Launching the Innovation Renaissance: A New Path to Bring Smart Ideas to Market Fast – Read Now and Download Mobi

Comments

Launching The Innovation Renaissance

A New Path to Bring Smart Ideas to Market Fast

By Alexander Tabarrok

Table of Contents:

The name of the rose is No. 20,175

The critical need for patent reform

Big prize funds: virtues and vices

Better teachers, better students, better society

Losing the world's best and brightest

Innovation nation versus the warfare-welfare state

One idea, one world, one market

A cathedral rises

The Cathedral of Santa Maria del Fiore began to rise in 1296. From father to son, to son again, the architects, stonemasons and artists of Florence labored with love and devotion to produce the greatest cathedral the world had ever known. Pausing only for the black plague of 1348, the great cathedral grew until by 1418 all was complete but the dome. In a fit of mad ambition and optimism the basic design set over 100 years earlier called for a dome higher and wider than any that had ever been built — either in 1296 or, as it turned out, in 1418. Without a dome, 122 years of work threatened to be uncrowned.

Unsure of how to proceed, the Arte della Lana, the guild of wool merchants who sponsored the cathedral, announced a prize: 200 florins and the commission would go to the best proposal to build the dome.1 Many entries were received, but the guild settled on the plan of Filippo Brunelleschi. The brilliant Brunelleschi had to invent new tools and techniques, but he proved up to the task and the dome was completed in 1436. For nearly 450 years it remained the largest in the world.

Among the tools Brunelleschi invented to complete his dome was a new type of paddleboat designed to carry marble down the river Arno. It was for this boat that Brunelleschi was granted what was arguably the world's first patent, a three-year monopoly.2 Brunelleschi's boat, nicknamed "the monster," sank on its maiden voyage but the idea of patents did not, and in 1474 nearby Venice passed the world's first general patent law.

Prizes and patents added “the fuel of interest to the fire of genius,” to use Abraham Lincoln’s wonderful phrase.3 To the fuel and the fire the Florentines added a foundation of knowledge. Florence provided a free public education in reading, writing and arithmetic. Private schools and tutors, for both children and adults, were also unusually common.4 As a result, literacy rates were high as was commercial numeracy. Continuing education was provided by The University of Florence and the University of Bologna (the world’s oldest).

The Florentines were obsessed with innovation because they lived by their wits. Florence had few natural resources. The wool merchants, for example, imported wool from England and alum and dyes from Turkey, India and the Middle East. Combining this raw material with sophisticated technology, they produced rich textiles that they exported around the world. Textile production was the high-tech sector of its day, and the Florentines needed innovative machines, methods and recipes to maintain their edge in production.

Competition in world markets meant that the Florentines had to innovate to prosper, but world markets also gave them the means to prosper. The opportunity to sell large quantities meant that incentives to research and develop new tools and techniques were strong and funds for innovation were readily available.

Trade also benefited the Florentines by bringing them into contact with the world's best ideas. Islamic artistry in silk, ceramics and metal inspired the Florentines, as did unmatched Chinese porcelain.5 The cosmopolitan Florentines were also among the first Europeans to adopt Arabic numerals. This increased the speed and flexibility with which they could balance their accounts and gave them an edge in banking as well as in trade.

Thus, in Florence, the epicenter of the Renaissance, we see five factors propelling that city's innovation: patents, prizes, education, global markets, and cosmopolitanism, an openness to ideas from around the world. How do these factors apply today? What combination of incentives and foundation will bring the greatest innovation to the modern world? How can we create a 21st-century Renaissance?

These questions are especially important now because the early 21st century has not been kind to the United States. The new century dawned with the destruction of the World Trade Center, and its first decade closed with the worst recession since the Great Depression. We face continuing wars, significant debt and divisive politics. Not all of our problems are recent in origin or likely to be resolved quickly. Most significantly, productivity growth, our best measure of innovation, fell dramatically in the United States in the post-1973 era and has not yet picked up again.

The United States needs to innovate to thrive; thus a reexamination of the motivations, foundations and achievements of our innovation policy is in order.

The problem with patents

In empowering Congress to create patents, the U.S. Constitution offered a standard justification, "to promote the Progress of Science and useful Arts." One negative aspect of patents is well-known: Patents increase monopoly power and raise prices. Patented pharmaceuticals, for example, are much more expensive than unpatented generics. But there is also a more fundamental critique: After hundreds of years of experience, there is surprisingly little evidence that patents actually do promote the progress of science and the useful arts.

The theory behind patents seems sound. Imitation is cheaper than innovation, so the worry is that firms that invest in innovation won't have time to recoup their innovation costs if other firms are allowed to immediately imitate. The theory dates back at least to 1834, when Jeremy Bentham wrote that "the protection against imitators" is necessary because "he who has no hope that he shall reap will not take the trouble to sow."6 The "recouping the costs of innovation" theory is the traditional theory of patents among economists, although, as we shall see, it is not much reflected in patent law.

The trouble comes when we try to correlate the existence or strength of patent law with measures of innovation. In the 19th century, for example, some countries, notably Switzerland, Denmark and later the Netherlands, had no patents at all and other countries had weak patent rights. According to the traditional theory, countries without patents should innovate very little. Yet that was not the case — countries without patents had as many innovations as those with patents, and in international fairs such as the Crystal Palace Exhibition in London in 1851 they even received a disproportionate share of the medals for outstanding innovations.7

The name of the rose is No. 20,175

For more than 70 years, All-American Rose Selections has named a best rose of the year. The 2009 winner, produced by the research team at Meilland International, was Carefree Spirit, a rose said to have "deep red blossoms with white twinkles in their eyes." "Carefree Spirit" is the name, but be warned: Use cuttings to grow more of these roses in your backyard and you will be breaking the law. Carefree Spirit is patented (PP #20,175).

It's surprising that roses are patented because over the centuries tens of thousands of new rose varieties have been created. As early as 2,500 years ago the Chinese were breeding new roses, and Confucius tells us that the emperor had hundreds of books about roses and rose breeding in his library. The world did not appear to lack new roses even though, until 1930, no roses were ever patented. Nevertheless, in 1930 the Plant Patent Act (PPA) gave rose breeders in the United States the right to exclude competitors.8 Have patents increased rose innovation?

Roses are a good test for the power of patents because, whether they are patented or not, roses are registered — so we have good data on rose innovation as well as on rose patents.9 In fact, a majority of new roses created between 1930 and 1970 — 84 percent in total — were never patented.10 Thus, most rose innovation is not due to patents, and even without patents we would have plenty of new roses. It might seem surprising that most new roses are not patented, but in fact most inventions and innovations in any field, with the exception of chemicals and pharmaceuticals, are not patented.11

It's not even clear whether patent rights increase the total number of new roses: Many of the roses that were patented (16 percent of the total) would probably have been created even without the right to exclude competitors, just as were the majority of new roses. Indeed, after the PPA of 1930 was passed, U.S. rose registrations declined relative to those in Europe, which had less patent protection than the U.S.

Fortunately, even today, not all roses are patented. So if you want to buy a beautiful rose and propagate it in your backyard, I suggest forgoing Carefree Spirit and choosing instead "the colors of mango orange, peach pink & ripe apricot" that "bounce off the mirrored glossy green leaves" of the 2010 AARS winning rose, Easy Does It. Easy Does It is not patented.

How patents reduce innovation

In the 1980s and 1990s patent rights were strengthened for semiconductors, software and business methods, but in none of these fields do we see clear evidence of an increase in innovation. Semiconductors, for example, were only weakly protected prior to the Semiconductor Chip Protection Act of 1984. But no one claims that innovation in semiconductors was lacking prior to the act, and no one has demonstrated that innovation increased after the act. It's true that patenting increased after the act, but that wasn't due to more innovating. It was due to more patenting as firms built up a war chest in order to protect themselves from the threats of other firms.12 Defensive patenting, as this practice is called, is basically a waste. It's a prisoner's dilemma in which two (or more) firms spend resources patenting only in order to trade patent rights with each other — the same outcome that would happen under a system of weaker patent rights.

