended to run Southam and maximize profits and transform its newspapers into agents for change in Canada. Their holdings were diverse and included some newspapers, but they were not newspaper publishers the way we were.

Power Corporation could sideline us to a marginal position, where we would depend on the talents of the incumbent Southam management to raise the value of our investment. This was an unpromising state of affairs. It is difficult for those not familiar with the company to grasp how incompetently managed Southam was and how dreary and disliked most of its newspapers were. The management had come from other industries. The publishers and unit heads tried to manage their divisions second-guessed by head office. Head office specialized in endlessly summoning unit management to Toronto for lengthy question-and-answer sessions.

The result was an immense infestation, a teeming anthill, of superfluous people and the dedication of much corporate energy to backbiting and internecine struggles. The newspapers were ruled by soft leftist editors who were themselves captives of soft leftist cadres of journalists. They were under instructions to keep coverage local, and this led to endless antagonisms between the newspapers and the principal figures in the communities where they were supposedly building goodwill.

It took a night of international calls to independent Southam directors from Japan to Hungary, but we managed, by the narrowest of margins, to defeat the original Power Corporation acquisition of treasury shares at the Southam board. André Desmarais and his father telephoned, and we met in Palm Beach a few days later. They were still eager buyers and the other Southam factions couldn’t be held indefinitely, so our best course was to let them in on terms we could live with. I had won this round but did not want to push it. At least Paul was dealing with me now, and not trying to come in the back door. As I recorded in my earlier book, published in 1993 about my career up to that time, we agreed that we would have equal rights, so that there was at least some incentive for the Desmaraises not to collude altogether with the old families and banish us to the corner to be tormented with sharp sticks and hot irons, as Torstar had been. As long as we and Power Corporation acted in unison, we would have determining influence on the company.

At the next annual meeting, Paul Desmarais sat right behind me. The company president, Bill Ardell, a pleasant and attractive man who had done well in other businesses but had no background in newspapers, gave a very defensive and gloomy report on the newspaper business. Desmarais leaned forward and whispered to me, in French: “When are we selling our shares?”

The official Southam line, as in so much of the newspaper industry, was that new technologies were a grave threat to newspapers and that the challenge for the industry was “managing decline,” as if our task were the dismemberment of the British Empire. In this way, no insufficiency of performance could be blamed on management. Their comments would be legitimized ten years later but were no excuse for the results they were producing then. I carried the flag for the business, and from time to time the Wall Street Journal and other publications asked me to take up the fight on behalf of newspapers. At Davos and the Museum of Television and Radio meetings, I was a virtual anachronism, like a member of the Flat Earth Society, and I became the most frequent advocate of the viable future of the newspaper industry.

My contention was that with the new technology we could deliver our newspaper content in any format – online, via telephones, or on flexible screens unrolled from pockets. People would pay for newspapers they liked, with individual writers who engaged them and news and features carefully edited and imaginatively presented. This could not be done with the Southam formula of bland, soft-left criticism of anyone who was actually trying to accomplish anything in the communities where the newspapers circulated. But lively, well-written, provocative, informative, and balanced newspapers could keep their readers, I ritualistically repeated, at Davos, in the Wall Street Journal, at Southam board meetings. I almost said it to passersby on Fifth Avenue or in Knightsbridge. I claimed, despite my lack of background in any form of technology and a desperate lack of rapport with new gadgetry, that in a few years everything would be broadband. We would use the same screen, with the same picture definition, for television (satellite or terrestrial), the Internet, video games; anything anyone wishes to put up. In these circumstances, there would be no television franchises left. The fragmentation of the market might overwhelm the networks, and the strong newspaper franchises would have an incomparable ability to build market share for those contesting for mastery of the screen.

To some degree, I believed this. But these were times of sheer drudgery for us, and there was little excitement or pleasure in the constant fight for business survival. Our social life was lively and interesting, but the corporate life on which it largely reposed was in constant turmoil. I became progressively more disgruntled with the failure of our Southam investment to achieve anything, and with the squandered opportunity, and with the lassitude of Power Corporation. We were simultaneously fighting the price war in London and being flimflammed by the politicians in Australia. There was a squeeze throughout our company, and the inert, unremitting investment in Southam was a large part of the problem.

