Catastrophe – Read Now and Download Mobi

Catastrophe

How Obama, Congress, and the Special Interests Are Transforming…a Slump Into a Crash, Freedom Into Socialism, and a Disaster Into a Catastrophe…and How to Fight Back

Dick Morris and Eileen McGann

Contents

Introduction: Take Back Our Country

I How Obama is Causing a Catastrophe

II How Congress Causes Catastrophe

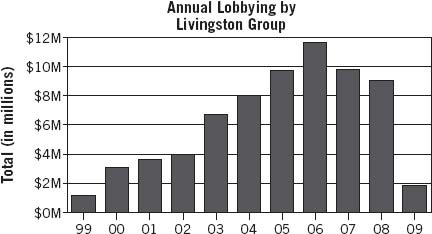

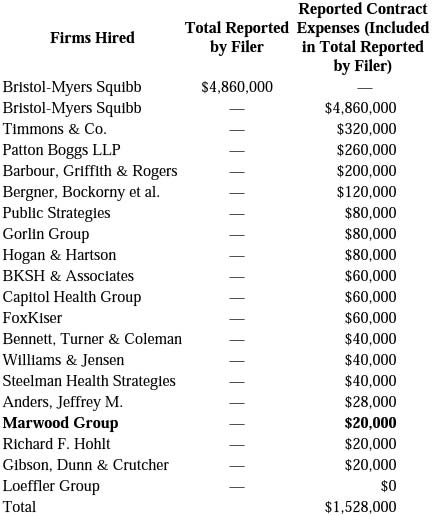

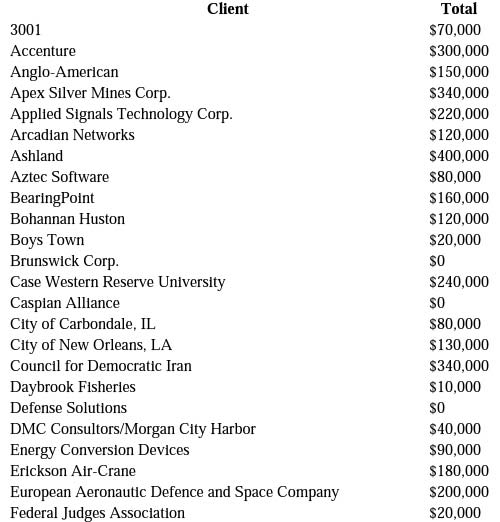

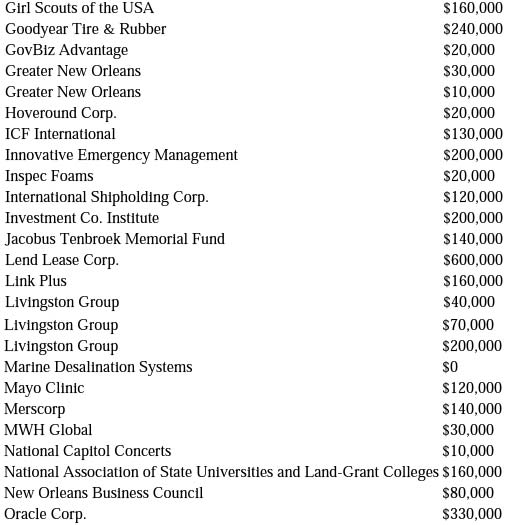

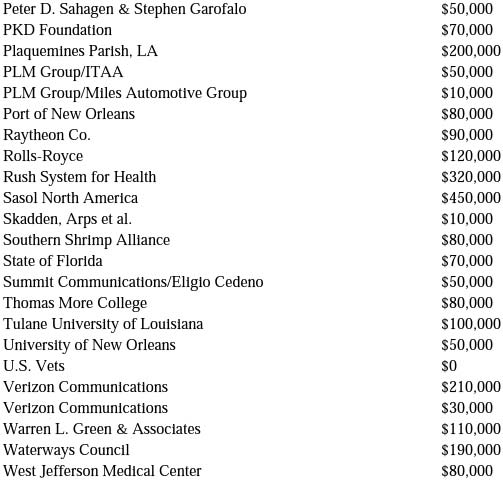

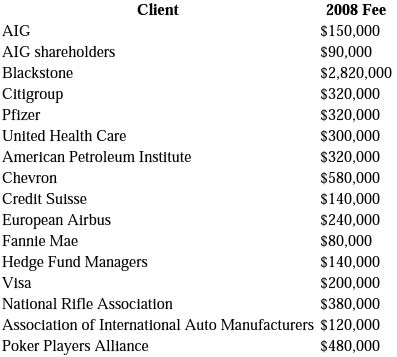

10 Stealth Lobbyists: The Former Congressional Leaders Who Secretly Influence Federal Policies and Spending

III How Special Interests Cause Catastrophe

11 The Sheer Chutzpah of Countrywide Financial Executives

12 Pay to Play: No-Bid Contracts Exchanged for Campaign Cash

13 Slow Surrender: How Our Banks and Investment Firms Are Opening the Door to Shariah Law and Muslim Extremist Domination

