The House of Rothschild: The World’s Banker, 1849-1999 – Read Now and Download Mobi

Table of Contents

ONE - Charlotte’s Dream (1849-1858)

TWO - The Era of Mobility (1849-1858)

THREE - Nationalism and the Multinational (1859-1863)

FOUR - Blood and Silver (1863-1867)

FIVE - Bonds and Iron (1867-1870)

SIX - Reich, Republic, Rentes (1870-1873)

SEVEN - “The Caucasian Royal Family”

NINE - “On the Side of Imperialism” (1874-1885)

ELEVEN - The Risks and Returns of Empire (1885-1902)

TWELVE - Finances and Alliances (1885-1906)

THIRTEEN - The Military-Financial Complex (1906-1914)

FOURTEEN - Deluges (1915-1945)

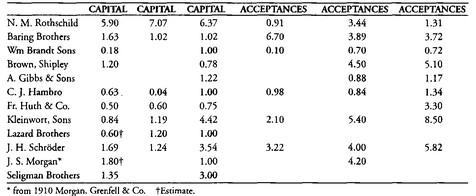

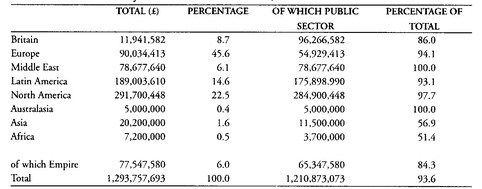

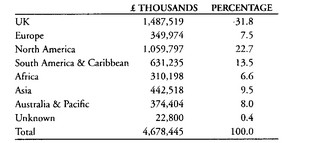

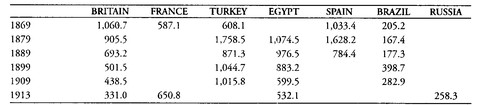

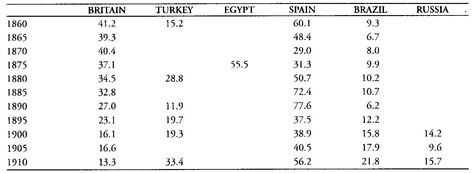

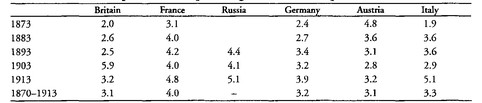

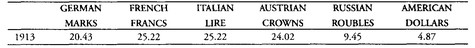

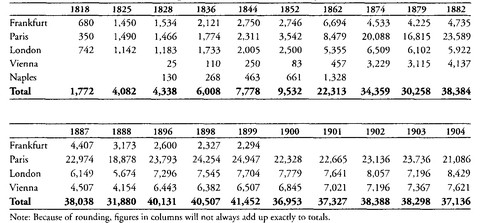

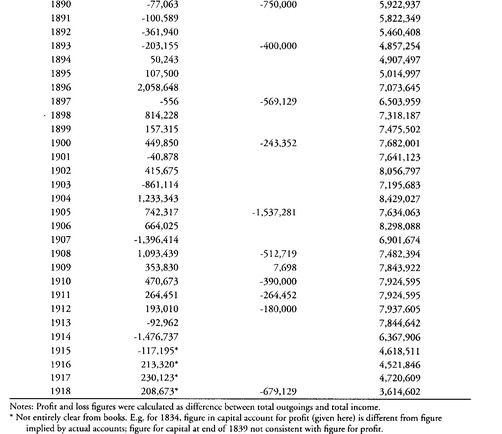

APPENDIX 2 - Selected Financial Statistics

PENGUIN BOOKS

HOUSE OF ROTHSCHILD

Born in Glasgow in 1964, Niall Ferguson is Fellow and Tutor of Modern History at Jesus College, Oxford, as well as a political commentator and author. His previous publications include The House of Rothschild: Money’s Prophets, 1798-1848, now a Penguin paperback, The Pity of War, and the bestselling book Virtual History: Alternatives and Counterfactuals.

PENGUIN BOOKS

Published by the Penguin Group

Penguin Group (USA) Inc., 375 Hudson Street, New York, New York 10014, U.S.A.

Penguin Group (Canada), 10 Alcorn Avenue, Toronto,

Ontario, Canada M4V 3B2 (a division of Pearson Penguin Canada Inc.)

Penguin Books Ltd, 80 Strand, London WC2R 0RL, England

Penguin Ireland, 25 St Stephen’s Green, Dublin 2, Ireland (a division of Penguin Books Ltd)

Penguin Group (Australia), 250 Camberwell Road, Camberwell,

Victoria 3124, Australia (a division of Pearson Australia Group Pty Ltd)

Penguin Books India Pvt Ltd, 11 Community Centre,

Panchsheel Park, New Delhi - 110 017, India

Penguin Group (NZ), cnr Airborne and Rosedale Roads,

Albany, Auckland, New Zealand (a division of Pearson New Zealand Ltd)

Penguin Books (South Africa) (Pty) Ltd, 24 Sturdee Avenue,

Rosebank, Johannesburg 2196, South Africa

Penguin Books Ltd, Registered Offices:

80 Strand, London WC2R 0RL, England

First published in the United States of America by Viking Penguin,

a member of Penguin Putnam Inc. 1999

Published in Penguin Books 2000

10

Copyright © Niall Ferguson, 1998

All rights reserved

This is the second of two volumes of The House of Rothschild. In Great Britain

The House of Rothschild was published as one volume by Weidenfeld & Nicolson

under the title The World’s Banker: The History of the House of Rothschild.

THE LIBRARY OF CONGRESS HAS CATALOGED

eISBN : 978-1-101-15357-4

1. Rothschild family. 2. Bankers—Europe biography. 3. Business people—

Europe biography. 4. Europe—Politics and government. I. Title.

HG1552.R8F-41868

332.1’092’2—dc21

FOR LACHLAN

ILLUSTRATIONS IN THE TEXT

1.i: Anon., Der 99ste Geburtstag der Groβmutter, Fliegende Blätter (c. 1848). Source: Fuchs, Juden in der Karikatur, p. 146.

1.ii: Anon., ONE OF THE BENEFITS OF THE JEWISH EMANCIPATION. Source: Fuchs, Juden in der Karikatur, p. 55.

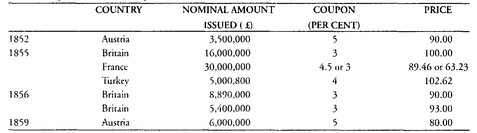

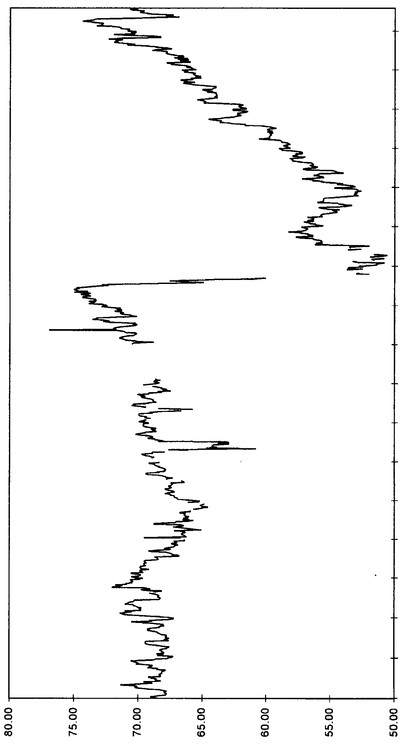

2.i: The weekly closing price of French 3 per cent and 5 per cent rentes, 1835-1857. Source: Spectator.

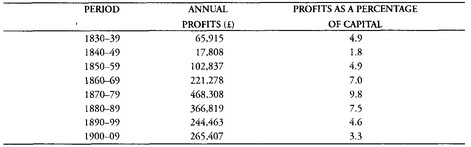

3.i: The profits of the Naples house, 1849-1862 (ducats). Sources: AN, 132 AQ 13 and 14; Gille, Maison Rothschild, vol. II, pp. 573f.

3.ii: Profits as a percentage of capital at N. M. Rothschild & Sons, Barings and Schröders, 1850-1880. Sources: RAL, RFamFD/13F; Ziegler, Sixth great power, pp. 373-8; Roberts, pp. 527-35.

3.iii: Das goldene Kalb (1862). Source: Cowles, Rothschilds, p. 136.

3.iv: Ferrières: Auf der groβen Jagd bei’m Rothschild (1862). Source: Wilson, Rothschild, 19th plate.

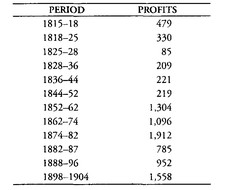

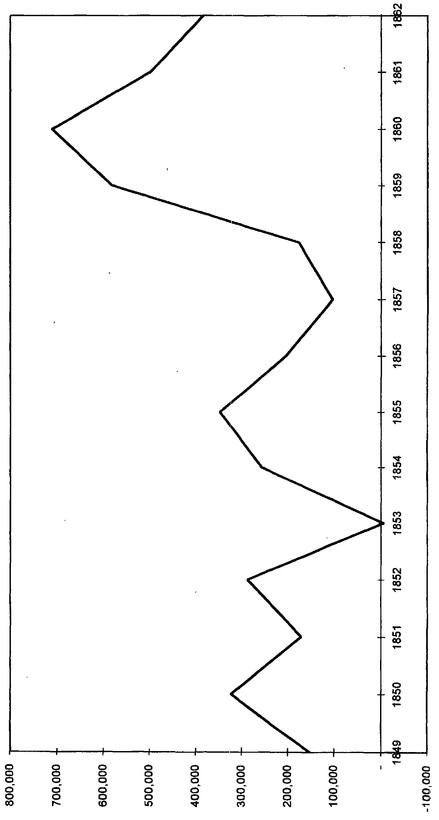

4.i: The Prussian-Austrian yield gap (Austrian minus Prussian bond yields), 1851-1875. Source: Heyn, “Private banking and industrialisation,” pp. 358-72.