Software patenting also increased in the 1990s after court decisions made software easier to patent. Rather than increase innovation, however, firms with lots of patents seemed to decrease research and development.13 To understand why this might occur, imagine an industry where patents are weak and innovation is rapid, so firms must innovate just to survive. In this kind of environment, firms will not hesitate to introduce technologies even if the new technologies make their own previous technologies redundant. Firms innovate because they know that if they don't, someone else will. In this kind of industry, instead of stimulating innovation strong patents may create a "resting on laurels" effect. A firm with strong patents may reduce innovation, secure in the knowledge that patents protect it.

The success of open-source software, such as the ubiquitous operating system Linux, used in everything from the Kindle on which you may be reading this book to supercomputers, demonstrates that innovative software can be provided without any software patents. In 2010, New Zealand banned software patents altogether. If that seems radical, remember that this was the basic situation in the United States prior to the 1990s and is closer to the situation today in Europe.14

As with open-source software, many innovative fields have no patent protection. Fashions, for example, are not patented. Innovations in sports are not patented (despite some calls for the patenting of sports moves!).15 The most productive sector of the U.S. economy in the late 1990s and early 2000s was the retail sector, led by Wal-Mart, and the major retail innovations — data warehousing, supply-chain coordination, product coding and so forth — are not patented.16 Wal-Mart is the world's largest public corporation, but it holds only about 60 patents in total, including one for a convertible shoe box (D429085). In comparison, Microsoft was issued over 3000 patents in 2010 alone.17

Wal-Mart has done just fine innovating without patenting. The number of business method patents granted in the U.S., however, exploded after the 1998 State Street Bank decision unambiguously signaled that business methods could be patented. Priceline, for example, got a patent on reverse auctions, that is, having consumers place bids on products. There are also patents on systems for training janitors (5,854,117) and teaching music (6,015,947), on online incentive systems involving points (5,774,870), and much else. It is difficult to believe that any of these business methods required a patent in order to be created.

Not all the business method or software patents are absurd. Consider the patent held by RSA Security on public key encryption (5,267,314). Public key encryption is a key aspect of Internet commerce, so there is no question that this represents a useful innovation. The issue, however, is not whether the patent is for something absurd or useful; the issue is whether the innovation would have been developed absent the patent. Since public key encryption was based on academic research in cryptography, and given the great incentives that online firms had to create a secure transmission standard, it seems clear that a monopoly was not necessary to generate this innovation.

Orphan drugs

Patents have a better track record for generating innovative pharmaceuticals. Pharmaceutical innovation is expensive; it costs about $1 billion to research and develop the average new drug.18 The costs of imitating a new drug, however, are very low. A billion dollars for the first pill, 50 cents for the second. As a result, it's not surprising that the managers of pharmaceutical firms — unlike those in almost all other industries — report that patent protection is important for innovation.19

The Orphan Drug Act of 1983 provided a good test of the power of patents to increase pharmaceutical innovation. The costs of developing a new drug are about the same whether the disease being treated is common or rare. But the revenues (and therefore the profits) are greater, the more common the disease. As a result, there are more drugs to treat heart disease than, say, Prader-Willi syndrome. The lack of drugs for rare diseases shows up in the mortality statistics. Patients diagnosed with rare diseases — those ranked at the bottom quarter in terms of frequency of diagnosis — are 45 percent more likely to die before age 55 than are patients diagnosed with more common diseases.20

The Orphan Drug Act gave the sponsors of drugs for rare diseases, defined as diseases with a patient population of less than 200,000, tax breaks, subsidies and, most importantly, seven years of market exclusivity. The seven years of exclusivity gives the sponsor the right to exclude any competitor from the same market, even a competitor with an entirely different drug.

Patients with rare diseases pay seven years of higher prices under the ODA and sometimes may even forgo innovations that are delayed by the exclusivity rule. Nevertheless, the act has increased the number of new drugs. In the decade before the ODA there were a total of 10 new drugs designed to treat rare diseases; in the decade after the ODA there were more than 200. Some of these new drugs were the result of a statistical sleight of hand. AZT, the early AIDS drug, slipped under the provisions of the ODA because even though the number of AIDS patients was increasing rapidly, there were fewer than 200,000 patients when the drug was released.21 As a result, AIDS patients paid higher prices, with no return in increased innovation. Overall, however, the ODA did create real innovation, and as the number of new drugs for rare diseases increased, the mortality rate for people with rare diseases fell.22

Are patents necessary?

Why have patents done little or nothing to increase innovation in the field of roses, semiconductors or software but have increased the number of new drugs? The traditional theory suggests that imitation threatens innovation, so patents are necessary to prevent "copying." The ratio of innovation costs to imitation costs is unusually high for pharmaceuticals, so the traditional theory fits that industry well. In most industries, however, the ratio of innovation to imitation costs is much lower and the copying metaphor is deeply misleading.

Thomas Keller has been called the best chef in America. His restaurant, the French Laundry, is regularly listed among the world's finest. There are only 14 tables so it's nearly impossible to get a seat, and if you do get a seat, the prices are high. But why bother? In The French Laundry Cookbook Keller presents his exact recipes. Stay at home, follow the recipe, save yourself the time and trouble of traveling to Napa, and you can still enjoy a meal every bit as good as at the French Laundry. Convinced? I hope not. Imitation is not as easy as it appears even with an exact recipe. What is true about recipes and the French Laundry is also true about innovation in general. It takes effort and time to imitate a product even when the formula is known.

In the minds of the public, someone who infringes a patent is akin to a plagiarist — the infringer has imitated or copied someone else's work and is attempting to reap the profits. In reality, the majority of patent cases do not involve copying but independent invention.23 In the paradigmatic patent case the alleged infringer not only doesn't copy the patented idea, the alleged infringer doesn't even know that a patent on the idea exists. Independent invention is common. Well-known cases include Newton and Leibniz with the calculus and Alexander Graham Bell, Elisha Gray and Johann Philipp Reis with the telephone. We think that Carl Benz and Gottlieb Daimler worked together to produce the gasoline-powered automobile, but they never met. Their invention was simultaneous (Daimler-Benz became a company only years later). If independent invention is the norm for world-class innovations, is it any surprise that independent invention is the norm for more ordinary innovation?

The fact that imitation is rarely an issue in patent cases is consistent with the idea that imitation costs are often quite substantial relative to innovation costs, with once again pharmaceuticals and chemicals being an important exception. When imitation costs are substantial, the natural protection of innovation is much higher than theory would suggest.

The high cost of imitation explains why managers in most industries do not regard patents as an important source of competitive advantage. When asked to rate various sources of competitive advantage only 4 percent of corporate managers regarded patents as highly effective. Much more effective was getting a head start, learning by doing, and investing in complementary sales and service.24 Patents are less necessary for innovation than many people imagine.25

Litigation, not innovation

In addition to often being unnecessary, patents can reduce innovation. In many industries, innovation is a cumulative process with new innovations building on older innovations. The problem is that under a strong patent regime, old innovators can block new competitors. Instead of promoting innovation, patents have become a way to veto innovation.

In the software, semiconductor and biotech sectors, for example, a new product can require the use of hundreds or even thousands of previous patents, giving each patent owner veto-power over innovation. Most of the owners don't want to actually stop innovation of course; they want to use their veto-power to grab a share of the profits. So in theory patent owners could agree to a system of licenses from which everyone would benefit. In practice, however, licensing is costly, time-consuming and increasingly less likely to work the more parties are involved.26 It's easy for a bargain to break down when five owners each want 25 percent of the profits. It's almost impossible to craft an agreement when hundreds of owners each want 10 percent of the profits.