14 How Bill Clinton Goofed…Costing You $60 Billion

15 Tarmac Hostages: How Airlines Imprison You on the Runway

16 The Silent Catastrophe: Post-Traumatic Stress Disorder in Our Military

Conclusion

Acknowledgments

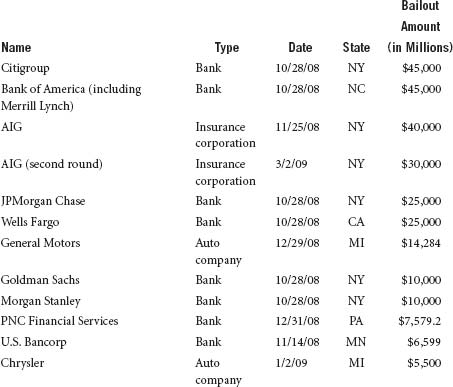

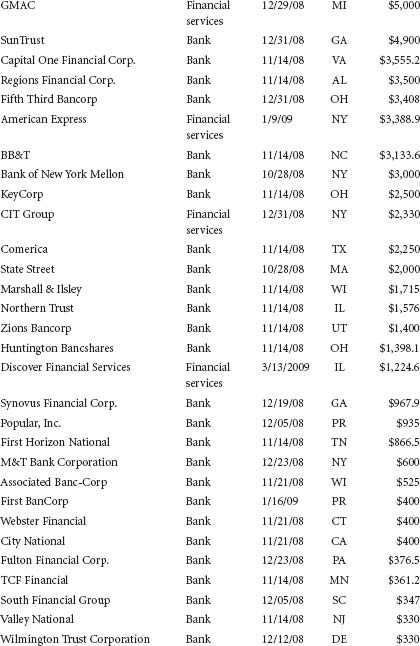

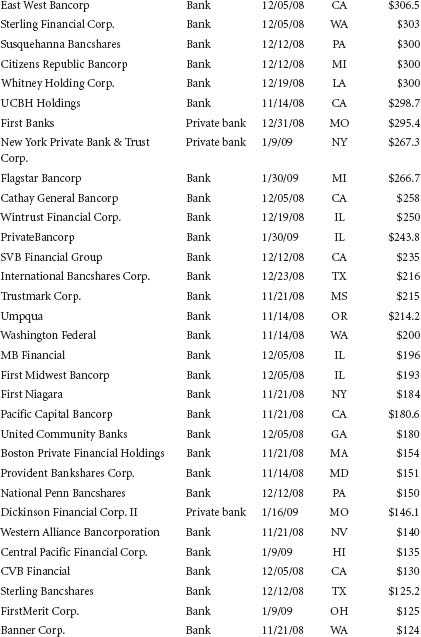

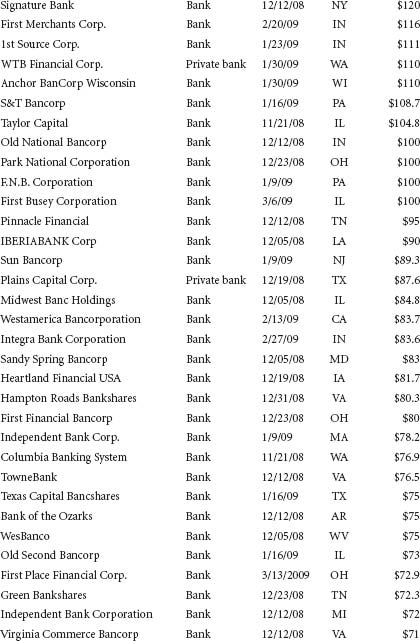

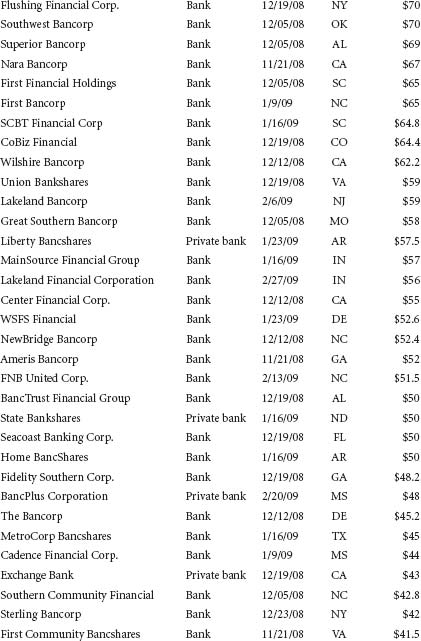

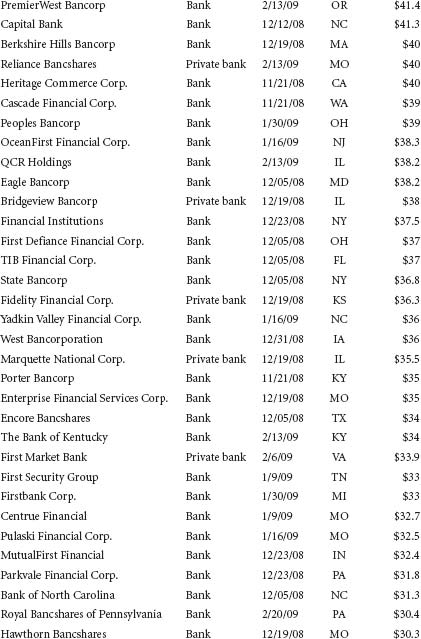

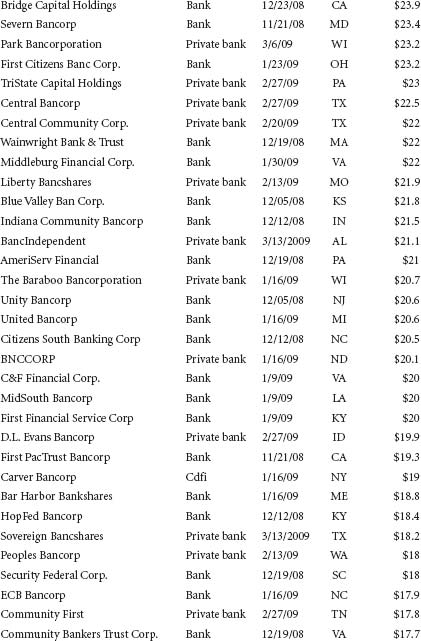

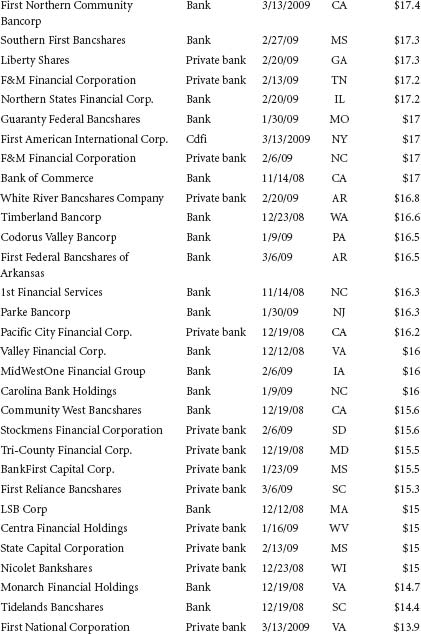

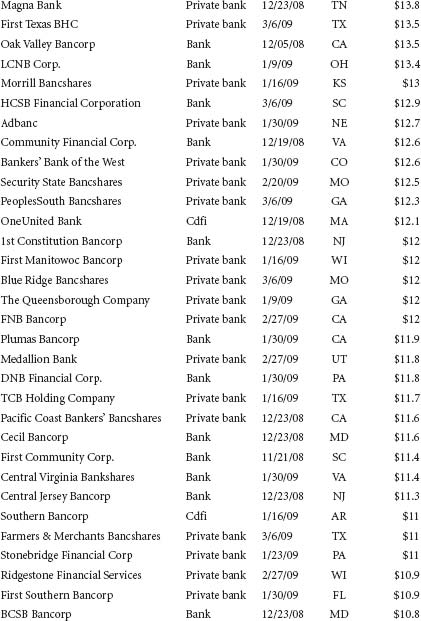

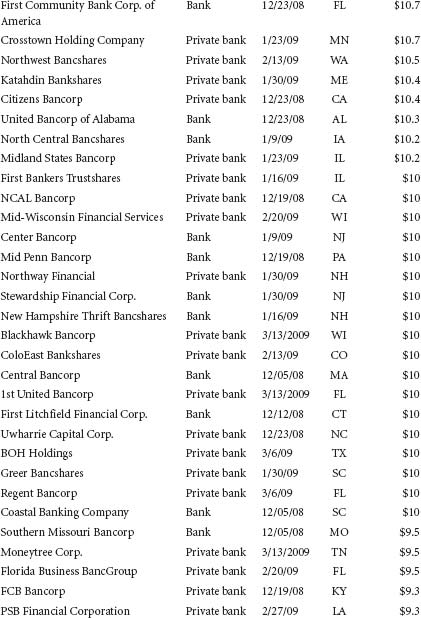

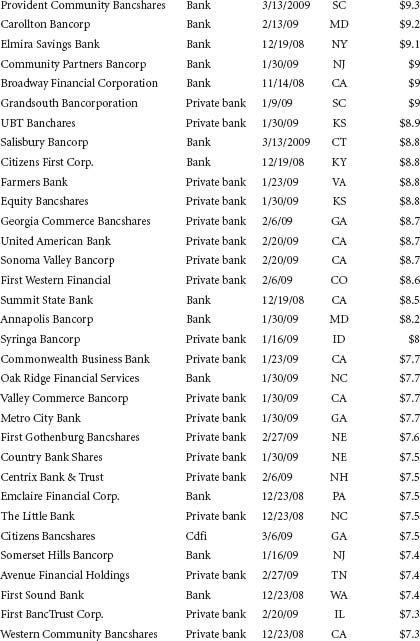

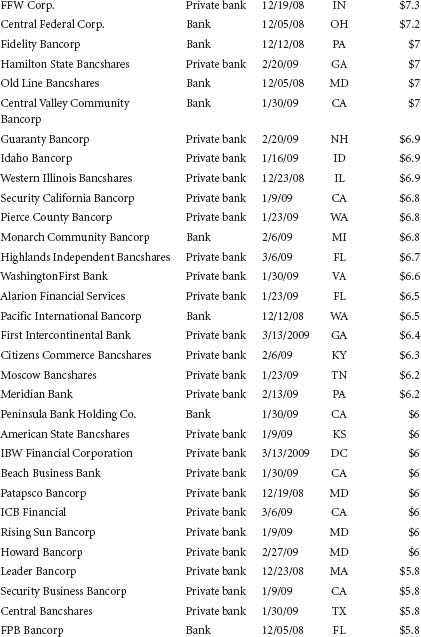

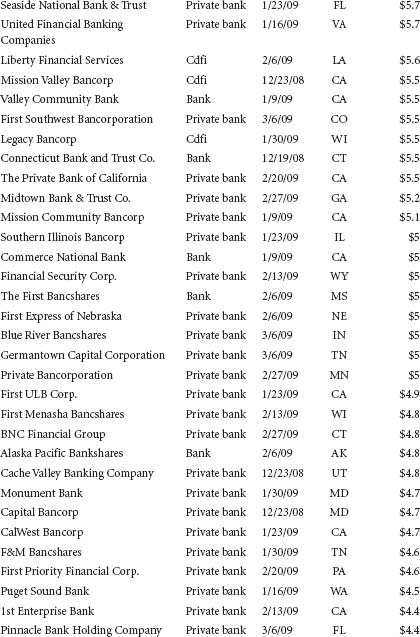

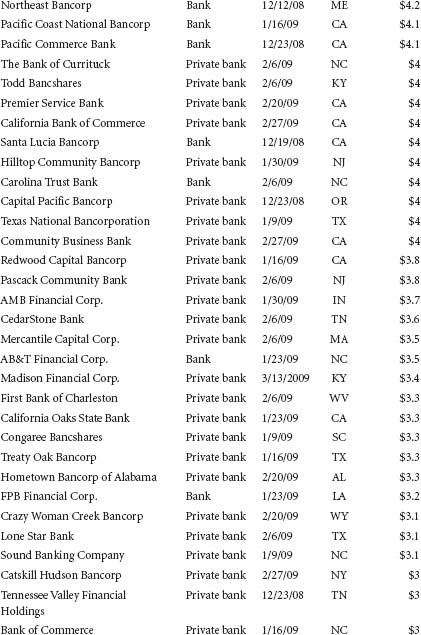

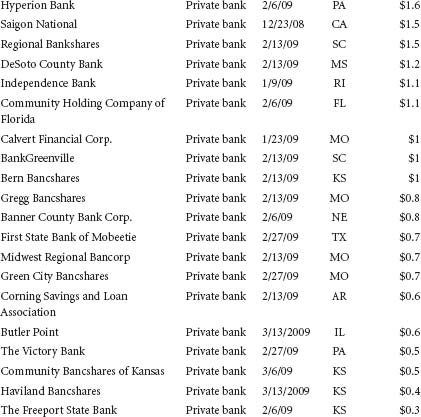

Appendix: Complete List of TARP Recipients

Notes

About the Authors

Other Books by Dick Morris and Eileen McGann

Credits

Copyright

About the Publisher

Take Back Our Country

We are today in the middle of the greatest catastrophe—the greatest catastrophe due almost entirely to economic causes—of the modern world.

—JOHN MAYNARD KEYNES, 1931

It’s time to take back our country.

Now.

It’s that simple. It’s that urgent.

It’s time to take it back from President Barack Obama, before he fully implements his radical political agenda—one that threatens our liberty, endangers our livelihood, and jeopardizes our very safety and security.

Obama has canceled the war on terror and declared a war on prosperity.

It’s a catastrophe.

Make no mistake about it: We now have a socialist in the White House. Barack Obama firmly believes in government control of our major industries, a hallmark of European socialism. Watch him. First it was the banks, then the auto industry. What’s next? He’ll keep going until the federal government owns or dominates every major American business and sets the salaries for all employees.

Using the global economic crisis as an excuse to revolutionize our economy and institutionalize pervasive and perverse changes masquerading as “reforms,” Obama wants to change our way of living, working, and even thinking.

He’s committed to orchestrating an extraordinary redistribution of wealth, significantly raising taxes on those who make more than $200,000 a year while providing tax credits and other advantages to those who don’t. He intends to create a dual tax system: on one side there will be those who pay an enormous amount of taxes, and on the other there will be those who pay nothing at all but are regularly and directly subsidized by the increased taxes of those who do. Think France.

Obama plans to expand the role, size, and cost of government vastly and to regulate each and every aspect of corporate and commercial conduct. It’s only a matter of time before political correctness, too, will be legislated, and the policing of acceptable personal conduct will become yet another role of the government. Everything is on the table. Remember that both his chief of staff, Rahm Emanuel, and his secretary of state, Hillary Clinton, have warned that we shouldn’t “waste” a good crisis like the one we’re in.

“Waste” a crisis? What do they mean? Well, apparently the Obama administration sees the current atmosphere of economic turmoil and uncertainty as a great opportunity to make sweeping changes that wouldn’t otherwise be acceptable to the American public. Changes the American left has been dreaming about for years. So now, under the guise of solving the crisis, Obama can pass and fund just about anything. Just take a look at his nearly trillion-dollar stimulus bill—and all of the outrageous earmarks that were wedged into it by Congress as the price of passage.

And it’s not just the economy: Obama has virtually ended the war on terror. His administration doesn’t even utter the words. In recent testimony before Congress, Department of Homeland Security secretary Janet Napolitano actually referred to “man-caused” disasters, pointedly avoiding the word “terrorism.” 1 Obama’s appointments to the Justice Department have been people who are determined to root out, investigate, and expose not the terrorists themselves but those who protect us from them. Guantánamo has become a resource center for terrorists; a new one is freed every week. And Obama is reversing our long-term commitment to Israel—and instead giving almost a billion dollars to Hamas.

Let’s face it: his policies are a catastrophe, and we need to stop him.

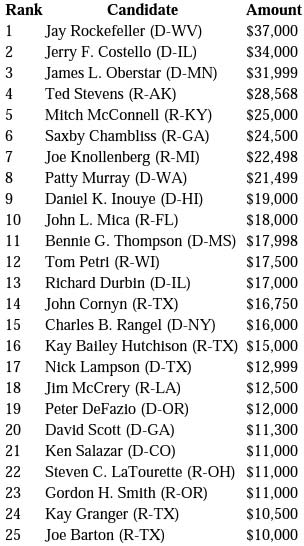

It’s also time to take our country back from the Democratic Congress, which has undergone an embarrassing transformation from a do-nothing body into a rubber-stamp annex of the Obama White House: 535 elected officials who didn’t even bother to read the details before they authorized almost a trillion dollars in stimulus spending that their constituents will have to pay for. A Democratic Congress that, in the middle of the gravest financial disaster since the Great Depression, bargained for billions in additional outrageous earmark spending programs to please their contributors and lobbyist friends, without a look back at the needs of their constituents. Just to whet your appetite (or, should we say, spoil it), here are a few of the worst expenditures of taxpayer money contained in that stimulus bill:

$200,000 to fund a tattoo removal clinic in California2

$190,000 for the Buffalo Bill Historical Center in Wyoming3

$2,192,000 for the Center for Grape Genetics in Geneva, NY4

$1,791,000 to fund Swine Odor & Manure Management Research in Iowa5

The malfeasance of the Congress is in itself a catastrophe. We need to clean house (and Senate) and replace the self-serving automatons with elected officials who genuinely understand that their job—their only purpose—is to serve the people who elect them, not the people who pay for their campaigns. People who understand that they, too, will be thrown out if we see more of the same. It’s about time we had representatives in Washington who root for the people back home, instead of conspiring against them with their generous lobbyist pals.

On a recent episode of Glenn Beck’s Fox News show, an organizer of a tea party protest in St. Louis indicated that members of Congress had been invited to the event in order to give them a chance to meet with their “board of directors”—the voters who elected them and who should be able to advise them about the needs of the district. She had it right. That’s how it should be, and it’s a good way to think about Congress: we hire them, we pay them, and they should be accountable to us. Unfortunately, most of them don’t think that way at all. The only boards of directors that our representatives routinely meet with are the corporate ones, who decide who their political action committees will contribute to.

We desperately need to take back Congress and make it accountable to us, the voters—not the banks, credit card companies, defense contractors, and other special interests that have been running the show for way too long.

Can we do it? Well, to quote our president: Yes, we can!

There’s a lot more we can do to make Congress more accountable and more constituent-friendly. One important step would be to work hard to keep the political dynasties from taking up space in Congress. It’s not just that it’s usually their family name recognition that gets them elected; it’s that the dynastic politicians come with a special kind of baggage: generations of hangers-on, people who have been given favors and jobs over the years who watch out for them and make it difficult for insurgents to take them on successfully at the polls. You know the names we’re talking about: Kennedy, Dodd, Clinton, Dole, to name a few.