4.ii: M. E. Schleich, Rothschild’s Kriegsbereitschaft, Ein humoristisches Originalblatt, Münchener Punsch, 19. Nr. 20 (May 20, 1866). Source: Herding, “Rothschilds in der Karikatur,” illustration 16. (Marburg Universitätsbibliothek.)

5.i: Baron Lionel de Rothschild (The Modern Croesus), The Period (July 5, 1870). Source: Rubens, “Rothschilds in caricature,” plate XVII.

6.i: The weekly closing price of French 3 per cent rentes, 1860-1877. Source: Economist.

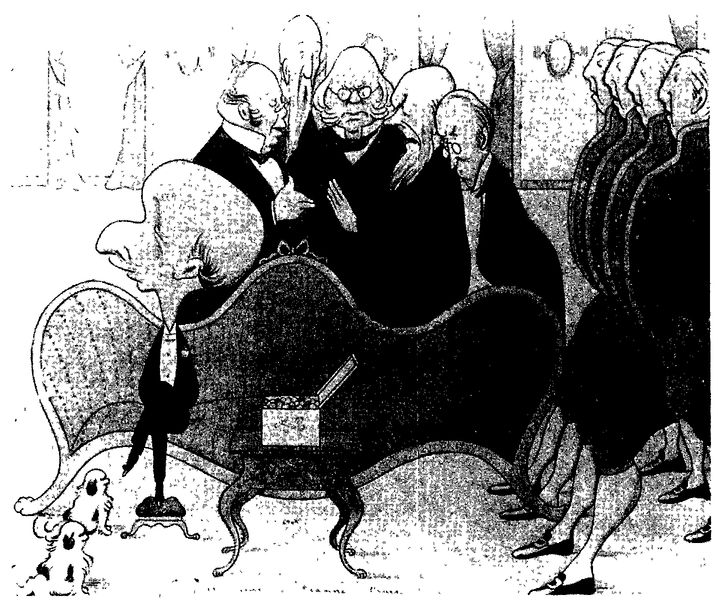

7.i: Max Beerbohm, A quiet evening in Seymour Place. Doctors consulting whether Mr Alfred may, or may not, take a second praline before bedtime. Source: Cowles, Rothschilds, p. 172.

8.i: C. Léandre, Dieu protège Israel, Le Rêve (April 1898). Source: Herding, “Rothschilds in der Karikatur,” p. 55, illustration 28. (Stadt- und Universitätsbibliothek, Frankfurt am Main.)

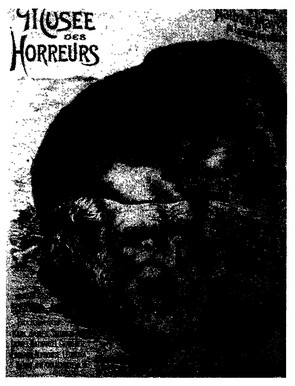

8.ii: Lepneveu, Nathan Mayer ou l‘origine des milliards, cover of Musée des Horreurs, no. 42 (c. 1900). Source: Herding, “Rothschilds in der Karikatur,” illustration 30. (Museum fur Kunst und Gewerbe, Hamburg.)

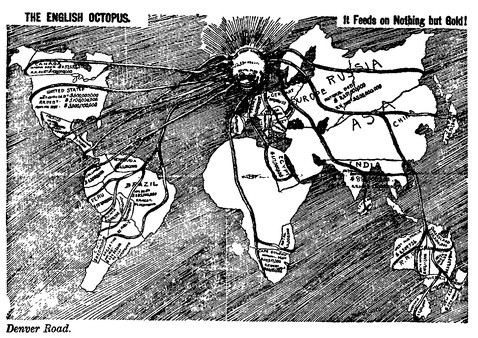

8.iii: “Coin” Harvey, The English Octopus: It Feeds on Nothing but Gold! (1894). Source: Harvey, Coin’s financial school, p. 215.

8.iv: Max Beerbohm, A quiet morning in the Tate Gallery ( 1907). Source: Rubens, “Rothschilds in caricature,” plate XXI.

8.v: Christian Schöller, Die Kinder Israels ziehen ins Gelobte Land, um eine Republik zu gründen (1848). Source: Herding, “Rothschilds in der Karikatur,” illustration 26. (Historisches Museum der Stadt Wien).

8.vi: Anon., Auszug der Juden aus Deutschland!, Politischer Bilderbogen, Nr. 17 (1895). Source: Herding, “Rothschilds in der Karikatur,” illustration 27. (Sammlung Germania Judaica, Cologne.)

9.i: Combined Rothschild capital, selected years (£ thousand). Source: see appendix 2, table c.

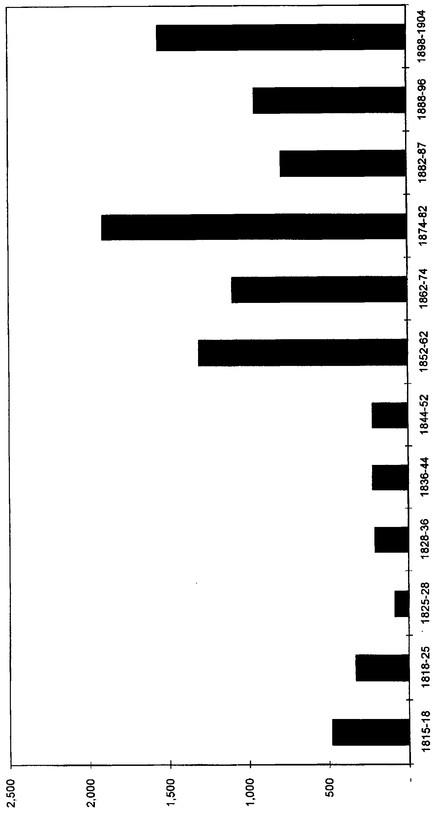

9.ii: Average annual Rothschild profits (combined houses), selected periods (£ thousand). Source: see appendix 2, table c.

12.i: The weekly closing price of Russian 5 per cents, 1860-1900. Source: Economist.

13.i: Potted Peers: Lord Rothschild, “The whole of the British capital having been exported to the South Pole as a result of the Budget Revolution, Lord Rothschild flies from St Swithin’s Lane and succeeds in escaping to the Antarctic regions disguised as a Penguin,” Westminster Gazette (1909). Source: Rothschild, Dear Lord Rothschild, illustration 21.

TABLES

ACKNOWLEDGEMENTS

A full list of acknowledgements appeared in the first volume of The House of Rothschild. I would nevertheless like to take this opportunity to thank Barbara Grossman, Molly Stern and everyone else at Penguin Putnam for their work in preparing both halves of the American edition.

PREFACE

If we consider the period between 1789 and 1848 as the “age of revolution,” then the Rothschilds were surely its supreme beneficiaries. To be sure, the political upheavals of 1848-49 had cost them dear. As in 1830, though on a far larger scale, revolutions caused the bonds of the governments,affected to plummet in value. For the Rothschilds, who held a large proportion of their immense wealth in the form of bonds, that meant heavy losses of capital. Worse, it brought their “houses” in Vienna and Paris to the brink of insolvency, obliging the others—in London, Frankfurt and Naples—to bail them out. Yet the Rothschilds survived even this, the greatest of all the financial crises between 1815 and 1914, as well as the greatest revolution. Indeed, it would have been a strange irony if they had not: without revolution, they would have had little to lose in the first place.

For it had been the original French Revolution that, in 1796, had literally demolished the walls of the Frankfurt ghetto and enabled the Rothschilds to begin their phenomenal, unprecedented and since unmatched economic ascent. Before 1789, Mayer Amschel Rothschild and his family’s lives had been circumscribed by discriminatory legislation. Jews were prohibited from farming, or from dealing in weapons, spices, wine and grain. They were forbidden to live outside the ghetto and were confined there at night, on Sundays and during Christian festivals. They were subject to discriminatory taxation. No matter how hard Mayer Amschel worked, first as a rare coin dealer then as a bill broker and merchant banker, there were strict and low limits to what he could achieve. All that changed when the French exported their revolution to south Germany. Not only was the Judengasse opened; the legal restrictions on the Frankfurt Jews were also largely removed—thanks not least to Mayer Amschel’s financial influence over Napoleon’s henchman in the Rhineland, Karl von Dalberg. Despite the best efforts of the Frankfurt Gentiles after the French and their collaborators had been ousted, the old apartheidlike system of residential and social restriction could never wholly be restored.

Moreover, the Rothschilds were presented with undreamed-of business opportunities by the revolutionary wars. As the scale and cost of the conflict between France and the rest of Europe rose, so too did the borrowing needs of the combatant states. At the same time, the disruption of established patterns of trade and banking created room for ambitious risk takers. Thus it was Napoleon’s decision to drive the Elector of Hesse-Kassel into exile, which allowed Mayer Amschel (one of the Elector‘s “court agents” since 1769) to become his principal fund manager, collecting the interest on those assets that eluded the French and reinvesting the money. This was dangerous business: the French police were suspicious enough about Mayer Amschel’s activities to interrogate him and his family, though no prosecution resulted. But the profits were in proportion to the hazard; and the Rothschilds quickly mastered the art of secrecy.

Likewise, revolution and war made possible the ascent of Mayer Amschel’s domineering son Nathan from exporting British textiles in Manchester to financing the British war effort in the City of London. In normal times, Nathan would doubtless have prospered as a cloth merchant: his strategy of cutting prices and increasing volumes was right; his energy, ambition and capacity for work were all prodigious. (“I do not read books,” he told his brothers in 1816. “I do not play cards, I do not go to the theatre, my only pleasure is my business.”) But Britain’s wars with France created conditions especially favorable to the bold and innovative newcomer. By prohibiting British exports to the Continent in 1806, Napoleon inflated the risks but also the potential returns for those, like Nathan, willing to beat the blockade. The naive will ingess of the French authorities to allow British bullion to cross the Channel gave Nathan a still more lucrative line of business. In 1808 he was able to leave Manchester for London, now unrivaled as the world’s biggest financial center since the Napoleonic occupation of Amsterdam.

