Overhaul

An Insider's Account of the Obama Administration's Emergency Rescue of the Auto Industry

Steven Rattner

HOUGHTON MIFFLIN HARCOURT

BOSTON NEW YORK

2010

Copyright © 2010 by Steven Rattner

All rights reserved

For information about permission to reproduce selections from this book,

write to Permissions, Houghton Mifflin Harcourt Publishing Company,

215 Park Avenue South, New York, New York 10003.

Library of Congress Cataloging-in-Publication Data

Rattner, Steven.

Overhaul : an insider's account of the Obama administration's emergency

rescue of the auto industry / Steven Rattner.

p. cm.

Includes index.

ISBN 978-0-547-44321-8

1. Automobile industry and trade—Government policy—United States.

2. Bankruptcy—Government policy—United States. 3. Industrial policy—

United States. 4. United States—Economic policy—2009– I. Title.

HD9710.U52R38 2010

338.4'76292220973—dc22 2010033188

Book design by Melissa Lotfy

Printed in the United States of America

DOC 10 9 8 7 6 5 4 3 2 1

FOR MAUREEN

Contents

Cast of Characters [>]

Prologue [>]

1. Dead Man's Curve • [>]

2. The Bridge to Obama • [>]

3. Mr. Rattner Goes to Washington • [>]

4. "F**k the UAW" • [>]

5. Rick, Bob, and Sergio • [>]

6. The B Word • [>]

7. "Is This Unanimous?" • [>]

8. Jimmy Turns Bright Red • [>]

9. Chrysler's Last Mile • [>]

10. Harry Wilson's War • [>]

11. Epic Bankruptcy • [>]

12. Dealer Nation • [>]

13. The Chief Executive Shuffle • [>]

Epilogue • [>]

Note on Sources [>]

Acknowledgments [>]

Index [>]

Cast of Characters

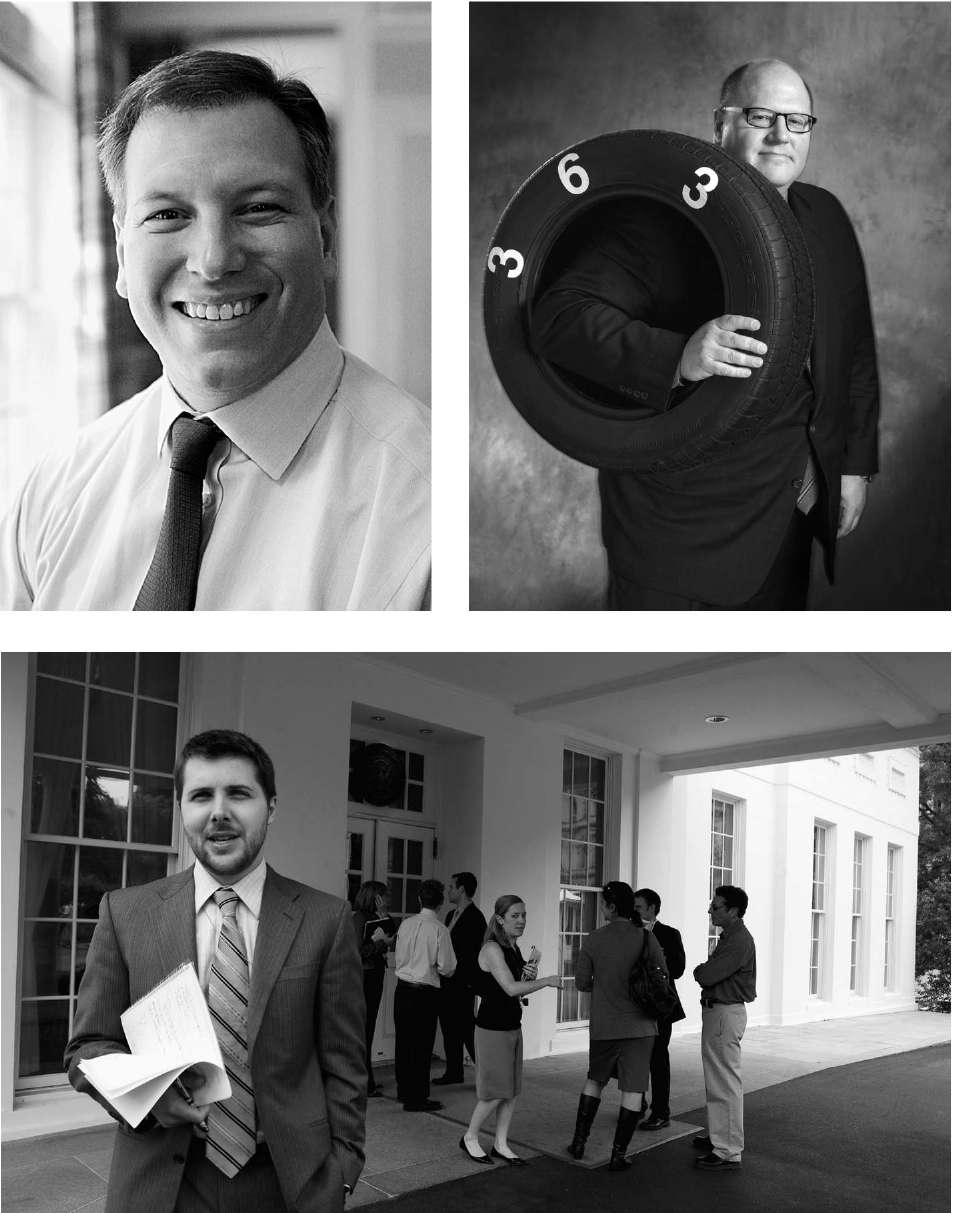

TEAM AUTO (U.S. Treasury, unless otherwise noted)

RON A. BLOOM

CLAY CALHOON

BRIAN DEESE (National Economic Council)

DIANA FARRELL (National Economic Council)

MATTHEW FELDMAN

ROBERT FRASER

SADIQ MALIK

DAVID MARKOWITZ

PAUL NATHANSON

BRIAN OSIAS

STEVEN RATTNER

BRIAN STERN

HALEY STEVENS

HARRY WILSON

ADVISERS TO AND STAKEHOLDERS IN CHRYSLER

ALFREDO ALTAVILLA, in charge of Fiat power-train technologies

STEPHEN FEINBERG, managing partner of Cerberus Capital Management (owner of Chrysler)

ANDREW HORROCKS, former managing director of UBS (adviser to Fiat)

THOMAS LAURIA, partner of White & Case (counsel to certain Chrysler senior lenders)

JAMES "JIMMY" LEE JR., vice chairman of JPMorgan Chase (Chrysler senior lender)

ROBERT MANZO, executive director of Capstone Advisory Group (adviser to Chrysler)

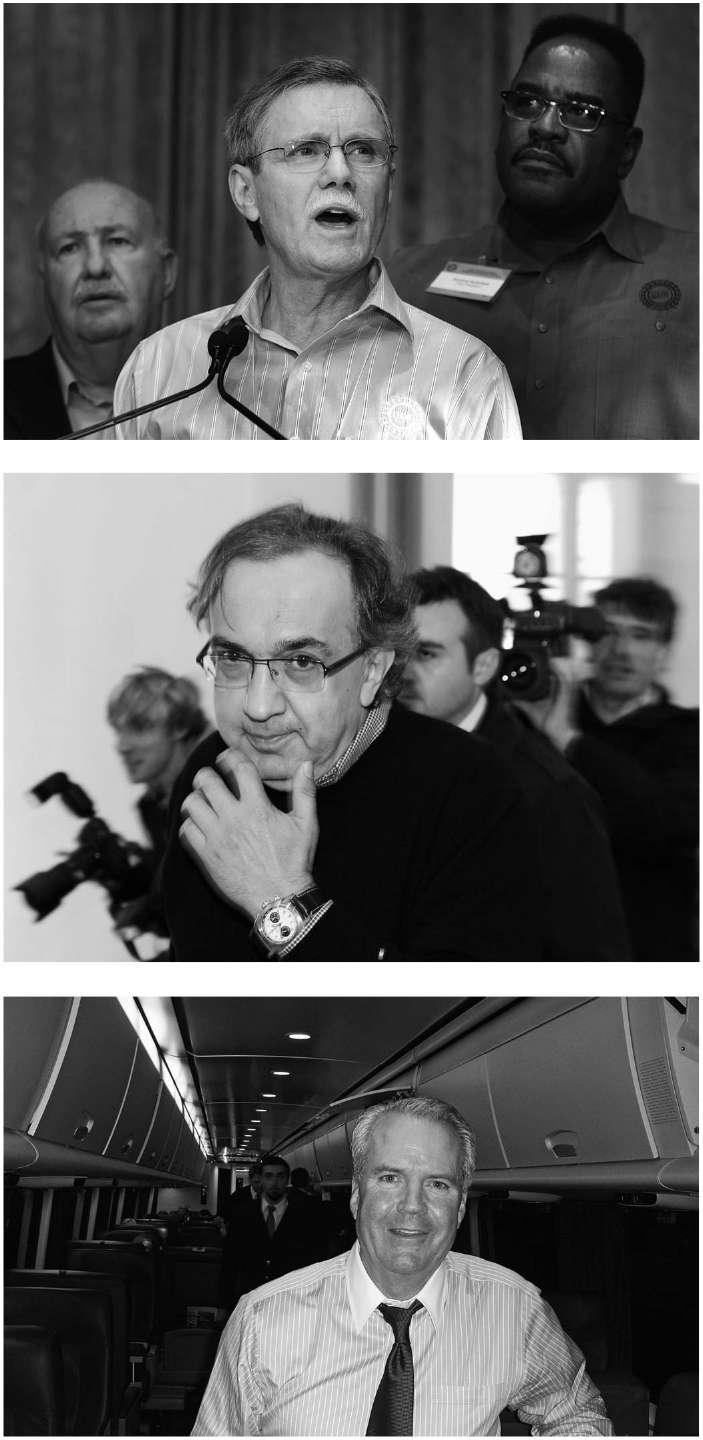

SERGIO MARCHIONNE, CEO of Fiat; later appointed CEO of Chrysler (since June 2009)

