The Money Class – Read Now and Download Mobi

ALSO BY SUZE ORMAN

You’ve Earned It, Don’t Lose It

The 9 Steps to Financial Freedom

Suze Orman’s Financial Guidebook

The Courage to Be Rich

The Road to Wealth

The Laws of Money, the Lessons of Life

The Money Book for the Young, Fabulous & Broke

Women & Money

Suze Orman’s Action Plan

This book is designed to provide accurate and authoritative information about personal finances. Neither the author nor the publisher is engaged in rendering legal, accounting, or other professional services, by publishing this book. If any such assistance is required, the services of a qualified financial professional should be sought. The author and publisher will not be responsible for any liability, loss, or risk incurred as a result of the use and application of any of the information contained in this book.

While the author has made every effort to provide accurate telephone numbers and Internet addresses at the time of publication, neither the publisher nor the author assumes any responsibility for errors or for changes that occur after publication.

A Certified Financial Planner® is a federally registered mark owned by the Certified Financial Planner Board of Standards, Inc.

Copyright © 2011 by Suze Orman, a Trustee of the Suze Orman Revocable Trust All rights reserved.

Published in the United States by Spiegel & Grau, an imprint of The Random House Publishing Group, a division of Random House, Inc., New York.

SPIEGEL & GRAU and Design is a registered trademark of Random House, Inc.

Library of Congress Cataloging-in-Publication Data

Orman, Suze.

The money class: learn to create your new American dream / Suze Orman.

p. cm.

eISBN: 978-0-679-60470-9

1. Finance, Personal—United States. 2. Wealth—United States. I. Title

HG179.O75764 2011

332.024′01—dc22 2011001394

Jacket design: Greg Mollica

Jacket photograph: Brian Bowen Smith

v3.1

CONTENTS

CLASS 1: THE NEW AMERICAN DREAM

Making Change • The Dreams of Tomorrow Reside in Today’s Choices • The Money Class Curriculum

LESSON 1. FINDING YOUR TRUTH: A PERSONAL FINANCIAL ACCOUNTING

LESSON 2. LIVING TRUTHFULLY: HOW TO STAND TALL

Focus on What Is Real Today … and What You Will Need Tomorrow • Live Below Your Means but Within Your Needs • The Pleasure of Saving Is Equal to the Pleasure of Spending • Define Yourself by Who You Are, Not What You Have

LESSON 3. THE FOUNDATION OF ALL TRUTHFUL LIVING: THE POWER OF CASH

Debit Card Rules • The “Life Happens” Fund • Credit Unions: A Great Place to Save • Safety First with Your Savings • Saving for Big-Ticket Items • The Truth Will Indeed Set You Free

LESSON 1. HOW TO BUILD HONEST FAMILY RELATIONS

Opening the Lines of Communication

LESSON 2. HOW TO RAISE YOUNG CHILDREN TO STAND IN THE TRUTH

Your Priceless Legacy • Set the Right Tone • Imparting Good Values When It Comes to Money • Money Lessons for Children • Money Lessons for Tweens and Teens • Money Lessons for Teenagers Heading to College • How to Handle Money Gifts and Savings • The Three-Option Approach

LESSON 3. HOW TO CREATE A FINANCIALLY HONEST COLLEGE STRATEGY

Who Should Save for College • The Best Way to Save for College: 529 Plans • UGMA/UTMA • Coverdell Accounts • How to Invest Your 529 Plan • The College Talk Every Parent Must Have with a High School Freshman • Borrowing Rules for College Loans • The Risks of Private Loans for College • Stafford Loans • PLUS Loans • How to Choose the Right School

LESSON 4. HOW TO HELP ADULT CHILDREN FACING FINANCIAL CHALLENGES

How to Handle Student Loans That Are in Default • How and When to Help Independent Children Who Are in Financial Trouble

LESSON 5. THE CONVERSATION EVERY ADULT CHILD SHOULD HAVE WITH HIS OR HER PARENTS

Building Family Financial Security Under One Roof • Updating Legal Documents • When a Parent Remarries

LESSON 6. ADVICE FOR GRANDPARENTS: HOW TO BUILD A LASTING LEGACY

Follow the Parents’ Lead • Pay It Forward • Give Experiences, Not Things

LESSON 1. THE TRUTH ABOUT HOME VALUES

A Decade of Extremes • A Home Is a Savings Account, Not a Hot Stock • Financing Is Cheap, but Not Easy

LESSON 2. WHEN IT MAKES SENSE TO RENT

The Math of Rent vs. Buy • Advice for Owners Who Now Want to Rent

LESSON 3. THE NEW RULES OF BUYING A HOME

Set a Budget That Satisfies Your Needs • Know Your Income Limits • Aim to Make a 20% Down Payment • A Special Note About FHA-Insured Loans • Special Rules for Buying Condos and Co-ops • Where to Come Up with the Down Payment • Opt for a 30-Year Fixed-Rate Mortgage • Understand the Risk of Distressed Property

LESSON 4. WHAT TO DO IF YOU ARE UNDERWATER

If You Are Underwater and Cannot Afford Your Mortgage • Loan Modification • Short Sale • Foreclosure • If You Are Underwater but You Can Afford the Mortgage

LESSON 5. HOW TO REDUCE MORTGAGE COSTS

When It Makes Sense to Pay Off a Loan Ahead of Schedule • The New Realities of Refinancing • Refinancing Rules • Lower Your Mortgage Costs Without a Refinance

LESSON 6. THE DANGERS OF HOME EQUITY LINES OF CREDIT

The Dangers of Rising Interest Rates and Falling Behind on Payments • Home Equity Loans

Reverse Mortgage Basics

LESSON 8. INVESTING IN REAL ESTATE

What You Need to Know Before You Buy Investment Property • What to Do with an Investment Property That Is Underwater

LESSON 1. ADVICE FOR THE EMPLOYED

Build Your Plan-for-the-Worst Fund • Live Below Today’s Means • Grab Your Full Retirement Bonus • Make Your Case for a Raise and Promotion Through Your Work • How to Ask for a Raise • Change Your Attitude Before You Change Your Job

LESSON 2. ADVICE FOR THE UNEMPLOYED

Cut Your Spending Immediately • Do Not Dip into Your Retirement Savings • Make Sure Your Credit Profile Remains Strong • Do Not Go Back to School to Avoid a Hard Job Market • Get to Work as Fast as Possible, Rather Than Holding Out for a Better Offer • How to Deal with a Steep Pay Cut • A Special Note for Stay-at-Home Moms

LESSON 3. STARTING (AND RUNNING) YOUR OWN BUSINESS

Launching a Business: Can You Afford It? • Where to Get the Money to Start Your Business • A Few Words About Micro Lending • Running Your Own Business • When to Expand • When to Close • Standing in Your Truth in Business • Closing Down a Business Responsibly

A Note About the Retirement Classes

The Money Navigator: A Special Offer for Readers of The Money Class

CLASS 6: RETIREMENT PLANNING: GETTING GOING IN YOUR 20S AND 30S

LESSON 1. TIME IS YOUR GREATEST ASSET

Getting Started Early • With Lower Returns, Savings Are More Important Than Ever

LESSON 2. RETIREMENT ACCOUNTS EXPLAINED

Retirement Plans Offered by Employers • Retirement Plan Withdrawal Rules • Non-Workplace Retirement Accounts • Nondeductible IRAs • Roth IRAs • Retirement Plans for the Self-Employed

LESSON 3. HOW MUCH YOU NEED TO SAVE FOR RETIREMENT

The Retirement Formula • The Best 401(k) and IRA Strategy • A Word on Vesting • Where to Open an IRA Account

LESSON 4. INVESTING YOUR RETIREMENT MONEY

The Ups and Downs of the Stock Market • Dollar Cost Averaging • How Much to Invest in Stocks • Choosing the Best Options Within Your 401(k) • How to Build the Best 401(k) Investment Portfolio • Exchange Traded Funds • Bond Investments • Retirement Planning Mistakes to Avoid • What to Do with Your 401(k) When You Leave a Job

CLASS 7: RETIREMENT PLANNING: FINE-TUNING IT IN YOUR 40S AND 50S

LESSON 1. DECIDING WHEN IT MAKES SENSE TO PAY OFF YOUR MORTGAGE

Questions to Ask Yourself • The Benefits of Paying Off Your Mortgage • How to Pay Off Your Mortgage Ahead of Schedule

LESSON 2. HAVE A REALISTIC PLAN FOR WORKING UNTIL AGE 66–67

Your Work-Longer Game Plan

LESSON 3. DELAY YOUR SOCIAL SECURITY BENEFIT

Social Security Basics • Social Security Strategies

LESSON 4. ESTIMATE YOUR RETIREMENT INCOME: HOW ARE YOU DOING?