While we’re at it, we should look at the growing number of spouses of members of the House and Senate who are invited to sit on corporate boards—and paid very well for doing so. Is this a backdoor way of paying the members?

But that’s not all. It’s also time to take back our country from the Wall Street masters of the universe, whose insatiable greed led them to create a dangerously unstable environment for American businesses and investors—until their house of cards crashed, taking the wealth of millions of shareholders, investors, and average Americans with them…and they turned to the government for a bailout.

The AIGs, the Citibanks, the Lehmans, and the rest of the unfortunately familiar Wall Street roster of shame created an unprecedented catastrophe—with the help of many in Congress, who contributed to that catastrophe by recklessly deregulating banks and financial institutions and ignoring the growing signs of economic catastrophe because they did not want to offend their patrons.

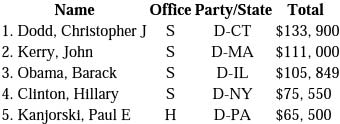

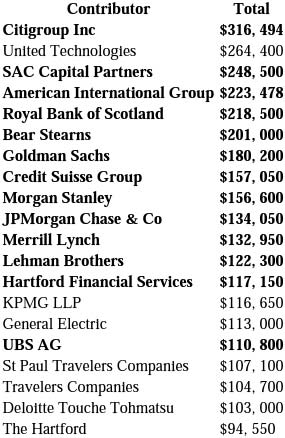

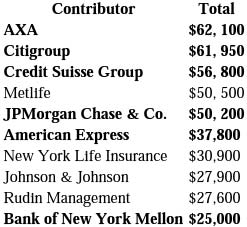

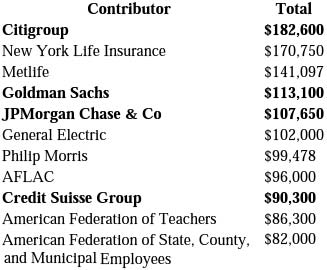

Those same institutions that are now broke poured millions into the campaign coffers of those in Congress who should have been watching out for the investors who needed protection instead of watching out for their donors. Is it any coincidence that the chairman of the Senate Banking Committee, Connecticut senator Christopher Dodd, was the number one recipient of AIG money and that company executives aggressively urged top-level employees to contribute to him as soon as it was clear he would be the next chairman of the committee? Within three days, the group had raised $160,000. Now questions have been raised about whether Dodd returned the favor when he agreed to insert language into an amendment to the stimulus bill to permit the retention of bonuses that had already been awarded. It’s a legitimate question: at first Dodd vehemently denied that he had had anything to do with the language that was so favorable to AIG, but he later admitted that he had reluctantly agreed to the change after the Treasury Department asked him to do so.

That’s the way things work in Washington, and that’s why we have to take it back.

It’s our country. It’s our Congress. It’s our government. We can’t simply cede them to the people who want to destroy our values or follow instructions from their corporate patrons.

We’ve seen what happens when greedy companies like Countrywide Financial lure customers into unconscionable mortgages that they know they can’t afford. Many believe that Countrywide’s unscrupulous practices—the writing of hundreds of thousands of subprime mortgages that were doomed to end in default and the baiting of customers with initially low interest rates that eventually ballooned into unaffordable notes—was the detonator that triggered the financial meltdown that we are now witnessing. Now those unfortunate people are lining up in foreclosure court and losing their homes by the thousands. Meanwhile, the Countrywide executives, who walked out with hundreds of millions of dollars in bonuses, have found a new business. Many of the former top executives at Countrywide (except for CEO Angelo Mozilo) have started a new company. Guess what it does? Buys up notes from failed financial institutions and then sells them again.

Having profited in the glory days of the subprime mortgages, these scoundrels are now buying many of them out—and exploiting the failure of the mortgage market for their own profit.

We need to take our country away from these predators, who have caused so much emotional and financial pain. They should be banned from having anything to do with mortgages. Forever.

When we take our country back, that should be high on our agenda.

Now is the time, as we reclaim our country, our Congress, and our right to determine our system of government, for us to join together to prevent an Obama-inspired class war. Because that’s where we’re headed.

It is the cruelest of ironies that, at this time and place in our history—when America desperately needs a president committed to reigniting economic growth—instead we’ve elected one who is more interested in dividing us by class and redistributing our wealth than he is in creating more of it.

Because now is not the time to govern by ideology. Not in the middle of an unprecedented economic meltdown.

And now is not the time to accept or reject solutions based only on whether they fit an extremist political agenda. Not while we are drowning in the worst economic disaster since the Great Depression, with record unemployment rates, staggering numbers of home foreclosures, decimated 401(k)s, and rising numbers of tent cities and shantytowns for the homeless.

And now is especially no time to accept or reject solutions based on whether they fit or don’t fit a particular philosophical agenda. The trendy economic populism we hear from the White House will do nothing but turn neighbors, families, and friends against one another. Americans don’t want that. We can’t afford that. It may sound tough for President Obama to say he’ll take every legal step possible to get back the AIG bonuses (the ones his administration initially okayed), but do we really want to encourage populist vigilantes to hire buses to bring ACORN community organizers and the press on a tour of the homes of the AIG employees? That’s what happened in Connecticut after Obama made his remarks. What does this do to the children of these people when they see protests outside their homes, their previously safe havens?

It’s not going to help us to condone this vigilantism. We can face our problems only by coming together as a nation and facing, with confidence, the storms that surround us. But our president would have 95 percent of us turn on the other 5 percent in an economic civil war, making class conflict the engine of our economic and tax policy.

Obama may speak eloquently about working together, but he doesn’t really seem to understand the fundamental necessity of support and respect for all sectors of our economy. Not just those who are at the core of the Democratic Party, not just those who are union members, not just those who are the poorest among us, but all of us.

Thus far, Obama’s behavior in office suggests that he has a flawed—and sometimes arrogant—approach to government. He needs the cooperation of business, yet he spurns it because of his class bias. He is desperate for more investors in our nation’s stocks and bonds, yet he hounds these potential investors, overregulates them, and taxes them because they have too much money. Does he really think that this will work?

Anxious to stimulate consumer spending, Obama would raise taxes on the most prodigious consumers—the wealthy—by almost 50 percent. Eager to return to the days of prosperity and opportunity, he leads us, instead, into his notion of entitlement.

We want to make capitalism work. He wants to replace it with socialism.

But Barack Obama is only our president, not our dictator. Even armed with top-heavy majorities in both houses of Congress, he cannot get around the fact that we still live in a democracy. We are still a free people. The more we understand what he’s doing to us—and why he’s doing it—the more we can defend ourselves and reverse his disastrous course in 2010, when the congressional elections will offer us the next opportunity.

But we need to start today—by remembering that it’s our country and taking it back.

Right now, in the darkness of the recession, that might seem difficult, even impossible. At the moment, reemerging into the light of prosperity is our primary concern. We all have immediate worries: our jobs, our families, our homes, our future.

But the very policies designed to extricate us from this hellish economy are those that will keep us in the darkness. Obama’s spending—his massive, massive spending—will not hasten the end of the recession. What it will do is ensure a period of rampant inflation and, likely, yet another recession after that, before the inflation can be cured.

Yet, as desperate as our agony is today, it is not our major threat.

Only when we come out of the darkness, blinking in the light of a more normal economy, will the true nature of our catastrophe become apparent.

Unless we act today, we’ll be returning to a very different world.

Will the bank on the corner be run by the government? Will it be like the Bureau of Motor Vehicles? Will we be able to get loans for cars and houses without passing a political loyalty test or a government-sponsored means test to establish our need?

And will our doctors be free to treat us as they wish, or will they have to check with Washington to find out what medications are approved and which procedures they can offer?

Will we be free to listen to talk radio as it explores alternatives to socialism, or will it have been forced off the air?

At our workplace, will we be coerced into joining unions that represent the Democratic Party but not us?

And will our country be dominated politically by a coalition of those who pay no taxes, while the rest of us are powerless to protest when the government takes two-thirds of our income?

These are the real stakes.

As John F. Kennedy said in his inaugural address, “In the long history of the world, only a few generations have been granted the role of defending freedom in its hour of maximum danger. I do not shrink from this responsibility—I welcome it.”

Nor can any of us afford to shrink from the present task, which demands our attention, our energy, our commitment, and our resolve, We, too, must welcome this challenge. And we must prove worthy of meeting it.

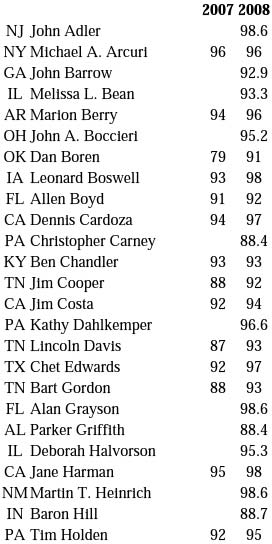

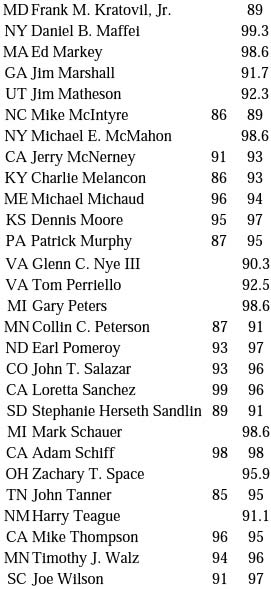

We need to attack Barack Obama’s socialist agenda in ways big and small. Between now and the elections of 2010, we must fight and win the special elections that will be called to fill vacancies in Congress. We need to demonstrate the revitalized power of opposition to socialism in the off-year elections in New Jersey and Virginia. And we must mobilize opinion, particularly in the districts of the marginal Democratic senators and congressmen—the frauds who run like moderates and then vote like socialists. We need to lay the basis for their defeat in 2010 and make them think twice before they vote to curtail our freedoms and give away our health care.

We must strike terror into the hearts of the Democrats in Congress who rubber-stamp Obama’s programs, so that we can slow his momentum. Those who perpetuate his radicalism must fear for their seats as we stir public anger at their actions in their districts.

Don’t worry if you don’t live in a district with an election coming soon or with a phony Democratic moderate. In a very real sense, these days we’re all in one district—our money, work, conversation, and anger carry across state and district lines. We will be heard!

And, when 2010 comes, we’ll be ready to take our country back. We will know the stakes. And we won’t be conned by a moderate-sounding president whose idea of change is the end of freedom and the dawn of socialism.

That’s not change we can believe in.

This book is a call to action. At the end of each chapter, we suggest specific actions that can help us regain our country.

Join us in this most necessary and urgent work.

In his provocative book Liberty and Tyranny, Mark Levin speaks of the “soft tyranny” of government regulation. No longer will we be blind to that threat.

Not if we work together.

To quote Obama: NOT THIS TIME.

HOW OBAMA IS CAUSING A CATASTROPHE

Obama’s tax increase will trigger a stock market crash and devastate the already slumping real estate industry. A selling psychology often feeds on itself and can induce a market-wide panic. So the nearer Obama gets to power the faster the markets are likely to dip. So look for a sharp downturn as election day approaches and especially in the period between a Democratic victory and inauguration day. Obama will doubtless blame the drop on the outgoing Bush administration, but it would be his own tax plans that send the markets into a tizzy.

—From Fleeced by Dick Morris and Eileen McGann written February 2008 published June 2008

OBAMA’S WAR ON PROSPERITY

Last year, in Fleeced, we predicted the disaster in which we now find ourselves. But who could have predicted the steps Barack Obama would take to turn this disaster into a catastrophe?

President Obama pledges to bring us back to prosperity, to end the recession. But his policies are likely to do the opposite—possibly casting us into a full-scale, long-lasting depression. At the very least, his huge spending will bring inflation and even more economic pain. And, in so many ways, Obama’s program undermines the very business confidence that will be essential to restoring normal economic activity.