ADVISERS TO TEAM AUTO

XAVIER MOSQUET, senior partner of Boston Consulting Group

JOHN RAPISARDI, partner of Cadwalader, Wickersham & Taft (counsel)

TODD SNYDER, managing director of Rothschild

JOHN "JACK" WELCH JR., former chairman and CEO of General Electric

BUSH PERIOD

JOSHUA BOLTEN, White House chief of staff

CARLOS GUTIERREZ, secretary of Commerce

KEITH HENNESSEY, director of the National Economic Council

DAN JESTER, Treasury contractor

JOEL KAPLAN, White House deputy chief of staff for policy

HENRY "HANK" PAULSON, secretary of the Treasury

JOSHUA STEINER, Obama transition adviser

CANADA

PAUL BOOTHE, senior associate deputy minister of Industry Canada

CHRYSLER

ROBERT KIDDER, chairman (since June 2009)

RONALD KOLKA, CFO

THOMAS LASORDA, copresident

ROBERT NARDELLI, chairman and CEO

JAMES PRESS,co-president

CONGRESS

SEN. ROBERT CORKER (R-Tennessee)

SEN. CHRISTOPHER DODD (D-Connecticut)

REP. BARNEY FRANK (D-Massachusetts)

REP. STENY HOYER (D-Maryland), House majority leader

SEN. MITCHELL MCCONNELL (R-Kentucky), Senate minority leader

REP. NANCY PELOSI (D-California), Speaker of the House

SEN. HARRY REID (D-Nevada) Senate majority leader

SEN. CHARLES SCHUMER (D-New York)

FINANCIAL REGULATORS

SCOTT ALVAREZ, general counsel of the Federal Reserve Board

SHEILA BAIR, chairman of the Federal Deposit Insurance Corporation

BEN BERNANKE, chairman of the Federal Reserve Board

ROBERTA MCINERNEY, deputy general counsel of the Federal Deposit Insurance Corporation

CHRISTOPHER SPOTH, senior deputy director for supervisory examinations at the Federal Deposit Insurance Corporation

FORD

LEWIS BOOTH, CFO

WILLIAM "BILL" FORD JR., executive chairman

ALAN MULALLY, CEO

ZIAD OJAKLI, group vice president of government and community relations

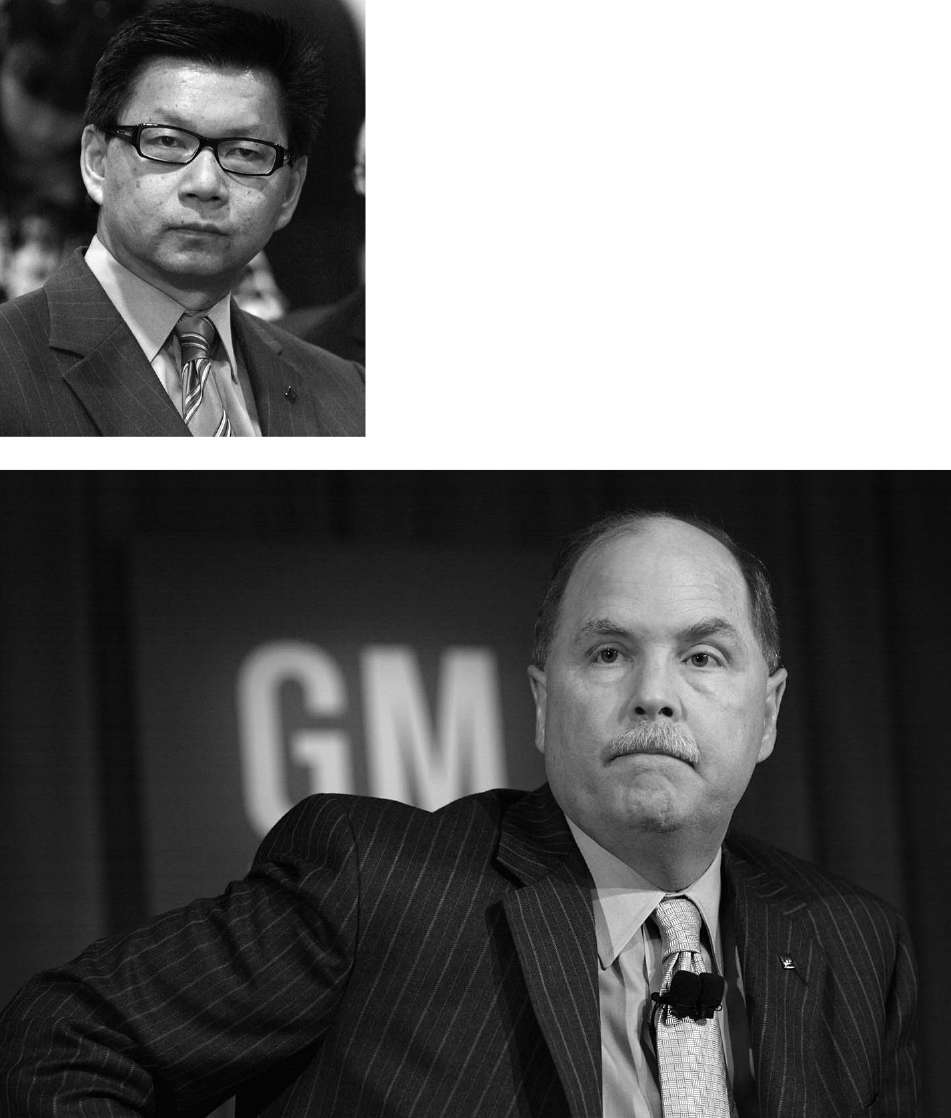

GENERAL MOTORS

DANIEL AKERSON, CEO (as of September 2010)

DAVID BONDERMAN, director

TROY CLARKE, president of GM North America

KENNETH COLE, vice president of global public policy and government relations

GARY COWGER, group vice president of global manufacturing and labor relations

NICHOLAS CYPRUS, controller and chief accounting officer

GEORGE FISHER, lead director (until July 2009)

STEPHEN GIRSKY, director; later appointed vice chairman of corporate strategy and business development

FREDERICK "FRITZ" HENDERSON, COO; later appointed CEO (March-December 2009)

KENT KRESA, director and interim chairman (March-July 2009)

MARK LANEVE, vice president of sales and marketing of GM North America

PHILIP LASKAWY, director

CHRISTOPHER LIDDELL, CFO (since January 2010)

ROBERT LUTZ, vice chairman and responsible for global product development

KATHRYN MARINELLO, director

PATRICIA RUSSO, lead director

JOHN SMITH, group vice president of corporate planning and alliances

CAROL STEPHENSON, director

G. RICHARD WAGONER, chairman and CEO (until March 2009)

EDWARD WHITACRE, chairman (July 2009 to December 2010) and CEO (December 2009 to September 2010)

RAY YOUNG, CFO; later appointed vice president of GM International Operations

MICHIGAN POLITICIANS

DAVID BING (D), mayor of the city of Detroit

REP. JOHN DINGELL (D)

GOV. JENNIFER GRANHOLM (D)

SEN. CARL LEVIN (D)

REP. SANDER LEVIN (D)

SEN. DEBORAH STABENOW (D)

OTHERS

ALVARO "AL" DE MOLINA, CEO of GMAC

CARLOS GHOSN, CEO of Renault-Nissan

JOHN MCELENEY, chairman of National Automobile Dealers Association

TREASURY DEPARTMENT

STEPHANIE CUTTER, chief spokesperson

JENNI ENGEBRETSEN LECOMPTE, spokesperson

KENNETH FEINBERG, special master for TARP executive compensation

TIMOTHY GEITHNER, secretary of the Treasury

ALAN KRUEGER, assistant secretary for economic policy

MARK PATTERSON, chief of staff

GENE SPERLING, counselor to the secretary of the Treasury

UNITED AUTO WORKERS

RON GETTELFINGER, president

GENERAL HOLIEFIELD, vice president and director of Chrysler department

BOB KING, vice president and director of Ford department; later elected president

CAL RAPSON, vice president and director of General Motors department

ANDREW YEARLEY, managing director of Lazard (UAW's financial adviser)

U.S. BANKRUPTCY COURT, SOUTHERN DISTRICT OF NEW YORK

JUDGE ROBERT GERBER, oversaw the bankruptcy proceedings of General Motors

JUDGE ARTHUR GONZALEZ, oversaw the bankruptcy proceedings of Chrysler

WHITE HOUSE

DAVID AXELROD, senior adviser to the President

RAHM EMANUEL, chief of staff

ROBERT GIBBS, press secretary

AUSTAN GOOLSBEE, member of the Council of Economic Advisers

CHRISTINA ROMER, chair of the Council of Economic Advisers

LAWRENCE SUMMERS, director of the National Economic Council

PROLOGUE

THE OVAL OFFICE has no proper waiting room, only a small anteroom in which President Obama's "body person," Reggie Love, and his secretary, Katie Johnson, are usually seated. Against the wall is a small TV, normally used to monitor news channels. But on this Sunday evening near the end of March 2009, it was tuned to the Arnold Palmer Invitational golf tournament, where Tiger Woods (then still heroic) was making a long-awaited return from knee surgery.