Social Security Benefits • Retirement Accounts • Pensions • Lump Sum vs. Annuity

LESSON 5. SAVING MORE, AND INVESTING STRATEGIES IN YOUR 50S

How to Invest Smart • Making the Most of What You Have • Best Investments Outside Your 401(k) • Bond Investments • No Target Funds Allowed

LESSON 6. PLAN FOR LONG-TERM CARE COSTS

When to Buy • Making the Financial Case for LTC Insurance • Health Insurance, Medicare, and Medicaid • LTC Basics

LESSON 1. HOME FINANCES: STAND IN THE TRUTH OF WHAT IS AFFORDABLE FOR YOU

The Affordability Issue • Start the Discussion

LESSON 2. COPING WITH THE HIGH COST OF HEALTHCARE IN RETIREMENT

Rising Costs vs. Your Annual Retirement Income • Long-Term Care Premium Increases

LESSON 3. STICK TO A SUSTAINABLE WITHDRAWAL RATE

The Right Rate • How to Make Tax-Smart Withdrawals

LESSON 4. AVOID LONG-TERM BONDS AND BOND FUNDS

What You Must Understand About Bonds • How to Build a Bond Ladder • Beyond Treasury Bonds: Municipal Bonds and Corporate Bonds

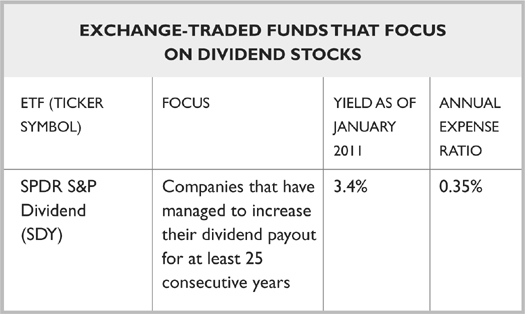

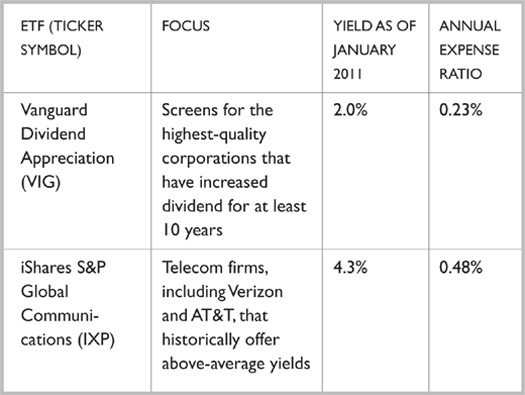

LESSON 5. EARN HIGHER YIELDS BY INVESTING IN DIVIDEND-PAYING ETFS AND STOCKS

The Case for Dividend-Paying ETFs and Stocks • Stock Dividend Basics • The Protection of a Stop-Loss Order • How Much to Invest • How to Choose a Dividend-Focused ETF • Tips for Owning Individual Dividend-Paying Stocks

LESSON 6. DOUBLE-CHECK YOUR BENEFICIARIES AND MUST-HAVE DOCUMENTS

Life-Changing Events

Clearing My Own Roadblocks • The Road Ahead, Not the Rearview Mirror • The Legacy We Create

How to Enter The Classroom

Welcome to The Money Class. The information in this book provides the foundation for your work: The facts describe the new financial reality we have to apprehend, both collectively and individually. The new perspective offered paves the way for the inner work—the emotional and psychological shifts—to be considered. The financial guidance and information contained in this book are supported by a number of important tools and resources that are housed in The Classroom on my website. It’s also where I’ll post any information updates you need to know.

To gain access, go to the home page of my website, www.suzeorman.com.

Click on The Classroom icon.

You will be asked to enter a passcode.

The code is: 999 999 999

In The Classroom you will find everything you need to put the lessons learned in this book into action. Throughout the book, this iconwill alert you to the additional information you can find online.

In The Classroom you will also find a special offer for readers of The Money Class that you can learn more about here.

CLASS

THE NEW AMERICAN DREAM

The American Dream. As a concept, it is so ingrained in our collective imagination that it doesn’t even need to be defined, right? Think about it: Did you ever need to have it explained to you? My guess is you did not and that even from a young age, you, like me, knew it represented a promise—of opportunity, of possibility—that came with being American.

But on closer inspection, it is not just an American impulse that the American Dream describes, it is a human one, and it unites us. No matter your socioeconomic, ethnic, or religious background, we all aspire to the same things: We seek to provide for our family and keep them safe, no matter what shape that family takes, no matter if we are talking about our parents or our children, a blended family or a family “by choice,” not blood. We want future generations to have even more opportunity than we ourselves have, a dream that is intrinsically linked with education and the advancement that follows from it. We want to live in a home that is secure in every sense—as a haven for our loved ones and as a wise place to have spent our money. We want the guarantee that our hard work will pay off, that it will support us financially, that it will allow us to achieve our goals, and that when it is time to stop working, we will reap the benefits of those years of dedicated service and live out the rest of our lives comfortably in retirement.

As universal as these desires are, we refer to them as the American Dream because for centuries this country has, for the most part, been able to make good on this promise of America as the land of opportunity. This belief has played a defining role in shaping our national psyche. It is at the heart of our Declaration of Independence—that we each possess “certain unalienable Rights, that among these are Life, Liberty, and the Pursuit of Happiness.”

How truly terrifying, then, to take stock of the American Dream today and to question the truth of it—to wonder if it still exists in reality or if it has become an illusion, a myth. Take a look around: As of December 2010, more than 14 million Americans were out of work; another 9 million were working only part-time because they cannot find full-time employment. That is 23 million people who are struggling to make ends meet. Many of those lucky enough to still be employed in their 60s are looking to hang on to their jobs as long as possible because they simply cannot afford to retire—which also means there are fewer job openings for young people entering the workforce.

In many areas of the country, the dream of homeownership has backfired. Real estate values have deflated to such an extent that a record number of people owe more than their homes are worth. That’s not an American Dream—it’s a nightmare.

Because of the dire economic conditions of recent years, many parents are unable to afford the high cost of college tuition for their children. And there is a record number of student loans in default, making people question whether they ever should have taken them on to begin with.

The sum total of all these facts and figures? The home, the job security, the education, the retirement—the very standard of living that all of us took for granted for so long is completely under siege.

Whether we speak about it or not, we are grappling with the frightening possibility, the fear, that we no longer live in a land where effort applied to opportunity produces a better life. The doors leading to more and greater things, once wide open, now seem to be closing. It is hard to move up in an economy where there has been no job or wage growth over the past decade. Once a manufacturing powerhouse—“Made in the U.S.A.” was our calling card—we have ceded that engine of growth, and the jobs that go with it, to other countries as our own economy now relies on our ability to consume, not produce.