We are hostage to an ideologue who wants to use this crisis—not solve it—to promote his dogmatic agenda.

How did we let things get this far?

HIDING IN PLAIN SIGHT: HOW OBAMA GOT INTO POWER

From the moment he first realized he could win the presidency, Barack Obama has known exactly what he would do in the Oval Office. He just wasn’t sure how to pull it off.

He told us his agenda with unusual specificity and elaboration. He hid nothing. He pulled no punches. Not for him the tack taken by Charles de Gaulle as the anxious French pressed him for his agenda before assuming power in 1957. “When I achieve power,” de Gaulle replied haughtily, “I will know what to do with it.” Obama not only knew what he wanted to do; he told everyone who would listen. If he hid his program, he did it in plain sight.

But most of America wasn’t listening. Enthralled by his charisma and the trappings of his candidacy, they tuned out his program and mindlessly applauded his sound bites. Willfully suspending skepticism, they eagerly believed his superficial promises to change the way Washington worked, to exclude the lobbyists and special interests, and to end partisan bickering. Only after he was elected, when we started to see him appoint lobbyist after lobbyist and ride roughshod over the Republican opposition, did we come to realize that these vague commitments were just the window dressing on his program. The parsley around the meat.

But his program was never obscured. In a mind-numbing series of debates with his fellow Democrats, he spelled it out for us all to hear.

But we weren’t paying attention to the boring programmatic details. How much more exciting it was to focus on the fact that we were witnessing the end of the color bar that first blighted America centuries ago, when the early slaves stepped onto these shores in chains. How much more thrilling to watch Barack Obama overcome the inevitable nominee, Hillary Clinton, by outsmarting her, defeating her, and making a mash of her strategy. What a relief to watch Mrs. Clinton’s ill-conceived focus on experience, in what was clearly a moment that called for change, backfire on her.

But what change did Obama represent? The truth was hard for us to accept: that the man who was marching inexorably to the White House was a genuine radical from Harvard and Chicago. We heard the rantings of Reverend Jeremiah Wright and the stories Sean Hannity told about William Ayers, but we wouldn’t believe the clues. The conclusion was too horrible. Were we really about to elect a man who would change not just Washington but our values, our nation, and our own lives?

But the program lay out there in the sun day after day. It never varied. Obama never temporized. He trimmed his tax proposals from time to time and waffled on details of his national security stance, but the basic thrust of his administration was as clear on the day he announced his candidacy in Springfield, Illinois, as it was when he spelled it out in his first address to Congress as president.

Most presidential candidates don’t bother. Bill Clinton, George H. W. Bush, Richard Nixon, Jimmy Carter, and John F. Kennedy all took office with only a vague idea of what they would do with the power. George W. Bush told us what he had in mind, but the agenda was so limited that it never much mattered. In our recent past, only Lyndon Johnson and Ronald Reagan took office with as clear an idea of what they wanted to achieve. And, like both of these presidents, Obama did not trouble to hide his proposals as he campaigned for the job. Like Johnson and Reagan, Obama let it all hang out.

Didn’t he plainly and frankly tell us that he would:

- Socialize health care

- Raise taxes sharply on those making over $200,000

- Raise capital gains taxes on high-income people

- Block the repeal of the estate tax

- Raise the Social Security payroll tax so everyone (or practically everyone) will have to pay it on his or her whole income

- Rebuild our infrastructure regardless of cost

- Pour money into alternative energy sources but go slow on nuclear power

- Pull out of Iraq

- End tough interrogations of terror suspects

- Dramatically increase federal spending

- Weaken the standards in the No Child Left Behind Act

- Push legislation allowing unions to organize without secret ballots

- Call for immigration legislation granting amnesty to most illegal immigrants already here

- Extend health care benefits to all legal immigrants, even those recently legitimized by his own amnesty plan

- Sharply increase aid to states and cities

- Change the ownership and rules of talk radio

- Shift our stance from support of Israel to greater sympathy for the Palestinian position

- Increase regulation of business

- Do more to regulate executive pay

- Weaken welfare reform

- Cut taxes for 95 percent of Americans while raising them sky high on the rest.

- Tax hedge fund and real estate partnership earnings as ordinary income

- Cap and trade legislation to charge utilities and industries for their carbon output

- Revise NAFTA and restrict free trade

This agenda was not new. It was a greatest-hits collection that revived proposals made by the Democratic-union Left for the past thirty years. But since Lyndon Johnson, and especially in the wake of Ronald Reagan, no Democratic president had dared to embrace it. Even with a Democratic Congress, Bill Clinton pursued only a small part of the liberal program. Politics, after all, is the art of the possible—and, in political terms, the labor/left agenda was clearly impossible.

Obama camouflaged his domestic agenda behind the single overshadowing position of opposition to the war in Iraq. His emphasis on this theme—as opposed to the changes he contemplated at home—distracted us from the essential radicalism of his agenda. Obama may not have been another Bill Ayers or Jeremiah Wright, but he was clearly another Walter Mondale, Jimmy Carter, and Michael Dukakis. He just couldn’t let anyone know.

The swelling casualty count in Iraq disenchanted Americans and distracted them from the importance of preserving our national security. Isolationism and obliviousness to the obvious costs of a premature pullout became the order of the day. As public opinion moved to the left, driven by the incompetence of George W. Bush’s war strategy, Obama seemed to offer a reasonable alternative. His antiwar position—once easily dismissed as turning tail—now looked like a rational position.

The war was an issue that would ratify Obama’s liberalism as centrist, and it gave him the opportunity to hide his radical domestic agenda behind his antiwar rhetoric. As Hillary’s more security-minded position stalled in the mud, Obama’s idealistic stance rode a national wave of war fatigue.

But then a funny thing happened: We started to win in Iraq. Guided by the new strategy of General David Petraeus and the surge in troop strength, the issue began to go away. By the late summer of 2008, Obama was left high and dry by the shifting tide—and his radical agenda threatened to attract newfound, and unwelcome, attention.

OBAMA’S CAMPAIGN: SAVED BY THE CRISIS

When the stock market began its long, dismal crash to the bottom on September 29, 2008, it saved the Obama campaign. The Democratic nominee had never really recovered from the loss of the Iraq issue, and for a moment Sarah Palin’s exciting debut seemed to put Obama on the ropes. But when the market fell apart on Bush’s watch, Obama was saved.

From there, the Democrat coasted. He encountered a momentary speed bump when a plumber named Joe did what the rest of the country had failed to do: read Obama’s program. Accused of raising taxes, the Democrat admitted that he was, in fact, trying to redistribute income. But in the trauma of the crisis nobody listened, and Obama scored his massive victory.

There is, however, one consolation: in a democracy, no victory lasts forever. The American people are watching Obama closely. His promises of recovery have been so bold that waiting to see if he manages to keep them has become a new national pastime. But the programs he has launched are likely to dig us deeper into the hole than we were when he took office. That’s why it’s crucial for us to understand what he’s doing to our country—so that we can reject his socialist agenda in the congressional elections of 2010.

“NEVER LET A SERIOUS CRISIS GO TO WASTE”

—RAHM EMANUEL

Having won the presidency, carried a top-heavy majority in the House, and filled the Senate with sixty Democrats, Obama knew he could count on easy sailing in Congress. He would have no problem getting most of the new spending programs he wanted passed during his term (or two) in office. He would likely succeed where Clinton had failed and pass health care reform.

But Obama had more—a lot more—in mind. He had no interest in a typical Democratic presidency, with the focus on incremental change that characterized the Carter and Clinton years. He wanted to be a president in the mold of Lyndon Johnson or even Franklin D. Roosevelt. He wanted to pass everything, and he wanted to do so right away.

Just as the economic crisis showed him the way to win the election, now it pointed the way to pass his program. He merely had to rebrand his radical/socialist agenda as an economic recovery package.

Taking a page from Rahm Emanuel, his chief of staff, Obama decided he wouldn’t “let a serious crisis go to waste.” Far from being wasted, this crisis would be put to a cynical use—to catalyze the most dramatic change in American politics and economics since the 1930s. When Obama got finished “solving” the crisis, nothing would ever be the same again.

Suddenly everything was possible! No need to wait year after year to pass the programs on the environment, energy, welfare, education, health care, higher education, veterans, infrastructure, and urban problems that Democrats had been pushing for years. Do it all at once! Jam through eight years of new spending proposals in one year! For that matter, do it in one week!

By cramming every Democratic spending fantasy into one bill—into that Trojan horse called “the stimulus package”—Obama could have it all, up front. No waiting.

It was just like the game urban social work agencies have played for years. The antipoverty storefront of the 1960s became the community development program of the 1970s. In the 1980s it morphed into an empowerment zone. Under Clinton it became a job training center, under Bush a tutoring program for No Child Left Behind. Same storefront. Same staff. Same clientele. Just a different shingle hanging outside.

So now Obama could put his entire agenda on the table at once, declare a national crisis, and jam it through. No time for debate. No time even to print the bill so members could read what they were voting for. Emergency!

Despite the empirical evidence that spending and one-shot tax cuts don’t work, Obama couldn’t resist. He finally had a chance to take advantage of Keynesian economic theory, to get Congress to pass all of his pet spending bills—his fantasies about renovating schools, computerizing health records, rebuilding roads and bridges, spreading broadband access, widening health care coverage of children and the unemployed, increasing scientific research, building alternative energy sources, and so on in the name of stimulating the economy, and so on. Suddenly everything was a stimulus measure.

Obama must have known that his stimulus package would do little to end the recession. He must have realized that the simple Keynesian approach wouldn’t work. But he didn’t care. He wanted the spending. He wanted the social programs. He wanted government to grow, and this was his excuse for doing it.

The wonderful thing about a spending/stimulus package is that it doesn’t really matter what you spend the money on. A check is a check is a check. It doesn’t matter if you’re hiring a teacher or a cop or a scientist or an artist or a dishwasher. The goal is to spend money, and it doesn’t much make a difference what the money is buying. So Obama invited the House and Senate Democrats to name their pet projects; whatever they were, he’d put them in the package.

It was like inviting an alcoholic in for a drink. And Congress was a thirsty drunk.

The proposals came fast and furious. The total cost was $787 billion. The stimulus bill itself ran 1,071 pages. Not that any member of Congress had time to read it, because the text didn’t reach them until a few hours before they had to pass it.

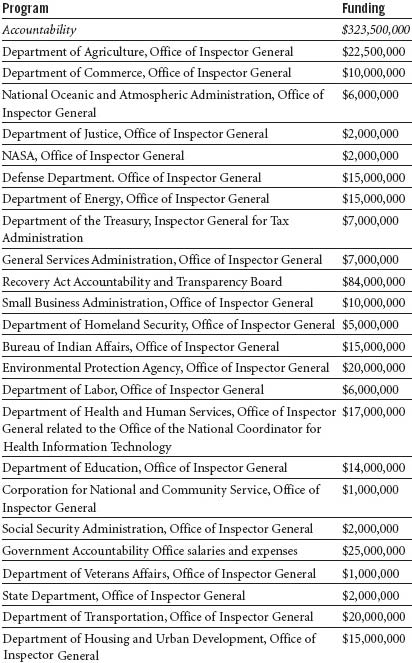

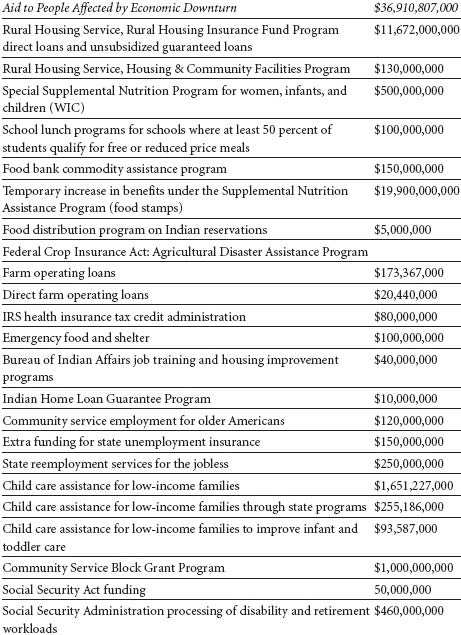

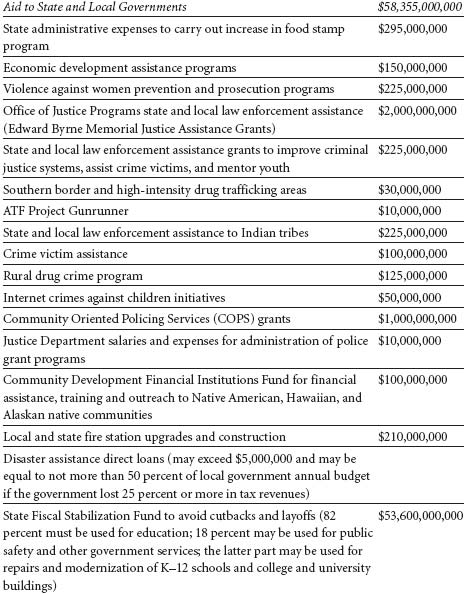

And here it is in all its gory glory!