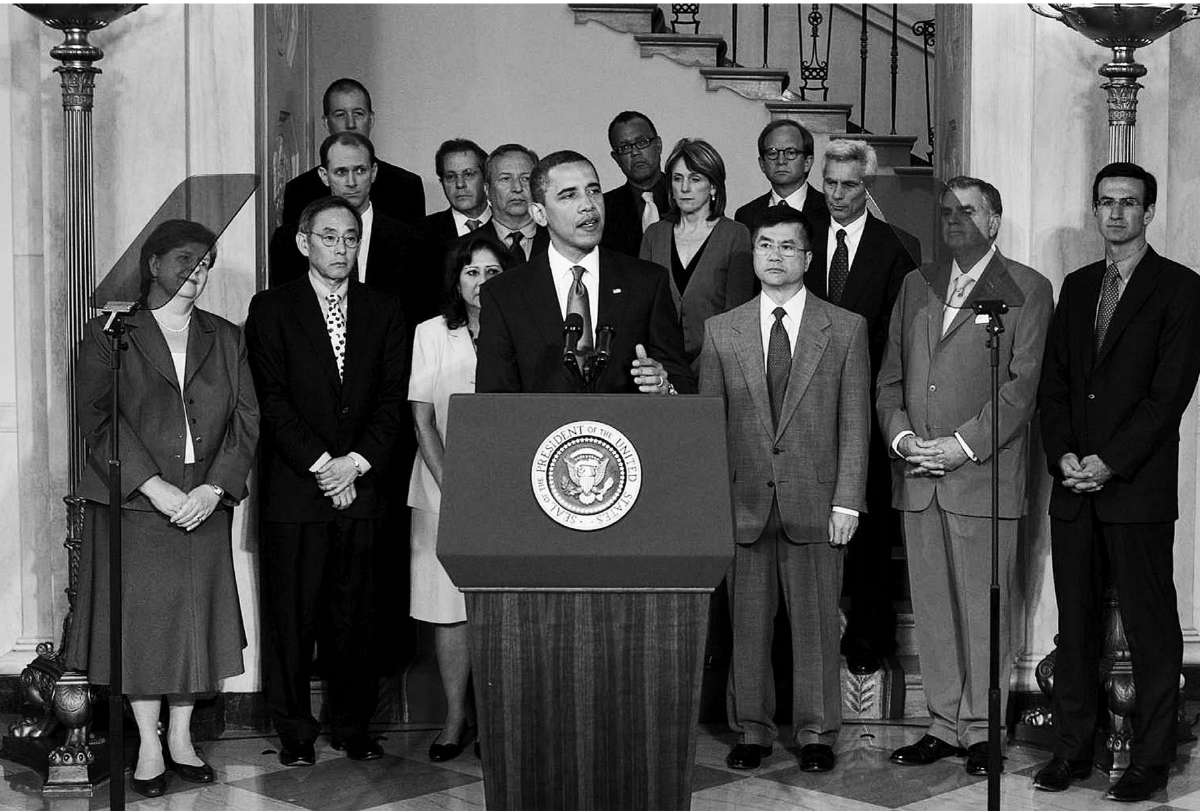

A few minutes before 7:30 a handful of us from the President's auto industry task force had followed chief economic adviser Larry Summers down a narrow flight of red-carpeted stairs and along a short corridor to this room. We'd spent the past hour in the rabbit warren of offices on the second floor of the West Wing, reviewing once more the key documents for a nationally televised announcement President Obama was to make the next day, the seventieth of his presidency. For Obama, this would be among his first major public actions; for our little task force, it was the point of no return.

Since the task force's hasty formation in February, we had been meeting with General Motors and Chrysler, both of which were being fed intravenously with taxpayers' cash. Dozens of consultants, investment bankers, and other outside experts had presented their views, and the question of what the government should do with the struggling automakers had been debated extensively up the administration chain of command. Finally, in tense meetings at the White House a few days before, the President had made his decisions. Those decisions had remained secret until now; tonight he would call the Michigan lawmakers to alert them to what he was planning to say the next day.

The President hadn't come downstairs from his living quarters yet, giving us a few minutes to root for Tiger's comeback—for me, a welcome distraction from worrying about whether our plans for the largest government intervention in industrial America since World War II could work. We had had only five frenzied weeks to prepare for this moment. One more time I mentally reviewed those plans, which included additional billions in taxpayer funding for General Motors and Chrysler and several other controversial and risky measures. What could go wrong? I'd asked myself over and over. As a prime mixer of the strong medicine that the President was about to administer, I was sure that if disaster ensued, all eyes would be on me.

In particular, I worried about the much-discussed prospect of putting the automakers into "controlled bankruptcy," a radical approach that defied conventional wisdom. While the President's speech the next day would leave open the possibility that bankruptcies might be avoided, I knew that the mere mention of it—let alone actually taking the step—risked imploding the auto companies, crippling thousands of related businesses, vaporizing millions of jobs, and intensifying what was already a deep recession across the Midwest. With America in the midst of the worst financial crisis since the Great Depression, this was no hyperbole: the failure of the auto companies could endanger the economy in ways that were almost too frightening to contemplate.

The President arrived a few minutes late (Tiger was playing a particularly crucial hole), dressed in khakis and a black zippered jacket. I was not surprised that he was wearing casual clothes—I had on khakis myself. Since President Obama's arrival in the White House, shirtsleeves had become the Oval Office norm, and on weekends almost anything went—even T-shirts and jeans worn by unshaven, sockless men.

While his dress was informal, the President's mood was resolute. He had the air of a man in the business of calmly executing his decisions, not second-guessing them. After he'd chatted briefly with Reggie about the golf match, we followed him into the Oval Office, where he sat behind his desk, bare but for a folder of talking points for his calls.

Katie dialed him first into a conference line on which four lawmakers awaited: Michigan's two senators and two of its congressmen. Delegations from our task force had been meeting regularly with them—tense, often testy sessions in which we were lectured about the importance of helping this critical industry.

We clustered around a phone across the room from the President's desk, by the armchair in front of the fireplace where he sat during meetings. Katie had activated the phone's speaker so we would all be able to listen in, but it barely functioned—probably installed by a "well-connected government contractor," the President joked.

He worked through his talking points, fluidly detailing the next day's announcements. Then he paused to let the legislators speak. John Dingell, the longest-serving member of the House of Representatives in history, was gracious and statesmanlike. The others were audibly on edge, although considerably more polite and restrained in conversation with the President than they had been in their meetings with us.

Congressman Sander Levin seemed to interpret the President's allusions to bankruptcy for GM and Chrysler as just a negotiating tactic. "I understand that you have to refer to bankruptcy to get people to the table," he began.

The President interrupted in a measured tone: "I don't want you to leave with that impression. I'm telling you that because it's a real possibility."

At this, a chorus of anxious voices crackled through the speaker. Senator Debbie Stabenow urged that if the President was going to send such a tough message, he ought to couple it with a strong statement of support for the auto industry. Senator Levin beseeched him not to use a broad brush in criticizing the companies and to acknowledge the progress that they had made.

The President listened carefully. When he brought the call to a close after about thirty minutes, he asked Larry to take another look at the speech. By the following morning we'd responded by sanding down the criticism of the companies and adding the "Cash for Clunkers" program to bolster car sales.

The next call was to Governor Jennifer Granholm of Michigan. I'd gotten to know her as an energetic, dynamic candidate during her 2006 campaign, but Michigan was suffering the nation's highest unemployment rate, and in our more recent conversations she'd seemed beaten down and demoralized. Now, as she listened to the President outline his plans, her spirits seemed to fall further and her voice barely rose above a whisper.

"I hope you know what you're doing," she said softly.

During the final call, Ron Gettelfinger, head of the United Auto Workers, who had been defiant the previous autumn when Detroit first asked for federal help, was low-key and respectful now. This augured well for the tough discussions we knew we needed to have with him.

When his calls were completed, the President walked out of the Oval Office and back to the small TV, to learn that Tiger had hit a birdie putt on the eighteenth hole to win. Tiger's day may have ended, but for the task force, a night of work was just beginning.

1. DEAD MAN'S CURVE

FOUR MONTHS EARLIER, on the day before Thanksgiving, I was about to leave my office to take one of my sons to a matinee of Speed-the-Plow on Broadway when the phone rang. It was Larry Summers, who'd just been named chief economic adviser to Barack Obama, the President-elect. "I'm calling with a hypothetical question," Larry said. "If you were asked to take on a six- to twelve-month assignment for the administration, would that be something that could work for you?" I replied that such an arrangement would be complicated, but all the same, it was something I'd be happy to consider.

For most of my career, I had majored in Wall Street and minored in Washington. I'd built a career in investment banking and private equity, limiting my involvement in politics to fundraising, serving on a few think-tank boards, and writing the occasional op-ed. While I'd flirted with government service in the past, the beginning of this new administration seemed like a compelling moment to step up. Our country was facing the greatest financial and economic crisis since the Great Depression; when would the skills of a finance guy like me possibly be more useful? If I hung back this time, what would I be saving myself for?

I hadn't worked in D.C. since the days of Jimmy Carter, and then not as a government official but as a reporter for the New York Times. I'd fallen into the job in 1974, starting as a news clerk for the Times"s legendary columnist James "Scotty" Reston. Arriving in the capital two months before Richard Nixon's resignation was a dizzying experience for a twenty-one-year-old college graduate. A few years later I was a full-fledged Washington correspondent, responsible for covering what in the face of OPEC and stagflation were the two most important domestic issues facing the Carter administration: energy and the economy.

Then came the election of Ronald Reagan. Some of the stories I wrote were deeply skeptical of supply-side economics, to the point where I found myself attacked on the Wall Street Journal editorial page. My superiors decided that this would be an excellent moment for me to move to London to cover European economics.

Neither London nor journalism outside Washington was particularly satisfying, however. I grew restless. Although I had leaped at the opportunity to work with Scotty Reston, I had never set out to be a journalist. I'd been raised in the New York suburbs in a nonpolitical, business-oriented family. My father, who had seen his family's fur business go bankrupt during the Depression and now ran our family's paint-manufacturing company in Queens, had urged me toward a professional education. I'd even applied and been accepted to business school and law school, both of which I'd deferred to stay at the Times. Now I felt the journalistic frustration of peering through the glass instead of running something or building something in the real world.

I could have tried returning to Washington as a public servant. But the private sector was a more realistic option in those days of Republican ascendance. Several friends I'd known in Washington had shifted to investment banking. That industry had nowhere near the glitz or notoriety it would gain within a few years, but listening to those who had entered the fray, it sounded like an exciting, challenging way to marry some of the variety and competitiveness of journalism with a chance to do more than report.