The impact of these economic shifts has been felt deeply within our homes. While the median household income for adults born in the 1960s is indeed higher than the income of their parents’ generation, much of that is a function of smaller household size and the fact that there are now likely two wage earners per household. It takes more of us working more to maintain our forward progress. Even so, the pace of our growth has slowed considerably. According to a study commissioned by the Pew Charitable Trusts, family income doubled in the postwar years, between 1947 and 1973, but in the three decades since then the increase has been a mere 20%. That statistic provides important context to why household debt relative to income more than doubled over the same period: For many, borrowing was a way to keep up with our parents and grandparents. To put it in more emotional terms, it is why so many of us wonder how our parents and grandparents seemed able to enjoy a higher standard of living even though their means were so much less than ours.

The meritocracy that underpins our economy and culture—work hard, move up the ladder—has also been weakening, as the distribution of income has become increasingly uneven. In the 1950s and 1960s, our national economic growth trickled down across a broad spectrum of income levels. Since the 1970s it has been more fractured, with much of the economic gains benefiting upper-income households. This concentration of wealth leaves the middle class, the heart and soul of this country, struggling just to hang on.

The epic financial crisis—and there really is no other way to describe it—that began in 2008 may have delivered a decisive blow to the stubborn optimism that we held on to in spite of the on-the-ground reality of how our financial lives have been marked by increasing struggle. For many, the crisis was a rude awakening; for others, it was a grim confirmation of the creeping anxiety we’ve been feeling about how we are going to make it all work. Either way, it is hard to find a family that was untouched by this financial disaster. It was a galvanizing moment for us as a nation—it has forced us to reckon with our beliefs in our country and our individual ideals.

Is it time, then, to pronounce the American Dream dead?

In many ways it pains me to say this, but in my opinion the American Dream as we knew it is dead.

But listen to me: That is not such a bad thing. The old American Dream has been in need of revision for quite some time; we have just been very good at avoiding that truth. It’s time to take that dream back into our hands and reshape it. It’s time to create a New American Dream that is based in honesty, authenticity, good intentions, and genuine need.

What is important to understand is that the American Dream is not something to put your faith in, to pray for, to embrace blindly, and hope that everything turns out okay—despite its long, dependable run. Rather, it is a concept, a loose set of goals that beg for individualization. The American Dream was never one-size-fits-all. The New American Dream asks you to fashion a dream that suits you—not one based on false premises and the expectations of others. It asks you to take measure of your own needs and understand what it will take to provide for yourself and those around you—your family, your community, and those less fortunate.

The truth is, we are on the threshold of an important moment. We can come together, right here, right now, and each one of us can envision our own New American Dream—a dream that is rooted in reality, not superficiality; in truth and integrity, not illusion and faslehood.

MAKING CHANGE

I am a great believer in the power of perspective. Often when we find ourselves in a difficult situation we come to believe we have no options. We convince ourselves there is no way out. Despair and frustration take root and convince us that things are more desperate than they may actually be. When I’ve found myself in those situations in my own life, I have learned that a change in perspective can change everything. What seemed insurmountable can be overcome. Not without difficulty, but through ingenuity and dedication. We can make a difference when we think differently. If you have any doubt about the truth of that statement, think of any significant achievement throughout American history, from our founding as a nation built on those inalienable rights and freedoms, to the civil rights movement.

What we need first and foremost then, to erase the feelings of hopelessness and to ease our fears, is a change in perspective. Let us recognize what the American Dream no longer is, in order to give birth to a New American Dream.

We must abandon any vestige of the old dream that suggested it was delivered on a silver platter as a matter of national birthright, and that our economy would forever be the rising tide that lifts all boats. The dream I am asking you to create—this New American Dream—is a very individualistic pursuit. It calls upon you to take stock of the challenges we face as a nation with an economy that is still struggling to recover from the effects of a crippling recession. And then it calls upon you to take stock of your own life, your own needs, your own security. We must transform ourselves from dreaming society’s dreams and putting our faith in a false and misleading sense of entitlement, to being a society where each of us strives for dreams that are personal and realistic and that are in the best interests—in the truest and most honest sense—of us and our family. I am calling upon each of us to rethink the very way we dream.

WHAT I LEARN FROM YOU

I am confident you are up to the challenge. I know you are absolutely capable of everything I am going to ask you to do. I also can feel that lurking just beneath your fear and frustration is an even more powerful resolve not to resign yourself to a life of less. You are resilient. It is a hidden upside to times of great turmoil. When we are shaken to our core, when the status quo no longer works for us on any level, we are motivated to change. Transformation becomes not just possible, but imperative. How do I know this? I have been listening to you—so many of you—over the years. I have heard your hopes and fears; I have made it my job to expose the falsehoods and deceptions we perpetrate on ourselves and others and encourage honesty and truth. And I hear how ready you are for change.

To that end, may I share some more statistics with you that I know you will find as heartening as I do? In a 2010 survey conducted by Charles Schwab & Company, 29% of respondents chose the phrase “Decade of Hope” to describe the coming years. Another 27% said “Decade of Great Change” and 20% chose “Decade of Personal Responsibility.” Three-quarters of respondents understand what it is going to take to create a new, sustainable, and achievable dream: hope, change, and personal responsibility.

Those are the very elements I ask you to bring to The Money Class. At the core of the change I am asking for is a willingness to stand in the truth. To take a clear-eyed accounting of exactly where you are today, what your circumstances are, and then plot a course that addresses your truth. The pendulum has swung out to an extreme and we now must ease it back to a more stable and sustainable sense of equilibrium. To do that, I am going to challenge each of you, after years of overextending yourselves, to put into effect a correction. I am going to challenge you not merely to live within your means, but to live below your means. This is not meant to be a punitive strategy; it is a course in self-awareness, a return to values that our grandparents and their parents embraced. It is at the very core of the American Dream of old. Yes, there is still a beating heart in that dream. It is our duty now to rescue what was so right about it: the virtues of hard work and sacrifice; of self-knowledge and steadfastness in achieving one’s goals; of aiming for something greater and longer-lasting than the fleeting rewards of instant gratification and indulgence.

THE MONEY CLASS CURRICULUM

I named this book The Money Class because what I can provide is knowledge—of what actions to take, what behaviors to correct, how to fortify yourself in the face of economic challenges, how to fashion a responsible dream and achieve it—and knowledge is the key. I can take you from here—a place of fear and despair—to there—a place of security and hope. You will need to learn and in some instances relearn what has changed in our world and in your life, and how you must adapt to those changes.

I understand fully: At this moment in time, you are in fear of the unknown. You don’t know exactly what to do or where to turn because you aren’t sure what works anymore. You don’t know who or what institutions to trust. The truth is, you must learn to trust yourself. To follow a path that is right for you, to make choices that are realistic for you and your family. And becoming that person requires an education, a course of study.

The nine classes that make up this book begin right here, with a lesson in learning how to dream. In the next class, “Stand in Your Truth,” I will teach you what it takes to become honest and stay honest. That lesson is the catalyst for everything that follows. The subsequent chapters on family, home, career, and retirement can only be put into action if you bring along a commitment to stand in the truth. Each class will begin with an explanation of the important elements that have changed and require us to rethink our assumptions and reimagine what’s possible. Next I will lay out the essential strategies to help you reach your newfound goals. With my guidance and your commitment, we can be a formidable team.

It is time to move beyond materialism in order to set our sights on authentic happiness. Authenticity is a word I find myself returning to again and again these days. I would ask you to put your finger on what is authentic in your own life—and what endures. Surely that is our relationships—with those we love, with our community, with the earth. We strive for connection, we gladly sacrifice and find strength in working toward a greater purpose, a sense that there is a reward in being true to yourself and honoring the limitless power that comes from living a life of integrity. More than anything else, isn’t that the legacy each of us would like to leave behind? Wouldn’t we take pride in knowing that future generations will look to us for inspiration, just as we look for inspiration to the greats who came before us? Then let us embrace the ideals that forged the American Dream, then and now: honesty, integrity, dedication, commitment, courage, and hope. And let us turn toward the future.

The Money Class is now in session.

CLASS

STAND IN YOUR TRUTH

How do we usher in this new era of personal responsibility? By taking an honest inventory of exactly where you are today and what you want most for your future. Sounds like it shouldn’t be so hard, right? But trust me—getting honest is the hard part. Based on my experience of working with people and their finances for three decades, I can tell you that culturally we have become a nation that hides from that truth.