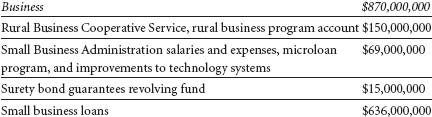

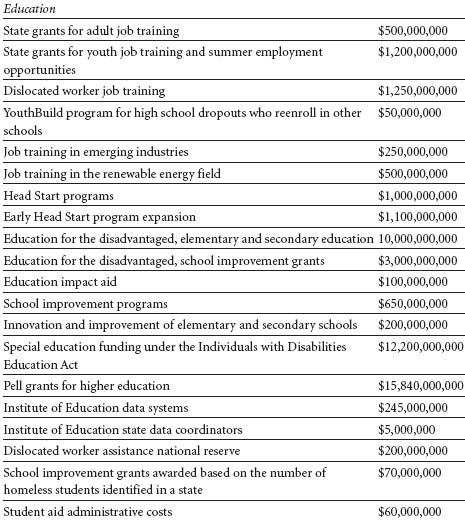

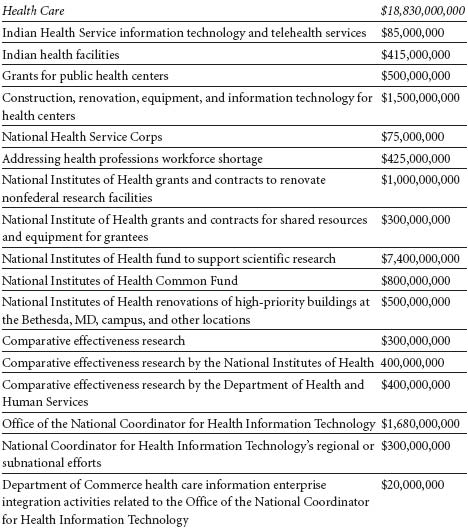

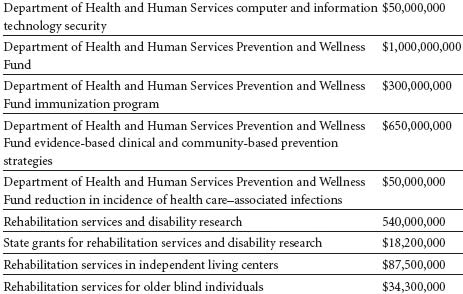

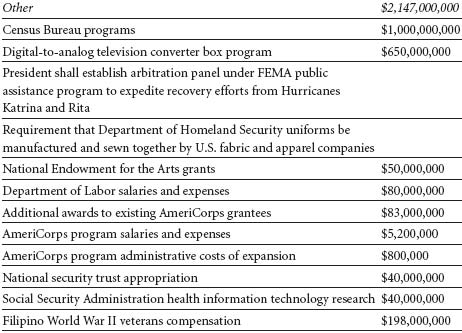

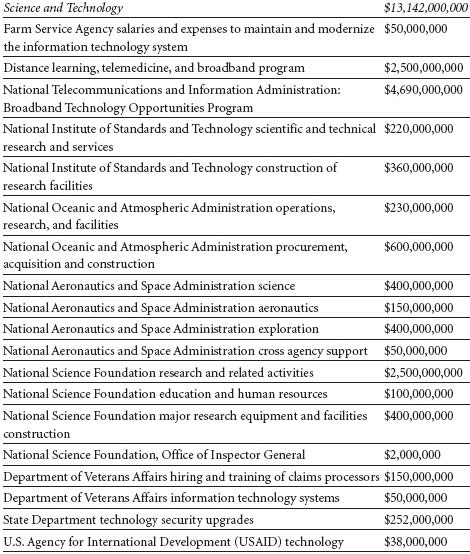

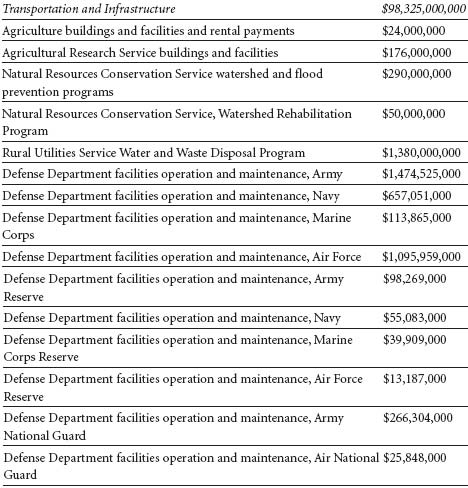

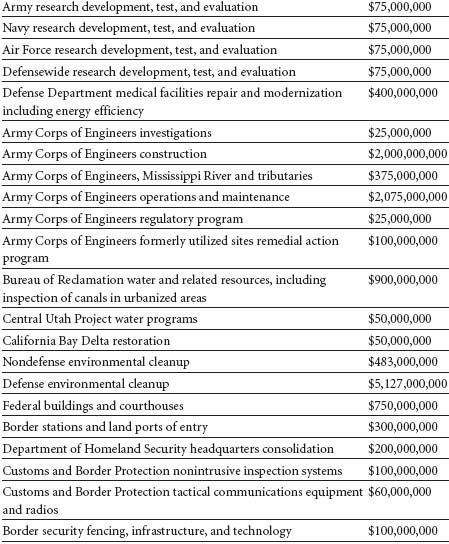

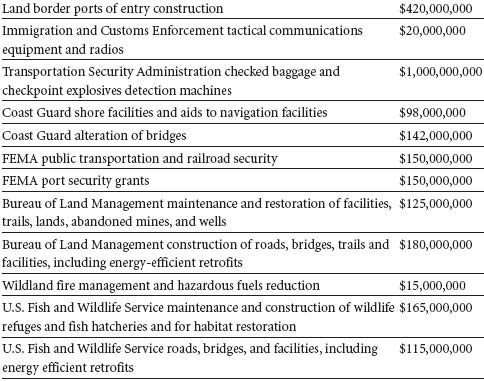

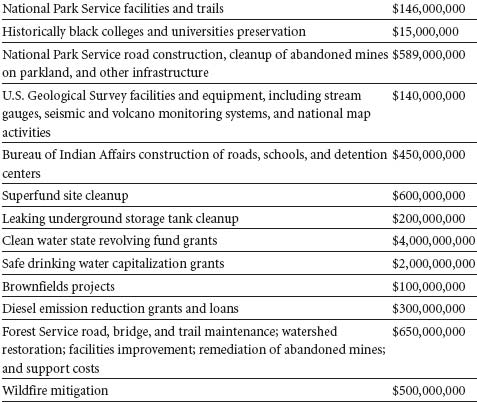

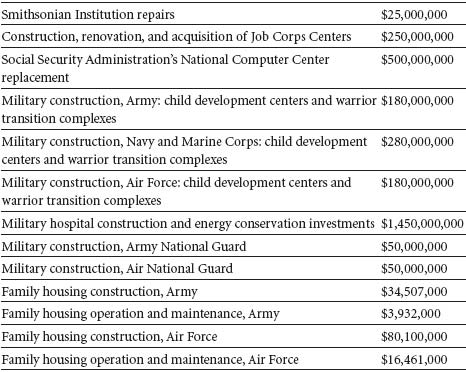

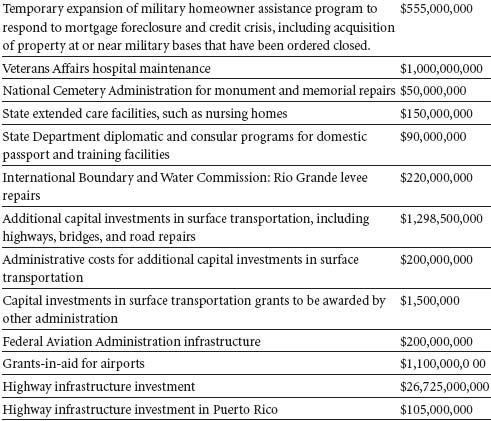

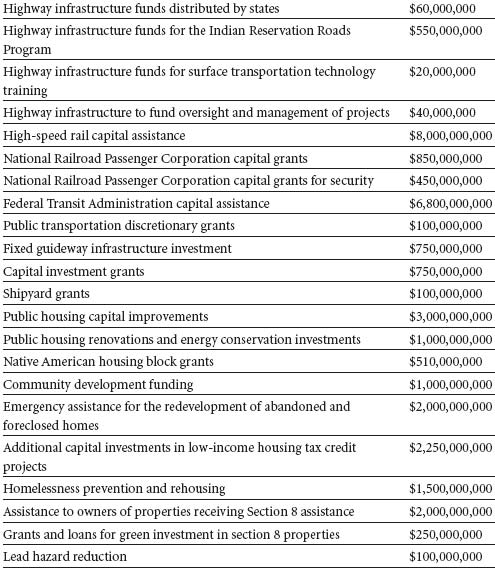

OBAMA’S STIMULUS PACKAGE

Source: Michael Grabell and Christopher Weaver, “The Stimulus Plan: A Detailed List of Spending,” ProPublica.org, February 13, 2009, www.propublica.org/special/the-stimulus-plan-a-detailed-list-of-spending.

It’s all a big spender could ever wish for—an orgy of outlays.

But even that much spending wasn’t enough for Obama and his hungry Democrats. As soon as Congress passed the stimulus bill, it went to work on a supplemental appropriations bill and added another $410 billion to the spending frenzy.

Obama had promised that he would eliminate earmarks. In his campaign against John McCain, he excused his own earmarks as a political necessity, making plain his desire to reform the system if he were elected. But enthusiasm for the avalanche of spending overcame his commitments and Obama signed the bill—even though it contained 9,287 earmarks, whose cost totaled $12.8 billion. 6

These earmarks made a mockery of the reform Obama claimed as his mantra. But even as he violated his promises by signing the earmark-laden bill, he issued recommendations to Congress to avoid earmarks in the future, clinging to his image as an apostle of fiscal responsibility.