Money wasn't my main motivation—I was single and earning more than $60,000 a year, with both a cost-of-living allowance and a generous expense account—and it took me a while to realize how weird I sounded saying that on Wall Street. When asked in job interviews why I wanted to become an investment banker, I would speak somewhat airily about doing something different from journalism. My prospective employers would look at me quizzically. The more forthcoming ones told me that this was too tough a profession to take on unless I had a real drive to get rich. So I learned to play up a passion for moneymaking and to mention the limitations of living on only a five-figure income.

"I understand completely," said one of my last interviewers. "I don't know how anyone can live on sixty thousand dollars a year." At that time, someone making that much ranked in the top 10 percent of all earners.

In my early years on Wall Street, I had no time for politics or policy. I devoted my waking hours to work and tried to be a good family man. The best thing that had come out of my time in London was meeting my wife, Maureen White, another American expat. When we decided we wanted children, we somehow managed to have four in four years' time (one set of twins).

Not until the mid-1990s, after I'd risen to a senior post at the investment bank Lazard Frères, was I able to focus again on Washington. I began to write op-eds. I became involved with several think tanks and started donating to candidates I liked.

Maureen and I had met the Clintons on Martha's Vineyard in the early years of Bill Clinton's presidency. Our relationship was cemented in 1995 when Vernon and Ann Jordan arranged for us to stay over in the Lincoln Bedroom, on the second floor of the White House. We were so naive about fundraising that we took the Jordans at their word when they said that the Clintons wanted to "meet a few new interesting people."

That year, we dove into Clinton's reelection effort—raising money, courting business support, and attending events. After the election, Maureen became the U.S. representative to UNICEF. I had conversations with Treasury Secretary Bob Rubin and his then-deputy Larry Summers, but their needs and my availability never coincided.

Maureen and I worked hard for our friend Al Gore in 2000, and then again for John Kerry in 2004, because we could not bear George W. Bush's policies. At the time, I wasn't thinking of a Washington job; I had made a commitment to the three partners with whom I started a private investment firm, the Quadrangle Group, in 2000, promising that I would not leave for at least five years. And I was enjoying helping our little firm grow and thrive.

When Hillary Clinton ran for President in 2008, the decision to support her was easy. I admired her enormously and thought that she was the best qualified to be President. But as the campaign unfolded, it became clear that on substantive policy grounds, she and Obama were almost indistinguishable. So while I was proud to be a Clinton supporter, I always felt that Obama would also be fine. In August 2007, I ran into him at a Martha's Vineyard golf club and mentioned that if he became the nominee, I'd be pleased to help in any way I could. (At that moment, I suspect neither of us thought that outcome was likely.)

We stayed with Hillary to the bitter end; I've always believed that the girl you bring to the dance is the girl you stay with. But when she dropped out in early June 2008, Maureen and I were happy to support Barack. As always, we tried to keep a low profile and help where we could, mainly in fundraising, business outreach, and cultivating other potential supporters, particularly those who had been for Hillary.

Election night 2008 was a celebratory moment for us. Of course, almost immediately the jockeying and speculating over appointments began. I wanted to serve and felt that now the timing was right: my kids were nearly grown, and Quadrangle was coming up on its ninth anniversary and I had capable partners. But I knew from observing previous transitions that Obama would pick his most senior advisers first. Any potential role for me would be a notch down.

I had not concealed my interest in Washington, so I didn't think I needed to do much to advance myself. I'd seen would-be officeholders put themselves forward shamelessly—and futilely. Any job I would want would be decided on merit, another reason for not trying too hard. My prospects were helped by my relationships with people involved in the transition, including its overall head, John Podesta, a former chief of staff to President Clinton. In charge of the personnel process was Mike Froman, a former Treasury chief of staff, a law school classmate of Obama's, and a good friend of mine. My partner from Quadrangle Josh Steiner, himself a former Treasury chief of staff who had been caught up in the Whitewater scandal, had been asked to help with the economic-policy portion of transition planning. One of the few people I talked to openly during this period, Josh urged me not to be passive. "Very few people get drafted for these jobs," he said. So I visited briefly with Podesta and Froman to register my interest in serving in the new administration.

On the Monday before Thanksgiving, Obama announced the key members of his economic team. Timothy Geithner's appointment as Treasury secretary made him my most likely new boss, so I sent him a congratulatory e-mail noting my willingness to serve. The cryptic phone call from Larry Summers as I was leaving to see Speed-the-Plow came the next day. After that, I sat back to wait. While Josh was discreet, I knew he would alert me if there was some action he thought I should take.

Tim was still president of the New York Federal Reserve Bank—a more-than-full-time job as the financial crisis accelerated. I could not imagine how he could manage it and prepare to run the Treasury at the same time. So I was excited to get an e-mail from his assistant, asking me to meet with him on December 18 at 8:30 A.M.

Having allowed plenty of time in case of rush-hour delays, I arrived early at the gray, fortresslike Federal Reserve building on Liberty Street in downtown Manhattan. Ushered into a small sitting room, I waited until Tim, in his customary blue suit and white shirt, rushed in, dropped his BlackBerry and phone on a side table, and began my first job interview in years.

Speaking in his usual concise, focused fashion, Tim explained that Treasury's traditional organization was unsuited to the current economic problems: there were more crises than there were formal jobs. And yet, he explained, it was hard to create new senior positions without congressional approval. So Tim was thinking in terms of tasks rather than positions, implying that he'd get to the specifics of positions and titles later. He mentioned four issues that might be appropriate for me to work on: housing, the immediate banking problems, longer-term financial policy, and autos.

I said that I was open to discussing any of the possibilities and didn't want to make his impossible life more difficult by being finicky. Less than fifteen minutes into our scheduled forty-five-minute meeting, an assistant came to summon him to another meeting, and Tim stood to leave.

"Do you have any questions for me?" I asked, disconcerted by this abrupt turn in my job interview.

"No," he replied and was gone.

Later, it struck me that the jobs Geithner had listed were like a four-point checklist of the financial and economic calamities facing the new President. With the collapse of the subprime mortgage market and the unprecedented fall in property values, homeownership had gone from the American dream to a debt nightmare for millions of families. The nation's biggest banks and investment houses were mostly crippled, threatening to paralyze the entire economy. Financial policy had clearly failed to guard against this, and once the emergencies were resolved, the question would be how to fix the system. And the auto industry, the once proud symbol of America's industrial might and still the employer of millions, was near ruin. If any one of these missions became mine, I thought ruefully, I certainly would not have to worry about being stuck in some purely honorary job.

Like most Wall Street denizens, I had watched closely as these crises cascaded through the financial markets and undermined the broader economy. Our private equity investments were mainly in media and communications, sectors somewhat removed from the financial industry collapse. Nor did we engage in derivatives or subprime or risky lending in our other principal business: serving as the investment arm for Mayor Michael Bloomberg's personal and philanthropic wealth. So we did not feel the same sense of imminent peril that many of my friends experienced. At first the crisis was simply unnerving—also fascinating in a morbid sort of way.

I followed the daily developments closely. As a private equity investor and mergers and acquisitions veteran, I was only vaguely familiar with the new lingo of Wall Street—special investment vehicles, collateralized loan obligations, super senior tranches, conduits and securitizations. Now I did my best to learn, often entreating friends who were closer to the action to explain to me the new alphabet soup of CLOs, SIVs, MBSs, and so on. Writing helped me collect and focus my thoughts. In 2007, I warned in the Wall Street Journal of a "coming credit meltdown." As the crisis developed, I contributed opeds on housing, on the likely emergence of better-capitalized banks, on what to do with Fannie Mae and Freddie Mac, on the future of private equity, and on the state of the economy (about which I was way too optimistic).

For many months, Wall Street was in a muddle about what it wanted Washington to do. In March 2008, when the Fed saved Bear Stearns, many in the financial community were dismayed. "Moral hazard!" they cried. "Poorly run institutions must be allowed to fail!" For the next few months, markets continued to erode only gradually, with the acute pain confined to those in the subprime mortgage arena. But then came the crisis of September 2008. "The Street" wanted the government to let Lehman go—a notch in the moral-hazard belt—and the Federal Reserve and the Bush administration obliged. But from that horrible Monday morning when we awoke to Lehman's bankruptcy—the firm at which I enjoyed beginning my Wall Street career and at which I still had many friends—it was clear that things would never be the same.

I had experienced market crises, but nothing like this. The 1987 stock market crash—unnerving as it was on another Black Monday, October 19—had proved short-lived. The Asian crisis in 1998 had been messier and protracted, but Asia was on the other side of the globe. This meltdown was right here in Manhattan, where we saw friends lose their jobs and much of their net worth. Financial markets began to seize up. Being a private equity guy was no longer a sheltered cove; we had portfolio companies that needed financing and none was available. Meanwhile, the recession that we now know officially began in December 2007 started to affect some of our companies' results, particularly those with substantial advertising revenues. We plunged into intensive reviews of each company, intent on cutting expenses and stretching liquidity as far as possible. The Bloomberg portfolio, conservatively invested, performed better than most of its peers, but the declines still stung. Above all, the sense that no one knew where the bottom was created more widespread terror than I had ever experienced in my Wall Street career. (As determined investors, we tried to find exciting opportunities amid the carnage, but it was hard to summon the courage to run into a burning building.)

I wasn't shocked—maybe I should have been—that Tim would have mentioned four very diverse jobs. For one thing, government has always placed more confidence in the transferability of skills than the private sector. Perhaps more importantly, all four issues had finance at their core, and all would benefit from a fresh look by people who were not wedded to past models and outmoded approaches. Even solving the auto crisis, I understood, would not be a management assignment like running a corporation; it would be a combination of restructuring exercise (cleaning up the mess) and private equity task (investing new capital). While the Wall Street community includes many who are more expert at both tasks than I, after twenty-six years in finance I felt that my "major" and my "minor" had converged.

Josh hinted a few days later that I was likely to be offered autos. My first reaction was to think, "But I live in New York!"—as a Manhattanite, I neither knew nor cared much about cars. (I'm a pilot, more interested in planes.) But Josh encouraged me, arguing that I could help prevent the devastation of this iconic industry. Among his many roles, he'd been named the transition team's senior auto adviser and had been scrambling to get up to speed on the ills of Detroit.