I see it week in and week out when working on my television show on CNBC. The most popular segment of the show is “Can I Afford It?” in which viewers ask my opinion about a financial purchase they are considering. It is a very simple concept: Viewers want me to tell them whether they can truly afford to buy something.

Before I render my Approved or Denied verdict I insist on finding out everything I can about a viewer’s financial situation. And I do mean everything. My staff and I pore over detailed financial information each guest must submit to be considered for the segment. Invariably we go back and forth a few times with the guest before the show is taped, until I am absolutely clear about whether they will be Approved or Denied.

Those of you who watch the show know that more often than not I have to tell guests they are Denied. I know that many of you think the people who are featured on the “Can I Afford It?” segments are just playing a game. I can’t tell you how often people come up to me on the street and say, “Oh Suze, I saw the show last weekend and there is no way those people were for real—it was crazy what they thought they could afford!”

I am here to tell you they are most definitely real. What you don’t see is that after they have been Denied and the taping is complete, the guests start trying to negotiate with me and my staff. They come back to us and change their story just a little bit in the hope that I will change my mind. The guests most desperate to change the verdict are caught up in what they wish were true; their desires about what they want in the here and now push them to bend the truth, to hide from the truth, just so I will tell them they are Approved.

I wonder if deep down on some level you are struggling with the same urge. That kind of wishful thinking is not unique to the guests who ask me “Can I Afford It?”; it’s something many of us indulge in because it allows us to avoid tough decisions and owning up to a difficult reality that we may not be ready to face.

There is no blame, no finger-pointing that accompanies my observation. As we embark on The Money Class I want to be crystal clear about my motivation for writing this book: empathy. I understand how painful it can be to face reality. Especially given the realities we are all facing, detailed in the opening class. It often seems to be in conflict with a healthy optimistic impulse.

So trust me when I say that I know it is not easy. But it is necessary. No, make that vital. As I explained in the first class, I am convinced that we can all move toward a better future, but in order to do so we must create a new template for achieving our dreams. An important starting point to these classes is the recognition that the events of the past fifteen years or so that culminated in the financial crisis were caused by a collective disconnect from reality.

The most fundamental lesson of The Money Class is this: In order to create lasting security you must learn to stand in your truth. You must recognize, embrace, and be honest about what is real for you today and allow that understanding to inform the choices you make. Only then will you be able to build the future of your dreams.

In this class we will learn:

- Finding Your Truth: A Personal Financial Accounting

- Living Truthfully: How to Stand Tall in Your Reality

- The Foundation of All Truthful Living: The Power of Cash

LESSON 1. FINDING YOUR TRUTH: A PERSONAL FINANCIAL ACCOUNTING

Moving toward new realistic dreams starts with an honest appraisal of exactly where you are today. I am not going to try to cajole you into this first lesson with some fancy window dressing. I am going to stand in this truth: There’s no way around the fact that every lesson that follows in The Money Class can only be helpful if you first take the time to create a personal balance sheet that shows you exactly what you currently spend and owe (your liabilities) and what you have managed to save for your future (your assets).

I realize that sounds like drudgery. But you have it so wrong. Stick with me here, commit to this exercise, and I promise you the experience will be revelatory.

If you already use a software program that helps you track your spending and saving, great. But I suspect that many of you really don’t have such a strong grip on where your money is going, month after month. If that is the case, I would like you to go to my website, www.suzeorman.com, and click on the link for The Classroom. The Classroom is where all the tools and resources referenced in The Money Class are housed. There you will find my Expense Tracker tool. I have made it as easy as possible for you to determine your monthly income and outgo. But please know that your ability to stand in the truth comes down to how honest you are about inputting the data requested. Please do not guess or estimate. I am asking you to take the time to go through all your statements and documents so you can input dollar amounts into each line item that are a realistic reflection of your actual spending. Be prepared—it could take hours, but that kind of ruthless honesty is necessary to beginning this lesson on a firm and true foundation.

The next piece of information we need is your credit score. You can get that at myFICO.com. If you have a FICO credit score that is below 700, you have some work to do.

Improving Your FICO Score

Your FICO score is important for many reasons, which you know if you’ve been following my advice for years, but it’s even more so today. Before the financial crisis a strong FICO score simply enabled you to qualify for the best deals. Now you must have a strong FICO score to qualify for a loan, period. Typically that means a FICO credit score of at least 700–720, and often lenders reserve their best terms for borrowers with FICO credit scores of 740 or higher. A great source of information on FICO scores can be found at ScoreInfo.org, a consumer site created by FICO.

Once you complete those worksheets and get a FICO score, please print them out. Hold those papers firm and give yourself credit. You have just taken a giant step toward getting honest. I realize many of you will not like what the numbers tell you. Do not panic. Do not beat yourself up. And do not give up. Making those numbers “work” for you is in fact the basis of the rest of this book.

Understand that we are not going to fix anything here in this class. Our focus right now is on facing the facts, so you can identify the areas of your financial life that are causing you stress. I realize you probably have a sense of that without going through these exercises. But it may be just a sense, or an inkling, or a hazy dread. When you take the time to put it all down on paper it brings everything into a sharp clarity. You are no longer guessing, or able to “bend” the truth. With the facts right in front of you, you have the building blocks of a solid foundation that will enable you to stand in your truth.

LESSON 2. LIVING TRUTHFULLY: HOW TO STAND TALL IN YOUR REALITY

Now that you have a clear-eyed accounting of your financial reality, our next challenge is to give you the means to take action based on what those worksheets tell you. I need to repeat myself: Do not be ashamed or upset. Know that in spirit I am sitting right beside you and I am excited for you: You have taken a giant step toward getting honest! That is no small achievement.

In the classes that follow I present a series of lessons that will guide you through making the adjustments and taking the proper actions to help you realize your dreams. Those chapters contain all the nuts-and-bolts information you will need. To be honest, the how-to part of those chapters is relatively easy; it is just a matter of understanding some basic financial rules, regulations, and truths and making smart choices based on that knowledge.

What I want to focus on in this lesson is how you find it in yourself to make those choices. The success of The Money Class is not just what I can teach you, but ultimately, what you are able to put into action for yourself, for your family, and for the benefit of future generations.

Here are the cornerstones of the better financial life you can build with the lessons that follow:

FOCUS ON WHAT IS REAL TODAY …

The only way you can move forward is to loosen your grip on the past. I know for many of you it is quite difficult to not look in the rearview mirror. You are still hoping your home’s value gets back to where it was in 2006, or you are stuck thinking about how much more your retirement accounts were worth a few years ago, or how much easier it was to generate income when interest rates were higher than they are today. Those of you looking for work are unwilling to settle for a job that pays less than your last one.

Please know that I say this with full knowledge of how deeply wrenching it is: We must let go of the past. The decisions you make today must be based on what is realistic today—not what may have been true in the past, but what you know for a fact is an honest accounting of what is happening for you right here, right now.

… AND WHAT YOU WILL NEED TOMORROW

What derails so many of our good intentions is that we find it hard to make decisions today that will serve us well in the future. So we spend today rather than save for tomorrow. Or we say yes to something—a vacation with friends, a cousin who is looking for investors in a new business—even though spending that money now will impede our ability to reach long-term goals. The process of standing in the truth must work for you not just in terms of what is right today, but also with a clear appreciation of the measures required to attain a secure future. Money you spend today is money that will not be able to grow and help you reach your most important future goals, be it a child’s college education, paying off your mortgage before retirement, or being able to live comfortably in retirement.

PUT MONEY IN ITS PLACE

Over the years you may have heard me say that money has no power of its own. It might have given you a moment’s pause when you first heard it, but maybe the truth behind it didn’t stick with you. So let’s dwell on it a moment here, because it’s truly an important concept.