The Wright brothers and another aviation pioneer, Glen Curtis, could not come to an agreement over their patents and that involved just a handful of owners. The aircraft patent-war slowed innovation in the American aircraft industry so much that just prior to World War I the government forced the industry to share its patents for reasons of national security.27 We are seeing the same kind of innovation-slowing litigation today. In 2011 Apple, HTC, RIM, Nokia and Google were all suing one another in various combinations over patent rights to smartphone technology. Figure 1 shows the current set of lawsuits.

Figure 1. The smartphone patent thicket.

[[Source: Originally published by Mike Masnick. Meet The Patent Thicket: Who's Suing Who For Smartphone Patents. Wireless: Tech Dirt. October 8, 2010. Reprinted by permission.]]

To protect themselves from thousands of potential veto threats, big firms like Google, Microsoft and Apple have gone on a patent buying spree, paying billions for patent arsenals. Firms aren't buying the arsenals to gain access to new technology. They are buying old patents so that they can threaten to counter-sue any firm trying to veto their innovation. The threat of mutually assured destruction (MAD) via litigation might avoid some costly patent wars; however, MAD was a dangerous strategy for maintaining peace and is an even more dangerous strategy for maintaining, let alone increasing, innovation.

The problem with the MAD policy of "innovation through strength" is that only the strong will be able to innovate. Small firms cannot afford to protect themselves with billion dollar patent arsenals. Patent arsenals protect big firms from small firms and from each other but they are a powerful weapon to squash small firms. Small firms are often the source of radical innovation, the type of innovation that threatens big firms, so the rise of the patent arsenal could decrease truly important innovations.

Moreover, even when licensing succeeds and patent wars are avoided, the expense of licensing means that firms invest less in fields where new innovations build on prior innovations. Increasing the cost of innovation can be especially harmful when innovation relies on widespread experimentation and exploration. The tale of the mouse illustrates.

The tale of the mouse

Patents are especially costly in research tools, innovations that help to produce more innovations. Mice, for example, are an important tool in scientific research because they share 95 percent of their genes with humans. Ordinary pet-store mice, however, will not do. Scientists want custom-made mice, mice that have been bred or engineered with specific genes and characteristics.

Thousands of specific strains of mice exist and are used regularly in scientific research. In the 1930s the Jackson Laboratory in Maine was established as a central mouse repository. Scientists donated mice to the lab, and when they wanted mice of a certain kind, they could simply order them from the lab. At the Jackson Laboratory you can order fat mice, thin mice, deaf mice, mice with a high probability of getting cancer, and even mice with ADHD or at least with some of the genes associated with ADHD.

In the 1980s researchers at Harvard working with DuPont created new techniques to insert cancer-causing genes, oncogenes, into mice. The new techniques allowed researchers to more precisely create mice strains suitable for studying human cancers, such as breast, lung or blood cancer.

[NOTE: Cartoon: cartoonstock.com, used with permission]

In 1988 Harvard patented mice created using the new techniques. Fortune magazine listed the OncoMouseTM, the world's first patented animal, as one of its 10 hottest products that year. The name was trademarked by Dupont. Researchers around the world were eager to use these new mice, thus illustrating the old adage that if you build a better mouse the world will beat a path to your door.

Harvard and its licensee, DuPont, however, had the rights to any mice created using the new techniques, even ones created by independent labs. A researcher who wanted to use an OncoMouse-like mouse would have to disclose their research to DuPont, pay DuPont a fee, and give DuPont a share of the revenue from any commercial applications of their research. Scientists did not like the OncoMouse patent — many felt that the license restrictions violated the spirit of scientific inquiry. Some even threatened to ignore DuPont's patent, raising visions of a scientific underground passing knockoff OncoMouse mice from lab to lab.

In 1999, bowing to pressure, DuPont signed an agreement with the National Institutes of Health lifting some of the license restrictions, lowering prices, and allowing OncoMouse mice to be distributed by the Jackson Laboratory.

Research using the new mice flourished after the restrictions on DuPont's license were lifted. Citations to the key OncoMouse papers, a measure of innovation, jumped by 21 percent after controlling for trends in OncoMouse research and research involving other mice strains.28 The lifting of the patent restrictions encouraged new authors and new lines of research; in other words, the OncoMouse patent had discouraged the exploration of new ideas. After research was opened up, there was a whopping 51 percent increase in applied research using OncoMouse mice.

What the tale of the OncoMouse tells us is that patents in research tools and fields with cumulative innovation can be much costlier than patents for consumer products. A patent on a new toaster, a new rose or even a new pharmaceutical will reduce the consumption of these products, but a patent on a new mouse reduces new ideas.

In short, patents increase the benefits of innovating but, especially in fields of cumulative innovation, patents also increase the cost of innovating.29 Since patents increase the costs of innovating, restricting patents does not necessarily harm innovators. When patents are restricted, firms lose some of their monopoly rights but they gain the right to use the innovations of others. The result is greater total innovation.

Isaac Newton said that he had seen a little further "by standing on the shoulders of Giants." Newton's story might have been different and his innovations fewer had the giants required him to pay for the privilege.

The critical need for patent reform

Innovators need time to recoup their sunk costs, but why should every useful, non-obvious and novel idea be granted a 20-year patent? Maximizing innovation requires treating different industries differently. The idea for one-click shopping does not have the same sunk costs of research and development as a new pharmaceutical, and the former does not need and should not be given the same monopoly rights as the latter.

The disjunction between patent law and patent theory has become more evident as patent law has become much more liberal toward the patenting of ideas.30 Thomas Edison invented and patented numerous products: the light bulb, the phonograph, movie film and much else besides. (At one point the patent office required that patents be accompanied by working models.) The invention of products typically requires the expenditure of sunk costs in a way that the creation of ideas does not. Today it is not necessary to implement an idea to patent it, and many patentable ideas are so broadly phrased that they could not be implemented in a model.

Edison famously said "genius is one percent inspiration, ninety-nine percent perspiration."31 A patent system should reward the 99 percent perspiration, not the 1 percent inspiration. In inventing the light bulb, for example, Edison laboriously experimented with some 6,000 possible materials for the filament before hitting upon bamboo. If Edison were to patent the light bulb today, he would not need to go to such lengths. Instead, Edison could patent the use of an "electrical resistor for the production of electro-magnetic radiation," a patent that would have covered oven elements as well as light bulbs.

In fact, something like this almost happened. William Edward Sawyer and Albon Man patented a light bulb prior to Edison and claimed the rights to any light bulb using a filament of "fibrous or textile material," which certainly covered bamboo. The Supreme Court, however, rejected these claims because Sawyer and Man had not invested the sunk costs necessary to discover that bamboo would in fact work as a filament. The court wrote:

They made a broad claim for every fibrous or textile material, when in fact an examination of over six thousand vegetable growths showed that none of them possessed the peculiar qualities that fitted them for that purpose. Was everybody then precluded by this broad claim from making further investigation? We think not.

The injustice of so holding is manifest in view of the experiments made, and continued for several months, by Mr. Edison and his assistants, among the different species of vegetable growth, for the purpose of ascertaining the one best adapted to an incandescent conductor.

[The court then describes at length Edison's many experiments and how he "despatched a man to Japan" to find the right kind of bamboo.]

. . . Under these circumstances, to hold that one, who had discovered that a certain fibrous or textile material answered the required purpose, should obtain the right to exclude everybody from the whole domain of fibrous and textile materials, and thereby shut out any further efforts to discover a better specimen of that class than the patentee had employed, would be an unwarranted extension of his monopoly, and operate rather to discourage than to promote invention. (The Incandescent Lamp Patent, 159 U.S. 465, 1895; italics added)

Broad claims reduce the incentives of future inventors to invest the sunk costs that are necessary to create actual working products. What has happened in recent decades is that the patent court has allowed much broader claims, and just as the 1895 Supreme Court described, this has created injustice and discouraged innovation.

The infamous "E-Data" patent (No. 4,528,643), for example, was granted in 1983 before the Internet was in widespread use or imagination, yet the courts ruled that the patent covered the technology of downloading music, pictures and other files! The actual creators of the new technologies were forced to pay E-Data for using the patent, even though their technologies owed nothing to E-Data. Would you invest in new technologies if you knew that at some point someone else could claim the fruits of your investment?