The same week as my job interview with Geithner, the Bush administration committed $17 billion of federal funds to General Motors and Chrysler, putting them on financial life support. The money came with a hodgepodge of conditions, including a mid-February deadline, when the automakers had to submit "viability plans," and another at the end of March, when the new Obama administration would revisit the whole issue. By then the automakers would again be almost out of cash.

Josh described this state of affairs as "challenging and interesting," perhaps in part because he was eager to hand it off. Another close friend, Senator Chuck Schumer, gave me a different take when we talked at dinner not long after I'd met with Tim. "Autos is a no-win," the senator bluntly declared. "The situation is probably unsalvageable. You'll run up against the unions and get eviscerated by your own party. Work on housing—it's a big, important issue, it affects everybody, it has to get resolved, and the politics are easier."

A week went by and the holidays came. On December 26, I took my family to Spain for a week of sightseeing ("history trips," our kids called these annual expeditions). But Tim's office interrupted our vacation on the thirtieth, asking to schedule a call for the following day. When my cell phone rang on New Year's Eve, Tim offered me the auto assignment, reporting to both him and Larry. I was very positively inclined, I said, but needed to discuss it with Maureen and a few others. Other than his telling me I would be a counselor to the Treasury secretary, there was no talk of terms or responsibilities, and the call ended in less than five minutes.

A few hours later, as we were about to go to dinner, the phone rang again; this time it was Larry, calling from vacation in Jamaica. "I know you talked to Tim," he began. "It would be great if you did this." He was surprised to discover I was in Barcelona and said, "It's a good thing I didn't call much later." Never one to stay up late, even on New Year's Eve, I replied, "My phone would have been off." I gave him the same response I had given Tim and went to join my family.

I lay awake for a while that night as 2009 began, sensing I was on the verge of the experience of a lifetime. I was being given a chance to play a central role in the largest industrial restructuring in history from within the most powerful institution in the world—the United States government. I would come to the job thinking I knew a lot about business and a reasonable amount about Washington. I didn't realize that my eyes would be opened to harsh new perspectives on both worlds. I would learn of both the devastation across our manufacturing sector—in part, collateral damage from our sound commitment to free trade and NAFTA— and the intimidating challenge of reversing the trend or even just halting the decline. I would discover that the struggles of GM and Chrysler were as much a failure of management as a consequence of globalization, oil prices, and organized labor. I certainly understood the importance of management to the small companies in which my firm invested; what would astound me was how important one or two individuals could be to the fortunes of businesses that were among the largest on the planet. And I would witness the dysfunction of Congress, its inability to rise above deep partisan divides and narrow parochial interests and produce legislative action to address in a thoughtful manner the many challenges that we face. I would conclude that if sunshine is indeed the best disinfectant, as Justice Brandeis once said, we need to find the most powerful lenses available to focus the sun's rays on the U.S. Congress and, particularly, the Senate.

In the end, the auto rescue would prove to be not just the story of two iconic automakers. It would exemplify many of the challenges that confront Americans in the twenty-first century—from our struggling manufacturing base to our declining middle class—and illustrate how difficult it is in the hothouse of Washington, so deeply divided along partisan lines, to take the desperately needed swift actions. I believe firmly in President Obama's efforts to restore our economy, yet because of such obstacles, the auto rescue remains one of the few actions taken by the administration that, at least in my opinion, can be pronounced an unambiguous success. Detroit should count itself lucky.

***

It had taken America's automakers my entire lifetime to come to the crisis they were in. I grew up during Detroit's heyday, the fifties and sixties, when the Big Three were just that. General Motors, Ford, and Chrysler controlled 90 percent of the U.S. car market, by far the world's largest. GM sold half the vehicles purchased annually in America, coming in year after year in the number one spot on the Fortune 500 list of America's largest industrial companies. Driveways and garages up and down the street in my parents' affluent Long Island suburb were filled with Ford Country Squires, Lincolns, Cadillacs, and the like.

In those upbeat days, Detroit's offerings echoed the optimism of the space age, drowning in chrome and sporting glamorous-sounding names like Galaxie, Starliner, Thunderbird, and Barracuda. My best friend in high school got a Camaro convertible as a graduation present from his parents, and we all thought it was about the coolest thing around. It was perhaps a precursor of things to come when in 1966 my mother abandoned our family's preference for Fords and bought herself a small Mercedes, and our family became among the first I knew to own a foreign car.

I was a college junior when gasoline prices first soared to shocking levels, which ended Detroit's hegemony and opened the floodgates for small, inexpensive, fuel-efficient Japanese imports. Competition, high gas prices, and stagflation squeezed the U.S. carmakers hard in the 1970s, ending with Chrysler nearly bankrupt and Ford and GM deep in red ink. At the New York Times I helped cover Chrysler's pleas for a government bailout. In one story I described the debate as a "first-rank political and economic controversy over whether it is obligatory, or even desirable, for the Federal Government to come to the rescue of a large, ailing corporation." That question, it turned out, would trail me.

On highways and streets, imports—Corollas, Civics, Datsuns, and Volkswagens—became as popular as American cars. I'd shared the use of a Ford Pinto in college (one of the worst cars ever built), but when I got to pick my own car, I chose a sporty Datsun 260Z. Volvos competed with U.S. station wagons, and Mercedes and BMWs displaced Cadillacs and Lincolns at the luxury end. In 1982 came the first successful "transplant"—a Honda factory opened in Marysville, Ohio, where non-union American workers turned out Accords just as efficiently as workers in Japan. Such plants enabled Detroit's rivals to avoid import restrictions and lessened the effects of currency swings, increasing the pressure on the Big Three.

That is not to say Detroit didn't have successes. After its first bailout, Chrysler, fired up by Lee Iacocca as its CEO and TV pitchman, invented the minivan and changed the world of driving for suburban moms. Ford launched the Taurus, a radically curvaceous full-size car that critics first ridiculed as a "flying potato," then hailed as a design breakthrough. Consumers made it the best-selling car in America, displacing the Honda Accord. These late-eighties successes drove Ford and Chrysler to record-breaking profits and lit up their stocks. Ford's stock price rose 1,500 percent between 1981 and 1987.

But beneath it all was an undertow. U.S. automakers' market share was eroding as the Germans and Japanese developed a better bead on what buyers wanted. Confronted with lagging demand, Detroit was always a lap behind in cutting capacity, raising productivity, and renegotiating with labor. The financial pages chronicled the Big Three's woes: a steady stream of reports about plant closures, layoffs, concessions to unions, and struggles with regulators and consumer watchdog groups.

GM, in particular, seemed incapable of effective change. Starting in the 1980s, top management gambled at least $90 billion on computers and factory robots and a sweeping remake of GM's 800,000-employee organization—all in hopes of leapfrogging the competition into the twenty-first century. Instead, the reorganization stalled and a newly engineered generation of Buick Regals and Oldsmobile Cutlasses fizzled in the marketplace.

In 1989, the once mighty GM became the butt of national ridicule when Roger & Me, the most successful documentary ever at the time of its release, skewered the company for exporting jobs to Mexico and impoverishing Flint, Michigan, one of the many seemingly doomed all-American factory towns. Detroit's ingrown management culture looked more arrogant than ever onscreen. How timely the film was: after the recession of 1990–1991 forced more layoffs and plant closures, GM earned the grim distinction of recording the largest one-year loss in American corporate history, $23.5 billion in 1992.

Less prosperity brought more challenges as the Big Three felt the effects of years of concessions to the UAW, including comprehensive health care for an ever-expanding number of retirees and their families. (The UAW was so central that when crunch time finally came in 2008 and Congress called the Big Three to testify about bailout needs, there were four chief executives at the table: the CEOs of GM, Ford, and Chrysler, and Ron Gettelfinger, head of the UAW.) It is not an exaggeration to say that the industry could have crumbled before the twenty-first century began had not a revolutionary development—the sport-utility vehicle—hit the streets. Consumers were in love again, not with American cars exactly, but rather with American light-trucks-turned-passenger-vehicles. SUVs enabled automakers to exploit cheap gasoline (the price of which, adjusted for inflation, had fallen to near pre-OPEC levels) and skirt clean-air regulations. Clinton's economic boom was on, and these high-riding, road-hogging, gas-guzzling monsters were the hallmark of the era. As foreign automakers initially dismissed the SUV as a craze, Detroit's profits and stocks went up once more. Detroit was on such a roll that in 1999 the Wall Street Journal predicted a new golden age for GM, Ford, and their top competitors (Chrysler by then had been bought by Daimler). In 2000, GM stock hit its all-time high of $93.63 a share.

Yet the reality was that SUVs slowed, but did not reverse, the erosion of Detroit's market share. By 2005, it would be easy to see all the wrong turns, including the diversion of billions of dollars of capital to acquisitions (Ford bought Jaguar and Volvo; GM picked up Hummer and Saab). None of these deals paid off. To juice up sales, the companies became addicted to incentives—cash-back offers and heavy discounts that sustained production but sacrificed profits. (Incentives weren't as stupid as they seemed: labor contracts guaranteed wages whether workers made cars or not.)

Detroit's ultimate implosion, begun long before the 2008 housing market collapse and financial panic, was triggered by the resurgence of oil prices. In 2004, gasoline, edging up at the pump for a couple of years, jumped to more than $2 a gallon. Suddenly, filling the tank of a large SUV cost $60 or more. Dealers had little to offer as consumer demand swerved back toward small, fuel-efficient sedans. The Big Three had never controlled expenses, especially labor costs, enough to be able to make money on such cars. In 2006, Ford lost $12.6 billion on $160 billion in sales.

Each Detroit giant responded in its own way. Chrysler's owner, Daimler, decided to bail—in essence giving away an 80 percent stake in the business, for which it had paid $38 billion nine years before, to the private equity firm Cerberus. Ford, by contrast, strapped in, raising $23.5 billion by taking loans on its factories, real estate, patents, and even the rights to its distinctive blue-oval trademark. GM unloaded assets, including a majority stake in its huge finance company, GMAC.