When you are staring at the numbers on your worksheets, I want you to recognize that you have been the catalyst that made the decisions to spend, save, and invest those dollars. Money has no power on its own. It is the car; you are the gas, ignition key, and driver. Without you nothing happens. That should actually make you optimistic. You have the power to make the right and honest decisions about how you handle your money. And finding your power will set off a wonderful chain reaction: When you take the necessary measures to regain security—or build it for the very first time—you bring happiness into your life. You are better able to be present and connect with your family; you are less preoccupied by financial anxiety.

I am asking you to recognize and embrace this concept with your head and your heart: Your money has no power of its own; you are what gives it power. That you are here with me in The Money Class tells me you are ready to own that power, fix what isn’t working, and build lasting security.

LIVE BELOW YOUR MEANS BUT WITHIN YOUR NEEDS

The reality is that in order to reach your goals, and maintain those goals once they are achieved, you must live below your means. If you do not have money left over each month you will have nothing to put toward fulfilling your dreams. So “below your means” means making a commitment not to spend every last dollar you take home. “Within your needs” requires that you make a clear-eyed assessment of what exactly you are putting in that category. Yes, it is the act of separating needs from wants, something that I’ve discussed in previous books; but now, in fact, I am asking you to take a more penetrating look.

You need a house, but do you need a house that eats up 35% or more of your monthly income? Could your family be just as content in a less expensive house where the rent or mortgage is just 20% of your monthly income?

I find it so interesting that over the past thirty years the average square footage of a new home grew 42%, even though the number of people living in that house actually decreased. That’s a lot more house to pay for, to heat and cool, to furnish and repair. We all need a place to live, but perhaps a smaller, less expensive place would help us achieve our new dreams. You are meeting your needs with the less expensive house but given the lower cost it will allow you to live below your means, and that can free up significant money to put toward other goals.

You need a car to get to work and shuttle the kids around. But can you honestly tell me you bought a car that met your needs but was as inexpensive as possible? The new dream car is one that is less expensive and that you drive for as long as possible.

I understand the desire to have the things that you want. You feel you work hard, so you deserve those things. But the truth of the matter is that they are just things and those things will never make you happy. Peace of mind will make you happy. Being able to sleep at night will make you happy. Not worrying about being able to retire one day will make you happy.

I want you to appreciate where I am coming from: My call to live below your means is the path to having more. Living below your means—but within your needs; this is not about punishing deprivation—will allow you to create more to put toward your goals. I need you to recognize, right here, right now, that your dreams for tomorrow reside in the choices you make today.

THE PLEASURE OF SAVING IS EQUAL TO THE PLEASURE OF SPENDING

I want to share a dream of mine: Someday, hopefully not too far in the future, I will have people call in to my television show or stop me on the street and excitedly share with me their latest savings triumph. I mean, let’s just say no one has ever asked me if they can afford to save another $500 a month, if you catch my drift. But a girl has gotta dream …

I am not suggesting you never allow yourself to spend money today. But what is painfully absent from so many of your lives is an appreciation that what you manage to save today is in fact what gives your family security, hope, and opportunity. When you see it from that vantage point, you begin to understand what I mean by the pleasure of saving. It is what makes your dreams possible.

To be sure, some of you do understand the pleasure that comes from saving. But those families seem to be the exception, not the norm. So my dream is that each and every one of you can embrace the power, security, and control that comes from saving:

- When I see a family that has an eight-month emergency fund, contributes to their workplace retirement funds, and also makes annual contributions into their own IRAs, I know they understand the pleasure of saving and that their family is not beset with financial stress.

- When I see a family that drives a six-year-old car they own outright that runs perfectly fine, and even though they can afford to buy a new one they do not, I know they are standing in the truth.

- When I meet families, as I have so often these past few years, that tell me with well-earned pride that they have cut back on their household spending and have reduced their credit card debt by 30%, I know they get it. When you stop me in the street to tell me you have managed to cut your food expenses dramatically by cooking dinner at home and reserving fancy restaurant meals for special occasions, I see that you’ve got a handle on your priorities.

- When you tell me you stopped yourself cold in the mall and put down an impulse purchase because you recognized it really wasn’t something you needed, I am happy for you, for you have experienced the pleasure that comes from saving.

One of the goals of this book is to make savings part of our national conversation. It’s my dream that someday soon we will share and measure ourselves by our saving exploits, rather than judging ourselves and others by what we spend. I’ve heard newscasters and pundits refer to this shift as the “New Frugality,” but I have to tell you, the negativity of that phrase turns me off. Finding equal pleasure in savings as you do in spending strikes me as something far more hopeful and exciting. It carries with it the promise of freedom, of liberation, for when you make it a priority to save, to fund your current expenses and future goals, you are in fact buying yourself freedom from crushing debt, from having to cross your fingers that the markets—real estate and stock—will generate the money you want and need. With savings comes control. And I think we can all agree that on many levels what went so wrong in the recent past and came to a head during the financial crisis is that we lost all control over our future. We borrowed it from the banks, or based it on unrealistic expectations.

YOU DEFINE YOURSELF BY WHO YOU ARE, NOT WHAT YOU HAVE

With all the spending of the past few decades came a not-too-surprising by-product. Money became our identity; we became defined by what we owned, or what we dreamed of owning. The New American Dream is rooted in a definition of self that has everything to do with character and intention and nothing to do with material things. When you are motivated by your own beliefs, aims, and principles, you possess the clarity and single-mindedness to achieve that which is truly valuable: security and peace of mind.

YOU CAN SAY, “I’M GLAD I DID,” RATHER THAN “I WISH I HADN’T”

Making tomorrow’s dreams a reality requires being able to make the right choices today. As you consider the options before you, I ask that you take a few moments to consider how that particular decision might play out over the next year, the next decade, the next generation, and imagine how you might grade your decision with hindsight. You will know you are standing in your truth today if during this exercise you can imagine your future self saying, “I’m glad I did make that decision,” rather than “I wish I hadn’t.” For a decision to be powerful it must not only provide you immediate gratification or relief, it must in fact be a choice that brings long-lasting satisfaction.

YOU ARE AN ELEPHANT

Don’t be offended—I mean that as a compliment!

I have a favorite saying that I recall whenever I need help to stand in my truth: The elephant keeps walking while the dog keeps barking.

The elephant stays on course, moving toward its goal, regardless of all the barking and noise that swirls around him. I do what is true and right for me. I listen to advice. I seek advice. But ultimately I know when I am standing in the truth because my mind and my gut are in agreement. The goal is to achieve an internal calmness that comes when your intellect and your instincts are operating in harmony.

Why is this saying so important for you? If you are going to stand in your truth then you will have to be strong and tenacious. You will have to be committed to your goal and determined to stay the course. You may feel pressured at every turn to spend money; there are many enticements all around us trying very hard to get you to part with your hard-earned cash—the sounds of excitement coming out of restaurants and clubs, the heady scents that waft out the doors of department stores, persuasive ads, the pages of glossy magazines telling you about the “must haves” of the season. Let me tell you, it’s not easy to ignore all that barking. A lot of time and money and invention is spent on coming up with ways to seduce you to spend. But if you are steady and true and you are able to just keep walking when your friends say let’s go skiing this weekend, let’s go out to eat, come on, live a little—if you can just keep walking then you will end up where you want to be, regardless of the obstacles thrown in your path. An elephant walks where it wants—surely and steadily it arrives at its destination, and that is the truth that I want you to stand in.

In the New American Dream we must all aspire to be elephants. We must decide what is true and right for ourselves and our family and then stay devoted to actions and behavior that are in service to our greatest goals. We must not let the barking dogs distract us.

LESSON 3. THE FOUNDATION OF ALL TRUTHFUL LIVING: THE POWER OF CASH

In the following chapters I dive into detailed advice on how to maneuver through the big financial decisions in your life. But before you venture into those lessons you must first make sure you and your family have a solid foundation to build upon. And that brings me to the last element of what it takes to stand in your truth: embracing the power of cash.