The “masterstroke” which enabled Nathan to leap into the first league of merchant bankers was his use of the Elector of Hesse-Kassel’s English investments to bolster his own resources. In 1809 Nathan secured authorization to make new purchases of British bonds with the interest the Elector’s existing portfolio was earning; over the next four years he bought securities worth more than £600,000. In peace-time this would have made him a major fund manager; in the turmoil of war, however, Nathan was able to treat the Elector’s bonds like his own capital. Unwittingly, the exiled Elector became a sleeping partner in a new banking house: N. M. Rothschild. (His minister Buderus was a more willing investor in the Frankfurt house.) In 1813 Nathan was therefore able credibly to offer his services to the British government as it struggled to finance Wellington’s penultimate campaign against Napoleon. This was what Carl meant when he said later that “the Old Man”—meaning William—had “made our fortune.”

In truth, they probably owed more to the industry and acumen of their own “old man.” It was Mayer Amschel who in 1810 designed the partnership structure that was to endure, modified but essentially the same, for very nearly a century, binding together the male line over four generations, rigorously excluding female Rothschilds and their spouses. And it was Mayer Amschel who taught his sons such hard-nosed business rules as: “It is better to deal with a government in difficulties than with one that has luck on its side”; “If you can’t make yourself loved, make yourself feared”; and “If a high-placed person enters into a [financial] partnership with a Jew, he belongs to the Jew” (“gehört er dem Juden”). This last piece of advice lay behind the brothers’ practice of plying politically powerful individuals with gifts, loans, investment tips and outright bribes. Above all, Mayer Amschel taught his sons to value unity: “Amschel,” he told his eldest son on his deathbed in 1812, “keep your brothers together and you will become the richest people in Germany.” His sons were still repeating these precepts to the next generation thirty years later, by which time they were the richest people in the world; indeed, the richest family in all history.

The operations of 1814 and 1815, in which Nathan and his brothers raised immense quantities of bullion not only for Wellington but also for Britain’s continental allies, ushered in a new era in financial as well as political history. The Rothschilds stretched their credit to breaking point, sometimes losing sight altogether of their assets and liabilities, gambling everything they owned for the sake of governmental commissions, interest payments and speculative gains from exchange rate and bond yield fluctuations. In 1815 alone, Nathan’s account with the British government totalled close to £10 million, a huge sum at that time. Lord Liverpool employed heroic English understatement when he called Nathan “a very useful friend.” It was, as other contemporaries acknowledged, Napoleonic finance, without which Napoleonic generalship could not have been defeated. Ludwig Borne justly called the brothers “Finanzbonaparten”; Nathan, as Salomon acknowledged, was their “commanding general.” Though they came perilously close to ruin when the French were defeated at Waterloo—a much quicker end to the war than Nathan had foreseen—the Rothschilds emerged in 1815 as sterling millionaires. Almost at once, Nathan embarked on perhaps the most successful transaction of his career: a huge investment in British government bonds (consols) whereby he rode the upswing caused by the government’s postwar financial stabilization, taking his profits just before the market peaked. This was Nathan’s supreme Meistergeschäft, realizing profits of more than £250,000 at a stroke.

The 1820s were a time of political as well as fiscal restoration. Throughout the Continent, the deposed were (mostly) put back on their thrones. Under the leadership of Prince Metternich, the great continental powers combined to resist new revolutionary impulses wherever they might occur. The Rothschilds bankrolled this restoration, no doubt. They enabled Austria, Prussia and Russia—the members of the Holy Alliance—as well as the restored Bourbons in France, to issue bonds at rates of interest only Britain and Holland had previously been able to enjoy. In that this made it easier for Prince Metternich to “police” Europe—notably when Austria and France intervened to restore the Bourbon regimes in Naples and Spain—there was truth in the jibe that the Rothschilds were the “chief ally of the Holy Alliance.” Rothschild loans also bolstered the private finances of many of the “high-placed persons” of the period, including Metternich himself, King George IV and his son-in-law Leopold of Saxe-Coburg, later King of the Belgians. As Ludwig Borne complained, “Rothschild” was “someone who gives nobles the power to spite freedom and deprives peoples of the courage to resist violence ... the high priest of fear ... on whose altar liberty, patriotism, honour and all civil virtues are sacrificed.”

Yet there was always an ambivalence about the Rothschilds’ view of the restoration. They could hardly relish the return to power of conservative elites which—most obviously in Germany—sought to reimpose second-class citizenship on the Jews. Nor was Nathan the kind of man to turn down good business on ideological grounds. Interventions by the Holy Alliance against revolutionary movements in Spain or Italy were not necessarily good for business: war unsettled the bond markets, not least because of its deleterious effect on state budgets. The new regimes that emerged in countries like Spain, Brazil and Greece were also potential new customers ; and experience seemed to suggest that parliamentary monarchies were better creditors than absolutist regimes. Significantly, the Rothschilds were tempted to lend to the Spanish liberals, but refused to bankroll Ferdinand VII after he had been restored to absolute power. As Byron put it in Don Juan, the Rothschilds held sway over “royalist and liberal” alike. Heinrich Heine went further in calling Rothschild a revolutionary on a par with Robespierre, because

Rothschild ... destroyed the predominance of land, by raising the system of state bonds to supreme power, thereby mobilising property and income and at the same time endowing money with the previous privileges of the land.

It was also Heine who memorably declared: “[M]oney is the god of our time and Rothschild is his prophet.” Without doubt, the Rothschilds’ most important contribution to economic history was the creation of a truly international bond market. There had, of course, been cross-border capital flows before: the Dutch had invested in British government bonds in the eighteenth century while the Rothschilds’ rivals in Frankfurt, the Bethmanns, had marketed large issues of Austrian bonds in the same period. But never before had a country’s bonds been simultaneously issued in multiple markets with (as in the case of Prussia in 1818) such alluring conditions as denomination in sterling, payment of interest at the place of issue and a sinking fund.

Bond issuance was not the Rothschilds’ sole business. They also discounted commercial bills, acted as bullion brokers, dealt in foreign exchange, engaged directly in commodity trade, dabbled in insurance and even offered private banking services to an elite of indivual clients. Their role in the gold and silver markets was important: it was the Rothschilds’ role as “lender of last resort to the lender of last resort” that prevented a suspension of convertibility by the Bank of England in 1825. But it was the bond market which came first. Moreover, buying and selling in the various secondary markets for bonds was almost as important a source of profit as issuance: this was the principal form of speculation in which the brothers engaged.

It was partly the multinational character of their operations that distinguished the Rothschilds from their competitors. While Nathan’s eldest brother Amschel continued the original family business in Frankfurt, his youngest brother James established himself in Paris. Later in the 1820s. Salomon and Carl established subsidiaries of the Frankfurt house in Vienna and Naples. The five houses formed a unique partnership, acting jointly in big transactions, pooling profits and sharing costs. Regular and detailed correspondence overcame the obstacle of geographical separation. The partners met together only every few years, when changing circumstances necessitated modification of their contractual agreement.

This multinational structure gave the Rothschilds several important advantages. First, it enabled them to engage in arbitrage, exploiting price differences between, say, the London and Paris markets. Secondly, they could bail one another out in the event of liquidity or solvency squeezes. Never—not even in 1848—did financial crises strike everywhere in Europe simultaneously and with equal severity. When Britain suffered in 1825, James could bail out Nathan. When Paris collapsed in 1830, Nathan could reciprocate. There is no doubt that the Vienna house would have gone bankrupt in 1848 if it had been an independent entity. Only the willingness of the other houses to write off substantial sums allowed Salomon’s son Anselm to restore it.

By rapidly accumulating capital—the Rothschilds did not distribute profits, contenting themselves with a low interest on their individual partnership shares—they were soon able to conduct such operations on an unparalleled scale. They were certainly the biggest bank in the world; by 1825 ten times the size of their nearest rivals, Baring Brothers. This in turn allowed them to modify their business strategy. After the early years of high risk and high returns, they were now able to content themselves with lower profitability without compromising their position of market dominance. Indeed, this shift away from profit maximization helps to explain the Rothschild partnership’s longevity as a firm. Time and again they would encounter competitors—Jacques Laffitte was the classic example of the restoration period—who gained on them during market upswings by taking bigger risks, only to come unstuck when the cycle dipped.

With riches came status. In the eyes of contemporaries, the Rothschilds personified new money: they were Jews, they were ill educated, they were coarse—yet within a few years they had accumulated net paper wealth worth far more than most aristocratic estates. Outwardly, the arrivistes seemed to crave acceptance by the old elites. As if to expunge the memory of the days when (as Carl recalled) “we all slept in one little attic room,” they bought the smartest of town houses in streets like Piccadilly and the rue Laffitte and, later, their first country houses at Gunnersbury, Ferrieres and Schillersdorf. They filled them with seventeenth-century Dutch paintings and eighteenth-century French furniture. They hosted lavish dinners and glittering balls. They sought titles and other honors: plain Jacob Rothschild became Monsieur le Baron James de Rothschild, Austrian consul general in Paris, chevalier of the Legion of Honour. They brought up their sons as gentlemen, giving them tastes for pleasures that had been unknown in the ghetto: horses, hunting and fine art. Their daughters had their piano lessons from Chopin. Men of letters—notably Disraeli, Heine, Balzac—sought patronage from these new Medicis, only to caricature them in their work.