Take a look at some of these earmarks and gauge for yourself how fiscally responsible our president really is:

OBAMA: TONE DEAF TO EARMARKS

Earmarks in President Obama’s 2009 budget

$1,049,000 for control of Mormon crickets in Utah7

$200,000 to fund tattoo removal clinic in California8

$190,000 for the Buffalo Bill Historical Center in Wyoming9

$2,673,000 for the Wood Education and Research Center10

$300,000 to promote women’s sports in Boston11

$206,000 to promote “wool research”12

$2,192,000 for the Center for Grape Genetics, Geneva, NY13

$1,791,000 to Swine Odor & Manure Management Research, Iowa14

$45,000 for weed removal in Berkshire, MA15

$469,000 for a fruit fly facility in Hawaii16

$800,000 for oyster rehabilitation in Alabama17

$4,545,000 for wood utilization research in Michigan18

$75,000 to create a “totally teen zone” for teens in Albany, Georgia19

$300,000 for research on migrating loons20

$900,000 for Chicago planetarium pushed by Rahm Emanuel21

$190,000 to buy trolleys in Puerto Rico22

$380,000 for lighthouse renovation in Maine23

$7,800,000 for sea turtle research in Hawaii24

$2,600,000 to monitor the population of Hawaiian Monk Seals25

$1,500,000 for research on pelagic fisheries in Hawaii26

$650,000 for beaver research and management in Mississippi and North Carolina27

$1,700,000 for a honey bee factory in the Rio Grande Valley28

Combined, the stimulus package and the Supplemental Appropriations Bill have left us with a deficit of at least $1.8 trillion for this year—a figure equal to 12 percent of the nation’s gross domestic product (GDP).29 Other, possibly more accurate estimates put it at $2 trillion, or 14 percent of GDP.30

Never since World War II has our deficit been even remotely that high. When the deficit crested at 4.7 percent of GDP in 1992, Bill Clinton had to focus all his energies on bringing it down. Now its size exceeds comprehension. In the worst of its economic recession, Japan tried supporting all manner of public works—to no avail—and swelled its deficit to 10 percent of GDP. But 12 percent and rising is a new peacetime record.

So anxious were Obama and Congress to pass their grand long-term spending plans while the light was green that they didn’t even take care to spend it in 2009 to combat the recession we’re facing today. According to the Congressional Budget Office (CBO), only 23 percent of the money from the stimulus package will be spent in the fiscal year that ends on October 1, 2009.31

For example, of the $28 billion to be spent on road construction projects, only $9.6 billion will be spent by 2020.32 And of the $16.8 billion for renewable energy, only $2.5 billion will be spent in 2009.33 Precisely what good spending so many years from now will do for today’s economy is a mystery.

TAKING HIS TIME: WHEN OBAMA’S STIMULUS WILL BE SPENT

Fiscal Year Amount Spent

2009 $185 billion

2010 $399 billion

2011 $134 billion

2012 $36 billion

2013 $28 billion

2014 $22 billion

2015* $5 billion

Source: Congressional Budget Office.

But in Washington no one asks such questions. It’s much easier just to vote yes.

IS OBAMA’S PROGRAM SOCIALISM?

In our era of breathless, hyperventilated politics, we often attach easy labels to our politicians without worrying too much about whether they’re truly justified. In the 1950s, anyone who leaned the slightest bit to the left was pilloried as a Communist; any liberal legislation, including civil rights and Medicare, was condemned as “creeping socialism.”

So it’s wise to ask: Is it unjust to call Barack Obama a “socialist”?

No. He’s earned it.

Historically, the adjective “socialist” has referred to people who believe that the government should own the means of production. As we’ll see later, Obama may indeed be deliberately angling to take over the financial sector, giving him an unparalleled opportunity to spread his influence throughout the economy. But he has yet to give any evidence of wanting to take all of private industry and put it under public ownership.

In modern geopolitics, however, the term “socialist” refers broadly to the Social Democratic ideology followed by the left-leaning political parties of Western Europe, who want to expand the role of government in their countries. They want to establish a broader cradle-to-grave social welfare system and to widen the influence of public institutions.

The best shorthand to determine where a nation is on the capitalist/socialist scale is to measure how much of its economy is in the public sector—in other words, what percentage of its GDP comes from government spending. By this measure, the United States has ranked well to the right of almost every other major industrialized country in the world, with the sometime exception of Japan.

The following list compares prominent nations in the proportion of their GDPs that go to government:

TOTAL GOVERNMENT SPENDING AS A PERCENTAGE OF GDP

Sweden 57.0%

France 54.0%

Italy 48.6%

Netherlands 47.1%

Germany 47.5%

United Kingdom 43.7%

Canada 40.1%

Japan 37.5%

United States 36.4%

Source: Forbes.

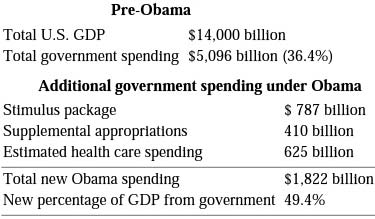

These data, of course, predate the Obama administration. To measure the impact his program on our standing in the socialist landscape, let’s do some simple math:

HOW OBAMA IS MAKING THE UNITED STATES A SOCIALIST DEMOCRACY

Now compare this table with the preceding one. Whereas U.S. government spending once accounted for 36.4 percent of our economy, it is now rising to 49 percent—sending us soaring past Britain and Germany and nestling in right under France—the very model of a modern socialist democracy!

So when it comes to Barack Obama’s spending programs, “socialist” is no political slur. It’s a simple description.

THE STIMULUS PACKAGE THAT DOESN’T STIMULATE

With so much of the spending in his program deferred until years from now, Obama’s stimulus package won’t really do much to stimulate the economy. Rather, it will create a whole new set of problems for our country down the road. In two or three years, it is likely to create massive inflation, which will necessitate a new, government-induced recession to get prices back in check.

Obama’s stimulus bill was a spending program, not an economic recovery program. And that’s a crucial difference.

To understand this, it’s helpful to review a bit of economic history.

The theory that spending equals stimulus was first popularized by the British economist John Maynard Keynes. Writing in the 1930s, he theorized that government should run deficits in times of depression to pump money into the economy and surpluses during times of inflation and prosperity to pull money out and avoid upward pressure on prices.

Before Keynes, economists had advised balancing the budget, particularly during tough economic times. The classical economists felt that running a deficit would undermine confidence in the economy and cause businesses to sit on their hands and not invest. A balanced budget, they reasoned, would induce businessmen to feel greater confidence in the economy and to put up their money for new jobs.

The classical theory was daft. Like the doctors of old who bled their patients with leeches to drain off evil spirits, the classical economists weakened the markets by raising taxes and cutting spending. Like the poor patients being bled years ago, however, the economy needed more blood, not less. It needed more spending and lower taxes, not the opposite.

The flaws of classical economic theory became glaringly apparent under President Herbert Hoover. After the stock market crash at the end of 1929, the economy seemed to be pulling out of depression as 1931 dawned. But then the economists started to bleed the patient. In order to attract more gold into the country (at that point the United States was still on the gold standard) and generate confidence in the U.S. currency, the Federal Reserve Board raised interest rates two points. To cut the deficit, Hoover raised income taxes on the top bracket from 25 percent to 63 percent and on the bottom bracket from 1 percent to 1.5 percent. To make matters even worse, Congress responded to the depression by passing the Smoot-Hawley Tariff Act in 1930, imposing sky-high tariffs to kill off foreign competition and protect American jobs. The result, of course, was to provoke retaliation from other countries and dry up foreign trade, depriving the economy of the stimulus that exports would have provided.

These “cures” made the disease worse, and the depression resumed with a vengeance. The stock market crashed. Unemployment soared to 23 percent. And by the time FDR took over in March 1933, banks were failing across the country.

Onto this stage burst the new theories of what became known as Keynesian economics. Keynes reasoned that if government increased spending on public works and other projects, more jobs would be created. The increase in the number of jobs and the extra paychecks flowing into consumers’ pockets would get the economy going again. The process was called “priming the pump.” The point was not to replace the private sector but to shock it back into working as it should. Like a shock from a defibrillator, the money would induce the economy to pump normally.

But it turned out that there was one problem with Keynsian economics: it didn’t work. During the 1930s—its heyday—large, persistent deficits did not end the depression. They helped a bit, lessening unemployment and easing the pain, but they failed to bring back prosperity.

The lesson of the 1930s is that when government provides jobs through deficit spending, the people who get regular paychecks are personally insulated from the worst of the depression; but the rest of the world gets little help from the change, if any. The government jobs created during the 1930s did little to stimulate the rest of the economy. The cycle Keynes predicted—in which government spending would increase purchasing power, generate more consumer spending, expand production, and lead to more private employment—never really happened.

Not until World War II broke out in 1939 did the American economy recover from the Great Depression and begin its rapid march back to full employment—a trend catalyzed by increased defense contracts and expansion of the military. The unemployed of the 1930s became the soldiers of the 1940s.

And when the war finally came to America in December 1941, the federal government’s purchases and contracts pushed the economy to full employment in a hurry.

So why wouldn’t Obama’s stimulus package have the same effect as the World War II spending?

Two reasons: First, because government spending during World War II was incomparably higher than anything we could contemplate today. Even though Obama is running a budget deficit that may rise to 13 percent of GDP, that doesn’t compare with the 30 percent deficit we ran in 1942.

Second, because in the 1940s contractors and businessmen knew that the war would go on for a while and that the new government orders wouldn’t dry up. So they didn’t hesitate to spend money to expand their production capacity and hire new workers. Today, everyone knows that Obama’s stimulus package is a one-shot affair. Even if he passes a second package, everyone knows it won’t last as long as America’s four-year involvement in World War II.

But why didn’t Keynes’s theories work in the 1930s? If taxpayers got refunds and workers got paychecks, why didn’t they spend the money? Why didn’t they flock to the stores to buy new products and services? And why didn’t that surge in demand lead to big increases in employment as businessmen raced to take advantage of the swelling market?

Because people have brains. They’re not animals who respond automatically to stimulation; they know what’s going on. In the 1930s, they realized that the new jobs the government gave out could end at any moment. They knew the tax refund checks they got were one-shot gifts that wouldn’t come around again. Their anxiety over the future paralyzed their ability to respond to the economic stimulus of the moment the way the economists had hoped.

Likewise, business executives of the time knew that any sudden bump-up in sales was due not to an end of the recession but to the artificial, one-shot stimulus provided by the government. Once it was spent, it’d be back to the same old depression. And so, rather than taking the revenue generated by momentary sales upticks and investing it in new factories or hiring additional workers, they put the money into safe Treasury bills and waited for better times.

What about tax cuts? Were they a better way of implementing Keynes’s theories? Did refund checks in the mail create the demand Keynes craved?

The experience with one-shot tax reduction or stimulus checks has been even more dismal that that with spending increases.

Earlier in 2008, faced with a faltering economy, George W. Bush and the Republican Congress approved a stimulus check program for American taxpayers. More than $100 billion went out, an average of $950 per family.34 What happened? Nothing. The economy remained flat. Later, academics concluded that only 10 to 20 percent of the money had actually been spent on new goods and services.35 The rest was just used to pay down bills or reduce debt—neither of which created any jobs.

In the past two decades, Japan has faced a very similar challenge. Saddled with a protracted recession with no growth and stubborn unemployment, the Japanese government has been borrowing like crazy, spending money on public works projects year after year—with no real effect.

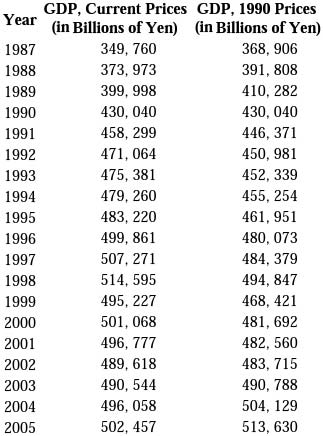

It was a sobering comedown for the once-thriving nation. In the 1980s, the Japanese economy soared. In the four years 1987 through 1991, the country’s GDP rose by 31 percent. Yet in the fourteen years that followed—from 1991 until 2005—it rose by only 10 percent!

The Japanese economy made slight gains in 2006 and 2007, but when the global economy caved in, the Japanese crash was worse. In the last quarter of 2008, according to CNN, the Japanese economy shrank at an annual rate of 12.7 percent.36

GROSS DOMESTIC PRODUCT IN JAPAN

Source: IMF Financial Statistics Yearbook.

It wasn’t that the Japanese government wasn’t trying to stimulate the economy all those years. It was following the same, futile Keynesian path that Obama is pursing—with no effect.