While you will always need to borrow to purchase a home, and many families will need to borrow for college as well, one of the fundamental principles of the New American Dream is to pay for as much as possible with cash. Spend what you have today, not what you hope to have tomorrow.

Paying with cash—be it good old dollar bills or a debit card—cuts down on the temptation to charge more on a credit card than you can truly afford. And studies show that when we use cold, hard cash to pay for things, we tend to spend less; it’s a more tangible experience to part with actual money than to hand over a credit card with a too-generous limit that won’t require us to pay in full.

DEBIT CARD RULES

Using a debit card tied to your bank or credit union checking account is the next best thing to paying with cash and it’s undeniably convenient. I think this is a fine way to shift your reliance on credit cards, but please make sure you adhere to these two rules:

Decline overdraft protection. Thanks to a new federal regulation that went into effect in 2010, you should have been asked whether you wanted this service; if you said yes or if you can’t remember what you chose, please check right away. I never want you to be enrolled in the overdraft program. An overdraft is a sign of dishonesty. You are spending money you don’t have. And it makes me nuts when you end up being stuck with expensive overdraft fees. When you are standing in your truth and living below your means, you don’t need overdraft protection.

Monitor your account every other day. If someone has managed to hack into your account and withdraw money using your debit card info, your liability is limited to $50 if you notify your bank or credit union within two business days. Otherwise you could be held liable for up to $500 in fraudulent charges.

LIFE HAPPENS

I’ve said it before and I’ll say it again: You need an eight-month emergency savings fund. Why so long? Well, it’s not just because 4 in 10 people who are unemployed today have been out of work for more than six months. Being laid off indeed creates a dire emergency, but there are less dramatic and more frequent emergencies that happen throughout the course of any given year. Your car may need new brakes. Your water heater goes on the fritz. Your kid tears a ligament playing soccer and suddenly you have $1,000 in copays for the doctor bills.

I have to admit, I regret casting these events as emergencies. They really aren’t; they are just life. So if it helps you embrace the necessity of this account to be well funded, we can call it a “life happens” fund.

Every New American Dream must rest on the foundation of a robust savings account that can absorb life’s emergencies, big and small.

CREDIT UNIONS: A GREAT PLACE TO SAVE

Credit unions are nonprofits and that makes them a whole lot nicer to do business with because they aren’t motivated to squeeze every dollar out of you with penalties and exorbitant fees. They are also less likely to shut down your credit card for no reason, and the fees they do charge are typically lower than bank-issued credit cards. Best of all, especially for those of you who are still not out of credit card debt, the maximum interest rate on all federally charted credit union credit cards is capped by law at 18%, whereas some bank cards are charging 28% or more these days.

Credit unions are also a smart place for your checking and savings accounts. You often can qualify for absolutely free checking at many credit unions, and the interest rates paid on your bank deposits are typically better than at many banks that are in the business of making money for themselves, not you.

You must be a member of a credit union, and some credit unions limit membership to people with a specific affiliation; it can be through an employer, or a community group. But many credit unions are in fact more than happy to invite “outsiders” to become members, often for a small fee of $5–$20 or so. You can search for federally insured credit unions that you may be eligible for at the website of the National Credit Union Administration. Go to cuonline.ncua.gov or CreditCardConnection.org.

There is just one trick to joining a credit union: Please make sure it is a member of the National Credit Union Association (NCUA). That means your deposits are federally insured in the same way bank accounts are backed by the FDIC. The base level of protection in an NCUA-member credit union is $250,000. That is, if anything were to happen to that credit union, the federal government would step in and pay you back every penny up to $250,000. You can learn more at www.ncua.gov.

Go to The Classroom at www.suzeorman.com:

Depending on how you set up your accounts you can in fact have more than $250,000 protected by federal insurance at either a bank or credit union. At my website I have a detailed explanation of how you can use different accounts to increase your total coverage at one individual credit union.

SAFETY FIRST WITH YOUR SAVINGS

In early 2011, most basic checking accounts are not paying more than 1% or 2% interest. We may see those rates persist at least through 2012 as the Federal Reserve is determined to keep short-term rates low to help spur economic growth.

As low as the yields are on super-safe bank and credit union deposit accounts, they are indeed the best place for your emergency fund. You must keep this savings account safe and sound. You need to know that money is available to you whenever you need it—and you need to know exactly how much is there.

Don’t use a money market mutual fund for your emergency savings. It’s not just that money market mutual funds are not federally insured. The problem is that they charge an annual fee. It can be quite small, maybe one-tenth or two-tenths of a percentage point, but right now that small sum is actually huge given how low general interest rates are. You want to earn as much interest income as possible.

I also want you to stay away from putting this money into a certificate of deposit account that matures in more than 12 months. These accounts, especially ones that have longer terms (five years or more), are not where you want to be when interest rates start to rise.

SAVING FOR BIG-TICKET ITEMS

The New American Dream also requires that you have ample savings beyond your “life happens” fund in order to borrow less for major purchases. Be it the cost of a new car, a 20% down payment on a home, or the full cost of a kitchen renovation, I want you to do your very best to have that money saved up—completely—before you embark on this expenditure. That is how our grandparents did it and it is the way of the future.

I have news for you: This isn’t just about my wanting you to borrow less. As I write this in early 2011, you probably will not qualify to borrow money from banks and credit unions unless you have a sizable amount of your own savings to bring to the deal. You need a down payment to make a deal. It is that simple. (Yes, I am well aware homebuyers can make just a 3.5% down payment and qualify for an FHA-insured loan. But as I explain in the Home Class, I do not think a 3.5% down payment is in any way standing in your financial truth.)

Here are a few tips on how to save for a capital expense.

Open a separate savings account for each goal. Your emergency fund should be its own separate account. And every additional savings goal should have its own dedicated savings account.

Set up an automatic monthly transfer from your checking account into your savings account(s). All banks and credit unions offer this service for free and I would encourage you to take advantage of it. It’s hard to have the discipline on your own to make sure you are setting aside money every month. By committing to an automatic transfer each month that the bank handles for you, you are making sure the money will in fact make it into your savings account every month. You can set up this service online, or by dropping into a local branch.

At my website, in the Suze Tools section you will find a free online Compound Interest Forecaster that will show you how your savings will grow over time. Play around with that calculator to get a sense of what you want to save each month to be able to make a sizable down payment for a future goal. Just promise me you will stand in your truth: If that goal is within the next 5–10 years, your money must stay in a super-safe savings account. So set your interest rate at just 1% or 2%. When rates rise, as I expect they will in the coming years, you can come back to the Forecaster and see how that will speed up your savings. But right now, we are standing in the truth that safe savings are growing at just a 1% to 2% rate. Agreed?

THE TRUTH WILL INDEED SET YOU FREE

As I said earlier in this chapter, in many ways “Stand in Your Truth” is the most important class I have to teach, for it is only when we turn inward and locate what is right and true for us that we can begin to move forward toward creating our new dreams. From learning to live below your means, to insulating your family from the unexpected major expenses that are a part of all our lives, your new dreams will begin to take shape only once you’ve begun to stand in your truth.

The challenge is to make this new way of living—this pursuit of genuine happiness—a long-term commitment. I ask you to do it from a place of sincerity and hope for the future, not just because you are afraid of what is happening to you at the moment. It is inevitable that the economy will improve at some point. That is something we are all hoping for. But as grateful as we will all be when those better times come, I hope you hold fast to the lessons in this class. Your future and that of your children and grandchildren, whether they’ve been born yet or not—all of us collectively will benefit from a commitment made to living a life of integrity, from moment to moment, of resisting the ephemeral temptations of immediate gratification, and staying steady with the dreams of your shining future squarely in your sights.

Trust me, it will not be long before the banks and financial services industry as a whole will be back offering you enticing ways to get you to stray from your path. Credit card limits will be loosened, home loans and home equity lines of credit will become easier to obtain. Get-rich-quick schemes will never die. My hope for you—for all of us—is that you will be able to stand tall in your truth and stay committed to the path that will lead you to peace, financial security, and happiness.