By 2006 GM's domestic market share had fallen to less than half of its historic peak. Industry watchers began to speculate about whether Toyota might usurp GM as number one in the U.S., once unthinkable in a country where World War II vets had insisted on American-made cars. (Toyota was on the brink of displacing GM worldwide, which it did the following spring.) It was a classic business saga, not unlike those of companies in many other industries that saw a once dominant market share challenged by new competitors. For the U.S. steel giants, it was imports. For the three broadcast TV networks, it was cable. As for Detroit, years of mismanagement had allowed structural problems such as labor costs to become intractable.

These decades of decline had left Detroit frighteningly vulnerable to the mounting calamities of 2008. That summer, when gas prices topped $4 a gallon, car dealers suffered double-digit decreases in sales. As the decline in housing prices gathered speed and the intensifying recession dried up credit, consumers could no longer get car loans and dealers couldn't finance their inventories. Sales plunged and cash began draining from the automakers' treasuries at a dramatic rate.

Increasingly desperate, the companies went into panic mode. Chrysler explored mergers with Fiat and Renault-Nissan. Ford, after experiencing the worst quarterly loss in its 105-year history—$8.7 billion in the second quarter of 2009—announced a radical shift in its product lines. GM's second-quarter loss was nearly double the size of Ford's—$15.5 billion. Amid other restructuring steps, the company said it would slash production capacity by 300,000 vehicles.

For the president of GM, Fritz Henderson, the months leading up to the company's one hundredth anniversary, in September 2008, were the hardest in his lifelong GM career. A stocky, energetic pragmatist, Henderson began worrying seriously about his company's survival as soon as sales began to ebb in the first quarter. In June, after successfully negotiating the end of an ugly, months-long UAW strike that had crippled production of SUVs, he saw an alarming statistic: GM had more days' supply of unsold trucks at the end of the strike than at the start. Consumers had stopped buying. "We should have let the strike run another sixty days," he grimly joked to the company's North American chief.

At first, the sales collapse was purely domestic—Europe was still strong, as were Asia and the emerging markets. But with oil at $140 a barrel, Henderson knew the malaise would spread and tried to prepare. Money in the capital markets was evaporating; it was becoming as hard for GM to finance operations as it was for consumers to get car loans. Henderson was soon elbow-deep in implementing what General Motors CEO Rick Wagoner and the board of directors called GM's self-help plan—taking production down, slashing jobs and orders with suppliers, cutting inventory and working capital. With Wagoner's acquiescence, he explored even more radical steps.

By late summer, teams of GMers sequestered in a hotel near Detroit were secretly analyzing a merger with Chrysler. The number three Detroit automaker had approached GM after its courtships with Fiat and Renault-Nissan failed. Henderson and his task force made a case to a skeptical Wagoner that by absorbing its smaller rival, GM might attract new investment and bolster its chances of survival, even if demand continued to fall.

The financial panic on Wall Street in September crushed that hope. At a very subdued hundredth anniversary gala two nights after Lehman Brothers went bankrupt, Henderson sat thinking how much he hated birthdays. He wondered if GM would even make it to 101.

The automakers by now had begun quietly asking Washington for help, focusing at first on diverting money from a $25 billion incentive program set up by Congress to speed production of electric cars and other "advanced technology" vehicles. Henderson was sure that GM had no alternative to federal aid. But it filled him with foreboding. In early October he shared his concerns with Wagoner in an e-mail. He believed the government would help—he couldn't envision George W. Bush letting the automakers fail in the last three months of his presidency. Yet if it accepted help, GM would jeopardize its autonomy, and its leaders risked losing their jobs. "Once you open this door, you don't know where it's going to go," Henderson told Wagoner. "You just need to understand that. Because when you ask for support from the taxpayer, things could change."

2. THE BRIDGE TO OBAMA

COLUMBUS DAY IS A holiday for government workers, but on Monday, October 13, 2008, the Treasury Department was frenetic. CEOs from nine of America's largest banks had been summoned by George Bush's Treasury secretary, Hank Paulson, for an afternoon meeting. Together they would be told that to preserve the financial system, each would be required to accept a multibillion-dollar infusion of public money from the Troubled Asset Relief Program (TARP). This intervention in the banks' business—the single most important step in the government's rescue of the financial industry—dominated the news.

Unknown to the world, another summit had taken place at Treasury that morning. General Motors, the second-largest industrial company of the largest economy on earth, was on the verge of bankruptcy and had come to the government, hat in hand. Had this become public knowledge, it would have grabbed more than a few headlines from the banks.

At 8:30 A.M., GM's CEO Rick Wagoner arrived at Paulson's office, accompanied by his chief financial officer and two carefully chosen members of the GM board, Erskine Bowles and John Bryan, both courtly southerners. Bowles had been chief of staff to President Clinton and was expert in the ways of Washington. Bryan, who had brokered the meeting, was Paulson's longtime friend.

What brought the GM team was money: the giant automaker was hemorrhaging cash. In the first quarter of 2008, $3.5 billion had drained away. In the second quarter, the outflow was $2.8 billion. Results for the third quarter, which had ended only two weeks before, were still unannounced—and horrendous. GM had burned through almost $9 billion.

Time had run out on the last of Wagoner's many efforts at a turnaround. The program of selling assets to raise cash had almost reached the end. To try to conserve cash, there had been white-collar headcount reductions, elimination of health care for older white-collar retirees, elimination of executive bonuses, and suspension of the dividend. Privately Wagoner had weighed the merger with Chrysler—an opportunity for significant cost savings—but scuttled it as GM's crisis became too urgent for the benefits of a merger to have time to kick in. "I was trying to reduce brands. Why add Chrysler's?" he later explained to me.

Then, on October 3, GM recognized a potential godsend when Congress created the TARP at President Bush's behest. The program established a $700 billion war chest for the Treasury to use in preventing a financial and economic collapse, of which fully half, $350 billion, was at the immediate disposal of Paulson and his staff.

Understandably, Paulson this morning was focused on banks, not cars. Compared with the upheavals on Wall Street, the woes of General Motors seemed small beer. Paulson, a sixty-two-year-old former Eagle Scout from the Midwest, had survived twenty-seven remarkable months at Treasury, where he had arrived in the sixth year of an unpopular administration obsessed with global terrorism. No one had expected him to be able to accomplish much. Then, in 2007, the housing bubble burst. As the impact spread through the U.S. economy and the world financial system, Paulson became, inarguably, the most important member of the Bush administration.

Indefatigable and relentless, the former Goldman Sachs CEO juggled crises and crammed in cell-phone calls while striding between high-pressure meetings. He had little patience for ceremony or bureaucracy. When some of his former Goldman colleagues materialized at Treasury as "special advisers," there were bruised feelings among the career staff. But Paulson made no apologies and, as the problems worsened, seemed to become ever more blunt. In September he'd caused a furor with a curt three-page pitch to Congress requesting not only a staggering $700 billion for TARP but also the authority to deploy it without review.

Still Wagoner, who had called twice in the past ten days, appeared convinced that his emergency deserved attention too. So Paulson had shoehorned the automaker in before Federal Reserve Board Chairman Ben Bernanke, who was due at 10 A.M. to prepare for the meeting with the bankers. But the Treasury secretary had taken preemptive steps to keep the automakers off his department's crushing caseload. The White House, sympathetic to Paulson's burdens, had agreed to have Commerce Secretary Carlos Gutierrez greet the visitors with Paulson and serve as the administration's point man on GM.

In the back of Paulson's mind, snagging his attention at every turn, was a frightening scenario. He feared that the $350 billion appropriated for TARP would be insufficient to shore up the financial system. The last thing he wanted was to divert rescue money to car companies. With liquidity short throughout the economy, he also worried that bailing out Detroit would entice other strapped companies to try to get on the federal dole too.

At 8:30 A.M., the GM delegation was ushered into Paulson's "small conference room," a modest, nondescript space less ornate and much smaller than the secretary's "large conference room," where the bank CEOs would gather later that day. As the GM visitors—outnumbered by Paulson, Gutierrez, and a half-dozen aides—took their places, John Bryan kicked things off with introductions. Then came Wagoner.

Leaning forward in his seat, the tall, stolid CEO explained matter-of-factly that without help, GM was likely to go bankrupt. That, he said, would almost certainly lead to the company's immediate liquidation, clearly an economic catastrophe. If GM factories locked their gates, suppliers and dealers all over America would fail in a terrible domino effect.

To explain the mess, Wagoner invoked the automakers' familiar litany of forces over which they had no control, specifically the rise in oil prices and the collapse of consumer confidence after the crises in housing and finance. He added a new reason for urgency, declaring that the end for GM might come as soon as Monday, November 3—the day before the presidential election—when GM was scheduled to announce its grim third-quarter results. Also due on that date was a multibillion-dollar payment to suppliers that threatened to drain GM's cash below the minimum reserves needed to run the business. The company's precarious state, if revealed, would not only spook Wall Street, but also, he warned, trigger "a run on the trade" by suppliers. Like panicked bank customers stampeding to withdraw their savings, the suppliers would cancel their credit and demand cash on delivery—money that GM simply wouldn't be able to pay.

The implied threat was clear: Did the administration want voters waking up on Election Day to news that the nation's largest manufacturer had gone bust? His alternative was $10 billion of TARP money, a loan, for which GM would be willing to pay a generous interest rate and give the Treasury a 19.9 percent ownership stake.

Ray Young, GM's chief financial officer, handed out a PowerPoint presentation to buttress the company's case. (I would later learn that nothing at GM happens without PowerPoint.) To the practiced eyes of the two cabinet secretaries, the recovery plan supposedly justifying the $10 billion loan was long on rosy predictions but short on facts and analysis. GM wanted to gamble taxpayer money on a vast, rapid rebound in auto sales as well as on gains in market share. Asked how he could be confident of such forecasts, Wagoner waxed eloquent about the new Chevy Malibu and GM's gains in J. D. Power quality studies.