Perhaps the most outrageous patent practice is that patent claims can be changed after a patent is filed to retroactively cover a competitor's invention! Rambus, for example, filed a patent on dynamic random access memory in 1990, and two years later it joined an organization creating a memory-chip standard. By using a patent continuance, Rambus was able to effectively change its claims to cover the new standard even though the standard was designed after Rambus' invention (and before Rambus' patent was issued). How can a patent increase the progress of the useful arts when the progress occurs before the patent is issued?32

Patents are supposed to incentivize invention, but when we allow broad, vague claims and even more when we allow claims to be retroactively changed, we don't incentivize invention so much as incentivize patenting. Patent reform should limit claims more closely to what the patentee actually invented (that is, it should enhance the enablement and possession requirements, to use the language of patent law), and it should aim at making claim interpretation more predictable.33

More generally, patents should be stronger in industries with high innovation-to-imitation costs such as pharmaceuticals and weaker in industries with low innovation-to-imitation costs such as software. Patents of say three, 10 and 20 years could be offered with the divisions either based on industry — with software and business-method patents getting three years, pharmaceuticals 20 years, and other innovations 10 years — or based on evidence of sunk costs. An innovator that wanted a three-year patent, for example, need not offer any evidence on sunk costs and would receive a quick response. Innovators applying for 10- and 20-year patents would have to provide more information and would need to pass a higher hurdle.

Firms would clearly have an incentive to exaggerate costs under this model, but this need not be a big problem if the goal is simply to distinguish between patents with low, medium and high innovation costs. No firm could plausibly claim a billion-dollar investment in the idea of reverse auctions, for example. Moreover, information on development costs is already required for many government benefits such as the R&D tax credit.

In fact, the United States had a model similar to this between 1836 and 1861. During that period, patents granted innovators a 14-year monopoly, but patent holders could also apply for a seven-year extension if they could show that their profits had not covered their costs of development.

Many countries in the world already have a "small patent" or "utility model" system that grants patents of typically seven to 10 years for small innovations. In this proposal, the utility model is extended to any innovation with low innovation costs.

It is also possible to implement a system like this with a more modest change in the law by making independent invention a defense against infringement. Two inventors, Kelly and Pat, work independently, neither aware of the other's existence. Kelly patents first. Under the present law, if Pat wants to sell his invention, he must pay Kelly a license fee (!) even though Pat's idea came from his own head and no other. A defense of independent invention (or prior-use rights, a slightly weaker formulation) would allow Kelly to exclude imitators but would prevent Kelly from excluding an independent inventor such as Pat. The advantage of this law is twofold. First, firms today are often surprised to find that they are being sued for patent infringement. An independent-inventor exemption would give inventors greater security in their ideas. Second, the type of inventions that are most likely to be independently invented are those with high value relative to their cost. Thus, an independent-invention defense would automatically tend to offer smaller rewards to low-cost innovations and larger awards to more costly innovations.34

Patent reform is often seen as a battle between the creators and consumers of intellectual property, with the creators demanding greater patent rights and the consumers more restrictions, but that's the wrong way to frame reform. Patent reform is about reducing the costs of innovating by increasing access to prior innovations. A patent system that reduces the cost of innovating is better for innovators and consumers.

The America Invents Act (H.R. 1249), although labeled as patent reform, did very little to improve the patent system. The act includes enhancements to prior-use rights but this is limited to business-method patents for the finance industry, a clear special privilege for this industry alone. The bill has a number of other provisions, such as stipulating "first to file" rather than "first to invent," but although much debated, this is a trivial adjustment that will affect very few firms. In many areas, the bill enhances patents by such means as including provisions for treble damages, which will increase litigation costs. Perhaps the most beneficial aspect of the act is that patent fees will flow to the patent office, and such fees could be used to improve the speed and quality of examinations. Overall, however, patent reform to increase innovation remains much needed.

The prize is right

On April 4, 2004, SpaceShipOne rocketed more than 100 kilometers into space, launching private space exploration into the 21st century and winning Burt Rutan and his team the $10 million Ansari X-Prize. After falling into disuse in the 20th century, prizes have seen a resurgence in the 21st.35

The X-Prize Foundation currently offers a number of multimillion-dollar prizes, including prizes for advances in genome sequencing, fuel efficiency, and robot moon landings. Businesses have also begun to use prizes. In 2000 a gold mine that wasn't bringing in much gold threw open to the public all of the data from its 55,000-acre property and challenged scientists and engineers around the world to suggest where to search. Goldcorp paid out $500,000 in prizes and discovered gold worth $3 billion to $6 billion.36

On Oct. 2, 2006, Netflix offered a $1-million prize for an algorithm that could predict consumer movie preferences at least 10 percent better than its own algorithm. Six days later an entrant had already beat Netflix's algorithm by a small amount. For three years, teams from all over the world battled. In a remarkable photo finish, on July 26, 2009, BellKor's Pragmatic Chaos team beat Netflix's internal algorithm by more than 10 percent. Just 20 minutes later, a second team beat Netflix's algorithm, but it was too late to win the million-dollar prize.

The U.S. government has also offered a small number of prizes. The Department of Defense awarded a $1-million prize for advances in wearable power sources and has held races and awarded prizes for robotic vehicles. The H-Prize offers $1 million for breakthroughs in hydrogen storage, and the $10-million L-Prize is up for grabs for innovations in light bulb design.37

The big advantage of prizes over grants is that prizes are open. To give a grant, the grant givers must figure out who is most likely to solve the problem. But how can grant givers predict the most likely solver if they don't already know quite a bit about the solution? When the space of possible solutions is large it makes sense to broadcast the problem and have the solvers come to you.

Experience with prizes shows that people who solve problems are often different from those that one would expect from the nature of the problem.38 The Goldcorp challenge received submissions from all over the world, many using theories and techniques that Goldcorp would never have funded in a traditional process. The same was true of the Netflix prize. Most famously, the British government's 1714 prize for solving the problem of longitude was won not by the expert, Sir Isaac Newton, but by John Harrison, an unknown clockmaker.39

But don't laugh at the experts. Experts have the best solutions for most problems, which is why they are consulted first. It's only after the experts have been stumped that a firm will find it profitable to offer a prize. Problems that are difficult from one perspective, however, are often easy from another, which is why broadcasting to a diverse group is the key to solving many difficult problems.

Prizes, along with a broadcast search and open innovation, allow a firm to draw on diverse problem solvers for those occasional problems that are resistant to dominant paradigms. Nevertheless, since expertise is the best way to solve most problems, innovation prizes have a limited, albeit important, role in innovation policy.

Prizes could take on a much bigger role, however, if patents were converted to prizes.

Big prize funds: virtues and vices

GlaxoSmithKline sells the AIDS drug Combivir in the United States for about $15 to $20 per pill. Without patent protection the price would fall to the cost of production, about a dollar per pill.40 Activists outraged by high prices for life-saving drugs demand that pharmaceutical patents be abrogated or price controls be imposed. In the case of pharmaceuticals, we have seen that innovation-to-imitation costs are high, so abrogating the patent or imposing price controls would reduce innovation.41 Is a lower price for Combivir today worth the loss of an even better AIDS drug tomorrow? Voters may be tempted to make unwise tradeoffs when today's lower price is seen while tomorrow's missing innovation is unseen.

Is there a way to maintain or even increase innovation without raising prices above competitive levels? In theory, yes. A "simple" solution is offered by a prize fund, such as the Medical Innovation Prize Fund, a 2005 proposal by then U.S. Rep. Bernard Sanders.42 Under Sanders' proposal, pharmaceutical firms would apply for patents as they do today, but once a drug was FDA-approved for marketing, the firm would lose the right to exclude competitors. In return, firms with patents would be eligible for payments from a large annual prize fund of, say, 0.5 percent of GDP ($73 billion in 2011). Payments would be based on sales figures, medical value and "special exceptions" such as top-ups for "globally neglected diseases."