LESSON RECAP

- Give a fresh review to all your spending and expenses; learning to live below your means creates the opportunity to fund your long-term dreams.

- Make a conscious decision to derive pleasure—yes, pleasure!—from the act of saving. When you value saving as much as spending you are standing in your truth.

- An eight-month Life Happens fund is a nonnegotiable necessity if you are to stand in your truth.

CLASS

FAMILY

THE TRUTH OF THE MATTER

Family has always been at the heart of the American Dream. We work, we strive for the sake of our family. We want our children to have endless opportunity, to be free to achieve and create and flourish. We want our parents to enjoy good health, to reap the benefits of a lifetime of hard work and sacrifice on our behalf, to live out their golden years free of financial worry. Sacrifice—that word was so ingrained in a generation of immigrants who came to America to make a better life, not necessarily one they themselves would realize, but for future generations. That is still true to this very day. No matter the current state of the American Dream, the promise still shines and American shores still beckon: If you work hard, you can improve your life and the lives of your loved ones.

I cherish that promise, as an American and a woman whose grandparents, full of hope, emigrated from Eastern Europe at the turn of the last century. And certainly if you read my books or watch me on TV, you know how important family is in my own life. I’m blessed to have my mother with me, to have a spouse, to be surrounded by siblings and nieces and nephews at holidays, and to be able to enjoy and share the gifts life offers us and the fruits of what we have been able to create with those we love best.

So is this aspect of the American Dream intact? Well, I’d have to say in theory, in our hearts, it is still alive and well. In practice, however, too often we fall prey to good intentions. We sacrifice the wrong things for the right reasons. We put our financial security at risk to make someone we love happy. We put wants before needs because we mistakenly think it’s a way to show our love. For the past two decades so many of us have spent more than we had any right to spend, all in the name of providing for our families. We used credit cards to buy things we couldn’t really afford. We bought bigger, more expensive homes, with bigger, more expensive mortgages, and then we used the equity in those homes to finance everything we couldn’t manage to save for: a vacation, a college education, retirement. The American Dream of more and bigger and better got distorted. And in the process, we lost the truth that one of the greatest gifts we can teach our children and put into practice for ourselves is self-sufficiency.

Sadly, even families that have behaved with more financial responsibility have been buffeted by punishing economic headwinds. A layoff or a stalled career that hasn’t produced a promotion or substantial raise in recent years can mean that your standard of living has not markedly improved for quite some time; it may even feel like it’s getting harder and harder just to make ends meet. And even as you work to regain your financial bearings, you may also find that your grown children and elderly parents need financial assistance now too. Add to that poor returns on your retirement portfolio and a decrease in your home value and you have plenty of cause for worry all around.

No matter what the current state of the American Dream in your family, we have arrived at a point in time that is defined by this one incontestable truth: How your family spends and saves money, and how money flows through the generations of your family, needs to be revisited. For many of you the challenge is to rein in your family’s spending so you can achieve the long-term financial goals you have set for yourself. For others, the task is more complex and far-ranging; it may require a reassessment of your very way of life—an honest reappraisal of your immediate needs and a realistic reworking of your priorities in the decades ahead.

No matter what your starting point, the first step, the first thing I’m going to call on you to do, is the same: Start talking.

The New American Dream is rooted in honesty—and honesty must be a family affair. With honesty as your foundation you can then lay down the framework of how as a family you intend to create and achieve sustainable dreams. The lessons in this class run the gamut, from how parents can instill the right money values in young children to how adult children can help their aging parents live a comfortable and secure life. You never really graduate from the Family Class, as you shall see. It is an ongoing lesson—a practice and a privilege for those of us blessed to share our lives with the ones we love.

A silver lining to emerge from the recent economic crisis is the fact that we are finally getting it. More Americans are paying down their debt; we are, sometimes painfully, facing up to the consequences of rash financial behavior; we are starting to learn what it means to stand in the truth. I am hopeful that on a large scale and individually we are recognizing the virtues and integrity of the generations who came before us, who understood what it meant to save, to sacrifice, to set a goal and work diligently and selflessly to achieve it. I speak to so many of you—at my lectures, in the course of producing my TV show, via email and social networks—and I am encouraged to see that there seems to be a new maturity, a new sobriety taking hold. That is a sea change, the beginning of a paradigm shift, that has occurred in the span of just a few years. With that promise in our hearts, let’s head into the Family Class.

I have organized the Family Class into the following lessons:

- How to Build Honest Family Relations

- How to Raise Young Children to Stand in the Truth

- How to Create a Financially Honest College Strategy

- How to Help Adult Children Facing Financial Challenges

- The Conversation Every Adult Child Should Have with His or Her Parents

- Advice for Grandparents: How to Build a Lasting Legacy

LESSON 1. HOW TO BUILD HONEST FAMILY RELATIONS

One of the great mysteries to me is how we have convinced ourselves that it is okay to lie to our loved ones.

When your credit card balance is full of purchases you made because your kids asked for something, you are in fact lying to yourself and your kids about what your family can honestly afford.

When you loan your sister money to cover her chronic shortfalls and that money depletes your emergency fund, you are lying to yourself and your sister that you can afford to help her—or that you are in fact helping her by enabling her irresponsible behavior.

When you tell your kids to focus on getting into the best college and not worry about the cost, even though you will have to spend your retirement savings to cover the bills, you are not being honest with them about the sacrifices you are prepared to make. What you are doing, in effect, is mortgaging their future. Who, after all, will you have to lean on in retirement if you haven’t planned well, but your children?

When your parents need financial help and your siblings assume you will take care of anything because you make the most money, and you participate in this disproportionate share of responsibility, you are encouraging a financial codependence that will surely lead to conflict and animosity. That is a shared dishonesty.

Your rationale for behavior of this sort seems so irrefutably pure and right: love. You give, and give, and give out of love. No questions asked. Because that is what family is all about.

I want you to know how sensitive I am to the good intentions behind all these choices. But there is no way to build sustainable dreams on a foundation of financial dishonesty.

OPEN THE LINES OF COMMUNICATION

Having taught you to stand in your truth in the second class, I am now going to ask that you go public with your truth. Bring everyone in your family on board, because we are always stronger and more successful in reaching our goals when we have the support and encouragement of our loved ones. But you must also open the lines of communication and share your financial truths because they will in many cases have a direct impact on your family. How you explain to a ten-year-old child why you will not be sending him to sleepaway camp this year is obviously different than how you express to your adult siblings your desire to change the gift-giving traditions in your family. But both conversations are a must. If you fail to communicate you leave it to those around you to fill in the backstory. That can be especially dangerous with children, who will think it is somehow their fault, or that they are being punished. A lack of communication also creates distance between you and your loved ones. That’s never a good outcome, but it seems especially ill timed when you are embarking on a new stage of your life and could benefit greatly from bringing your family into the process.

TAKE PRIDE IN YOUR HONESTY

I know that many of you think having truthful conversations with your family about your financial situation is embarrassing or painful. You feel so defeated by having to admit what is going on. Please listen to me: You have it all wrong. When you stand in the truth, and you are able to communicate that truth, you should feel proud and triumphant. For when you take the step forward to live your life with honesty you are at your most powerful and your most admirable. It takes strength and resolve to stand in your truth. Your family will love you all the more for your ability to embrace the changes you need to move toward your new realistic dreams.

Now, that said, if there are young children involved, a transition to a more modest lifestyle will no doubt be met with some resistance. That’s to be expected. And you must respect that they need time to absorb and adapt to the shift. But your words, your body language, and your spirit throughout will set the tone for them. Stand in your truth with pride and confidence and you will be parenting in a way that will benefit your children not just next week and next month, but for decades to come. You are imparting the invaluable lesson of living life honestly.

GIVE IT SOME THOUGHT

One of the reasons you find it so hard to act with financial honesty when it comes to your family is that you tend to act in the moment, rather than step back and contemplate before you make a decision. You say yes without ever stopping to think if you can in fact afford to say yes.