Yet the Rothschilds privately viewed their own social ascent with cynicism. Titles and honors were “part of the racket,” helpful in giving the brothers access to the corridors of power. Playing host was an uncomfortable duty, to the same end: much of it was corporate hospitality, as we would now say. Even the gentrification of the next generation was superficial: their sons’ real education was still in the “counting house.”

The Rothschilds’ most important reservation about social assimilation was religious. Unlike many other wealthy European Jews, who opted to convert to Christianity in the 1820s, the Rothschilds remained firmly attached to the religion of their forefathers. Though the extent of their individual religiosity varied—while Amschel was strict in his observance, James was very lax—the brothers shared the view that their worldly success was intimately bound up with their Judaism. As James put it, religion meant “everything. Our good fortune and our blessings depend upon it.” When Nathan’s daughter Hannah Mayer converted to Christianity in order to marry Henry Fitzroy in 1839, she was ostracized by nearly all her relatives, including her own mother.

The corollary of the Rothschilds’ belief that fidelity to Judaism was integral to their worldly success was the interest they took in the fate of their “poorer co religionists.” This commitment to the wider Jewish community extended beyond traditional charitable donations to embrace systematic political lobbying for Jewish emancipation. The practice that Mayer Amschel had established in the Napoleonic period, of using Rothschild money to secure or defend the civil and political rights of Jews, continued more or less uninterruptedly throughout the century. When the Jews of Damascus were falsely accused of “ritual murder” in 1840, the Rothschilds orchestrated a successful campaign to end their persecution. This was only the most celebrated of many cases. Rothschild loans to the pope were also used as a lever to improve the lot of the Jews in the papal states. Ironically, the English Rothschilds’ efforts closer to home were less successful. Nathan and his wife Hannah had first become involved in the campaign to end Jewish exclusion from Parliament as early as 1829. By the time of Nathan’s death seven years later, nothing had been achieved. It was left to his son Lionel to lead the campaign for Anglo-Jewish emancipation: the subject of this volume’s opening chapter.

Nevertheless, the Rothschilds’ sense of identification with the wider Jewish community was not unqualified. Not only their wealth but their genealogy set them apart from the rest of European Jewry. For the Rothschilds pursued a strategy of endogamy-marrying not just within their own faith but within their own immediate kinship group. Only a Rothschild would do for a Rothschild, it seemed: of twenty-one marriages involving descendants of Mayer Amschel between 1824 and 1877, no fewer than fifteen were between his direct descendants. Typical was the marriage of Nathan’s son Lionel to Carl’s daughter Charlotte in 1836, an arranged and not very happy match. The main rationale behind this strategy was to fortify the cohesion of the financial partnership. It certainly did this, though to modern eyes the family tree of the period looks fraught with genetic risk. Cousin marriages ensured that the family’s capital was not dispersed. Like the strict rule that excluded daughters and sons-in-law from the partnership’s hallowed books, and the repetition of Mayer Amschel’s imprecations to maintain fraternal unity, it was one of the devices that prevented the Rothschilds from going the way of Thomas Mann’s decadent Buddenbrooks. Of course, other dynasties behaved in similar ways. Cousin marriage was relatively common in Jewish business families. Nor was it confined to Jews: British Quakers practiced it too. Indeed, even Europe’s royal families used cousin marriage to cement their political relationships. Yet the Rothschilds practiced endogamy to a degree not even the Saxe-Coburgs could match. It was this that prompted Heinrich Heine to call them “the exceptional family.” Indeed, other Jews came to regard the Rothschilds as a kind of Hebrew royal family: the “Kings of the Jews” as well as the “Jews of the Kings.”

The revolution of 1830 revealed two important things. First, the Rothschilds were not tied to the Holy Alliance but were perfectly willing to offer their financial services to liberal and even revolutionary regimes. If anything—once he had got over the initially severe shock of the revolution—James found it easier to do business with the “bourgeois monarchy” of Louis Philippe. Equally congenial was the new Belgian state, especially when it (like Greece) accepted a “tame” German prince as its monarch—one who was already a Rothschild client—and subordinated itself to collective international regulation by the great powers. The second point was that the Rothschilds had a strong interest in seeing the great powers reach such arrangements and believed that here too financial leverage could be exerted.

The outbreak of revolution had caused a major slump in the price of French rentes (the perpetual bonds that were to France what consols were to Britain). The slump had taken James almost wholly by surprise, plunging his balance sheet into the red. But what made the European financial markets so volatile in the early 1830s—and delayed the recovery of the rente even after a more or less stable parliamentary monarchy had been established—was the fear that, as in the 1790s, a French revolution would engender a European war. It was this fear as much as anything else which caused the financial contagion of the period, pushing up bond yields even in countries unaffected by revolution.

At various times in the early 1830s war threatened to break out over Belgium, Poland or Italy. The Rothschilds were now well enough connected to act as peace brokers on each occasion. Their uniquely fast communications network—which relied principally on private couriers to-ing and fro-ing with copies of letters—was by now also being used by the leading statesmen of the continent as an express postal service. This gave the family one form of power: knowledge. James saw Louis Philippe, heard his views, wrote them down in his letter to Salomon, who went to see Metternich, and passed them on. The process then repeated itself in reverse, with Metternich’s reply reaching Louis Philippe via at least two Rothschilds. Needless to say, the messengers could subtly alter the messages along the way; or the news could be acted upon in the stock exchanges before being passed on.

At the same time, the Rothschilds’ dominance of the international bond market gave them a second form of power. Because any state that seriously contemplated going to war would have to borrow money to do so, the Rothschilds discerned the possibility that they could exercise a veto: no peace, no cash. Or as the Austrian diplomat Count Prokesch von Osten said in December 1830: “It is all a question of ways and means and what Rothschild says is decisive, and he won’t give any money for war.”

It did not quite work so neatly. Though contemporaries were enchanted by the idea that the Rothschilds could keep the European peace merely by threatening to ration credit, in reality there were other reasons why war did not break out in the 1830s. Still, at certain times the Rothschilds were able to wield political power by financial means. Metternich’s bellicosity was, if not thwarted, at least dampened by Salomon’s explicit refusal to support a new loan in 1832. And the creation of Greece and Belgium as new states was literally underwritten by Rothschild finance in the form of loans guaranteed by the great powers and floated by the Rothschilds.

By the time of Nathan’s untimely and painful death in 1836, the Rothschilds had therefore established a formidable business with unrivaled resources and geographical reach. They were able to extend that reach even further by using agents and affiliated banks not only in other European markets but also all over the world, from Weisweiller in Madrid to Gasser in St. Petersburg to Belmont in New York. Their power fascinated contemporaries, not least because of their so recent lowly origins. An American observer portrayed the five brothers “peering above kings, rising higher than emperors, and holding a whole continent in the hollow of their hands”: “the Rothschilds govern a Christian world ... Not a cabinet moves without their advice ... Baron Rothschild ... holds the keys of peace or war.” This was exaggeration, but not fantasy. Yet this huge and powerful organization remained at its core a family firm. It was run as a private—indeed, strictly secret—partnership, with its main business the management of the family’s own capital.

There was no loss of entrepreneurial momentum as the third generation joined the partnership, though the relations between the five houses did become slightly more confederal. To some degree, James carried on where Nathan left off, as primus inter pares. He too was a masterful man, indefatigably devoted to business, as addicted to the bread and butter of bill broking and arbitrage as to the big bond issues that delivered the fattest profits. His longevity kept the ethos of the Frankfurt ghetto alive in the firm well into the 1860s. Yet James was never able to dominate the other houses as Nathan had done. Though one of Nathan’s own sons—Nat—became his chafing adlatus in Paris, the others were never under his thumb. Lionel in particular proved as successful a businessman as his father, though his manner was sotto voce where Nathan had been explosive. Salomon’s son Anselm also proved a man of strong will. Nor could James really control his older brothers: Salomon in particular tended to pay more heed to the interests of the Austrian government and the other Vienna banks than his partners liked.

In some ways, this shift from monarchy to oligarchy within the family was advantageous : it allowed the Rothschilds to respond to the new financial opportunities of the mid-century more flexibly than Nathan might have allowed. For example, Salomon, James and Amschel were able to play leading roles in railway finance in Austria, France and Germany, which their brother had conspicuously omitted to do in England.

Nathan had been inclined to extend the practices of the 1820s into the 1830s. As the finances of the major European states stabilized, he looked for new clients farther afield: in Spain, Portugal and the United States. But to become “master of the finances” of Belgium was one thing; to repeat the process in Iberia or America quite another. Political instability in both Spain and Portugal led to embarrassing defaults on Rothschild-issued bonds. In the United States the problem was the decentralization of fiscal and monetary institutions. The Rothschilds hoped the federal government would prove a good source of business, but it tended to leave the business of foreign borrowing to the states. Likewise, they expected the Bank of the United States to evolve into an American Bank of England. Instead, politically undermined and financially mismanaged, it went bust in 1839. The Rothschilds’ failure to establish a strong foothold in the United States—they had little confidence in their self-appointed agent on Wall Street—proved to be the single biggest strategic mistake in their history.

Such reverses in the familiar field of government finance made diversification logical. Thus the decision to acquire control over the European mercury market was partly a response to the risks of governmental default. By controlling a tangible asset like the Almadén mines, then the world’s biggest, the Rothschilds could finance the Spanish government with minimal risk, advancing money against consignments of mercury. The involvement in mercury mining made sense doubly because of the use of mercury in silver refining. Already experienced bullion brokers before 1815, the Rothschilds branched into minting too.