The biggest virtue of a prize fund is that, unlike price controls, a prize fund could lower prices without reducing innovation. Without the right to exclude, pharmaceutical prices would fall to competitive levels. The incentive to innovate, however, need not be lower and could be larger than under patents if the prize fund were large.

The major vice of a prize fund is that it replaces a decentralized process for rewarding innovation with a political process. Under patents, many thousands of medical consumers decide which products to buy or not buy, generating a flow of payments that in sum total rewards producers for medical innovation. No one person or group is in charge of deciding which pharmaceuticals to reward or by how much to reward them. In contrast, under a prize fund both the size of the innovation fund and how it is divided became political decisions.

Is it a good idea to throw a medical innovation fund into the budget battle with every other claim on public monies? How will a medical innovation fund fare when the country is at war? The prize fund could be a tempting target for budget cutters who wish to spend on other goals ("just temporarily," of course). Pharmaceutical profits already evoke the ire of voters. What will happen when these profits flow from directly from taxpayers? If voters are myopic or do not understand the long-run benefits of pharmaceutical innovation a prize fund could be a disaster.43

The Medical Innovation Prize Fund, as a mandatory replacement for patents, has two problems: It's a) difficult to estimate the true value of a patent and b) difficult to avoid politicization of the reward process. The economist Michael Kremer has made a clever proposal that avoids both of these problems.44 Kremer suggests that patents be auctioned, much like electromagnetic spectrum bands or timber licenses are auctioned today. In an open auction with plenty of bidders, the winning bid will be a good estimate of the true value of the patent. In Kremer's proposal, after holding the auction the government will then roll, say, a 10-sided die. Nine times out of 10 the patent would not be sold to the high bidder but to the government at the auction price plus a markup. The markup can be used to increase the incentive to innovate and to encourage patent holders to offer their patents for sale voluntarily. One time out of 10, the patent is sold to the high bidder at the auction price.

Kremer's patent-buyout process has two virtues. First, nine times out of 10 the government buys the patent and throws it open to the public, thereby opening the market to competition and lowering prices. Second, the auction price also reveals the best estimate—and a nonpoliticized estimate — of the value of the patent, which combined with the markup, means that patent buyouts increase the incentive to innovate. The one time out of 10 the patent is sold to the higher bidder maintains the incentive to bid carefully.

Prizes can also be used to supplement patents where patents are least effective. An innovative and important example, already exists: the Advance Market Commitment for Vaccines.

Nearly 1 million children die every year from pneumococcal diseases like pneumonia, meningitis and the blood infection bacteremia. A vaccine is available in developed countries, but it is expensive and not suitable for delivery in developing countries. The problem is not patents but poverty. Pharmaceutical manufacturers do not have an incentive to develop drugs and vaccines for the world's poor. No blame should be put on pharmaceutical firms for following their incentives. Porsche doesn't produce cars for poor people either, but no one attacks that company for callous indifference. Nevertheless, we may wish to increase drug development for developing countries. A traditional approach has been to subsidize R&D, but that approach addresses only a small aspect of the problem. The road from lab to village is a long one, and we need an incentive system that moves drugs and vaccines all the way along the road.

The Advance Market Commitment (AMC) for Vaccines is a type of prize fund, except instead of a winner-take-all prize for producing an idea, it's a "per pill" prize for supplying vaccines to the world's poor. The AMC has gathered $1.5 billion in funding from a number of governments — shamefully not including the United States — and the Bill & Melinda Gates Foundation. In return for producing vaccines for the world's poor and guaranteeing a long-term price no higher than $3.50, the AMC will top up funding from recipient countries to $7 per dose for some 200 million doses. In short, the AMC commits to vaccine manufacturers, "If you build it, we will buy it."

The first AMC was funded in June 2009, and by October of that year four offers to supply vaccines had been submitted. Two of these, vaccines from GlaxoSmithKline and Pfizer, were approved by September 2010. Each firm has agreed to supply 30 million doses, with GSK starting delivery in January 2012 and Pfizer in January 2013.

No single institution solves all problems. Patents, innovation prizes, patent buyouts and advance market commitments all have their place. The key is to match problems to institutions.

Nor is intellectual property the only or even the most important lever we have to move innovation. Let's turn to education.

The $40-trillion reward

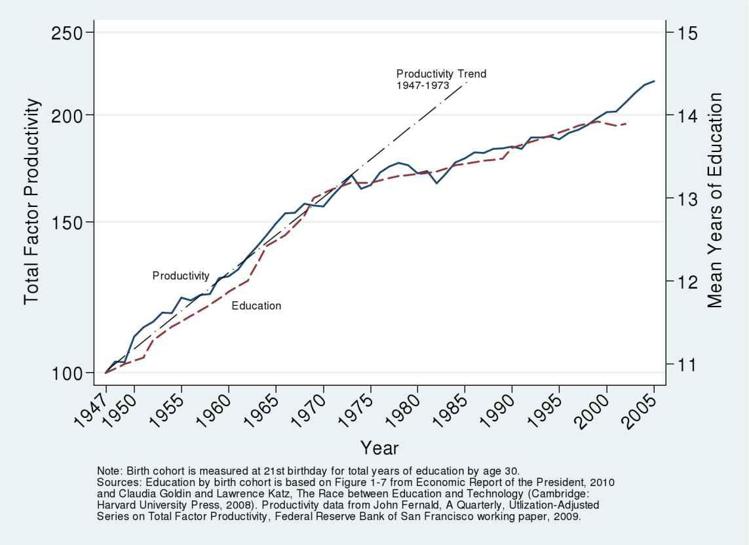

Knowledge is power. From Florence in the 14th century to Great Britain in the 19th and the United States in the 20th, the leading economic power has always been a leading educational power. Throughout the 20th century, the United States increased the educational level of its citizens. Sons were more educated on average than fathers, and then with the feminist revolution so were daughters. In just two decades, from 1950 to 1970, mean years of education rose from approximately 11 to 13. Beginning around 1970, however, growth in education slowed and even stagnated. We are now well into the 21st century and mean years of education have hardly increased over 1970 levels and now hover just below 14, as shown in Figure 2 (dashed line, right axis).

Figure 2. Total factor productivity and mean years of education by birth cohort.

Figure 2 also shows how productivity changed over 60 years. Productivity is the ultimate source of our standard of living. If we want to increase our income, we can work harder or we can work smarter. Productivity means working smarter, getting more from the same inputs of labor and capital. From 1947 to about 1973 productivity increased rapidly; we were working smarter and getting the benefits in the post-WWII boom. Beginning around 1973, however, productivity grew more slowly and more of our economic growth came from working harder; for example, from increasing the share of women in the workforce. Nothing wrong with hard work, but if productivity had continued to grow along the 1947-1973 trend then wages today would be more than 50% higher than they are now. In terms of innovation, if productivity had continued to grow along the 1947-1973 trend then we would be living today in the world of 2076 instead of the world of 2011. The post-1973 period has been called the Great Stagnation.45

When education grew rapidly, productivity grew rapidly. When education stagnated, productivity stagnated. It would be rash to conclude that education causes productivity; there are other explanations. Perhaps productivity results in more education, perhaps a third factor influences both productivity and education or perhaps the connection is spurious. Nevertheless, credible research suggests that increasing the quantity and especially the quality of education has potentially enormous payoffs. I return to this point below after we examine the sources of education stagnation in greater detail.

Years of education can't increase forever, and we don't want everyone to have a Ph.D., so is stagnating education simply to be expected? No. Average education levels have stagnated not primarily because of fewer Ph.D.s (although as we shall see that is also a problem) but because fewer people are graduating from high school.