That needs to change. For you to build and reach your new dreams you must carefully weigh each and every money decision. This is not simply about what you can afford. Obviously if you do not have money to spare you cannot give it away. But even when you do have the money to share, I am asking you to take the time to think through whether you are helping that person stand in his or her truth.

When you cosign a loan for a child who can’t get a car loan because she has a lousy credit score, are you helping her stand in her truth? When you give a brother $15,000 to get out of credit card debt, is that helping him stand in his truth? I realize your intentions are good, but you need to distinguish between helping and enabling. People who are standing in the truth and need financial assistance deserve your help, if you can in fact afford to give financial help. People who are looking for your money to solve (probably temporarily) a problem of their own creation are not standing in their truth. My advice? Guide them, with love and encouragement, toward personal accountability and financial honesty. Don’t allow your money to do the talking for you; it will send the absolute wrong message.

LESSON 2. HOW TO RAISE YOUNG CHILDREN TO STAND IN THE TRUTH

One of the saddest aspects of our national borrowing binge of the past few decades is the damage it has done to an entire generation of children. Parents who used credit cards and home equity lines to finance a lifestyle way beyond the family’s means have left their children with no experience, understanding, or appreciation for what it means to live a financially honest life.

I am not interested in assigning blame or provoking feelings of guilt. I raise this important issue in the hope that from this day forward all parents will devote themselves to instilling a strong set of values in their children and teaching them essential money management skills. Survey after survey reports that, in the wake of the financial crisis, parents worry that their children’s future will be limited. That is what we are addressing head-on in this class, so you will not live in a state of anxiety about your children, but you will in fact act to secure their future, right here, right now.

YOUR PRICELESS LEGACY

Children in their teens who are aware of what is going on in our economy—and within their own family’s finances—are less likely to repeat the same mistakes. They can feel the stress and worry and they are way too smart to want the same for themselves. But what makes me truly optimistic about the future of today’s children is the fact that so many of you, their parents, have financial regrets. In “Stand in Your Truth” we talked about changing your inner dialogue from “I wish I hadn’t” to “I am glad that I did.” Well, there is no more important proving ground for that intention than to raise children who from an early age respect the value of money and know how to make smart money choices. Much of this comes down to creating an environment where those lessons are woven into the daily rhythms of your family’s life. Raise a child in a home where money is valued, and that child is likely to be an adult who values money. It is really that simple.

Life Insurance: The Ultimate Gesture of Love

So many of you tell me you would do absolutely anything to protect your children, yet when I ask about your life insurance policy you look at me sheepishly and admit you don’t have one. That is an unacceptable act of hypocrisy. If you love your children and if those children are financially dependent on you to provide them food, shelter, and education, then you must have life insurance. There are no ifs, ands, or buts here. If your death or the death of your spouse or partner would leave your family unable to continue to pay its bills and maintain the lifestyle you help provide today, it is your obligation to have life insurance. And I do mean obligated. Life insurance is a must when you have dependent children.

Purchasing that protection is neither hard nor expensive. In the vast majority of situations all your family needs is a term life insurance policy. Just as an example, a 40-year-old male in good health could purchase a $1,000,0000 policy—meaning his survivors would receive $1 million tax free upon his death—for a monthly premium of $80 or so.

Go to www.suzeorman.com: In The Classroom you will find a detailed explanation of how term life insurance works, what features you want in a policy, and resources for working with top-notch insurance agents.

SET THE RIGHT TONE

Your family will take its cues from you. If your words and actions telegraph that you are scared, or sad, then that is exactly what you are going to transmit to those who depend on you.

Do not apologize. There will obviously be instances when standing in your truth requires saying no to spending you previously said yes to. Be compassionate. Be patient. But please do not ever apologize. There should not be any regret. That is not respectful of yourself, and it also sends a message to your children that you feel bad about these changes.

Focus on what will be gained, not lost. Make sure your family understands why you want to make changes. When you present your truth in the context of wanting to move toward realistic new dreams, you set the tone that this is not about loss or defeat. This is a triumphant step forward into a new life where you can build lasting financial security for yourself and your family. Every spending cut is an appropriate measure that moves you closer to your family’s greater goals.

Be patient but strong. I am not going to pretend this is going to be in any way easy if your kids have grown accustomed to having everything they want, when they want it. They are going to be upset. There will likely be tears. I realize that can be excruciatingly hard to impose—on all parties—but please focus on your long-term goals. You are not punishing them. You are not punishing yourself. Just the opposite. I think you will be surprised at how quickly your kids will adapt to your new ways, but you need to summon the strength to stand firm during the transition. Resist caving. Keep reminding yourself that by standing in your truth today you are creating a better future for your children, and you are also instilling in them an attitude toward money that will help them reach their dreams when they are adults.

IMPARTING GOOD VALUES WHEN IT COMES TO MONEY

Talk about what you love. The first and most important money lesson you need to teach your children is to put money in its place. Ask your children—even children as young as four or five—what they love most. Do not guide them, just listen to what they value. Is it people or is it things? Did they talk about loving you, and their grandparents, a sibling, a pet? A favorite food? Or was their list about possessions? It is perfectly natural for every human being—child and adult—to desire and enjoy material possessions. But you need to make sure you are raising your children to have a broad view of what is important in life. Many of you know my motto: People first, then money, then things. If your child has moved things to the front of the line, that’s a clear sign you have some work to do. I would start by making sure you communicate, through words and actions, what you love most. If you are clear that you care most about your family, about the well-being of others, rather than what you own, you are telegraphing an important lesson.

If you don’t particularly like what you hear, I have to point out that you are the issue here. Kids don’t do as you say, they do as you do. They are watching and mimicking your behavior. If you are constantly shopping, or ordering things online, or focusing on your latest mall conquest, what else can you expect than for your young child to assume that is the absolute best way to behave? After all, you are the all-knowing and all-wonderful parent they worship and take all their cues from. Including your cues about how to value material possessions.

MONEY LESSONS FOR YOUNG CHILDREN, AGES 3 TO 6

Establish the work-pay-purchase connection. As far as I am concerned there is no age too young to start learning that money must be earned to buy the things your family needs.

Explain why you work. It makes me absolutely nuts when I see parents kiss their young children goodbye in the morning and say, “I hate that I have to leave you to go to work, but I need to make money.” All that does is teach your child that work and money is a bad thing. What your children need to hear from you is that you are incredibly grateful that you get to go to work and get paid money and that that money enables you to take care of them. Also let them know that you personally get satisfaction from your work.

Explain how you earn money and what it does. Unless you make a concerted effort to explain how money is earned, your children will think it is simply something anyone can get by punching a few keys at the ATM. Or worse, they will have no concept of real money—actual dollar bills—because you are always using a credit card. You must explain that your work earns you money, that money goes into the bank, and that you can only take out as much money as you have earned at your job.

Explain that the groceries in the refrigerator and the toys in the playroom were bought with the money you earned. The electricity that keeps the computer humming has to be paid for too. Once your child is old enough to understand the concept of dollar bills, I want you to have them join you on your errands from time to time, and have them pay the cashier with real dollar bills. Physically connecting to money—real dollar bills—helps us focus on what we are spending. That is a lesson you should be teaching your kids from an early age.

Teach giving. Two times a year sit down in your child’s room or the playroom and together sort through all the clothes, toys, books, and crafts that they no longer use. Whether you give these away to a friend, a charity, or a thrift store, I want your child to be the one to make the physical transfer. It is such an important lesson to learn the power of giving. A friend recently made her five-year-old’s birthday party into a pajama party, asking children to come in ther PJs and to bring a new set of pajamas instead of a gift. The pajamas were donated to the Pajama Program (www.pajamaprogram.org), a charity that gives new pajamas and books to children in need, in the United States and around the world. I thought this was a great idea that created a real opportunity to teach small children about our obligation to help those less fortunate.