Railway finance was the most exciting new line, however. In most European countries, the state played some role in railway building, either directly financing construction (as in Russia or Belgium) or subsidising it (as in France and some German states). This meant that issuing shares or bonds for railway companies was not so very different from issuing government bonds—except that the volatility of railway shares was much greater. To begin with, the Rothschilds sought to play a purely financial role. But they were drawn inevitably into closer involvement by the long lags between a rail company’s flotation and the actual opening of its lines, not to mention the payment of dividends on its shares. By the 1840s, Lionel’s brothers Anthony and Nat were spending a substantial proportion of their time supervising their uncle James’s French railway interests. It was a sign of the third generation’s greater aversion to risk that Nat strongly criticized James’s “love” of lines like the Nord and the Lombard and, when accidents happened (as at Fampoux in 1846), Nat saw his fears fulfilled. James was nevertheless right: capital gains on continental railway shares in the course of the nineteenth century were the principal reason the French house subsequently outgrew the English. By the middle of the century, the Rothschilds were already well on the way to. building a highly profitable pan-European railway network.

In one respect, however, Nat’s fears were justified. Unlike the management of government debts, the management of railways directly and tangibly affected the lives of ordinary people. The Rothschilds’ involvement in railways therefore exposed them to unprecedented public criticism. Radical and (for the first time) socialist writers began to portray them in a new and lurid light: as exploiters of “the people,” pursuing capital gains and profits at the expense of taxpayers and ordinary travelers. There had been press attacks on the Rothschilds before; but in the 1820s and 1830s they had mainly stood accused of financing political reaction, or (by business rivals) of sharp commercial practice. In the 1840s, hostility to wealth fused with hostility to Jews: anticapitalism and anti-Semitism complemented one another. The Rothschilds provided the perfect target.

Along with inflammatory polemics, the depressed economic conditions of the mid-1840s were intimations of political instability. Unlike 1830, the revolution of 1848 could be seen coming from afar. The Rothschilds were not blind to its approach, yet underestimated the magnitude of the crisis. The problem was that economic stagnation increased government deficits by reducing tax revenues; in the short term, that meant new business for the Rothschilds, which they could not resist. Both Salomon and James undertook major loans on the very eve of the insurrections. With the spread of revolution eastward from Paris, Salomon’s industrial and railway bonds and shares simply became impossible to sell, and his contractual obligations to the Austrian state equally impossible to fulfill. James was only able to ride out the storm by negotiating major changes to his most recent loan contract with the new and financially naive government.

By dint of their multinational structure, immense resources and superb political contacts, the Rothschilds were able to survive the upheaval of 1848-49. In conditions of near-universal loss, their relative position may even have been slightly enhanced. However, the recovery of the European economies and the (not-coincidental) return of political stability brought new challenges.

First, one of the unspectacular achievements of the revolution was to weaken the resistance of state bureaucracies to the ideas of joint-stock company formation and limited liability. Once company formation became easier, the number of new entrants into finance began to rise. The Pereire brothers had started life as railway enthusiasts, with technical visions but without much money to realize them—hence their subordinate relationship with the Rothschilds in the 1830s. In the 1850s they were able to break free, mobilizing the resources of numerous smaller investors in raising the capital of the Credit Mobilier.

Related to the challenge symbolized by the Pereires was a change in the relationship between state finance and the bond market. The 1850s saw the first serious attempts by states to sell bonds by public subscription, without the mediation of bankers, or with bankers acting as underwriters rather than buying new bonds outright. If nothing else, states began to exploit the growing competition between private and joint-stock banks in order to whittle down commissions. Though still dominant in the bond market, the Rothschilds’ position became less monopolistic. The spread of the telegraph further weakened their grip, bringing to an end the period when their couriers had been able to deliver market-sensitive news ahead of the competition.

But perhaps the most important threat to the Rothschilds’ financial hegemony was political. The triumph of Louis Napoleon Bonaparte in France introduced a new uncertainty into European diplomacy. The possibility that he might seek to emulate his uncle never wholly disappeared until 1870. At the same time, the rules of the international game were subtly altered by the tendency of politicians elsewhere—notably Palmerston, Cavour and Bismarck—to elevate national self-interest above international “balance,” and to place as much trust in cannons as in conferences. Compared with the relatively peaceful thirty-three years from 1815 until 1848, the next thirty-three years would be marked by a succession of wars in Europe (not to mention America): wars that the Rothschilds found themselves unable, despite their best efforts, to prevent.

In May 1848 Charlotte de Rothschild affirmed her belief “in a bright, European and Rothschildian future.” Her confidence in the waning of the French revolutionary era was well founded. In the second half of the nineteenth century, the threats to monarchical politics and bourgeois economics did indeed recede. But the brightness of the Rothschildian future would depend on the family’s ability to meet new challenges. Of these, nationalism and then socialism would prove the greatest—especially when combined.

I

Uncles and Nephews

ONE

Charlotte’s Dream (1849-1858)

I went to sleep at 5 and woke against 6; I had dreamt that a huge vampire was greedily sucking my blood . . . Apparently, when the result of the vote was declared, a loud, enthusiastic roar of approval resounded... throughout the House [of Lords]. Surely we do not deserve so much hatred.

CHARLOTTE DE ROTHSCHILD, MAY 1849

Though they had managed to weather its storms financially, 1848 might still have proved a fatal turning point for the Rothschilds—but for reasons unrelated to economics and politics. For in the years immediately after the revolution the very structure of the family and the firm was called into question. It is easy to forget as one reads their letters that the four remaining sons of Mayer Amschel were by now old men. Amschel was seventy-seven in 1850, Salomon seventy-six and Carl an ailing sixty-two. Only James was still indefatigable at fifty-six.

Longevity, on the other hand, was a family trait: though their father had died aged sixty-eight, their mother, born in 1753, lasted long enough to see the crown of a united Germany offered to a Prussian king by a national assembly gathered in her own home town. Indeed, Gutle Rothschild had become something of a by-word by the 1840s, as The Times reported:

The venerable Madame Rothschild, of Frankfort, now fast approaching to her hundredth year, being a little indisposed last week, remonstrated in a friendly way with her physician on the inefficiency of his prescriptions. “Que voulez-vous Madame?” said he, “unfortunately we cannot make you younger.” “You mistake, doctor,” replied the witty lady, “I do not ask you to make me younger. It is older I desire to become.”

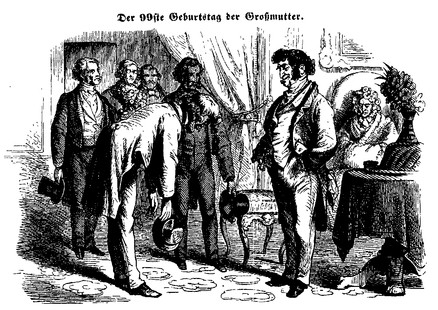

Cartoons were published on the subject: one, entitled Grandmother’s 99th Birthday, depicted James, with Gutle in the background, telling a group of well-wishers: “When she reaches par, gentlemen, I will donate to the state a little capital of 100,000 gulden“ (see illustration 1.i). A different version of the same joke has a doctor assuring her she will ”live to be a hundred.“ ”What are you talking about?“ snaps Gutle. ”If God can get me for 81, He won’t take me at a hundred!“

1.i: Anon., Der 99ste Geburtstag der Groβmutter, Fliegende Blätter (c. 1848).

Her dogged refusal to quit the old house “zum grünen Schild” in the former Judengasse appealed to contemporaries, suggesting as it did that the ‘Rothschilds’ phenomenal economic success was rooted in a kind of Jewish asceticism. Ludwig Borne had sung her praises on this score as early as 1827: “Look, there she lives, in that little house ... and has no wish, despite the world-wide sovereignty exercised by her royal sons, to leave her hereditary little castle in the Jewish quarter.” When he visited Frankfurt sixteen years later, Charles Greville was amazed to behold “the old mother of the Rothschilds” emerging from her “same dark and decayed mansion ... not a bit better than any of the others” in the “Jews’ street”:

In this narrow gloomy street, and before this wretched tenement, a smart calèche was standing, fitted with blue silk, and a footman in blue livery was at the door. Presently the door opened, and the old woman was seen descending a dark, narrow staircase, supported by her granddaughter, the Baroness Charles Rothschild, whose carriage was also in waiting at the end of the street. Two footmen and some maids were in attendance to help the old lady into the carriage, and a number of inhabitants collected opposite to see her get in. A more curious and striking contrast I never saw than the dress of the ladies, both the old and the young one, and their equipages and liveries, with the dilapidated locality in which the old woman persists in remaining.1

But on May 7, 1849, in her ninety-sixth year and with her surviving sons at her bedside, Gutle finally died.

It was one of a spate of deaths in the family. The year before, Amschel’s wife Eva had died. In 1850, so did Nathan’s widow Hannah as well as—to the great distress of the Paris Rothschilds—her youngest grandson, Nat’s second son Mayer Albert. Carl’s wife Adelheid died in 1853, followed a year later by Salomon’s wife, Caroline. The effect of these events on the older members of the second generation may easily be imagined. Mayer Carl noticed how “deeply affected” Amschel had been by the death of his mother. “It is a great loss to [him] ... & I cannot tell you how many wretched hours we have spent lately ... Uncle A. is confined to his room but feels rather better after the first shock which was really fearful.” He was only slightly “calmer” when the family gathered in Frankfurt for Gutle’s funeral. Indeed, he and his brother Salomon cut rather forlorn figures in their twilight years, spending less and less time in the counting house and more and more time in Amschel’s garden.