Paul Desmarais was not at all antagonistic, but neither was he an active supporter. For us to get anywhere, I knew this had to change. I invited him to buy our position. Desmarais was unenthused. Eventually, the lack of any progress at Southam became so irritating that I lobbied Paul on the theory of exchanging our shareholdings for a number of Southam’s non-metropolitan assets. Ultimately, the situation was resolved by its cause: the astonishing vanity and complacency of the Southam directors. The unaffiliated directors, “the independents,” as they styled themselves, had engaged an obnoxious lawyer. The independents instructed their counsel to compose a lengthy and dismissive letter to Paul and me jointly. The letter – from the chairman, Ron Cliff of Vancouver, but clearly inspired by the independents’ egregious lawyer – informed us that we had no standing to waste management’s time devising such schemes as an exchange of a block of stock for a carve-out of assets, and that henceforth we could deal with the management only through the independents. By now I was fairly accustomed to being cuffed around by these people, but given that Power Corporation and Hollinger between us had more than 40 per cent of the stock, this was a fairly nervy stance.

Paul telephoned me in Prague, where I was attending a New Atlantic Initiative Conference (one of the many forums I attended for a while, and one of the better ones). He was so disgusted by the letter, he said, that he was prepared to sell us his stock at his cost. We quickly agreed, and Paul promised that the Power Corporation votes at the next directors meeting would be cast in favour of a special shareholders meeting to remove what I soon publicly described as “the obdurate rump” of our antagonists. We still had a couple of supporters on the board, and the motion passed. The intended targets of the special meeting abstained, a little like East German Communist leader Erich Honecker voting for his own removal in order to preserve party solidarity.

The shareholders meeting took place when Barbara and I were in Biarritz in the spring of 1996, as we were trying to find a holiday destination with a level of light that would not inflame her dermatomyositis. (Biarritz and the Pyrenees were not the place, but good Jew Barbara found Lourdes astonishing. The birthplace of Marshal Foch in Tarbes she found quaint, but she was distinctly less riveted by it than I was.) The Southam shareholders threw out the five designated retirees by a margin of well over 80 per cent. We could have won without casting any of the Power and Hollinger votes. Even the long-suffering regular shareholders had had enough.

We went through the head office like a scythe. The millions of dollars that fell off the payroll were imperceptible to the functioning of the company and freed up time for the publishers to operate their newspapers. The editor in Montreal, a distinguished woman who would not represent the interests of 1.5-million primarily English-speaking Quebec readers by being anti-French (an attitude she and we would not tolerate), but was, I felt, quite inadequate in the leadership she was prepared to give the community, graciously retired.

The Ottawa Citizen was such a shockingly inadequate newspaper for the capital of a G7 country that I suggested Russell Mills, its publisher, retire. He asked to see me. I told him that the editor would have to be changed, and he said that he had been about to propose the same move, and he accepted my suggestion for a replacement, Neil Reynolds, then an editor for the Irving family in New Brunswick.

Mills and Reynolds produced an almost unrecognizably improved Ottawa Citizen within a few months, and after a grand relaunch, the newspaper’s circulation began to rise slightly following a decade of decline in one of Canada’s faster growing metropolitan areas.

I suggested to the publisher in Calgary that the oil and ranching capital of the country, the closest Canada has to the ethos of Dallas or Houston, could do without a friendly socialist as editor, who daily debunked the wellsprings of Calgary’s prosperity and the very raison d’être of the city. This was done.

Beyond that, we laid down only a few general guidelines, disabused the advertising team of the notion that we were managing decline, culled fat, and worked with the publishers and editors to improve their products. In less than three years, the straight profit from operations increased from barely $100 million to $300 million, confirming the sense of our gamble on what newspaper franchises in such rich cities as Vancouver, Calgary, Edmonton, Ottawa, and Montreal could do if operated seriously, and the stock price rose quickly by 50 per cent. There were not many further personnel changes, only steady pressure for integrity, balance, good writing, and lively presentation. Canada’s national newspaper company was no longer something to be ashamed of, and almost all of our critics in the Canadian media accepted this fact, however reluctantly. When we consolidated our control over Southam in 1996, Hollinger owned 59 of the 105 daily newspapers in Canada.

Once we were in charge of the company, all those shareholders who had conspired to prevent us from taking control of it joined forces to jack up the price for us. This was fair business, but unctuous cries of shareholder rights were a little hard to take from those people, as they often are.

Our initial effort at a takeover bid brought us up to only a little more than 50 per cent, so we allowed the offer to die rather than raise the price. We wanted Southam’s operating income for our company in order to liberate its dependence on dividends, the ancient curse of Argus Corporation. This required ownership of all the shares: intercorporate dividends are tax-free, while debt interest is tax-deductible, so we needed operating income from which to deduct, for tax purposes, the cost of interest on our debt, thus effectively laying off much of it on the tax collector. We were the victims of our own improvements to Southam’s operating performance. The method we adopted to take out the public was to declare a six-dollar special dividend and then bid at a slightly lower price for the ex-dividend stock. This was thought by some to be devious and by others to be clever, but it accomplished our objective to privatize Southam.