It's astounding that in the 21st century about 25 percent of men do not graduate from high school in the U.S.46 Even more astounding, the number of high school dropouts has increased since the 1960s, when about 18 percent of men dropped out. The difference is that the prospects for a high school dropout were much better in the 1960s than today. Dropout rates are even higher among blacks, especially black males, 37 percent of whom do not finish high school. A large fraction of black dropouts end up in prison. During an average day in the 1990s there were more black dropouts aged 20-35 in prison than working.47

The United States today is performing poorly not only relative to its past but also relative to other countries. In Italy, 85 percent of students graduate from high school; in the U.K. it's 91 percent; in South Korea, 93 percent; in Japan, 95 percent; and in Germany, 97 percent.48

The quality of U.S. education is also middling. The Programme for International Student Assessment (PISA) is an internationally standardized assessment of the knowledge and skills of 15-year-olds in the major developed countries. In the 2009 PISA, the U.S. scored average in reading (15th to 17th out of 65 countries ranked), average in science (23rd) and below average in math (30th).49 A solid C to C-minus, not a good report card in my house.50

The potential gains to the United States from a better educational system are enormous. Countries with better-educated workforces innovate more and grow faster than less well educated countries. Even small changes in growth rates create stunning increases in wealth. Consider what would happen if the U.S. improved the skills of its workforce enough to raise PISA scores by 25 points. In 2009, for example, U.S. students scored 487 points on the PISA math test, so a 25-point increase would bring them to 512; in other words, from slightly below the OECD average of 500 to slightly above the OECD average.51

At first, the gains from an increase in the quality of education would be small and would accrue mostly to the better-educated individuals. Over time, however, the proportion of the workforce that was better educated would increase. The gains to society would increase even more as better-educated workers interacted with other better-educated workers. When a better-educated worker joins your team it's not like adding another person to a tug-of-war in which the new worker's strength is simply added to your own. It's like adding a new and different tool to your team's toolbox, greatly expanding the total of what is possible.

Ultimately, according to one estimate, the value of a permanent 25-point increase in scores discounted over the next 80 years would be over $40 trillion.52 That is an astronomical increase in wealth, and the temptation is to dismiss potential improvements of this magnitude as unlikely. But that would be a mistake. In the context of the American economy over 80 years, $40 trillion is an achievable gain. Small but permanent improvements in the skill level of a large population have big payoffs.

A 25-point increase would bring the United States from about the level of mathematics education in Ireland and Spain to the level in Germany and Australia. U.S. scores would still be below those in Canada (527) and well below world leaders such as Finland (541), South Korea (546) and Singapore (562). Other countries have improved their test scores by 25 points or more. Poland did it in reading from 2000 to 2006, and Brazil did it in math from 2003 to 2009. Other countries such as Turkey have also managed more than 20-point increases. Thus, substantial improvement is possible. Moreover, we know how to increase student knowledge and skills—better teachers.

Better teachers, better students, better society

One of the reasons for the poor performance of U.S. education is that teacher quality has declined significantly over the past four to five decades.

In the 1970s smart women became teachers. In fact, in 1970 about half of all college-educated women were teachers. By comparison, in that year just 10 percent of the entering class of law school and medical school students were women, and just 3.9 percent of the entering class of MBA students. Ten years later, 30 percent, 36 percent and 28 percent of the entering students in law, medicine and business, respectively, were women.53 Many smart women have exited teaching and entered the professions because of declining discrimination in the professions and sharply rising salaries. In 1970 a young corporate lawyer earned just a little bit more than a young teacher. Today, the corporate lawyer's salary is triple that of the teacher on day one.

As smart women exited the classroom for better opportunities, the quality of teachers as measured by high school rank, college selectivity and SAT scores declined. Teachers used to come from the top ranks of their college classes, but today 47 percent of America's teachers come from the bottom one-third of their college classes.54

Raising teacher salaries will help to increase the quality of applicants and bring teacher salaries back into line with other important professions. Raising average salaries alone, however, will not solve the education stagnation. If we really want to increase student achievement, we need to give better rewards to better teachers. Teachers today are paid more when they have more experience and more advanced degrees, but such teachers are not necessarily better teachers.55 In 2007 alone we wasted $80 billion paying bonuses to teachers for factors that had little or nothing to do with the quality of their teaching. We may as well give teachers bonuses based on the whether their last name contains the letter Q.

Teachers differ enormously in their ability to raise student achievement. Within the same school are great teachers and not-so-great teachers, and the difference is measurable. At the end of the year some students will learn much more than others, simply because they have been assigned to better teachers.56

We know that some teachers increase student achievement more than others, and we know that student achievement matters for adult earnings. So what is a quality teacher worth? One calculation is that a teacher who is just slightly better than average (in the 60th percentile) will raise the discounted lifetime earnings of a student by $5,292 more than will an average teacher (50th percentile). That may not seem like a lot of extra value over a lifetime, but remember, this is just one student over one year. In a class of 20 students that's a gain of $105,840, and that gain is annually for every year of teaching.57 A teacher who is a lot better than average will increase the earnings of her students by hundreds of thousands of dollars. The importance of teachers begins at an early age. Compared with a mediocre kindergarten teacher (25th percentile), a great kindergarten teacher (75th percentile) creates some $320,000 of annual value for a class of 20.58

The large numbers reflect the importance of better teachers to their students, but these numbers are an underestimate of the total gains to society. Better students go out into the world and earn more for themselves, but they also turn into scientists and engineers who innovate and create more value for everyone. Better students also turn into citizens who support better institutions for economic growth.59

Remember the $40-trillion increase in value we discussed earlier? How much better would teachers have to be to win that $40-trillion prize? Surprisingly little. If we could improve our selection procedures so that the bottom 5 percent of teachers were replaced with teachers of just average quality, that would be more than enough to generate $40 trillion in value.60

We know enough about teacher quality that we can, over time, substitute the bottom 5 percent of teachers with teachers of average quality.61 Politically, however, any violation of the "no one gets fired" rule is opposed by the powerful teachers unions. Firing a teacher in New York is "virtually impossible" says Joel Klein, New York's former chancellor of schools.62 Since firing teachers after they have tenure is a nonstarter, Klein proposed that teacher quality should be used to help to decide whether a teacher should get tenure. Klein's modest proposal would have given the top 20 percent of teachers a bump up in tenure points and the bottom 20 percent a bump down. The United Federation of Teachers, however, mobilized its forces and barred New York from using student test scores in tenure decisions. Michelle Rhee, the controversial and hard-charging former chancellor of the District of Columbia public schools, tried to offer teachers better pay in return for giving principals greater flexibility in hiring and firing decisions, but the Washington Teachers Union and the American Federation of Teachers refused to even allow teachers to vote on the proposal. Rhee later lost her job, due in no small part to union opposition.63

At times, teacher pay in the United States seems more like something from Soviet-era Russia than 21st-century America. Wages for teachers are low, egalitarian and not based on performance. We pay physical education teachers about the same as math teachers despite the fact that math teachers have greater opportunities elsewhere in the economy. As a result, we have lots of excellent physical education teachers but not nearly enough excellent math teachers. The teachers unions oppose even the most modest proposals to add measures of teacher quality to selection and pay decisions.

Soviet-style pay practices helped to eventually collapse the Soviet system, and the same thing is happening in American education. Rhee is no longer the D.C. chancellor, but IMPACT, the teacher evaluation system developed under her tenure, is in place. IMPACT uses student scores to evaluate teachers along with five yearly in-class evaluations, three from the school administrator and two from master educators from outside the school. Evaluations are meant not only to reward but also to discover and spread best teaching practices.64 Charter schools and voucher programs for private schools are also expanding in many states, which will, if nothing else, encourage greater flexibility in teacher hiring and evaluation practices.

A teaching policy for the 21st century will reward teachers based on skills and measured student performance, not on irrelevant details such as certification, experience or advanced degrees. A 21st-century teaching policy will pay teachers more and bring teacher salaries back into line with those of other professions such as lawyers and doctors. As in other professions, however, not all teachers will be paid the same. Most teachers will thrive in a system that offers greater pay for greater performance, as will the students.