Gutierrez broke in to ask about bankruptcy. "Companies in your situation tend to pursue some form of reorganization," he said. "Isn't that something that could make sense here?"

No way, said Wagoner, shaking his head; bankruptcy would sink the business by scaring off customers. "You can't sell cars to people under those circumstances," he argued, holding firm when Gutierrez pushed a little more. Bankruptcy was not on the table.

After that, the federal officials remained largely silent, in part because Paulson had made it clear that he wanted the meeting kept short. Bryan, who hadn't quite picked up the mood, jumped back in to emphasize, "This isn't really a bailout, it's a bridge loan and, as you can see, this company can pay it back." Wagoner called attention to an appendix in the handout showing the importance of auto manufacturing, particularly in Ohio, Michigan, and Indiana. Across the United States, carmakers and their suppliers accounted for millions of jobs, 775,000 pensioners, and two million health care participants. A GM collapse would damage millions of lives.

Then Paulson spoke up, reminding the visitors that TARP was intended to stabilize the financial system, not bail out industrial companies. "You're not going to be able to use it," he said with certainty. "You will probably need to go to Congress." Finally he circled back to soften the message. "The White House cares greatly about this. Carlos is going to be working with you on the President's behalf."

A brief silence following the visitors' departure was broken by Paulson, who declared, "This is complete bullshit!" From long experience as an investment banker, he knew a scare story when he heard one. Yet it was unclear whether this alarm was entirely false—GM was offering only the most superficial analysis, with no detailed support for its assertions.

Studying the page about the Midwest, Ken Wilson, one of Paulson's advisers from Goldman Sachs, mused, "If these companies go down, you could have riots in the streets." And Paulson remembered the terrifying speed with which Lehman Brothers had collapsed weeks before, after the government refused to intervene. With that in mind, he took his undersecretary for domestic finance, Tony Ryan, aside. "I want this kept quiet and secret," he told Ryan, "but come up with a plan in case we find out at five o'clock some afternoon that General Motors is going to file the next day. The President needs the option to prevent a very messy bankruptcy. So find out what's the smallest amount of money we could give GM to get them to the next administration and what would we get for that. Would 19.9 percent of the equity be right, or what?"

As a further precaution, Paulson also asked Joel Kaplan, a deputy chief of staff to President Bush whom Paulson viewed as one of the few sensible people in the White House, to alert the President to the work soon to commence on the secret backup plan.

The Columbus Day meeting set the tone for two months of struggle and confusion. Within the week, Chrysler signaled that it, too, was desperate for cash. Ford, having prudently borrowed billions early in the downturn, was in better shape, although its CEO, Alan Mulally, began calling administration officials to try to ensure that the company wouldn't be put at a competitive disadvantage if its Detroit rivals got help.

For Washington, Detroit's emergency was in some ways more vexing than the cataclysm on Wall Street. The Treasury and other federal entities were rich in expertise for dealing with a banking crisis. But thanks to a long-standing and appropriate aversion to industrial policy, the government had no comparable resources to bring to bear on imploding automobile giants. In fall 2008, this traditional distance from nitty-gritty business was compounded by the complete focus of the economic team on the financial crisis. So now, in response to Detroit's threatened collapse, the administration and Congress were going to have to start from scratch.

On the ride back to the Commerce Department after the secret meeting with Paulson and Wagoner, Carlos Gutierrez was puzzled. If GM really was in danger, was there any way to keep it afloat without having to involve Congress and without TARP? Gutierrez was a seasoned businessman whose career, begun behind the wheel of a Kellogg's delivery truck, had led him to the top of the $10-billion-a-year cereal company. After several uneventful years as commerce secretary, he was open to a challenge. Back at the office, he shifted into CEO mode. "We need facts," he told his lieutenants.

That afternoon, in Gutierrez's private conference room, Ray Young and a group of Treasury and Commerce staffers reviewed a chart of GM's cash position, from the PowerPoint presentation. It showed, week by week, steep decline until, right around Election Day, GM would hit $11 billion of cash on hand. "That's the minimum we need to operate," Young replied when asked about the significance of that figure. To Gutierrez, this in itself was a red flag. A well-managed business, even on GM's vast scale, should never need that much cash.

After two frustrating hours, Young left. "He's the CFO of General Motors and he can't answer a single question," complained Phillip Swagel, a high-level economist, as the team regrouped. Others would also find the forty-six-year-old Young, who had been GM's chief financial officer for only seven months, less than impressive.

During the next several weeks, the Commerce staff scrutinized two possible sources of emergency cash for GM: the Department of Energy's Advanced Technology Vehicles Manufacturing Loan Program and the abandoned plan to merge with Chrysler. GM did its best to cooperate, with Young and his staff scrambling day and night to satisfy requests for data. But Fritz Henderson, for one, despaired of getting help from the Bush administration the minute he heard that the Commerce Department was involved. "Commerce never actually accomplishes anything," he pointed out. "They're good people, but they don't do stuff ... Treasury gets things done, because that's what they do."

Nor was Wagoner reassured. GM had come to Washington hoping for a quick response—it was, after all, General Motors. Instead it got a paper chase. As the collapse in demand for new vehicles spread around the world, Wagoner concluded that neither of the solutions under study would work. The Department of Energy had yet to publish its rules for tapping the $25 billion in advanced-vehicle incentives, but it was pretty plain that as the law was written, the money was meant for retooling plants and couldn't be used for a bailout. As for resurrecting the merger with Chrysler, Wagoner decided he had to put a stop to the idea. On the day before Halloween he told Gutierrez flatly that the merger was a nonstarter—it would not address the liquidity crisis and would only compound GM's problems. By now it was clear to Wagoner that Paulson had been right; if GM wanted help, it would have to go to Capitol Hill.

Election Day 2008 came and went without General Motors running out of money. But the Commerce Department's studies confirmed that GM's emergency was real and getting worse: before the year was out, the coffers would almost certainly be empty. Wagoner wasted no time getting in touch with his counterparts at Ford and Chrysler to ensure they would be at the front of the line when Congress reconvened for a lame-duck session.

The Democrats' victory parties had scarcely ended when, on November 6, the CEOs of the Big Three, along with Ron Gettelfinger, the UAW chief, paid a visit to House Speaker Nancy Pelosi, Senate Majority Leader Harry Reid, and other Democratic leaders. For ninety minutes, the visitors pleaded for loosened restrictions on the $25 billion of advanced-vehicle incentives so they could borrow the money to stay afloat. Not surprisingly, given Obama's support from midwestern union voters, the Democrats listened attentively, but Pelosi's subsequent effusive statement of support was carefully hedged.

The next day, the automakers unveiled dire third-quarter earnings reports (GM having quietly dropped its plan to post results the day before the election). GM's in particular caused an uproar on Wall Street. It revealed that the company was now burning through a stunning $3 billion a month—roughly $4 million an hour—more than double the losses of the previous quarter. And for the first time, GM acknowledged publicly that its cash balance would approach "the minimum amount necessary to operate our business" by the end of 2008.

Wagoner made a customary pilgrimage to CNBC, where auto correspondent Phil LeBeau didn't hold back. "The numbers are not pretty," he began. "How close is General Motors right now towards bankruptcy?"

Wagoner ducked, but LeBeau kept asking, finally eliciting a direct response: "We have no plans whatsoever to consider anything other than continue to run the business," Wagoner said. "We don't think anything positive would come out of any sort of consideration of reorganizations. I've seen pundits write this stuff, but you can't sell cars to people under that circumstance."

This wasn't spin. The GM chief executive was convinced that, while consumers might fly on bankrupt airlines, they would never buy cars from a bankrupt automaker because of the need for warranty coverage and concerns about resale value. Our task force would later learn that, on Wagoner's instructions, GM was making no contingency plans, no preparations whatsoever for a possible bankruptcy filing. Its investment bankers from Morgan Stanley and Evercore Partners had taken the unusual step of beginning to explore bankruptcy options on their own. But in October, when they'd advised GM's board to prepare, Wagoner had cut off the discussion, curtly thanking them for their time. He had similarly dismissed every other effort to convince him to prepare for a possible bankruptcy. This attitude would add materially to the cost of the eventual rescue.

The auto industry was high on the agenda when Congress returned to work on November 18. At 3:02 P.M. on that overcast Tuesday, Senator Christopher Dodd gaveled to order a hearing of the Banking Committee on the automakers' bailout request. Perhaps underrating the import of the moment, Dodd's aides had passed on storied Senate venues like the ornate Caucus Room in the Russell Senate Office Building, where the Watergate hearings occurred. Instead the session took place in a remote hearing room in the Dirksen building, a drab 1958 relic. It was packed with photographers crowded in front of the dais, attendees in rows of chrome-and-plastic chairs, and banks of TV cameras. Dodd quipped, "If I had known the interest, I would have held this at RFK"—the former football home of Washington's beloved Redskins.

The guests—CEOs Wagoner of GM, Mulally of Ford, and Robert Nardelli of Chrysler, as well as the UAW's Gettelfinger—testified in alphabetical order. Mulally and Nardelli bemoaned poor vehicle sales, and Wagoner summed up GM's problems as not of its making, as he had at Treasury: "Mr. Chairman, I do not agree with those who say we are not doing enough to position GM for success. What exposes us to failure now is not our product lineup, is not our business plan, is not our employees and their willingness to work hard. It is not our long-term strategy. What exposes us to failure now is the global financial crisis, which has severely restricted credit availability and reduced industry sales to the lowest per-capita level since World War II." As business skidded further in the weeks following the election, the automakers had dropped the pretext of requesting speeded-up advanced-technology incentives. Instead they asked Congress point-blank to open up TARP and direct the Treasury to provide $25 billion of emergency bridge loans.

That week is remembered less for anything the CEOs said than for the furor that erupted after Brian Ross of ABC News reported that the three had flown to Washington in separate private jets. Wagoner had been advised by his Washington PR person, Greg Martin, to fly by commercial jet, but he had rejected the idea. "I have meetings," he told Ross after the hearing. "I have a tight schedule."