Here is the dismal history of Japanese efforts to spend their way into prosperity:

WHEN JAPAN TRIED OBAMA’S PROGRAM37

1992 As the stock market sinks 60 percent, Japan launches a Keynesian economic stimulus program, passing an $85 billion stimulus package (approximately double it to get the U.S. equivalent). Net result: investment keeps falling and unemployment rises. By the end of the year, Japan’s debt-to-GDP ratio is 68.6 percent.

1993 Japan spends $117 billion on public works and small businesses and announces widespread tax cuts, along with a program of deregulation and decentralization. Result: the economy gets worse; GNP shrinks by 0.5 percent.

Later in 1993, the government spends $59 billion on low-interest home financing, “social infrastructure,” and business. The economy doesn’t respond. By the end of the year, Japan’s debt-to-GDP ratio reaches 74.7 percent.

Is any of this beginning to sound familiar?

1994 The government passes a new $150 billion stimulus package, including a one-year income tax, public investment, aid to small businesses, and employment support. The economy remains stagnant; the country’s prime minister, Morihiro Hosokawa, resigns amid a corruption scandal. By the end of the year, the country’s debt-to-GDP ratio rises to 80.2 percent.

1995 The new government spends $137 billion on another stimulus program. No improvement.

1996 Facing a huge and growing deficit, the Japanese government raises the consumption (sales) tax from 3 percent to 5 percent. The economy goes from bad to worse.

1998 Japan passes another stimulus package, this time worth $128 billion. It doesn’t work. Later that year, it passes yet another stimulus, the largest ever: $195 billion. By the end of the year, the country’s debt-to-GDP ratio reaches an astonishing 114.3 percent.

1999 The government passes a new stimulus package of $70 billion. The debt-to-GDP ratio reaches 128.3 percent.

Source: Wall Street Journal.

All told, Japan spent about $1 trillion (double it to find the U.S. equivalent) in trying to jump-start its economy. By April 2009, the debt-to-GDP ratio was an incredible 217 percent. What did it get for its trouble? An average growth of .6 percent a year!

All that trouble for nothing.

So how can anyone still believe that the Keynsian approach—which didn’t work in the United States in the 1930s, in Japan in the 1990s, or again in the United States in 2008—stands any chance of working in 2009?

Yet Keynesian economics remains the conventional wisdom—not of economists anymore, but of the mainstream media. As the economist Mark Skousen writes in his book The Big Three in Economics, “If a country falls into a military conflict, a deep slump, or other crisis, the Keynesian model immediately comes to the forefront: maintain spending at all costs, even if it means significant deficit financing. The misleading Keynesian notion that consumer spending, rather than saving, capital formation, and technology drives the economy, is still very much in vogue in the halls of government and in financial circles.”38

The Wall Street Journal points to a key flaw behind the model: “Keynesian ‘pump-priming’ in a recession has often been tried, and as an economic stimulus it is overrated. The money that the government spends has to come from somewhere, which means from the private economy in higher taxes or borrowing. The public works are usually less productive than the foregone private investment.”39

But don’t take our word for it. A wide range of economic experts is already on the record as disagreeing with Obama and predicting failure for his stimulus package.

TOP ECONOMISTS SAY NO TO OBAMA’S STIMULUS PROGRAM

GARY BECKER, WINNER OF THE NOBEL PRIZE IN ECONOMICS:

“I tend to believe that [estimates of stimulus from government spending] are excessive. They will be put together hastily, and are likely to contain a lot of political pork and other inefficiencies. For another thing…it is impossible to target effective spending programs that primarily utilize unemployed workers, or underemployed capital. Spending on infrastructure, and especially on health, energy, and education, will mainly attract employed persons from other activities to the activities stimulated by the government spending. The net job creation from these and related spending is likely to be rather small. In addition, if the private activities crowded out are more valuable than the activities hastily stimulated by this plan, the value of the increase in employment and GDP could be very small, even negative.”40

ERNIE GROSS, PROFESSOR OF ECONOMICS, CREIGHTON UNIVERSITY:

“We’re creating a real problem for 2010 and beyond in terms of inflation, tax rates, and certainly in terms of debt.”41

GEORGE REISMAN, AUTHOR OF CAPITALISM: A TREATISE ON ECONOMICS:

“That [increasing government spending to stimulate growth] is a view held by a large school of economists, perhaps the majority school, for the last 60 years or so. That’s the Keynesian school, but there are other economists, like the Austrian school, which holds a very different position…. In their view, an essential requirement to a sound economy is balanced budgets with small government.”42

ROBERT BARRO, PROFESSOR OF ECONOMICS, HARVARD UNIVERSITY:

“This is probably the worst bill that has been put forward since the 1930s. I don’t know what to say. I mean it’s wasting a tremendous amount of money. It has some simplistic theory that I don’t think will work, so I don’t think the expenditure stuff is going to have the intended effect. I don’t think it will expand the economy. And the tax cutting isn’t really geared toward incentives. It’s not really geared to lowering tax rates; it’s more along the lines of throwing money at people.”43

ARNOLD KLING, MERCATUS CENTER FINANCIAL MARKETS WORKING GROUP:

“[T]he risks of a large stimulus, compared with a small stimulus, are:

- It is harder to spend larger amounts quickly and cost-effectively.

- There is a greater risk that we will run into a “sudden stop,” in which foreign investors are no longer willing to fund our deficits.

- There is a risk that fiscal stimulus, large or small, is actually ineffective, so that a large stimulus only means a large failure.

- There is a risk that much of the spending will kick in after a recovery is underway.

- The government’s capacity to deal with an emergency, such as a major natural disaster or a foreign attack, will be limited, because its credit worthiness will be damaged.

- There is a risk that government will absorb a permanently higher share of GDP. Policymakers will be reluctant to cut public spending for fear of causing a downturn. Moreover, it will be difficult politically to cut public spending.”44

THOMAS SARGENT, PROFESSOR OF ECONOMICS, NEW YORK UNIVERSITY:

“The calculations that I have seen supporting the stimulus package are back-of-the-envelope ones that ignore what we have learned in the last sixty years of macroeconomic research.”45

GREG MANKIW, PROFESSOR OF ECONOMICS, HARVARD UNIVERSITY:

“My advice to Team Obama: Do not be intellectually bound by the textbook Keynesian model. Be prepared to recognize that the world is vastly more complicated than the one we describe in Econ 101. In particular, empirical studies that do not impose the restrictions of Keynesian theory suggest that you might get more bang for the buck with tax cuts than spending hikes.”46

EUGENE FAMA, PROFESSOR OF FINANCE, UNIVERSITY OF CHICAGO BOOTH SCHOOL OF BUSINESS:

“Unfortunately, bailouts and stimulus plans are not a cure. The problem is simple: bailouts and stimulus plans are funded by issuing more government debt. (The money must come from somewhere!) The added debt absorbs savings that would otherwise go to private investment. In the end, despite the existence of idle resources, bailouts and stimulus plans do not add to current resources in use. They just move resources from one use to another.”47

JOHN TAYLOR, PROFESSOR OF ECONOMICS, STANFORD UNIVERSITYV

“The theory that a short-run government spending stimulus will jump-start the economy is based on old-fashioned, largely static Keynesian theories. These approaches do not adequately account for the complex dynamics of a modern international economy, or for expectations of the future that are now built into decisions in virtually every market.”48

As this book goes to press in April 2009, the nation’s jobless rate continues its upward climb. The economy swallowed the 2009 part of the stimulus package, burped, and went nowhere.

But the more the economy stagnates despite Obama’s medicine, the more he will sap his own credibility. The more unemployment data pile up and jobless claims grow week by week, the more the president’s ratings will plummet.

And the more likely it is that we can turn things around in the election of 2010!

MISERY INDEX: THE UPWARD, UNRELENTING MARCH OF UNEMPLOYMENT

Month Jobless Rate

August 2008 6.1%

September 2008 6.1%

October 2008 6.5%

November 2008 6.7%

December 2008 7.2%

January 2009 7.6%

February 2009 8.1%

March 2009 8.5%

April 2009 8.9%

FIGHTING THE RECESSION: WHAT OBAMA SHOULD HAVE DONE

So what should Obama have done?

The classic conservative answer, revealed as on tablets from Mount Sinai by the economic giant Milton Friedman in the 1980s, held that money supply and monetary policy were the key. Friedman warned against looking to Keynesian economics to stimulate demand; the more government borrows, he reasoned, the less is available to the private sector, which actually has to create the jobs. And any short-term effect of massive deficit spending will be obviated by fears about the inflation it will cause.

Instead, Friedman said, use monetary policy—interest rates—to increase the supply of money and credit. Work on the supply side, not the demand side, of the economy. Give businesses the low interest rates to borrow the capital they need to expand, and get government out of the way.

But the problem is that interest rates today, as in Elton John’s song, are already “too low for zero.” Faced with the onset of the recession, the Federal Reserve Board has cut them as close to zero as you can get. Yet the recession has only deepened. And the deeper it gets, the more prices drop. After all, when no one wants to buy, prices go down. But with prices dropping by 3 or 4 percent a year, even a 0 percent interest rate is really 3 or 4 percent! (If money is worth 4 percent more each year—because prices have fallen by that much—why borrow money at 0 percent interest? Even at that price, it means you can’t take advantage of the rising value of the currency.)

Cutting interest rates has done little to solve the recession. Credit has continued to dry up. And with confidence in the economy at historic lows, no one wants to borrow anyway.

So if Keynesian demand stimulation won’t work and Friedman’s monetary policy was ineffective, what will work? In the years since Keynes, economists have developed what’s known as the Theory of Rational Expectations. Simply priming the pump—and hoping for the water to flow—clearly doesn’t work on its own, they reasoned. Beyond that, you have to convince people that the future is bright—that they can afford to buy that new car or flat-screen TV after all.

Without that confidence, those who get the stimulus money will just thank their lucky stars and use the money to pay down their credit cards or student loans or mortgages or car loans or home equity lines of credit. After all, who knows if a windfall like that will ever come again? And none of these uses for the money will do the slightest to stimulate the economy.

The need was not for a one-shot stimulation of the economy but for some long-term basis for rationally buying into the idea that the economy was recovering.

That’s the key: it all comes down to confidence. If you’re afraid you’re going to lose your job, you save your money and don’t spend anything you don’t have to. That makes the economy drop even more—and only increases the chance that you might actually lose your job!

If Obama had offered the prospect of a real change in the economic environment, rational people would have responded. A short-term rise in sales due to a stimulus or a tax cut wouldn’t be enough to encourage discerning businessmen to invest in new plants or equipment. But how about a cut in the capital gains tax? Or a cut in the income tax? If you knew that in the future you would have to pay only 10 percent—not the current 15 percent—in capital gains taxes on your investment earnings, wouldn’t that encourage you to invest? If you knew you’d have to pay only 30 percent of your income in taxes—not the current 35 percent—wouldn’t that encourage you to spend more?

One-shot tax refunds are as useless as one-shot spending increases. But permanent tax cuts, which can encourage long-term growth, send a real message to rational people that better times are coming.

Anxious to use the crisis as a pretext to expand government, Obama criticized the idea of permanent tax cuts, particularly for the wealthy, saying that it was just this sort of policy that got us into the current mess. He was determined, he insisted, to break with the “failed approaches” of the past.

But it wasn’t George W. Bush’s tax cut that caused the recession. His tax cuts pulled us out of the recession of 2001–2002, which hit us right after Osama bin Laden flew a plane into the global economy and knocked it down. Largely because of these tax cuts, the economy grew for five years.

The Bush tax cuts didn’t cause the budget deficits of the first decade of this century either. Even though Bush cut taxes for the rich (the top 10 percent of earners), their share of total tax payments rose from 64.89 percent in 2001 to 70.79 percent in 2006.49 In total, the richest 1 percent of the nation actually paid more money overall because of Bush’s policies—an amount rising from $301 billion a year in 2001 to $408 billion in 2006.50 In fact, it’s precisely because the drop in tax rates stimulated the economy that the lower rates brought in more revenue than the higher ones had.