College has been oversold

Looking at the flood of students on college and university campuses, the education stagnation isn't obvious.65 Enrollment is at an all-time high, and a greater percentage of high school graduates than ever will attend college.66 Look below the surface, however, and the stagnation remains.

Many of the students who begin their studies will never graduate. Only 35 percent of students in a four-year degree program will graduate within four years, and less than 60 percent will graduate within six years. Among black males only 35 percent will graduate within six years.67 Students who haven't graduated within six years probably never will. Thus, the U.S. college dropout rate is about 40 percent. The U.S. has the highest college dropout rate in the industrialized world. That's a lot of wasted resources. Students with two years of college education may get something for those two years, but it's less than half of the gains from completing a four-year degree.68

A college degree does pay for most people. College graduates earn about double what high school graduates earn, and high school graduates earn significantly more than dropouts.69 Unemployment rates are much lower for workers with more education. In 2010, the unemployment rate among high school dropouts was close to 15 percent; it was about 5 percent for college graduates. More education is even associated with better life satisfaction, lower divorce rates and less criminality, even after controlling for income.70

What is true on average, however, is not necessarily true for every student. College has been oversold, and in the process the amount of education actually going on in college has declined as colleges have dumbed down classes and inflated grades to accommodate students who would be better off in apprentice and on-the-job training programs. As the number of students attending college has grown, the number of workers with university education but high school jobs has increased. Baggage porters and bellhops don't need college degrees, but in 2008 17.4 percent of them had at least a bachelor's degree and 45 percent had some college education. Mail carriers have traditionally not been college-educated, but in 2008 14 percent had at least a bachelor's degree and 61 percent had some college education.71

More than half of the college graduates in the humanities end up in jobs that do not require a college degree. Not surprisingly, these graduates do not get a big "college bonus." A college graduate in the humanities who finds a job requiring a college degree had median annual earnings in 2009 of $21,000, but for the majority who end up in jobs not requiring a college degree, median annual earnings were only $14,000.72

It may seem odd that at the same time that the United States is failing to get people through high school, it is also pushing too many students into college. But let's compare the situation with Germany's. As we said earlier, 97 percent of German students graduate from high school, but only a third of these students go on to college. In the United States we graduate fewer students from high school, but nearly two-thirds of those we graduate go to college, almost twice as many as in Germany.73 So are German students undereducated? Not at all.

Instead of college, German students enter training and apprenticeship programs — many of which begin during the high school years. By the time German students have finished high school they have had a far better practical education than U.S. students — equivalent to a U.S. technical degree — and, as a result, they have an easier time entering the workforce.74

It's not just Germany that uses apprenticeship and training programs. In Austria, Denmark, Finland, the Netherlands, Norway and Switzerland between 40 to 70 percent of students opt for an educational program that combines classroom and workplace learning.75 In the United States "vocational" programs are often thought of as programs for at-risk students, but that's because they are taught in high schools with little connection to real workplaces. Apprentice programs with workplace training motivate theory with practice. Programs are rigorous because employers fund these programs and they consider apprentices an important part of their current and future workforce.

The U.S. has paved a single road to knowledge, the road through the classroom. "Sit down, stay quiet, and absorb. Do this for 12 to 16 years," we tell the students, "and all will be well." Most of them, however, crash before they reach the end of the road — some drop out of high school and then more drop out of college. Who can blame them? Sit-down learning is not for everyone, perhaps not even for most people. There are many roads to knowledge.

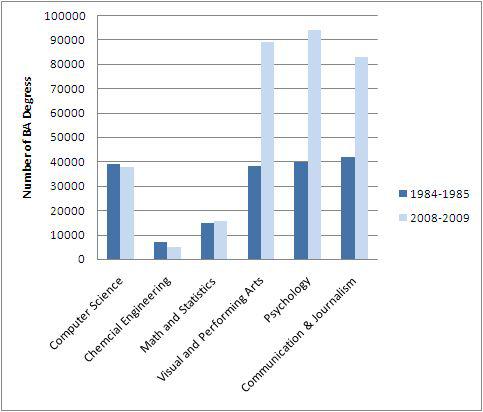

Even the students who graduate from college often graduate with few marketable skills, which helps to explain our surplus of overeducated bellhops. American students are also not studying the fields with the greatest potential for increasing economic growth. In 2009 the U.S. graduated 37,994 students with bachelor's degrees in computer and information science. Not bad, but here is the surprise: We graduated more students with computer science degrees 25 years ago! In comparison, the U.S. graduated 89,140 students in the visual and performing arts in 2009 — more than double the number of 25 years ago! Figure three shows some of the relevant data.

Few fields have been as revolutionized in recent years as microbiology, but in 2009 we graduated just 2,480 students with bachelor's degrees in microbiology — about the same number as 25 years ago. Who will solve the problem of antibiotic resistance?

The U.S. graduated just 5,036 chemical engineers in 2009, no more than we did 25 years ago. In electrical engineering there were 11,619 graduates in 2009, about half the number of 25 years ago. In mathematics and statistics there were 15,496 graduates in 2009, slightly more than the 15,009 graduates of 1985. In comparison, the U.S. graduated just under 40,000 students in psychology 25 years ago but nearly 95,000 today. Perhaps most oddly, the number of students in journalism (!) and communications has nearly doubled in 25 years, rising to 83,109 graduates in 2009. Ask your bellhop for more details.

Bear in mind that over the past 25 years the total number of students in college has increased by about 50% so the number of graduates in science, technology, engineering and mathematics has stagnated even as the total number of students has increased.

Figure Three: Math and Science Degrees have Stagnated

Source: Digest of Education Statistics, 2010.

There is nothing wrong with the arts, psychology and journalism, but graduates in these fields are less likely to find work in their field than graduates in computer science, microbiology and chemical engineering. In 2009, for example, we graduated 94,271 students with psychology degrees at a time when there were just 98,330 jobs in clinical, counseling and school psychology in the entire nation. The latter figure isn't new jobs — it's total jobs!76 Furthermore, wages in the arts, psychology and journalism are considerably lower than in computer science, microbiology and chemical engineering. Most importantly, graduates in the arts, psychology and journalism are less likely to create the kinds of innovations that drive economic growth.

Economic growth is not a magic totem to which all else must bow, but it is the primary reason we subsidize higher education. The wage gains for college graduates go to the graduates — that's reason enough for students to pursue a college education. We add subsidies on top of the higher wages because we believe that education has positive spillovers, benefits that flow to society. The biggest positive spillover is the increase in innovation that we hope workers with greater skills will bring to the economy. As a result, an argument can be made for subsidizing students in fields with potentially large spillovers, such as microbiology, chemical engineering, nuclear physics and computer science. There is little justification for subsidizing sociology, dance and English majors.

Losing the world's best and brightest

Science and engineering education has stagnated in America over the past quarter century, as we showed in Figure 3. The stagnation is even greater when one considers that a large fraction of the students in these programs are foreigners. In 2009, for example, 27 percent of the doctorate graduates in the life sciences (which includes microbiology) were temporary visa holders. In the physical sciences, including mathematics and computer science, 42 percent were temporary visa holders. In engineering a majority of the graduates (55 percent) were temporary visa holders. In comparison, in the social sciences and the humanities a large majority of the graduates were citizens or permanent residents.

It's worrying that native-born Americans are abandoning fields like science and engineering (perhaps because they feel ill-equipped by their high school education), but it's not a bad thing that our universities are educating large numbers of foreigners. Some of these students will become citizens or permanent residents who will contribute to U.S. innovation. High-skill immigrants innovate, patent and start new firms at higher rates than natives. At least one-quarter of the new firms in technology and science fields, from software and semiconductors to biotech, are founded by immigrants. In Silicon Valley more than half of the high-tech startups were founded by immigrants.77

The problem is that the world is now competing for highly skilled workers, and the U.S. has an immigration policy that treats these potential citizens with something between indifference and hostility. Historically, large fractions of foreign students have stayed in the United States because only in the United States could they exercise their talent, be rewarded for their efforts, and live free. Surveys, however, indicate that the most recent cohorts of students expect to return to their native countries. A majority of Chinese students now believe that the land of opportunity is China, not the United States. President Ronald Reagan was fond of saying that "America's best days are yet to come"; 25 percent of Indian students agree, but 86 percent of them believe that India's best days are yet to come.78 As China and India prosper, it's natural that more Chinese and Indian entrepreneurs will make their home in their native countries. The tragedy is that U.S. immigration policy is supplementing pull with push.