To the new Prussian delegate to the Diet of the restored German Confederation—a mercurial and ultra-conservative Junker named Otto von Bismarck—Amschel seemed a pathetic old man. “[I]n monetary terms,” Rothschild was of course the “most distinguished” man in Frankfurt society, Bismarck reported to his wife shortly after arriving in the town. But “take their money and salaries away from the lot of them, and you would see how undistinguished” he and the other citizens of Frankfurt really were. The newcomer was characteristically rebarbative when Amschel invited him to dinner ten days in advance (to be sure of an acceptance), replying that he would come “if he was still alive.” This answer “alarmed him so much that he repeated it to everybody: ‘What, why shouldn’t he live, why should he die, the man is young and strong!’” With his limited private means and meagre stipend, the Junker diplomat was bound to be impressed as much as he was repelled by the “hundredweight of silverware, golden forks and spoons, fresh peaches and grapes, and excellent wines” which were laid before him on Amschel’s dinner table. But he could not conceal his disdain when the old man proudly showed off his beloved garden after their meal:

I like him because he’s a real old wheeling and dealing Jew, and does not pretend to be anything else; he is strictly Orthodox with it, and refuses to touch anything but kosher food at his dinners. “Johann, take some pread vit you for the deer,” he said to his servant, as he went out to show me his garden, in which he keeps tame deer. “Herr Paron, this plant cost me two tousand gulden, honestly, two tousand gulden cesh. You can hef it for a tousand; or if you’d like it es a present, he’ll pring it to your house. Gott knows I regard you highly, Paron, you’re a hendsome man, a fine man.” He is a short, thin, little man, and quite grey. The eldest of his line, but a poor man in his palace, a childless widower, cheated by his servants and despised by smart Frenchified and Anglicised nephews and nieces who will inherit his wealth without any love or gratitude.2

As Bismarck shrewdly divined, it was this last question—who should inherit their wealth—which most preoccupied the old Rothschilds, who accordingly spent long hours tinkering with their wills. Years before—in 1814—Amschel had joked that the difference between a rich German Jew and a rich Polish Jew was that the latter would “die just when he was losing, whilst the rich German Jew only dies when he has a great deal of money.” Forty years later, Amschel was living up to his own stereotype, with a share in the family firm worth nearly £2 million. But who should inherit this fortune? Denied the son he had so long prayed for, Amschel brooded on the merits of his twelve nephews, particularly those (principally Carl’s sons Mayer Carl and Wilhelm Carl) who had settled in Frankfurt. In the end, his share of the business was divided in such a way that James got a quarter, Anselm a quarter, Nathan’s four sons a quarter between them and Carl’s three sons the last quarter.

Salomon had an heir, of course, and a daughter well provided-for in Paris; but—perhaps because of the harsh words they had exchanged in Vienna at the height of the revolutionary crisis—he sought to avoid making Anselm his sole heir. Instead, he devised complicated provisions designed to transmit most of his personal wealth directly to his grandchildren. At first he seems to have considered leaving almost all of it (£1.75 million) to his daughter Betty’s children (£425,000 apiece for the boys and just £50,000 for Charlotte, whom he had already given £50,000 on the occasion of her marriage to Nat), leaving only his three houses to Anselm and his sons, and just £8,000 for their married sister Hannah Mathilde. Even his Paris hotel, he told Anselm, would go to “you and your sons ... I repeat it is for you and your sons. I have thought about it and put in a clause [to ensure it remains their property for] over a hundred years. No sons-in-law or daughters can have any claim on it.” This was partly a self-conscious strategy to exert the maximum posthumous influence, rather as Mayer Amschel had done in 1812; indeed, the exclusion of the female line was an idea he had inherited from his father. But, unlike his father, Salomon decided that only one of his grandsons would ultimately inherit his share of the family business from Anselm—a new development in a family which had hitherto treated all male heirs more or less equally. In a final codicil to his will dated 1853, he scrapped the clause which left the choice of successor to Anselm, specifying (unsuccessfully, as it turned out) his eldest grandson Nathaniel. Ultimately, all Salomon’s schemes came to naught; in practice, it was Anselm who inherited his fortune and who decided which of his sons should succeed him. Bismarck was right too that the younger Rothschilds ridiculed their old uncles. Visits to the invariably “sad and morose” Uncle Carl were especially dreaded. If there was great grief in 1855 when Salomon, Carl and Amschel one after another expired in the space of just nine months, no record of it has come to light.

This wave of mortality came in the wake of a dramatic upheaval in the Rothschilds’ financial affairs. As we have seen, the huge sums which had to be written off in the wake of the Vienna house’s effective collapse were not easily forgotten, especially by the London partners, whose worst fears about their uncles’ reckless business methods appeared to have been confirmed. Unfortunately, the structure of the firm meant that losses of the sort sustained by Salomon had to be borne collectively; his personal share of the firm’s total capital was not proportionately reduced. This explains why, in the period immediately after the revolution, unprecedented centrifugal forces threatened to break the links which Mayer Amschel had forged nearly forty years before to bind his sons and grandsons together. In particular, the London partners sought to “liberate” themselves from the commitments to the four continental houses which had cost them so dear in the wake of the revolution. As Nat put it in July 1848, he and his brothers wished to “come to some sort of an arrangement so that each house may be in an independent position.” Small wonder the prospect of a “commercial and financial congress” had filled Charlotte with such dread when it was first proposed in August 1848: “Uncle A. is weakened and depressed by the loss of his wife, Uncle Salomon by the loss of his money, Uncle James by the uncertain situation in France, my father [Carl] is nervous, my husband, though splendid, is stubborn when he is in the right.”

When James set off to see his brothers and nephews in Frankfurt in January 1849, Betty fully expected the congress to “alter the bases of our Houses, and following the London house, [to] grant mutual freedom from a solidarity which is incompatible with the movements in politics ...” Characteristic of the strained relations between Paris and London was the row later that year when James heard that Mayer had “ordered” one of the Davidson brothers “not to send any gold to France”—an assertion of English paramountcy he found intolerable. In Paris itself, there was constant friction between Nat and James. The former had always been a good deal more cautious than his uncle, but the revolution, as we have seen, all but broke his nerve as a businessman. “I advise you to be doubly cautious in business generally,” he exhorted his brothers in a typical letter at the height of the crisis:

As for me I have taken such a disgust to business that I should particularly like to have no more of any sort or description to transact ... What with the state of things all over the world, the revolutions that spring up in a minute & when least expected I think it downright madness to go & plunge oneself up to one’s neck into hot water for the chance of making a little money. Our good Uncles are so ridiculously fond of business for business’ sake and because they cannot bear the idea of anybody else doing anything that they can’t let anything go if they fancy another person wishes for it. For my part I am quite sure there is no risk of Baring advancing much [on Spanish mercury] & if he chooses so to do let him do it, be satisfied and take things easy.

Betty saw the force of this. As she commented, “Our good Uncle [Amschel] can’t tolerate a lessening of our fortune, and in his desire to restore it along previous lines, he wouldn’t think twice about throwing us back into the disturbance of hazardous affairs.” But James was increasingly impatient with Nat’s pusillanimity. Charlotte suspected that James would positively welcome his nephew’s withdrawing from the business as it would allow him to increase the involvement of his elder sons Alphonse and Gustave (who first begin to figure in the correspondence in 1846). As Betty put it, the “old ties of fraternal union” for a time seemed “pretty close to falling apart.”

Nor were these the only sources of familial disunity. Even before the 1848 revolution, there had been complaints from Frankfurt about the attitude of the London house. It was, complained Anselm, “very unpleasant to be the most humble servant, to execute your order without even knowing by the Spanish correspondence what is going forward. Very true it is that we do not merit any consideration, & that since a long time ago [sic] we are ranged in a secondary line in the Community of the different houses.” As this implies, Anselm was assuming that he, as the eldest of the next generation, would be Amschel’s successor in Frankfurt. Yet the collapse of the Vienna house changed everything, as it put pressure on him to take over permanently his father’s place in Austria. In the same way, Carl wished his eldest son Mayer Carl to succeed him in Italy. However, the childless Amschel was even more determined that Mayer Carl should take over from him in Frankfurt, leaving his younger and less able brother Adolph to go to Naples. As James observed, such arguments were not only between the elderly brothers but also between their sons and nephews, who were all evidently vying for control of the Frankfurt house, since it continued to be dominant over its Vienna and Naples branches: “Anselm is at odds with Mayer Carl. Mayer Carl is at odds with Adolph.” Although notably partisan in her eldest brother’s favour, Charlotte’s diary details some of the ill-feeling this rivalry generated:

Mayer Carl ... is mature; a man of the world and an international citizen. He is in his prime and at the height of his by no means inconsiderable powers. He has certainly earned himself a greater degree of popularity than Anselm through his engaging manner, his vivacious personality and witty conversation. Indeed he is a welcome and well liked figure in Frankfurt, far more so than my brother-in-law ever was, is or could be. I rather doubt that he possesses the solid breadth and depth of knowledge that Anselm has gained and I am in no position to assess whether he is an experienced businessman, or whether his judgement on important matters is sound and whether he is a good writer and speaker. But ... Anselm is utterly condescending towards my brother, which is quite unjustifiable for one would have to scour whole kingdoms to find such a gifted young man. Perhaps he does not have the aptitude for thorough research and lengthy study required for the pursuit of the scientific branches of intellectual thought. Yet, as a banker and a man of the world, as a refined and educated member of European Society (for he is at ease with all nationalities and classes), it seems to me he is without equal. It is unjust and unworthy of Anselm to treat him with such disdain.

Finally, it is important to bear in mind the anger felt in London and Paris towards the Vienna house after the débâcle of 1848. At times, James talked as if even he would not be sorry to sever his links with Vienna. “I have no interest in Vienna,” he wrote to New Court in December 1849. “While others speculate against the government there, our people in Vienna are not so smart and are unfortunately poor businessmen. They always think they are doing business for the good of the state.”