Yet the hearings proved pivotal in other ways, providing a public display of the automakers' state of denial and revealing Washington's confusion about whether and how to help the industry. Most senators and representatives glossed over tough issues and tossed around terms like "prepack bankruptcy" without any real idea of what they meant.

And the hearings created one of the unsung heroes of the auto bailout, Senator Bob Corker, a Republican from Tennessee. I came to Washington with a bias against Corker because he had beaten my favorite Senate candidate of the 2006 election, Congressman Harold Ford Jr., after a particularly ugly campaign. Small and wiry, with an intensity belied by his soft southern drawl, Corker had been a mayor and businessman before being elected to the Senate. In that arena of show-horses and workhorses, he was proving to be a workhorse.

For Corker, the hearing was an eye-opener. Just returned from a trip to Russia and Ukraine, he was tired, had a headache, and hadn't spent more than a minute thinking about autos. But it wasn't lack of sleep that left him dumbfounded. The automakers were asking for $25 billion but hadn't even told the senators how they were going to divide it up. Nor had any of them submitted or prepared plans to show how, if the request was met, their companies could be made viable without further outlays.

Corker, getting down to business with terse, biting questions, pressed the CEOs on how the money would be split. Wagoner replied that GM wanted "our proportionate share," in a tone that irritated Corker. He asked Gettelfinger to rank the three companies' "shape," best to worst: "Ford, Chrysler, and General Motors," the union chief acidly replied. Corker hammered the CEOs over the lack of analysis in their request, and Gettelfinger over an extreme provision of the UAW contract under which laid-off workers received 95 percent of their normal pay.

For Corker, this was his chance to "own" a major issue, at least among Republicans. Returning to his office in the nether reaches of the Dirksen building, he gathered his staff and began to lay plans for a fact-finding mission to Wall Street. He would seek out the finest auto industry analysts and financiers and maybe, just maybe, come up with a rescue plan.

With Thanksgiving fast approaching, Congress ended its session without taking action on autos. Instead, in a public letter, Pelosi and Reid offered the CEOs a do-over: the House and Senate would return for a rare second lame-duck session in December, devoted exclusively to autos. But that session would take place, the letter warned, only if each company presented "a credible restructuring plan." Interestingly, the letter did not directly address the most important issue: whether $25 billion, as staggering as that sum would have seemed just months before, would even be enough.

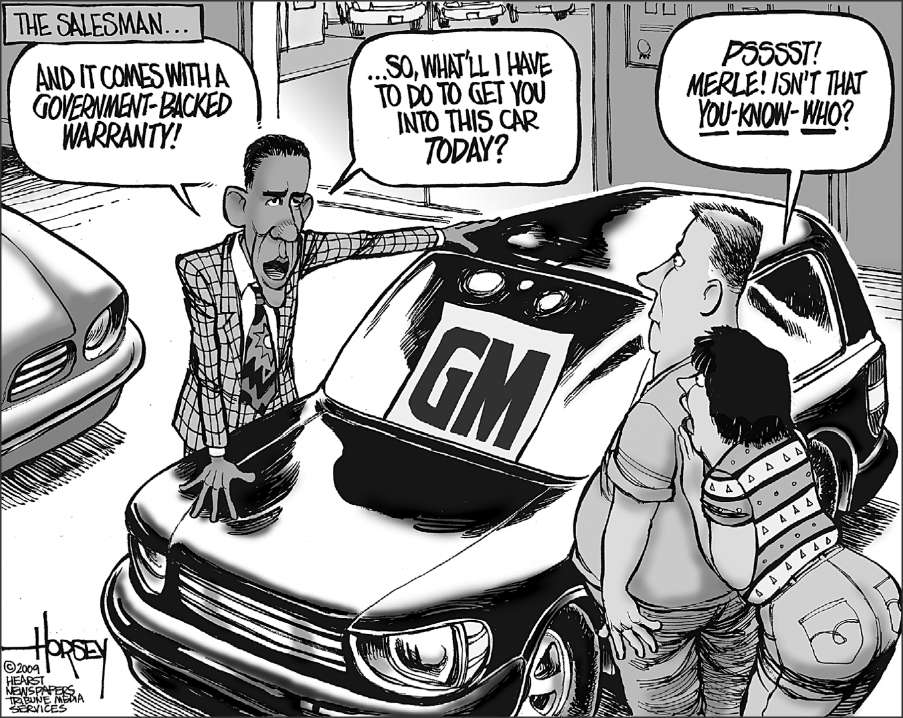

The coda to the week happened not on Capitol Hill but on Saturday Night Live. The show opened with a parody of what the second set of hearings might be like. In the skit, the CEOs do not fly to Washington, they drive—and apologize to Congress for showing up late because their cars all broke down. "I was going to drive my 2009 Cadillac XLR-V, a model we at GM are very proud of," says the ersatz Rick Wagoner, "but every time I tried to start it, I just got a powerful electric shock, and the upholstery would catch on fire." The CEOs ask Congress not for $25 billion but for hundreds of billions, to be paid over in quarterly installments over five years. "As you can see, Mr. Chairman," says Wagoner, "this proposal is specific, it is detailed, and it is both short- and long-ranged." When the congressmen protest, he adds testily, "With all due respect, we are not talking about a gift or a subsidy. We are talking about a loan." The skit careens on until the CEOs end up boasting that they have entire factories devoted to building lemons, and acknowledge amiably that they probably will never pay the money back. As over-the-top as it was, the parody spoke to the unpopularity of using tax dollars to rescue the automakers: by early December, most polls showed public sentiment running against the idea.

Hank Paulson kept tabs on the auto crisis, but in truth Detroit's headaches were pretty far down his list of major problems. The struggle to stabilize the financial system was gobbling auto-rescue-sized chunks of federal funding every week, and at the rate at which Treasury was bailing out banks, Paulson feared that TARP would run out of money. Congress had appropriated half of the $700 billion authorized in the law that established the program; of that $350 billion, the Treasury had already committed more than $200 billion and the rest was going fast. If one or two more financial giants failed—Bank of America, say, or the huge financial operation at General Electric—the Treasury might not have the resources necessary to stave off a systemic collapse. Paulson's worries intensified just before Thanksgiving, when Citigroup needed a second bailout—$20 billion on top of the $25 billion the Treasury had already kicked in.

All of Washington realized that the lame-duck Congress was unlikely to appropriate the second half of TARP. Bailing out Wall Street—unpopular back in October when TARP had first been passed—had become more politically toxic in the intervening six weeks. And of course President Bush, on his way out, had exhausted his political capital. Winning approval for the second half of TARP would certainly be easier in 2009, with a new President and a new, more heavily Democratic Congress.

But Paulson didn't think the matter could wait. He set out to make the case to Obama for securing the second half of TARP. He called Rahm Emanuel, Obama's chief of staff, two days before Thanksgiving.

"We need to take down the last part of the TARP and we can only do that with you and we need your help," Paulson said.

"That's not good news," Emanuel replied in his blunt fashion. He directed Paulson to call Larry Summers, the incoming President's top economic adviser. Summers questioned Paulson about TARP, and then, to Paulson's surprise, pointedly brought up autos. "You are not going to let the autos fail, are you?" Summers asked. The Democrats were moving Detroit to center stage.

Bush's White House staff, more focused than Paulson on the auto crisis, had expected this. In his first postelection press conference, Obama had emphasized his commitment to autos, which he called "the backbone of American manufacturing." He'd made the point again in his first private meeting with President Bush, pressing for help for the auto industry.

Bush's team saw that to obtain the additional TARP funding that Paulson argued was essential, they would have to rely on Democratic votes. That support, they believed, would be contingent on two things: the active endorsement of the President-elect and relief for the auto companies. But they didn't want to help Detroit unless they could attach strings—they wanted the automakers to secure concessions from major stakeholders to ensure their long-term viability. Otherwise, Bush's advisers argued, the incoming Democrats would cave in to special interests—particularly the UAW—with $25 billion becoming $50 billion or more. Meanwhile, the auto companies would do no genuine restructuring and instead end up wards of the state. To address these worries, Joel Kaplan, a deputy chief of staff, floated an interesting idea. Kaplan was a young, articulate Harvard Law graduate who had worked in the Bush White House since 2001. Paulson much preferred dealing with Kaplan and his boss, Josh Bolten, than with others among the White House's hefty contingent of rigidly ideological conservatives.

Kaplan proposed creating a "financial viability adviser" and granting him or her the power to hold the automakers accountable—they would get no long-term money from the government without showing they could survive as going concerns. Importantly, from the Bush team's perspective, the incoming administration would publicly embrace that same commitment at the time of the viability adviser's appointment.

Paulson responded warmly to the idea. Bailing out an industry so fundamental to the American identity and way of life was a politically charged subject. Only someone outside the usual chains of command, someone of authority and integrity—Paul Volcker, the former Federal Reserve chairman, was mentioned—could force the tough decisions the industry would need. What was more, if the White House could persuade the Democrats to agree on the choice of an adviser now, there would be someone securely in place to hold off the unions and keep the bailout in check after Bush left office. "Financial viability adviser" quickly got shortened to "car czar," an epithet that would come to cause me much grief.

Paulson and Summers went round repeatedly that week about TARP. Summers felt that Paulson hadn't truly sold the Bush White House on the importance of taking down the second half of TARP and was trying to enlist the Obama team in his cause instead. In the course of every conversation with Paulson, Summers brought up autos. Although skeptical about the car-czar idea, he had started thinking about possible recruits, hence the call to me the afternoon before Thanksgiving.

Over the holiday, the White House stepped up its effort to engage Obama in a joint approach on both TARP and autos. Bolten phoned Emanuel to ask for a face-to-face meeting, but Rahm was reluctant. In the last presidential transition occurring during a historic economic crisis—Franklin Roosevelt's succeeding Herbert Hoover in 1933—FDR had deliberately remained aloof until he was in office. The Obama team doubted that there was a workable way to co-govern. And it had studied that precedent and concluded that it had little to gain politically by collaborating on any issue, let alone TARP and autos. This carefully calculated decision was packaged under the appealing sound bite "there can be only one President at a time."