But Obama wouldn’t let all those inconvenient facts get in the way. He wasn’t about to give up his big chance to use the crisis as an excuse to grow the government. And he certainly wasn’t about to use it to shrink it!

OBAMA TRASH-TALKS THE ECONOMY

Even with top-heavy majorities in both houses of Congress, Obama couldn’t be absolutely certain that he’d manage to get his big spending legislation passed. In the House, of course, he could do whatever he wanted: His majority there would pass anything, and the House Republicans—the best-dressed hostages in the world—could only sit back and watch the legislation sail through.

But the Senate was a different story. There, too, he had an ample majority, but there were still forty-one Republicans that stood in his way. To bring his proposals to a vote, he needed sixty senators—and that means he couldn’t do it with Democrats alone.

So Obama needed to heat up the sense of crisis. He had to make his stimulus program a do-or-die proposition. “Pass this plan or you’ll plunge us into the abyss” became the administration’s daily message. In one speech, Obama used the word “crisis” more than twenty times. Intent on raising the level of anxiety for political purposes, he was seemingly oblivious to the effect his words were having on the economy. What little consumer spending that survived the crash of the last quarter of 2008 dried up; business pulled in its horns.

The president said the sky was falling, so everybody looked up.

Here’s a sample of the language Obama has used to describe the economic crisis to the American people—language that has only increased our collective sense of fear and deepened the recession.

HOW OBAMA DEEPENED THE RECESSION…WITH HIS SPEECHES

“We are in the worst financial crisis since the Great Depression, and a lot of you, I think, are worried about your jobs, your pensions, your retirement accounts.”51

—October 7, 2008

“But I think what unifies this group is a recognition that we are experiencing an unprecedented, perhaps, economic crisis that has to be dealt with, and dealt with rapidly.”52

—January 23, 2009

“I want to say a few words about the deepening economic crisis that we’ve inherited.”53

—Kicking off an event on jobs, energy reform, and climate change, January 26, 2009

“We’ve inherited a terrible mess.”54

—Arguing for his stimulus plan, February 4, 2009

“We’ve inherited an economic crisis as deep and dire as any since the Great Depression.”55

—February 10, 2009

“By any measure, my administration has inherited a fiscal disaster.”56

—At an event calling for government contracting reform, March 4, 2009

“There are a lot of individual families who are experiencing incredible pain and hardship right now.”57

—March 13, 2009

This was good politics but rotten economics. The more Obama described the economic situation as the “worst financial crisis since the Great Depression,” the more he fanned the very flames his stimulus package was supposedly meant to extinguish. He was yelling “FIRE!” in a crowded theater, stampeding an already damaged economy into a panic-driven recession.

Didn’t he know what he was doing? Of course he did. It’s the fundamental mission of the president to keep Americans looking forward, energized, optimistic. But Obama needed to pass his radical big spending package. Curing the recession was not his end; it was his means to the end. The end was bigger government.

But Obama’s insistence on the negative, and the harm it has done to the economy, is really a classic case of shooting oneself in the foot. His every pessimistic comment delays the time when the economy will rebound—and makes his eventual political defeat more likely.

INFLATION: THE REAL COST OF OBAMA’S POLICIES

The Obama spending package (aka the stimulus plan) won’t just increase the national debt and burden every subsequent generation with massive interest payments. In the next few years it is also likely to cause runaway inflation.

Indeed, inflation, not the recession, may be the true economic catastrophe of our times.

Most economists agree that Obama’s spending programs will cause huge inflation—particularly because they are to be funded by borrowing (or printing) money.

The economist Barry Elias, for example, believes that inflation may come in the next two to three years. Here’s why.

According to the Federal Reserve Board, from October 2008 through February 2009 the supply of money in circulation (plus that held in reserve by financial institutions) grew by 271 percent.58 That’s right—it almost tripled. Yet car sales didn’t triple. Home sales didn’t triple. Consumer spending didn’t triple. In fact, mostly they dropped.

So what happened to all that extra money? Where is it?

It’s parked on the sidelines of the economy, in the equivalent of economic parking garages, waiting to come out. Right now, the economic weather is still too bad to go out driving. With layoffs on the rise and sales on the decline, no one dares to spend what money they have. People are paying down their debts or putting their money into Treasury bills.

But when the sun comes out, so will the money—and all at once.

Anthony Karydakis, a contributor to CNN, explains the danger in a graphic way:

The Fed prints, say, $7 trillion worth of $100 bills (representing roughly 50 percent of the size of the economy’s current GDP) and all of those bills are neatly stacked up in a large room, the windows and doors of which are all locked—no bills are taken out of the room. As a result, all of that enormous amount of newly printed money stays inactive, not generating any additional economic activity (although that would have presumably been the Fed’s original intent for doing so). No increase in spending and demand for goods and services are generated, hence no inflation. This is very close to the reality confronting the Fed today.59

Right now, an awful lot of Americans are following the Posturepedic Savings Plan (PSP)—that is, stuffing cash under their mattresses. But when the economy improves, all that money is going to come out at once, as consumers head out to buy new goods and services. All those purchases they’d deferred—a new car to replace their cranky old one, new furniture for their threadbare living room, a new house for their growing family—all of these pent-up consumer desires will come out at once.

And too much money will be chasing too few goods, leading to huge inflation.

The financial community clearly expects inflation. That is why long-term interest rates are now so much higher than short-term rates. Investors are pretty confident that inflation won’t be a problem as long as the recession rages. There’s more likely to be deflation. But once it ends, they can see inflation coming a mile away.

So even though interest rates on very-short-term Treasury bills are only one quarter of one percent, the Treasury has to pay 2.94 percent to get people to lend it money for ten years.60 And the average mortgage interest rate for a 15-year loan (at fixed rates) is 4.61 percent.61 Why? Because we expect to be hit with inflation.

Because banks aren’t lending no matter how large their reserves are, the stimulus money remains parked on the sidelines. But when the banks decide the climate is right to start lending, huge inflation will be the likely result.

As Karydakis notes, “The Fed is acutely aware of the need to start mopping up that excess liquidity, very quickly after the economy starts showing signs of making a gradual comeback.”62

But inflationary psychology can be a hard habit to kick. Once consumers see inflation, they start demanding higher salaries, even asking their bosses to put cost-of-living wage adjustments into their compensation package. Employers, desperate to meet the new demand for their company’s services, don’t have time to argue. They can’t fire their workers, because once unemployment starts dropping there’s too much risk that they’ll have to scramble to find replacements and end up falling behind their competitors in market share. So they give in—and the inflationary wage/price spiral takes over.

Karydakis mentions the need to “start mopping up that excess liquidity” as soon as the economy improves. What would probably happen in such a circumstance is that the Fed would try to buy up the extra money in circulation. To do that, however, the Federal Reserve would need to sell debt—Treasury bills—in the open market. The T-bills would soak up part of the money in circulation, keeping it from being spent and causing more inflation.

Right now, to stimulate the economy, the Fed is paying those who buy T-bills a measly one-quarter of one percent interest. Buy $100,000 in Treasury bills, and after a year you’ll see only $250 as a return on your investment. Yet despite these low rates people are flocking to buy T-bills. Why? Because the U.S. government is the strongest in the world—and therefore the safest place to park your money while the recession runs its course.

As soon as the recession eases, however, all demand will disappear for T-bills that pay such little interest. Instead people will want to spend their money, or to invest it in more profitable ventures. The Fed will have to raise T-bill rates to competitive levels to induce people to take their money out of circulation and buy T-bills with it instead. And there’s the rub: the higher interest rates climb, the more of a drag on the economy they become.

So to borrow the money to pay for Obama’s “stimulus package,” we will have to raise interest rates which will undo any good his stimulus spending may have done.

And the only way to cure an inflationary spiral, once it takes effect, is to induce a recession!

As a nation, our last experience with persistent inflation came during the 1970s, when the big deficits we ran to pay for the Vietnam War and the residue of the Great Society (all without a tax increase) led to double-digit inflation. No matter how often President Gerald Ford spoke of the need to “WIN” (Whip Inflation Now), his pathetic efforts came to naught.

The result was a period of what became known as “stagflation”: inflation continued, but economic growth lagged. Unemployment and prices rose at the same time. The only remedy, it turned out, was a new recession—this time caused by the government.

The man behind it was Paul Volcker, who was appointed chairman of the Federal Reserve by President Jimmy Carter (to Carter’s credit). It was after Volcker raised interest rates to close to 20 percent that inflation finally stopped. But of course Volcker had to nearly kill the economy to do it. The recession of 1980–1982 was one for the history books: unemployment rose rapidly, and bankruptcies soared. It took three years to tame the inflation beast, during which the nation endured a recession almost as bad as our current one.

This is the pleasant prospect Obama has in store for us. And it’s totally unnecessary!

The cause of this coming calamity is Obama’s excess spending binge and the skyrocketing deficits his plan will cause. This “cure” is certain to cause both inflation and a future recession—while doing little or nothing to stimulate an early end to the recession we’re in right now. It’s all an excuse to allow Obama to pursue his big-government dreams. And what a catastrophe it’s going to cause!

THE WILD CARD: DOUBTS ABOUT CURRENCY

So far, we’ve been talking about conventional economics: things Obama should have foreseen but didn’t. But there is an added, and even scarier, dimension: in the unfolding economic disaster, people may lose faith in the world’s currencies.

During the Great Depression, the currencies of the world were tied to the price of gold. Standing behind every national Treasury department was a commitment to buy the local currency back, at a fixed price, in exchange for gold. Nobody needed to worry about the currency losing its value as long as they could take away as much gold as their currency could buy (and they could carry) whenever they wanted.

But as the depression deepened, Great Britain went off the gold standard. With British currency the strongest in the world, London decided it wanted flexibility to inflate the currency to fight the deflation of the depression, even if it didn’t have enough gold to cover the extra money.

Its action led investors around the world to fear that their currency might also go off the gold standard. It was his desire to reassure the markets on this point that led Herbert Hoover to the disastrous tax increases and interest rate hikes of 1931 that deepened the depression.

When he took office, Franklin D. Roosevelt followed Britain’s lead and abandoned the gold standard. Whereas dollar bills used to bear the legend “Silver Certificate,” marking them as redeemable in silver or gold, now they simply read “Federal Reserve Note.” But the credibility of the United States and the United Kingdom were such that nobody minded.

After the United States abandoned the gold standard, the rest of the world followed suit. But in the current recession, the United States is borrowing money at a pace surpassed only by the World War II deficits—and once again the rest of the world is following in our footsteps. China, Rus-sia, the United Kingdom, Japan, and the European Union are all borrowing money like mad to stimulate their own economies.

SPENDING THEIR WAY TO INFLATION

(Percentage of GDP Spent on Stimulus)

Source: “How No 3 China Is Gaining on US and Japan,” LookingForWords.com, http://lookingforwords.com/2009/04/01/current-affairs/how-no-3-china-is-gaining-on-us-and-japan/.

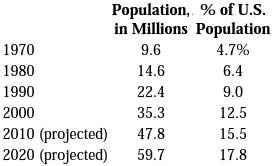

Some estimates suggest that global borrowing to pay for government and corporate spending will total $10 trillion this year. But the rest of the world doesn’t have $10 trillion to invest. In fact, it doesn’t have much to lend us at all.

China, the leading lender to the United States, is finding that its exports are down by more than one-third as the recession stops Americans from buying Chinese products. Without foreign currency coming in at a rapid pace, China has slowed its purchases of Treasury bills. And China needs to spend its extra cash on stimulating its own economy. Economists estimate that the total amount Chinese businesses will borrow this year will come to more than $2 trillion on its own.

So what happens when everyone wants to borrow and no one has money to lend? The word “borrowing” then becomes a euphemism for printing money. Uncle Sam won’t be able to borrow the $1.75 trillion he may need this year, so he’ll print new money to cover the difference. (And, no, the money isn’t literally printed. It’s virtual money, created when the Fed lets banks lend money that doesn’t exist.) And every other country in the world will do the same. After all, they’re even less creditworthy than we are.