Yet in the end the partnership was renewed in 1852 with relatively limited alterations to the 1844 system and continued to function with as much success as ever in the following two decades. Why was this? The best explanation for the survival of the Rothschild houses as a multinational partnership lies in the vital role played by James in bridging the generation gap and binding the increasingly divergent branches of the family together again. As Charlotte remarked when she saw her uncle in Frankfurt in 1849, James had emerged from the crisis of 1848 with his lust for life and business undiminished:

I have seldom seen such a practically shrewd man, so worldly and canny, so mentally and physically active and indefatigable. When I reflect that he grew up in the Frankfurt Judengasse and never enjoyed the advantages of high.culture in his childhood and youth, I am amazed and admire him beyond words. He has fun and takes pleasure in everything. Every day he writes two or three letters and dictates at least six, reads all the French, German and English newspapers, bathes, has a one-hour morning nap, and plays whist for three or four hours.

And this was James’s routine when he was away from Paris. The James whom the young stockbroker Feydeau encountered in the rue Laffitte was as much a force of nature as he had been in Heine’s heyday; if anything, age made James only the more formidable.

For all his youthful vigour, James nevertheless remained deeply imbued with the familial ethos of his father’s day. Even before 1848, he had been worried by the signs of dissension between the five houses. Disagreements about the accounts, he warned Lionel in April 1847, were leading “to a state of affairs that in the end everyone deals for himself and this then creates a great deal of unpleasantness.” “It is only the reputation, the happiness and the unity of the family which lies close to my heart,” he wrote, echoing the familiar admonitions of Mayer Amschel, “and it is as a result of our business dealings that we remain united. If one shares and receives the accounts every day, then everything will stay united God willing.” It was to this theme that James returned with passionate urgency in the summer of 1850—a letter of such importance that it deserves to be quoted at length:

It is easier to break up a thing than to put it back together again. We have children enough to carry on the business for a hundred years and so we must not go against one another ... We must not delude ourselves: the day when a [single] company no longer exists—when we lose that unity and co-operation in business which in the eyes of the world gives us our true strength—the day that ceases to exist and each of us goes his own way, then good old Amschel will say, “I have £2 million in the business [but now] I am withdrawing it,” and what can we do to stop him? As soon as there is no longer majority [decision-making] he can marry himself to a Goldschmidt and say, “I am investing my money wherever I like,” and we shall never stop reproaching ourselves. I also believe, dear Lionel, that we two, who are the only ones with influence in Frankfurt, must really aim to restore peace between all [the partners] ... What will happen if we are not careful is that capital amounting to £3 million will fall into the hands of outsiders, instead of being passed on to our children. I ask you, have we gone mad? You will say that I am getting old and that I just want to increase the interest on my capital. But, firstly, all our reserves are, thank God, much stronger than when we made our last partnership contract, and secondly, as I said to you on the day I arrived here, you will find in me a faithful uncle who will do everything in his power to achieve the necessary compromise. I therefore believe that we must follow these lines of argument and do everything possible—make every sacrifice on both sides—to maintain this unity which, thanks be to the Almighty, has protected us from all the recent misfortunes, and each of us must try to see what he can do in order to achieve this objective.

These were themes James harped on throughout 1850 and 1851. “I assure you,” he told Lionel’s wife Charlotte (whom he had identified as an ally), “the family is everything: it is the only source of the happiness which with God’s help we possess, it is our attachment [to one another], it is our unity.”

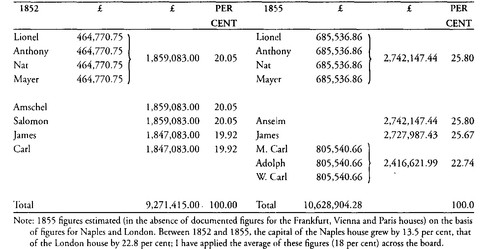

It is in the light of James’s campaign for unity that the partnership contract of 1852 should therefore be understood—not as weakening the ties between the houses, but as preserving them through a compromise whereby the English partners dropped their demands for full independence in exchange for higher rates of return on their capital. As early as 1850, James had outlined the terms of this compromise: in Nat’s words, he proposed “that the rate of interest on the capital for us should be raised,” provided always that the London house was more profitable than the others. This was also the thrust of his letter to Lionel quoted above; and it was the system finally agreed to in 1852. The British partners received a variety of sweeteners: not only were they permitted to withdraw £260,250 from their share of the firm’s capital, but the interest on their share (now 20 per cent of the total) was increased to 3.5 per cent, compared with 3 per cent for James, 2.625 per cent for Carl and 2.5 for Amschel and Salomon. In addition, the rules governing the joint conduct of business were relaxed: henceforth, no partner could be obliged by the majority to go on business trips, while investments in real estate were no longer to be financed from the collective funds. In return for these concessions, the English partners accepted a new system of collaboration. Clause 12 of the agreement stated that “to secure an open and brotherly co-operation and the advancement of their general, reciprocal business interests” the partners would keep one another informed of any transactions worth more than 10 million gulden (c. £830,000), and offer participations of up to 10 per cent on a reciprocal basis. Otherwise, the terms of all previous agreements not specifically altered by the new contract remained in force including, for example, the procedures for common accounting. This undoubtedly represented a measure of decentralisation. But considering that the alternative (seriously discussed the following year) was the complete liquidation of the collective enterprise, it represented a victory for James.

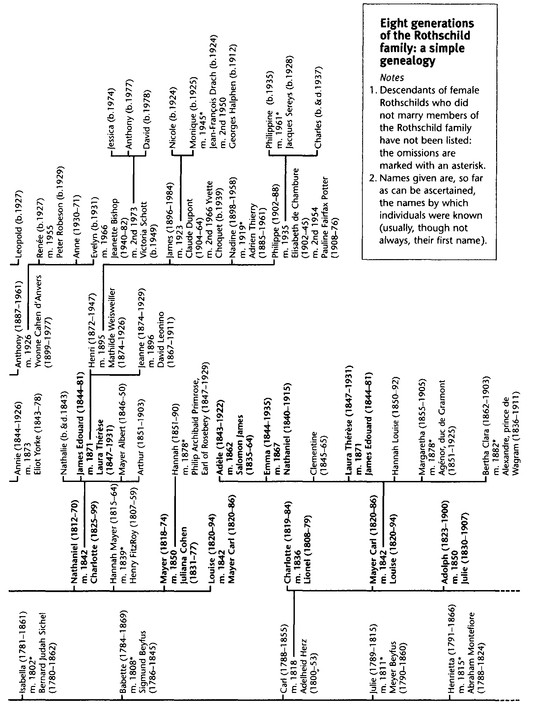

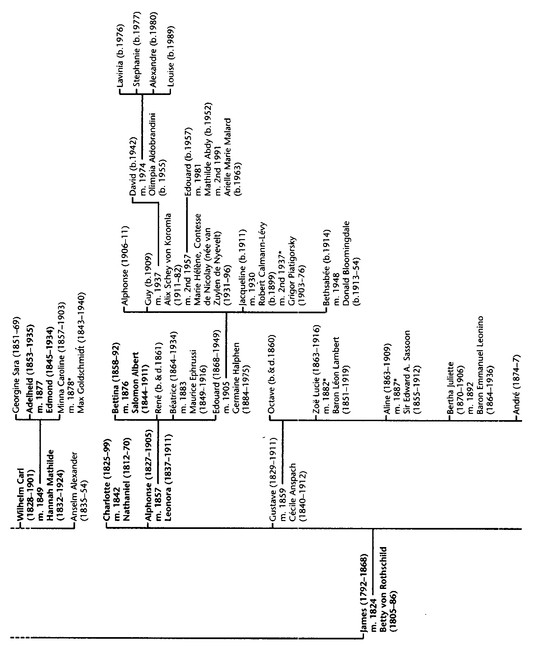

What the 1852 agreement did not do was to decide the succession in Frankfurt (other than to rule out Adolph): henceforth, Anselm, Mayer Carl and Wilhelm Carl were all to sign for the Frankfurt house. (It also gave Alphonse and Gustave the right to sign for the Paris house.) Only after the deaths of James’s brothers in 1855 did the new structure of the firm emerge (see table 1 a). Despite the provisions of his will, all Salomon’s share of the collective capital passed to Anselm (an outcome which, for reasons which are obscure, James challenged only half-heartedly on his wife’s behalf). Carl’s share was divided equally between his sons after the deduction of a seventh, which went to his daughter Charlotte. Finally, and decisively, Amschel’s share was divided up in such a way that James and Anselm each received a quarter, as did the sons of Nathan and the sons of Carl. The net effect of all this was to give close to equal power to Anselm, James and the English-born partners, while reducing the influence of Carl’s sons. Their influence was further reduced by the decision to put Adolph in charge of the Naples house, and leave Frankfurt to Mayer Carl and his pious brother Wilhelm Carl.

Table 1a. Personal shares of combined Rothschild capital, 1852 and 1855.

Sources: CPHDCM, 637/1/7/115-120, Socieräts-Übereinkunft, Oct. 31, 1852, between Amschel, Salomon, Carl, James, Lionel, Anthony, Nat and Mayer; AN, 132 AQ 3/1, Undated document, c. Dec. 1855, reallocating Amschel and Carl’s shares.

It was a compromise which worked in practice. After 1852, James was prepared to show a much greater degree of deference to his nephews’ wishes than in the past. New Court no longer took orders from James—as can easily be inferred from the diminished length of his letters to London after 1848. Increasingly, he scribbled no more than a postscript to Nat’s despatch and often concluded his suggestions about business—as if to remind himself that there was no longer a primus inter pares—with the telling phrase: “Do, dear nephews, what you wish.” This was doubtless gratifying to Lionel. Yet the compromise of 1852 meant that the pre-1848 system of co-operation between the five houses was in fact resumed with only a modest degree of decentralisation. The balance sheets of the Paris and London houses reveal a rate of interdependence which was less than had been the case in the 1820s, but it was still substantial. To give just one example, 17.4 per cent of the Paris house’s assets in December 1851 were monies owed to it by other Rothschild houses, principally London.