The U.S. policy toward high-skill immigrants is truly bizarre. Annually we allow approximately 120,000 employment visas, which cover people of extraordinary ability, professionals with advanced degrees, and other skilled workers. The number is absurdly low for a country with a workforce of 150 million. As a result, it can be years, even decades, before a high-skilled individual is granted a U.S. visa. Moreover, these 120,000 visas must also cover the spouse and unmarried children of the high-skilled worker, so the actual number of high-skilled workers admitted under these programs is less than half of the total, about 48,000!79 Perhaps most bizarrely there is a cap on the number of visas allowed per country regardless of population size. How many visas are allocated to people of extraordinary ability from China, a country of over 1 billion people? 2,803. The same number as are allocated to Greenland.80

A rational immigration policy would open the United States to many more high-skill immigrants. At a minimum we should shift from family-based immigration to work-based immigration, using a point system for skills, such as used by Canada, Australia and Hong Kong. At the same time as we limit skill-based visas to 120,000, we have over 1.1 million legal immigrants per year, most based on family immigration. Even the harshest critics of immigration cannot fault a policy that keeps the number of immigrants constant while shifting toward more high-skill immigrants.81

We also should create a straightforward route to permanent residency for foreign-born students who graduate with advance degrees from American universities, particularly in the fields of science, technology, engineering and mathematics. We educate some of the best and brightest students in the world in our universities and then on graduation day we tell them, "Thanks for visiting. Now go home!" It's hard to imagine a more shortsighted policy to reduce America's capacity for innovation.

Increasing high-skill immigration is such a win-win policy for increasing innovation that it's tempting to call it a no-brainer except for the fact that "no-brainer" is a better description of our current policy.

I focus on high-skill immigration, by the way, because this policy ought to receive widespread agreement, not because low-skill immigration does not also have advantages. Low-skill immigration can even increase innovation because it helps highly skilled workers to better use their time and skills. A low-skilled worker who mows a physicist's lawn is indirectly helping to unlock the mysteries of the universe. In fact, over the last several decades, states with greater low-skilled immigration have seen greater increases in innovation (total factor productivity) than states with less immigration.82

Innovation nation versus the warfare-welfare state

The people of Renaissance Florence had a vision of themselves as innovators. In the United States we also have that vision, especially in the high-tech and bioscience sectors of the economy. But at the level of government, the innovation nation competes with the warfare and welfare state.

The United States military has troops in more than 100 countries and is presently involved in wars and various hostilities in Afghanistan, Iraq, and elsewhere around the world.83 The wars in Iraq and Afghanistan have had a direct cost of over $1.2 trillion.84 Indirect costs and costs budgeted under homeland security would raise this total far higher. The welfare state is even larger than the warfare state, with spending on medical care taking up about $800 billion and Social Security some $700 billion annually.

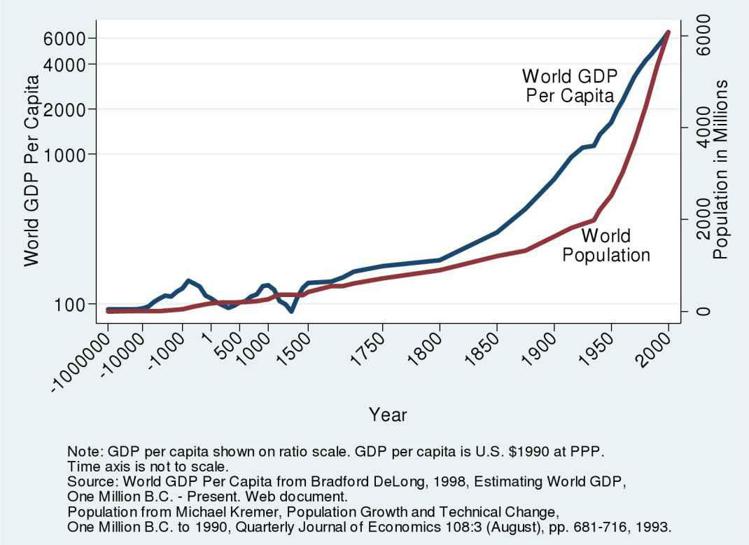

Together the warfare and welfare states, counting only the big four of defense, Medicaid, Medicare and Social Security, eat up $2.2 trillion, or nearly two-thirds of the U.S. federal budget. In contrast the National Institutes of Health, which funds medical research, spends $31 billion annually, and the National Science Foundation spends about $7 billion as shown in Figure 4.

Figure 4: The Innovation State and the Warfare and Welfare States

(Billions of dollars of spending, 2010)

Source: Economic Report of the President 2010 and Federal Budget 2010.

The biggest federal spending on R&D comes from the $78 billion spent by Department of Defense. Most of defense R&D spending, however, is not for basic science and the development of general technologies but for weapons ($64 billion). DARPA, the Defense Advance Research Projects Agency, has funded prizes for robot races in the desert and also helped to develop the Internet. But DARPA’s budget is only $3 billion. Overall, basic and applied non-weapons research, the type of research that has the best chance of creating beneficial spillovers, is a small minority of defense R&D. Even ignoring this point, all federal R&D spending together amounts to around $150 billion, a mere 4 percent of the budget.85

The point is not simply that the U.S. should spend more money but that a state with these kinds of budget priorities does not have innovation at the center of its vision. If innovation is not central to the vision, then it is inevitably given short shrift.

To give one example, the debate over the Patient Protection and Affordable Care Act was long and vociferous. One of the reasons the debate was vociferous is that the PPACA is part of the vision of the welfare state, a redistributive vision.

How would the innovative state approach the issue of health care? From an innovation perspective two facts about health care are of great importance. First, a huge amount of health care spending is wasted. A strong consensus exists on this point from health care researchers all along the political spectrum.86 More money will get you a much bigger house, but once you have basic health insurance more money won't get you much better health care. Should Bill Gates get prostate cancer, his billions will get him a private room and a personal physician, but they won't do much to extend his lifespan beyond that of a middle-class man with the same disease. But when you are dying, you don’t have much reason not to waste resources on health care, especially if they are someone else's resources, so if not constrained you will willingly spend a lot to get little or nothing.

The second fact is that although spending more on health care now doesn't get you much, spending more on health care research gets you a lot. It has been estimated, for example, that increases in life expectancy from reductions in mortality due to cardiovascular disease over the 1970-1990 period were worth over $30 trillion–yes, 30 trillion dollars.87 In other words, the gains from better health over the period 1970-1990 were comparable to all the gains in material wealth over the same period.

Looking at the future, if medical research could reduce cancer mortality by just 10 percent, it would be worth $5 trillion to U.S. citizens (and even more taking into account the rest of the world). The net gain would be especially large if we could reduce cancer mortality with new drugs, which are typically cheap to make once discovered. A reduction in cancer mortality of this size does not seem beyond reach, and the value of such a reduction in mortality far exceeds that of spending more on medical care today. Yet because the innovation vision is not central to our thinking, we overlook potentially huge improvements in human welfare.

Regulation is another area in which we have failed to put innovation at the center of our thinking. There are good regulations and bad regulations and lots of debate over which is which. From an innovation perspective, however, this debate misses a key point. Let's assume that all regulations are good. The problem is that even if each regulation is good, the net effect of all the regulations combined may be bad. A single pebble in a big stream doesn't do much, but throw enough pebbles and the stream of innovation is dammed.88 The patent thicket we illustrated in Figure 1 has an analog, the regulation thicket.