Moreover, the London partners’ assumption that their house would be more profitable than the others proved over-confident. Although the Naples and Frankfurt houses tended to stagnate (for reasons largely beyond the control of Adolph and Mayer Carl), it was James who made much of the running after 1852, expanding his continental railway interests so successfully that by the end of his life the capital of the Paris house far exceeded that of its partners. Anselm too proved unexpectedly adept at restoring the vitality of the shattered Vienna house. It turned out to be far from disadvantageous for the London partners to share in these continental successes. The new system thus inaugurated a new era of equality of status between the London and Paris houses, with Vienna reviving while Frankfurt and Naples declined in their influence.

As in the past, it was not only through partnership agreements and wills that the Rothschilds maintained the integrity of the family firm. Endogamy continued to play a crucial role. The period between 1848 and 1877 saw no fewer than nine marriages within the family, the manifest purpose of which was to strengthen the links between the different branches. In 1849 Carl’s third son Wilhelm Carl married his cousin Anselm’s second daughter Hannah Mathilde; a year later, his brother Adolph married her sister Julie; and in 1857 James’s eldest son Alphonse married his cousin Lionel’s daughter Leonora at Gunnersbury. To list the rest here would be tedious.3 With a single exception in the years before 1873, those who did not marry other Rothschilds did not stray far from the Jewish “cousinhood.”4 In 1850 Mayer married Juliana Cohen—defeating a rival suit from Joseph Montefiore—while his nephew Gustave married Cécile Anspach in 1859. If Wilhelm Carl had not married a Rothschild, he would have married a Schnapper—a member of his grandmother Gutle’s family.

The brokering of these alliances was, as it had been for nearly two generations, a major preoccupation of the female members of the family. Charlotte made no bones about their rationale. As she enthused on hearing of her brother Wilhelm Carl’s engagement to Hannah Mathilde, “My good parents will certainly be pleased that he has not chosen a stranger. For us Jews, and particularly for us Rothschilds, it is better not to come into contact with other families, as it always leads to unpleasantness and costs money” The idea that either the pious groom or the musical bride was making a spontaneous choice was, in this case, nonsense. Charlotte’s cousin Betty saw the match in a very different light, reporting to her son that “poor Mathilde only determined regretfully to marry Willy.” Now she was “preparing herself with a truly angelic resignation for the sacrifice of her young heart’s dearest illusions. It has to be said that the prospect of being Willy’s lifelong companion wouldn’t entice a young woman brought up as she has been and blessed with a cultivated mind.” The question which remained to be resolved was whom Betty’s sons Alphonse and Gustave should marry. It seems that Hannah Mathilde had in fact set her heart on the latter, while her sister Julie had hoped to marry Alphonse. But, after teasing her son on the subject, Betty reported that:

Papa, frank and honest man that he is ... brought up the subject without beating about the bush. He expressed all his regrets to the poor mother ... and he undeceived her of illusions that the desire for success might encourage wrongly, and he asked her in her own interest and for the happiness of her daughter to look elsewhere.

This was good news for Charlotte, who was planning a similar double match between Betty’s sons and her daughters Leonora and Evelina. In her diary, she coolly weighed up the respective merits of the two putative sons-in-law:

Gustave is an excellent young man. He has the best and warmest heart and is deeply devoted to his parents, brothers and sisters and relatives. He has a strongly developed sense of duty and his obedience could serve as an example to all young people of his generation. Whether he is talented or not, I could not in all honesty say. He has enjoyed the great benefits and advantages of a good education, but is, he claims, stupid, easily intimidated and unable to string ten words together in the company of strangers. They say he has acquired considerable skill in mathematics but I am ignorant of that subject and cannot pass judgement.

His brother, Alphonse, combines the extraordinary energy and vitality of our uncle [James] with Betty’s facility for languages. He is a good reader, listener and observer and he remembers everything he absorbs. He can converse on the topics of the day with an easy manner, without pedantry, but always in a direct, penetrating and amusing way, touching upon every subject in the most agreeable fashion. He cannot be relied upon for an opinion, since he never voices one, indeed, perhaps does not have opinions; but it is a pleasure to hear him, for he speaks without emotion in the most engaging and lively tone.

Mrs Disraeli calls Gustave handsome; I do not know whether I agree with her. He is the only one of the Jacobean line who can boast this advantage with his large, soft, blue-green eyes. In his early years they were apparently weak like all the Rothschild eyes, but now there is no trace of the childhood trouble, except a certain quality which one might almost call languishing. His eyebrows are finely drawn; his brow well formed, fair and clear; he has a full head of dark brown, silky hair; his nose is not oriental; he has a large mouth which, however, cannot be praised on account of its expression which is good natured at best and reveals neither understanding nor depth of feeling. Gustave is slim, his bearing is easy and his manners those of the highest society. I should like to see his profile at the altar.

She was only half-successful: nine years later it was Alphonse’s profile she saw at the altar, alongside her daughter Leonora. By that time, moreover, she had revised her opinion of the bridegroom. Now he seemed “a man, who perhaps for ten of fifteen years has run the round of the world—is completely blase, can neither admire nor love—and yet demands the entire devotion of his bride, her slavish devotion.” Still, she concluded, it was “better so—the man whose passions are dead, whose feelings have lost all freshness, all depth, is likely to prove a safe husband, and the wife will probably find happiness in the discharge, in the fulfilment of her duties. Her disenchantment will be bitter but not lasting.” In any case, her daughter attached “much importance to a certain position in the world, and would not like to descend from what she fancies to be the throne of the R’s to be the bride of a humbler man.”5 Such sentiments were doubtless based on Charlotte’s own experience, and tell us much about the distinctive quality of such arranged marriages.

The extent to which parental choice was decisive should not, of course, be exaggerated. The fact that Charlotte failed to secure Alphonse’s brother for her other daughter suggests that parents were less able to impose their choices of spouse on their children than had previously been the case. Anselm’s daughter Julie also successfully repelled the advances of her cousin Wilhelm Carl, as well as those of a more distant relation, Nathaniel Montefiore. On the other hand, her final “choice” of Adolph was strictly governed by her father and future father-in-law, who spent months drawing up the marriage contract; and although such negotiations often involved sums of money being settled individually on the bride-to-be to give her a measure of financial independence, this should not be mistaken for some sort of proto-feminism.6 There were limits to what the Rothschilds were prepared to inflict on their daughters, as became apparent when old Amschel announced shortly after his wife’s death that he wished to remarry none other than his own grand-niece, the much sought-after Julie (who was not yet twenty). The rest of the family—backed up by his doctors—closed ranks against this idea. But it is not known how far their opposition was actuated by fears for his health as opposed to the happiness of the young lady in question: James for one appears to have worried that, if Amschel’s proposal were rejected too abruptly, he might withdraw his capital from the firm and marry a stranger.

The Orthodox and the Reformed

As Charlotte emphasised, endogamy continued to be partly a function of the Rothschilds’ Judaism: the family policy remained that sons and daughters could not marry outside their faith (even if they were socially so superior to their co-religionists that they could not marry outside the family either). The extent of Rothschild religious commitment in this period should not be underestimated: if anything, it was greater than had been the case in the 1820s and 1830s, and this was another important source of familial unity in the period after 1848. James continued to be the least strict in his observance. “Well, I wish you a hearty good Sabbath,” he wrote to his nephews and son in 1847. “I hope you are having a good time and a good hunt. Are you eating well, drinking well and sleeping well as is the wish of your loving uncle and father?” As the existence of such a letter itself testifies, he saw nothing wrong with being at his desk on the Sabbath. He and Carl also were conspicuously erratic in their attendance at synagogue (unlike their wives).

Yet James remained as firmly convinced of the functional importance of the family’s Jewish identity as he had been in the days of Hannah Mayer’s apostasy. Although he very nearly forgot the date of Passover in 1850, he was nevertheless willing to cancel a business trip to London in order to read the Haggadah. He was happy to receive the Frankfurt rabbi Leopold Stein’s new book in 1860 (though the size of the donation he sent Stein is not recorded). His wife Betty was as secular-minded as her husband, but she too had a strong sense that observance was a social if not a spiritual imperative. When she heard that her son Alphonse had attended the synagogue in New York, she declared herself “over the moon,” adding:

It’s good thing, my good son, not only out of religious feeling, but out of patriotism, which in our high position is a stimulus to those who might forget it and encouraging to those who remain firmly attached to it. That way you reconcile those who might blame us even while they think as we do, and make sure you have the high esteem of those who hold different beliefs.

That said, it was evidently something of a surprise to her that Alphonse had gone to the synagogue of his own volition.

Wilhelm Carl meanwhile remained the only Orthodox member of the younger generation. Continuing his uncle Amschel’s campaign against the Reformist tendencies of the Frankfurt community, he supported the creation of a new Israelite Religious Community for Orthodox believers, donating the lion’s share of the funds to build a new synagogue in the Schützenstrasse. Yet he opposed the outright schism advocated by the new community’s rabbi, Samson Raphael Hirsch, who wished his followers to withdraw altogether from the main Frankfurt community. Orthodox though he was, Wilhelm Carl shared the Rothschild view that diversity of practice should not compromise Jewish communal unity.

His English cousins also continued to consider themselves “good Israelites,” observing holy days and avoiding work on the Sabbath. James once teased Anthony when he was visiting Paris that he liked to pick up his prayer books, an impression of piety confirmed when his nephew dutifully fasted at Yom Kippur in 1849, despite fearing (wrongly) that it was medically inadvisable given the outbreak of cholera then sweeping Paris. It was typical that he and Lionel had to supply Nat with matzot when he was in Paris during Passover. Even when on holiday in Brighton, Lionel and his family celebrated Yom Kippur, fasting and praying on the Day of Atonement. But the four London-born brothers were not Orthodox in the way that Wil helm Carl was. In 1851 Disraeli unthinkingly sent Charlotte and Lionel a large joint of venison he had been given by the Duke of Portland: